We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Share dividend tax increase

Laura Suter, head of personal finance and AJ Bell, said the dividend tax hike will be felt the most by company directors, including the self-employed and contractors, who pay themselves via company dividends in addition to salary.

“The move means that anyone taking home more than £2,000 a year in dividends will now face a slightly higher bill. At £10,000 of dividends this equates to £100 a year more, regardless of your tax bracket, while at £20,000 a year it means an extra cost of £225.

Individual investors will only face a higher tax bill if their annual dividends are over the annual dividend allowance of £2,000, Suter added.

“To be in that position you’d have to have a portfolio of over £50,000 if it was yielding 4% a year and the government estimates that around 60 per cent of people who have dividend income outside of ISAs will not see a tax increase next year.”

How many people will this tax rise affect, a good tax?

Comments

-

I'm not sure how many people this tax rise will effect, but it will generally affect those who are earning well, or have more investments than they can hold in an ISAs, so for me this seems fair enough.The comments I post are my personal opinion. While I try to check everything is correct before posting, I can and do make mistakes, so always try to check official information sources before relying on my posts.1

-

It affects me as a company director paying myself dividends but I don't pay national insurance. Also, dividend tax only starts after the tax free allowance (plus the £2k) rather than the NI which begins at the secondary threshold. So I will pay a little less than a PAYE employee. I also won't need to pay the employer NI increase.

Seems like a reasonably fair tax overall that gets everyone to pay a little.

3 -

Prism said:Seems like a reasonably fair tax overall that gets everyone to pay a little.I agree if they are going to tax people then it's reasonably fair that it's spread across both NI and dividends and while I have no problem with some extra for the NHS to help them catchup it does seem very unfair that all the workers should be required to pay more ongoing in order to protect the inheritance for some.The whole point of an inheritance is that it's the money leftover that wasn't needed to be spent during life. Care home charges are a life expense and if there are assets available to pay then it never seemed unreasonable that they would be usefully deployed for that purpose. I never had a problem with the idea that I would receive less inheritance if my parents had care fees or would give less inheritance if I needed care.I feel sorry for those in their 20s starting out with higher taxes, student debt, expensive house prices, etc. At least they get LISAs. We are established enough to not need our LISAs however I justify them to myself as they will help our kids on the property ladder after I am 60. If we didn't have kids then it probably wouldn't feel right claiming those 'young person' bonuses especially as I don't feel young anymore!On a personal level it's slightly annoying the £50k child benefit limit hasn't been raised in years so they aren't letting me draw more income in order to pay these higher taxes so for us it's just less money going into ISAs.7

-

It won't impact that many people. How many people are drawing >£2k dividends annually where the assets or not wrapped in a tax-free vehicle? And for the super wealthy the assets are hidden offshore anyway.tacpot12 said:I'm not sure how many people this tax rise will effect, but it will generally affect those who are earning well, or have more investments than they can hold in an ISAs, so for me this seems fair enough.

Could have lifted capital gains, or income tax, or added additional stamp duty to calm housing market too. Dividends was chosen as least impactful option on higher earners, whereas the NI hike was deliberately chosen to avoid pensioners (aka Tory voters) getting hit.

See through as anything. Like Alex said, inheritance should be money that can't be used in a lifetime, not money that could be used but the Government have instead chosen to protect that and levy the demand on the shoulders of workers/less well off people instead.

Every time. Jeesh.1 -

Laura Suter, head of personal finance and AJ Bell, said the dividend tax hike will be felt the most by company directors, including the self-employed and contractors, who pay themselves via company dividends in addition to salary.Although the self employed don't receive dividends (unless they hold investments).“To be in that position you’d have to have a portfolio of over £50,000 if it was yielding 4% a year and the government estimates that around 60 per cent of people who have dividend income outside of ISAs will not see a tax increase next year.”I tend to find a typical person can have around £100k-£150k in a GIA without breaching the dividend allowance as the average consumer will have a mixed portfolio including fixed interest securities that are not subject to the dividend tax. So, a couple can have around £200k-300k outside of ISA, pension and offshore bond wrappers.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.5 -

As it happens, I probably won’t be much affected by this tax, but I would have been happy to pay if I was. The problem with paying for your own care and particularly residential care is that’s it’s a lottery. Most of us won’t need it and most who do, will only need it for a short period. For some - particularly those with Dementia or their partners the costs can be astronomical and are likely to get even higher when we start paying carers better. For most similar risks (house burning down might be in the same ballpark financially) we have insurance but not for this.I think people on here may be underestimating the desperation felt by people who loose out on this lottery. Some of the cases on the news last night were heartbreaking. My elderly neighbour, whose wife had dementia, unfortunately took the extreme way out of shooting his wife and then himself at the point when his health meant that he wasn’t going to be able to carry on caring for her…2

-

There is a budget this month. All that will come in that.MaxiRobriguez said:

Could have lifted capital gains, or income tax, or added additional stamp duty to calm housing market too. Dividends was chosen as least impactful option on higher earners, whereas the NI hike was deliberately chosen to avoid pensioners (aka Tory voters) getting hit.

See through as anything. Like Alex said, inheritance should be money that can't be used in a lifetime, not money that could be used but the Government have instead chosen to protect that and levy the demand on the shoulders of workers/less well off people instead.

Minister for Health has already said this morning that Boris Johnson saying "nobody will have to sell their house" was absolutely wrong and that many people will still have to sell their house.

I'm paying more tax to pay for a solution to prevent home owners selling their houses which doesn't prevent them selling their houses. I'm paying for an elderly social care plan which which the IFS has already confirmed today will entirely go to the NHS backlog, not elderly social care.

4 -

pip895 said:As it happens, I probably won’t be much affected by this tax, but I would have been happy to pay if I was. The problem with paying for your own care and particularly residential care is that’s it’s a lottery. Most of us won’t need it and most who do, will only need it for a short period. For some - particularly those with Dementia or their partners the costs can be astronomical and are likely to get even higher when we start paying carers better. For most similar risks (house burning down might be in the same ballpark financially) we have insurance but not for this.I think people on here may be underestimating the desperation felt by people who loose out on this lottery. Some of the cases on the news last night were heartbreaking. My elderly neighbour, whose wife had dementia, unfortunately took the extreme way out of shooting his wife and then himself at the point when his health meant that he wasn’t going to be able to carry on caring for her…

And this 'plan' doesn't tackle any of those issues. The cap doesn't cover rent, energy, food, or day to day expenses so the lottery continues.

The tax rise money goes to the NHS backlog not social care.

So why would you be happy to pay it?2 -

Everything in this country is planned on the back of a fag packet.0

-

Although working people above state pension age (aka pensioners ) will pay the 1.25% levyMaxiRobriguez said:

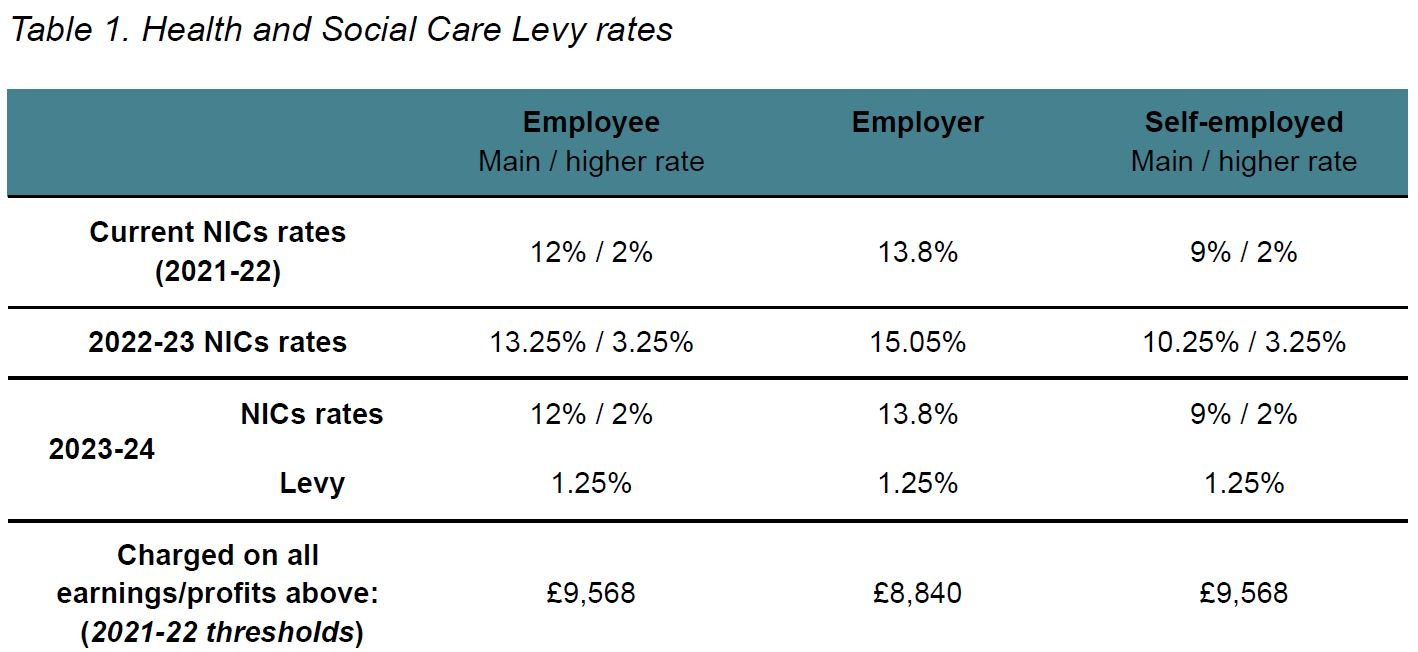

Could have lifted capital gains, or income tax, or added additional stamp duty to calm housing market too. Dividends was chosen as least impactful option on higher earners, whereas the NI hike was deliberately chosen to avoid pensioners (aka Tory voters) getting hit.- 60.The new Levy will be based on NICs which already part-fund the NHS and have historically been the way in which money is raised for social security provision in this country. The Levy will be effectively introduced from April 2022, when NICs for working age employees, self-employed and employers will increase by 1.25 per cent and be added to the existing NHS allocation. From April 2023, once HMRC’s systems are updated, the 1.25 per cent Levy will be formally separated out and will also apply to individuals working above State Pension age, and NICs rates will return to their 2021-22 levels. Revenues will be ringfenced for health and social care (see the Technical Annex for more detail).

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards