We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

Can i afford to retire (if pushed)

Comments

-

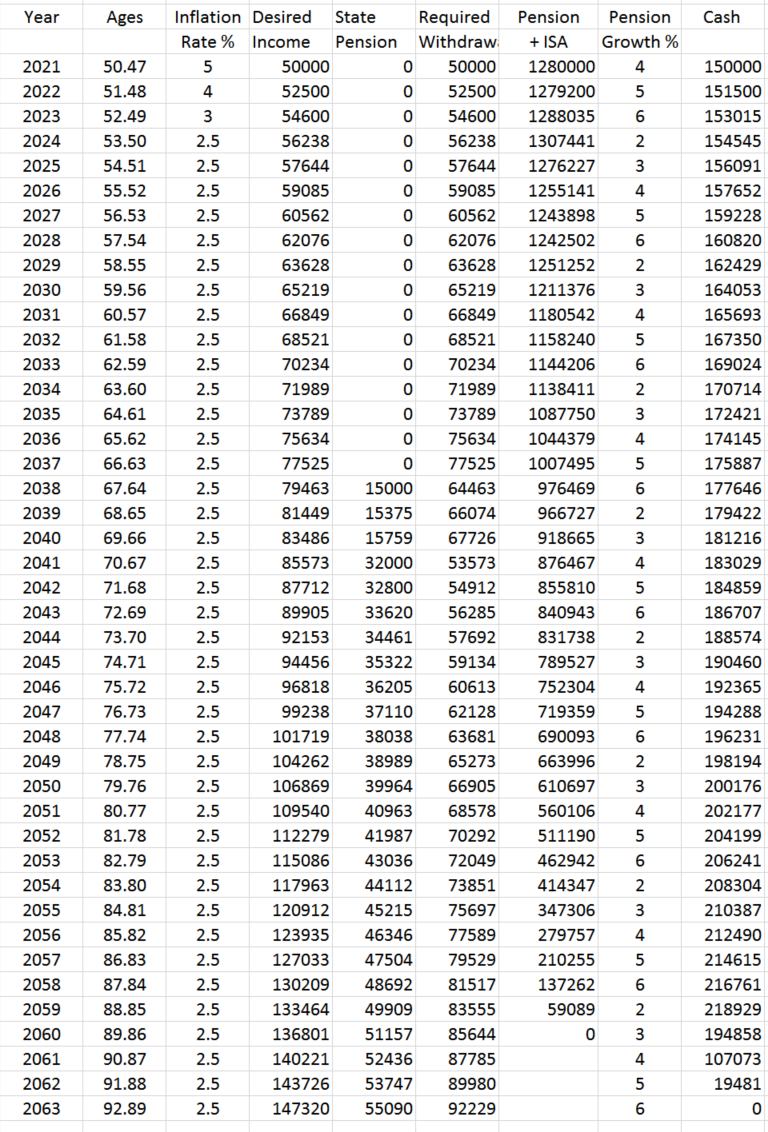

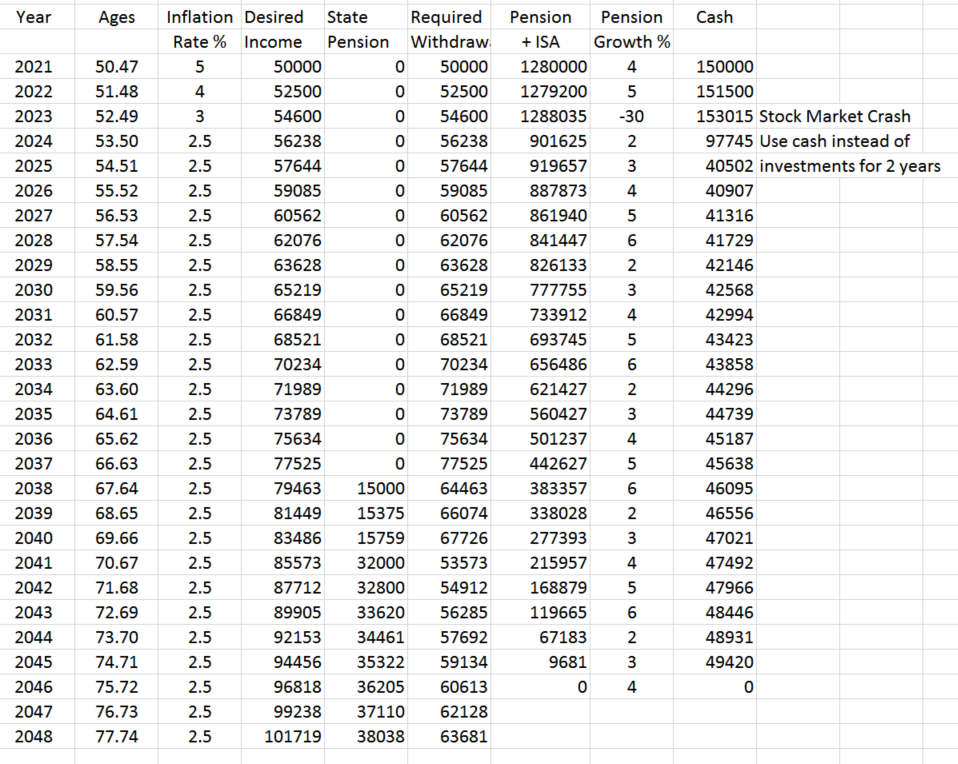

I'm glad you gave a scenario that fails. It shows how bad early retirement losses can be. But in real life spending should probably be cut after a big crash which is why control of your budget is important so you have a ready made plan to save some money. Of course there are an infinite number of scenarios and we need to play the percentages and hope that our particular scenario is one of the ones that succeeds. There will be parallel universes where we will fail, but let's hope we don't collapse into one of those.Secret2ndAccount said:Here's how drawdown might work:

This takes inflation and growth into account. You burn through the Pensions and ISA's first, then switch to cash.

Your money would last until you are 90-ish.

Here's how it might not work:

A stock market crash early in retirement would see your money run out at age 75 if you weren't able to cut back your spending.

I mentioned the LTA in my previous post. For info, in the successful scenario above, I estimate you could be hit with about 160k in LTA taxes, and remember that's retiring today with no further pension contributions. (Remember also you are saving a lot of tax by paying into your pension, so maybe it's not as bad as it sounds).

I have a similar spreadsheet where I can use the mean and SD of the historical returns and a random number generator to give the yearly returns and I also stress test with some negative returns early on and lower than historic returns for the rest of my lifespan. There are so many unknown parameters in these projections that we are dealing with probability distributions and that's why I focus on what I can control; things like spending and taxes and also the generation of a guaranteed income floor that will keep the wolf from the door.“So we beat on, boats against the current, borne back ceaselessly into the past.”3 -

I think you might be confusing withdrawal rate and growth rate. The original 4% withdrawal rate rule of thumb was derived with 8% average annual return which was 5% adjusted for inflation, but the average doesn't tell the true story, it's the size of the annual gains, or losses, and when they occur in your retirement that matters. Losses in the first few years matter far more than losses towards the end.Madrick said:That does look like a useful spreadsheet.

Robwales, I would definitely build in at least 3 or 4 stock market crashes and other negative growth years when you create the spreadsheet. An interesting exercise is to look at say, average growth of 4% over 40 years, but vary when the crashes occur. If for example you forecast a bad first decade, you will see how quickly your pot depletes. Then using the same average 4% growth rate for 40 years, key in a good first decade with big crashes later in retirement, and you will see a much healthier pot despite the same average growth and withdrawal rate. This example shows the important of the Sequence of Returns.

Is 4% a good percentage to use for average Pension growth?

I have a small DC pension (compared to most on here) , just over £200k

Then a £2k pa DB pension and some cash/premium bonds etc.

And relatively small outgoings

Could survive comfortably starting on £18k pa

Aged 60 and looking to retire early and soonish.

I had been working on a very Conservative growth of 1.25%

And running low of funds at age 85

I did change this to 2% to see the difference and suddenly life looked a lot more comfortable

If I worked on a 4% growth, it would be unbelievable

Without knowing your asset allocation that's impossible to answer your questions and any answer would be based on what happened in the past and prognostications about the future and you really need to include a good safety factor.“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

What are you figuring for inflation? 4% pension growth, with inflation at 2% is certainly something that could happen. 4% pension growth over and above inflation is unlikely over long periods.Madrick said:Is 4% a good percentage to use for average Pension growth?

I had been working on a very Conservative growth of 1.25%

And running low of funds at age 85

I did change this to 2% to see the difference and suddenly life looked a lot more comfortable

If I worked on a 4% growth, it would be unbelievable2 -

HiSecret2ndAccount said:What are you figuring for inflation? 4% pension growth, with inflation at 2% is certainly something that could happen. 4% pension growth over and above inflation is unlikely over long periods.

I was figuring 2% for inflation along with the very low 1.25% for DC pension growth, which I then increased to 2%

Then an annual increase of 2.5% on the State Pension (which I wont get for 7 years) and 1% increase to the small £2k Royal Mail DB pension which started this year.

Would go Into retirement , (investing £3.6k pa from savings into pension)

Taking an initial annual withdrawal of 7% into drawdown for the first 6 years leaving the remaining pension invested. This including the £2k DB pension will keep me just above the tax allowance, paying minimum tax.

The shortfall up to £19k required income after tax made up from savings, premium bonds, etc. ( this £19k required income would increase by 2% for annual inflation)

Once SP kicks in, on my spreadsheet, the drawdown drops to between 3.5% - 4%.

This would seem to last until age 85-88 based on the 1.25% growth

With 2% growth, just over 90 years old.

My thoughts were, if some people are using up to 4% as a good average figure for pension growth, I'm laughing.0 -

I was figuring 2% for inflation along with the very low 1.25% for DC pension growth, which I then increased to 2%

It is felt generally that the next ten years will not be as good as the last ten . Not just for equities but bonds also .

The more conservative regular posters on here are thinking/guessing that One to two percent above inflation ( inflation at 2.5% estimated ) is a sensible forecast . This assumes paying relatively low fees.

1 -

(and conscious of LTA so might need to look for other vehicles eg VCTs / EIS if i continue work and get into that position).

In other posts you say you need to spend more time looking into potential LTA issues , but here suggest using VCTs and EIS .

You can use these to mitigate LTA but I think it is fair to say that they would only be for more experienced investors . I do not think many regular posters on this forum with LTA issues go down that path ( with one notable exception) .

1 -

I guess it depends what you invest in, but I think most of us are at least hoping for a return that keeps up with inflation. You can get 1.75% from a 2yr fixed rate savings account right now, so you could use that as a minimum.I was figuring 2% for inflation along with the very low 1.25% for DC pension growth, which I then increased to 2%

I think 4% average equity growth would not be overly optimistic. Bonds need to make a comeback, otherwise the cash rate above is better.

You've clearly got a plan and a model. I would allow some of the growth numbers to go a bit higher, but you also want to stress test it. Does your plan hold up if inflation is steady around 2.5%? What if inflation is 5% for a few years? What about if there is a significant crash in stocks in the first few years? Only if you can find a way to navigate through those outcomes and a suite of other nasty what-if's should you feel safe to retire.1 -

A nice clear article about the FTSE100 here: https://www.ig.com/uk/trading-strategies/what-are-the-average-returns-of-the-ftse-100--200529

FTSE is widely viewed as an underperformer on this board, but the worst 20 year return since inception is over 4% (dividends reinvested, no allowance for costs).

Switching to the US S&P 500, the worst 20 year average over the last fifty years was +6.4%. There was a nightmare period that included 2002 and 2008, but by the end of 2016 the average was again back above 4%

YMMV

1 -

And inflation is 3.2% and climbing steeply and such savings rates are not available inside a pension wrapper.Secret2ndAccount said:

I guess it depends what you invest in, but I think most of us are at least hoping for a return that keeps up with inflation. You can get 1.75% from a 2yr fixed rate savings account right now, so you could use that as a minimum.I was figuring 2% for inflation along with the very low 1.25% for DC pension growth, which I then increased to 2%

I think 4% average equity growth would not be overly optimistic. Bonds need to make a comeback, otherwise the cash rate above is better.

You've clearly got a plan and a model. I would allow some of the growth numbers to go a bit higher, but you also want to stress test it. Does your plan hold up if inflation is steady around 2.5%? What if inflation is 5% for a few years? What about if there is a significant crash in stocks in the first few years? Only if you can find a way to navigate through those outcomes and a suite of other nasty what-if's should you feel safe to retire.

Personally I prefer using the online tools and spreadsheets that test pot values against all historical paths of inflation and asset prices than a spreadsheet with one or two 'what if paths' based on guess for inflation and returns. The downside here is that 'history' is not necessarily any guide to the future and it has not lasted very long compared to the number of observations you would model in a simulation.

The alternative would be a montecarlo simulation based on historical variance but I think these 'random walk' models do not exhibit any tendency for 'reversion to mean' whereas I think in reality when asset prices are 'high' they are not equally likely to go up and down in the next period.I think....0 -

The annual average return is nice to know, but the sequence of the returns is the thing that will determine success or failure. If you have early losses and then sell funds into a down market it can severely reduce your lifetime withdrawal rate.Secret2ndAccount said:A nice clear article about the FTSE100 here: https://www.ig.com/uk/trading-strategies/what-are-the-average-returns-of-the-ftse-100--200529

FTSE is widely viewed as an underperformer on this board, but the worst 20 year return since inception is over 4% (dividends reinvested, no allowance for costs).

Switching to the US S&P 500, the worst 20 year average over the last fifty years was +6.4%. There was a nightmare period that included 2002 and 2008, but by the end of 2016 the average was again back above 4%

YMMV“So we beat on, boats against the current, borne back ceaselessly into the past.”1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599K Mortgages, Homes & Bills

- 177K Life & Family

- 257.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards