We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is there an efficient frontier for including smaller companies alongside an index fund?

Comments

-

For convenience: "there is no doubt that adding a small/mid-cap element to a portfolio can achieve the seemingly impossible feat of generating additional return whilst reducing risk ... if you changed 35 per cent ... of your portfolio to MSCI World Small Cap you would get a higher return for the same risk. For any lower percentage, the higher return would be accompanied by lower risk".Prism said:Here are Terry Smiths thoughts on the matter.

Fundsmith > Smithson > Financial Times - Busting the myths of investment3 -

Smithson is almost 3 years on from IPO - I will put together a 3 year monthly standard deviation when it is and see how it went. The timing of this article was before that launch and I'm not sure he would comment any further.Thrugelmir said:

Be interesting to hear an updated view. 3 years on. Historic comments need to considered in context. Far too often immediately become gospel at a later date.Prism said:Here are Terry Smiths thoughts on the matter.

Fundsmith > Smithson > Financial Times - Busting the myths of investment0 -

What's happened has happened. Global markets have risen over 40%. Views change.Prism said:

Smithson is almost 3 years on from IPO - I will put together a 3 year monthly standard deviation when it is and see how it went. The timing of this article was before that launch and I'm not sure he would comment any further.Thrugelmir said:

Be interesting to hear an updated view. 3 years on. Historic comments need to considered in context. Far too often immediately become gospel at a later date.Prism said:Here are Terry Smiths thoughts on the matter.

Fundsmith > Smithson > Financial Times - Busting the myths of investment0 -

rofl. It's not rocket science. If you want to know the risk of an investment, just look up the beta. Equities have a higher beta than bonds. Small companies have a higher beta than big companies. You take the risks that you are comfortable with. There's no "final frontier".0

-

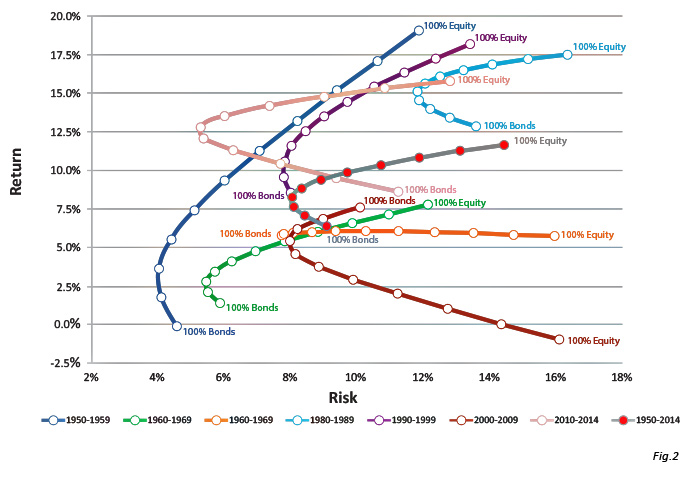

maxsteam said:rofl. It's not rocket science. If you want to know the risk of an investment, just look up the beta. Equities have a higher beta than bonds. Small companies have a higher beta than big companies. You take the risks that you are comfortable with. There's no "final frontier".Combining different financial assets leads to a portfolio beta that is not simply the average of its constituents. That is an indisputable fact.Efficient Frontiers do exist. They are not static, just as a single asset beta value is not static, so the only question is whether what worked in the past will continue to work in the future. This is a question that applies to any tactic you use when investing.6

-

Thrugelmir said:

You do realise that Jack bogle died in January 2019. Any viewpoint needs to be considered in relation to the markets at the time the interview was recorded. Not years later.Yes, I do know, but Bogle was talking about how to invest for fixed interest when interest rates are rock bottom. You yourself said the link between bonds and equities is "irretrievably broken" or at least "hibernating" due to low rates so, given they remain low (although with rumours of an increase to quell post-Covid inflation), I think his view remains relevant at least for today.

The easy answer would be that we are talking about data and not views, but that would be a little disingenuous, wouldn't it? After all, "lies, damned lies and statistics" (Mark Twain).Thrugelmir said:What's happened has happened. Global markets have risen over 40%. Views change.0 -

Couple of things…You've made my day, Prism! 15-20% small caps give you the lowest risk, and 35% small caps gives you a better return than 0% small caps with no extra risk.Steady on. The thread title is about ‘smaller’ companies, as are many of the charts. What are these beasts? But now you’re talking about ‘small’ companies’. ’Small’ companies has some sort of a definition(s) in the hands of index makers; something about the smallest 15% of the market, maybe. What are ‘smaller’ companies? Because the Terry Smith 2018 FT article talks about small AND mid-cap stocks giving the nice efficient frontier he shows. Is he talking about ‘smaller’ companies?

Secondly, and to repeat another post, don’t hang your hat on an efficient frontier without remembering that the curves have had a different shape when you use data from a different time period. Past performance does not …etc.I watched a Jack Bogle video yesterday (I just can't get enough of him) and, with rock bottom interestCan you post a link?

....since the historic equities/bonds formula isn't working well these days.In what way is it not working, because I looked at the returns for 80/20, because it was mentioned here, for 5 year periods covering the last 25 years. Arbitrary of course; choose your own. The annual returns for each 5 year period starting 1995, ending 2020, were: 5.3%, 2.6%, 5.5%, 7.6%, 8.6%. The standard deviations are all similar. Something's working.1 -

JohnWinder said:Couple of things…You've made my day, Prism! 15-20% small caps give you the lowest risk, and 35% small caps gives you a better return than 0% small caps with no extra risk.Steady on. The thread title is about ‘smaller’ companies, as are many of the charts. What are these beasts? But now you’re talking about ‘small’ companies’. ’Small’ companies has some sort of a definition(s) in the hands of index makers; something about the smallest 15% of the market, maybe. What are ‘smaller’ companies? Because the Terry Smith 2018 FT article talks about small AND mid-cap stocks giving the nice efficient frontier he shows. Is he talking about ‘smaller’ companies?

Secondly, and to repeat another post, don’t hang your hat on an efficient frontier without remembering that the curves have had a different shape when you use data from a different time period. Past performance does not …etc.Yes, small vs. smaller vs. SME. vs midcap. Terms need defining but not now as I need to turn on my work computer, but the index Terry Smith references is, I think, represented by iShares' WLDS.And Yes re the frontier changing dramatically over each decade, which I did mention in my opening post. JohnWinder said:Couple of things…I watched a Jack Bogle video yesterday (I just can't get enough of him) and, with rock bottom interestCan you post a link?I can't find it right now but there a lots - this is a good oneJohnWinder said:

JohnWinder said:Couple of things…I watched a Jack Bogle video yesterday (I just can't get enough of him) and, with rock bottom interestCan you post a link?I can't find it right now but there a lots - this is a good oneJohnWinder said:

That was sloppy of me. I was just mentioning how fixed interest is less straightforward than it used to be, in these times of low interest rates. That does not mean the 80/20 equity/bond rule will not turn out to be sound if that suits your risk tolerance, especially compared to alternatives.Couple of things…In what way is it not working, because I looked at the returns for 80/20, because it was mentioned here, for 5 year periods covering the last 25 years. Arbitrary of course; choose your own. The annual returns for each 5 year period starting 1995, ending 2020, were: 5.3%, 2.6%, 5.5%, 7.6%, 8.6%. The standard deviations are all similar. Something's working.

1 -

JohnWinder said:Couple of things…You've made my day, Prism! 15-20% small caps give you the lowest risk, and 35% small caps gives you a better return than 0% small caps with no extra risk.Steady on. The thread title is about ‘smaller’ companies, as are many of the charts. What are these beasts? But now you’re talking about ‘small’ companies’. ’Small’ companies has some sort of a definition(s) in the hands of index makers; something about the smallest 15% of the market, maybe. What are ‘smaller’ companies? Because the Terry Smith 2018 FT article talks about small AND mid-cap stocks giving the nice efficient frontier he shows. Is he talking about ‘smaller’ companies?

The IA defines four smaller companies sectors - UK, North America, European and Japanese. They represent roughly the bottom 10%, 20%, 20%, 30% respectively of their region by market cap. In comparison MCSI uses the term small cap and defines it as the bottom 14% in all regions. MCSI also combines these country indexes into a global index.

Currently that means a median of around £1bn but the range is pretty large. Some UK small caps make it into the FTSE 1004 -

How do we measure risk here? Volatility over what period?What about returns? Over what period?E.g. equities and bonds are negatively correlated over the short term, but long term they have been positively correlated for decades.If you are truly long term investors, why do short term volatility and return metrics matter so much (which is what the efficient frontier is based on)?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards