We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Can i afford to retire (if pushed)

Options

Comments

-

MaxiRobriguez said:You've got more than enough to retire.

Do you really need £50k a year?

Actually - i think when i refresh my budget, it will be more. Sounds a lot, but we dont spend big (e.g we've never head a new car...indeed my car is now 15 yrs old..wifes is 11)....3 kids and a big house with big electirc and food bills etc. My eldest's first car and insurance was £2.5k last year - same will apply to my 2nd child in 2022. So there is £5k - it stacks up!

0 -

kinger101 said:Assuming you don't take a cash lump sup, 25 % of the income from your DC pensions is tax free.

That means only £37,500 of £50,000 pension withdrawal is taxable, and the first £12,500 is covered by the personal allowance. So £25,000 @ 20% is £5K of tax. £50K gross = £45K net.

Thanks - i need to review how pensions work in draw down...as said - ive fixated in "accumulation" mode and not really thought about the other side when i actually begin to spend the money and how thats done best with regard my needs and tax efficiency.

0 -

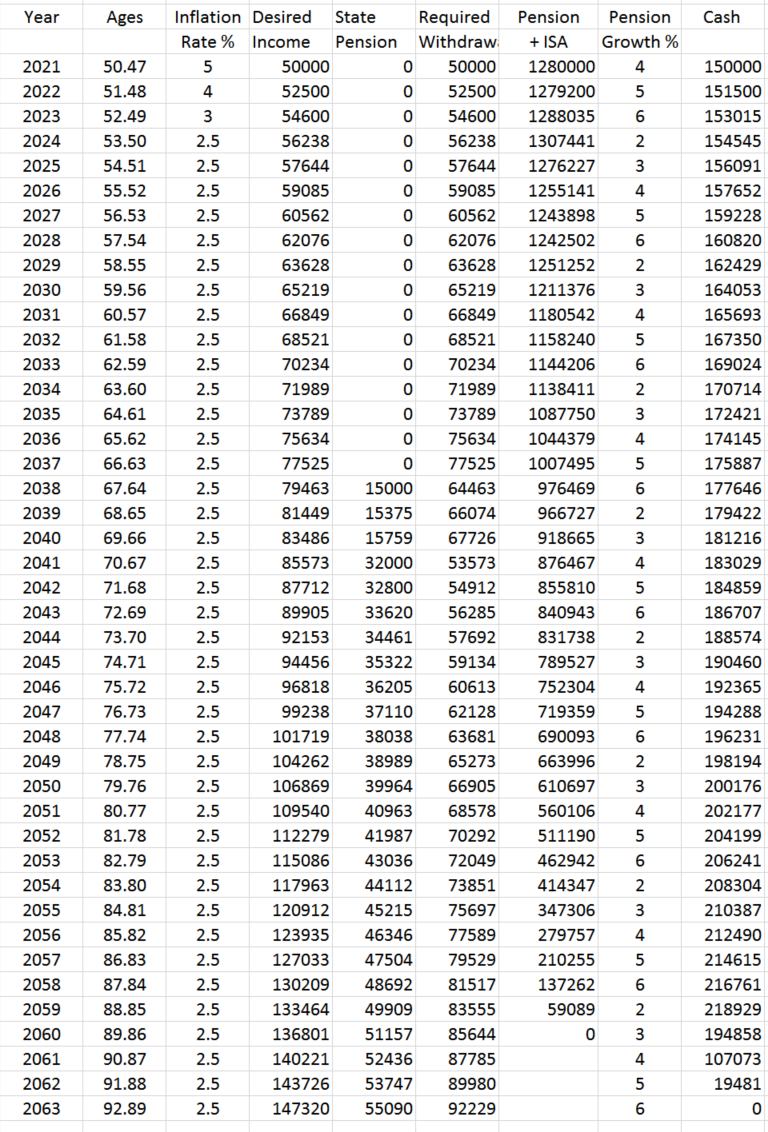

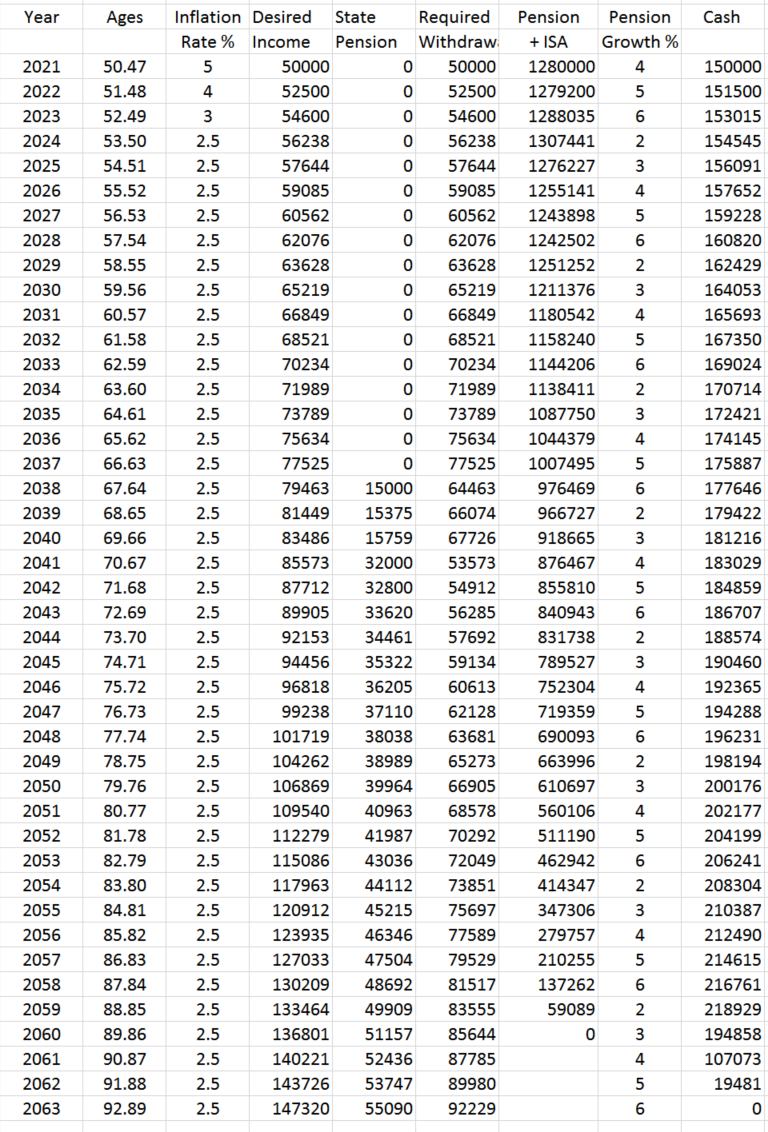

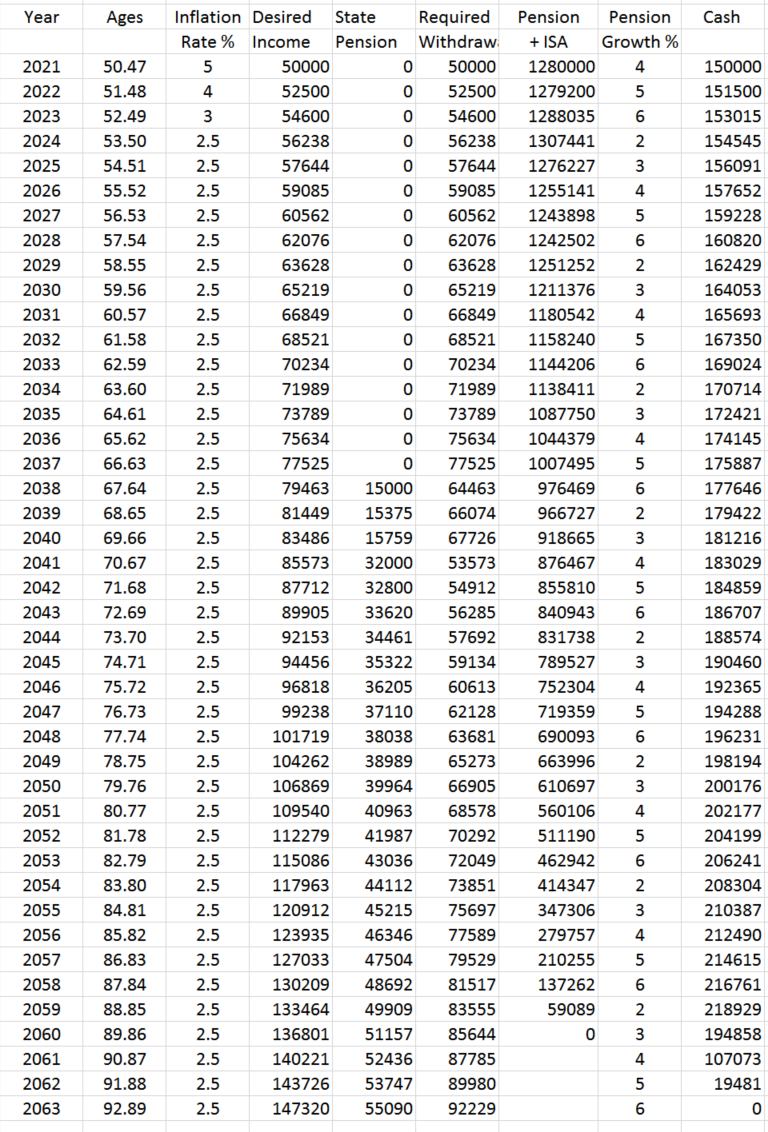

Here's how drawdown might work:

This takes inflation and growth into account. You burn through the Pensions and ISA's first, then switch to cash.

Your money would last until you are 90-ish.

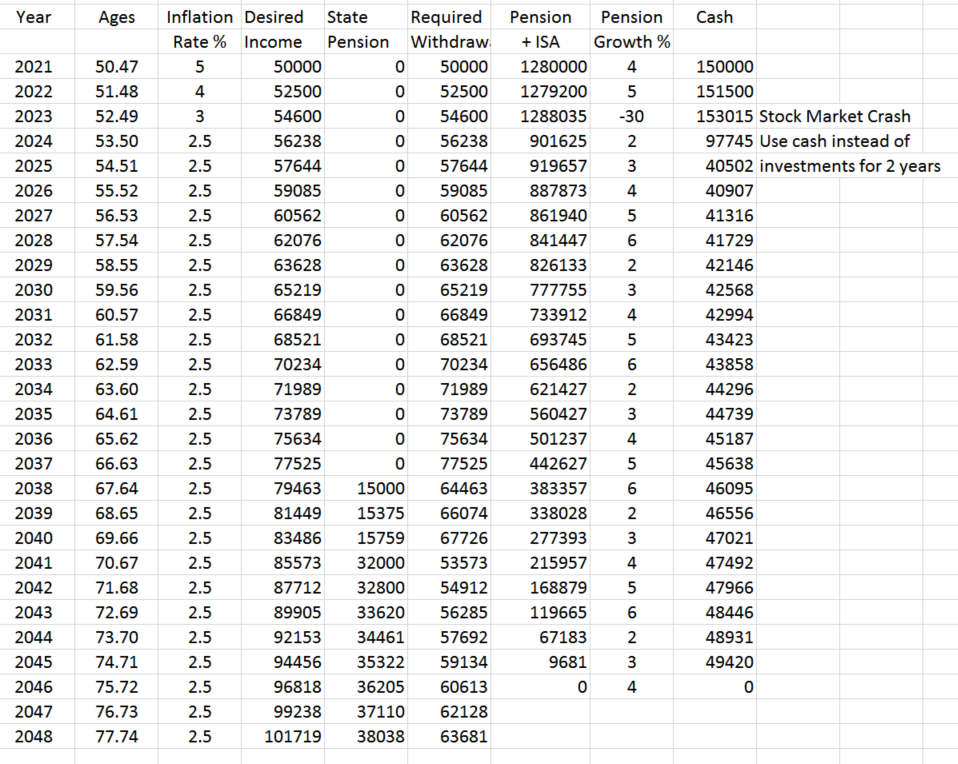

Here's how it might not work:

A stock market crash early in retirement would see your money run out at age 75 if you weren't able to cut back your spending.

I mentioned the LTA in my previous post. For info, in the successful scenario above, I estimate you could be hit with about 160k in LTA taxes, and remember that's retiring today with no further pension contributions. (Remember also you are saving a lot of tax by paying into your pension, so maybe it's not as bad as it sounds).

1 -

Yup its lurking in the back of my mind...on the "to do" list for the end of the financial year depending on how near i get to the allowance (ie do i max out £40k or not). At 5% growth on my current £850k pension i calc it will be breached in 5 yrs time. At what point does one need to think about stopping contributions and looking for alternatives - i mean how far off the LTA?Secret2ndAccount said:I can't believe nobody has mentioned Lifetime allowance (LTA) yet.

0 -

Robwales said:

Yup its lurking in the back of my mind...on the "to do" list for the end of the financial year depending on how near i get to the allowance (ie do i max out £40k or not). At 5% growth on my current £850k pension i calc it will be breached in 5 yrs time. At what point does one need to think about stopping contributions and looking for alternatives - i mean how far off the LTA?Secret2ndAccount said:I can't believe nobody has mentioned Lifetime allowance (LTA) yet.

Two thoughts:

1) You can either stop now as you'll almost certainly breach the LTA, whether that's in 5 years time or 20.

2) You can ignore it and just accept the tax hit. You're still getting to defer tax now.0 -

Secret2ndAccount said:Here's how drawdown might work:

Thanks so much - thats really useful - is that your own xls?

i will try and emulate - but with perhaps variable spending (see my earlier post) rather than building inflation onto £50k every yearYour point about LTA is noted - i need to do some more analysis

0 -

You have plenty of money to retire now very comfortably indeed. If you choose to keep working it will be to maintain a certain level of luxuries for your family. Up to you of course, nothing wrong with that but if it were me I'd be handing in my notice tomorrow.1

-

If it wasn’t for the kids there, I’d say the same. However….as the OP mentioned, just early car insurances can need some parental help these days 😳Gary1984 said:You have plenty of money to retire now very comfortably indeed. If you choose to keep working it will be to maintain a certain level of luxuries for your family. Up to you of course, nothing wrong with that but if it were me I'd be handing in my notice tomorrow.

We paid accommodation for Uni plus a bit….perhaps £6-700 pcm. Now coming towards the end, with hopes they will both be very independent soon (one is already…it is a great feeling🤪🤣)

The LTA will almost certainly be an issue here. Some minor mitigation possibilities:stack some into ISAs: make the pension funds less ‘risky’ (less volatile) & have the ‘riskier’ funds in the ISAs.Of course markets can (& will at some point, to some degree!) crash and provide….challenges, eh!

Happy to share my sanitised spreaddie for you to play with OP, just msg me.Plan for tomorrow, enjoy today!1 -

That does look like a useful spreadsheet.Robwales said:Secret2ndAccount said:Here's how drawdown might work:

Thanks so much - thats really useful - is that your own xls?

i will try and emulate - but with perhaps variable spending (see my earlier post) rather than building inflation onto £50k every yearYour point about LTA is noted - i need to do some more analysis

Robwales, I would definitely build in at least 3 or 4 stock market crashes and other negative growth years when you create the spreadsheet. An interesting exercise is to look at say, average growth of 4% over 40 years, but vary when the crashes occur. If for example you forecast a bad first decade, you will see how quickly your pot depletes. Then using the same average 4% growth rate for 40 years, key in a good first decade with big crashes later in retirement, and you will see a much healthier pot despite the same average growth and withdrawal rate. This example shows the important of the Sequence of Returns.0 -

That does look like a useful spreadsheet.

Robwales, I would definitely build in at least 3 or 4 stock market crashes and other negative growth years when you create the spreadsheet. An interesting exercise is to look at say, average growth of 4% over 40 years, but vary when the crashes occur. If for example you forecast a bad first decade, you will see how quickly your pot depletes. Then using the same average 4% growth rate for 40 years, key in a good first decade with big crashes later in retirement, and you will see a much healthier pot despite the same average growth and withdrawal rate. This example shows the important of the Sequence of Returns.

Is 4% a good percentage to use for average Pension growth?

I have a small DC pension (compared to most on here) , just over £200k

Then a £2k pa DB pension and some cash/premium bonds etc.

And relatively small outgoings

Could survive comfortably starting on £18k pa

Aged 60 and looking to retire early and soonish.

I had been working on a very Conservative growth of 1.25%

And running low of funds at age 85

I did change this to 2% to see the difference and suddenly life looked a lot more comfortable

If I worked on a 4% growth, it would be unbelievable0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599K Mortgages, Homes & Bills

- 177K Life & Family

- 257.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards