We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Using LifeStrategy 20 as a Bond Fund

Comments

-

I like it! I have heard good things about CGT and it appears to be a good shield in volatile times. I will do some investigation work.coastline said:0 -

If you like that, I posted an article discussing a number of these funds earlier in the thread: https://forums.moneysavingexpert.com/discussion/comment/78538512/#Comment_78538512older_and_no_wiser said:

I like it! I have heard good things about CGT and it appears to be a good shield in volatile times. I will do some investigation work.coastline said:

2 -

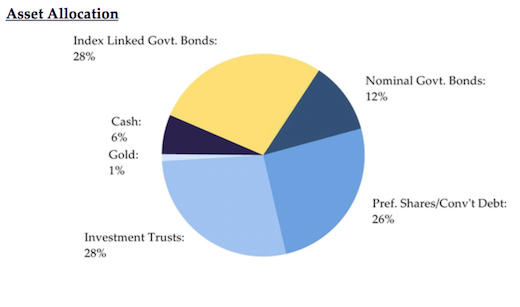

CGT's holdings are, according to its latest factsheet:

So 45% equities puts it closer to VLS40 than VLS60. If that is where it has historically been positioned - does anyone know?? - it seems to give good returns over the five years in coastline's link, matching VLS60 with less risk and volatility...

So 45% equities puts it closer to VLS40 than VLS60. If that is where it has historically been positioned - does anyone know?? - it seems to give good returns over the five years in coastline's link, matching VLS60 with less risk and volatility... .. but extend that to ten years and it looks less impressive

.. but extend that to ten years and it looks less impressive

0 -

Looking at Vanguard's annual report they have been making a net profit on their GBP hedging while the pound has been weakening (total returns have exceeded the GBP hedged benchmark minus fees). It will be harder for them to do that over the next period where the pound has strengthened and hedging would deliver a positive return for investors.Deleted_User said:I am pretty sure that the way yields are quoted doesn't allow for hedging gains/losses. And it is of course misleading to project returns based on the yield without also allowing for the hedging effect.

1 -

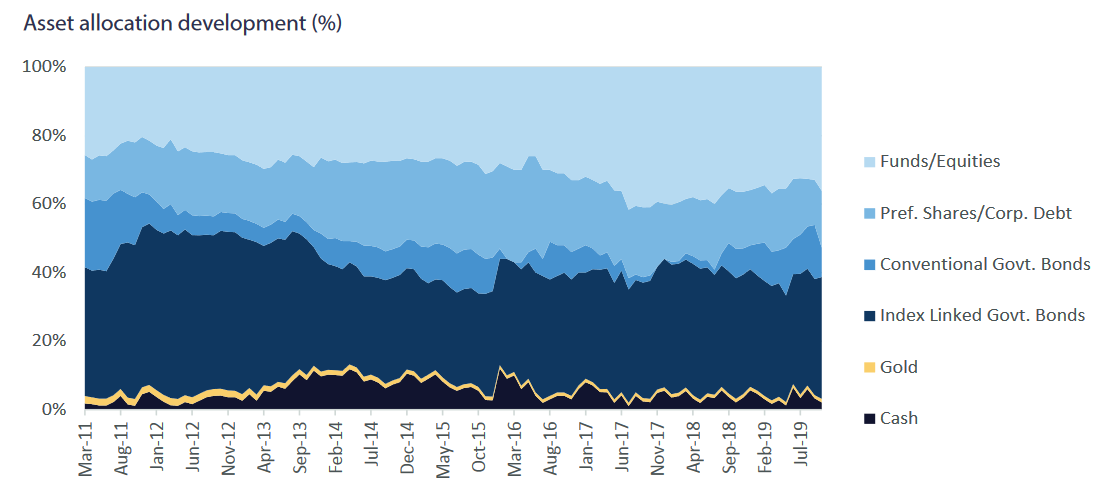

Capital_Gearing_Trust_-_Asset_Allocation_over_from_2011_to_2019.png (1108×494) (itinvestor.co.uk)

Capital Gearing Trust: Playing Ultra-Defensive – IT Investor

So 45% equities puts it closer to VLS40 than VLS60. If that is where it has historically been positioned - does anyone know?? - it seems to give good returns over the five years in coastline's link, matching VLS60 with less risk and volatility...

I have this bookmarked for reference as you can stretch the chart back to at least 1995.

Chart Tool | Trustnet

1 -

aroominyork said:So 45% equities puts it closer to VLS40 than VLS60. If that is where it has historically been positioned - does anyone know?? - it seems to give good returns over the five years in coastline's link, matching VLS60 with less risk and volatility...Monevator had an article on it about 6 years ago, including the asset allocation at that time. I believe it does shift around a bit. https://monevator.com/capital-gearing-investment-trust/

0 -

I'm showing coastline's Capital_Gearing_Trust_-_Asset_Allocation_over_from_2011_to_2019.png (1108×494) (itinvestor.co.uk):

So, as masonic's https://monevator.com/capital-gearing-investment-trust/ says: "...being bearish meant being wrong between 2010 and into 2015."You pays your money and you takes your choice!1

So, as masonic's https://monevator.com/capital-gearing-investment-trust/ says: "...being bearish meant being wrong between 2010 and into 2015."You pays your money and you takes your choice!1 -

One more thing I'll throw into the mix. I own Royal London Short Duration Credit. Map it against a global bond index since its launch and it performs similarly with less volatility. Looking forward, its short duration will be good as and when interest rates rise (though if that is just to dampen a temporary rise in inflation that might not be so important). On the downside, it only holds corporates so is no good if you want gilts in the mix.

0 -

I think the performance during the Covid crash gives a clue to the likely underperformance during a stockmarket downturn. It is, in effect, a lowish risk corporate bond fund. Only a quarter of the bonds are rated AAA-A vs over three quarters for the Vanguard fund, so considerably more credit risk is being taken on for those returns, which is fine while the companies can service their debts.

0 -

masonic said:I think the performance during the Covid crash gives a clue to the likely underperformance during a stockmarket downturn. It is, in effect, a lowish risk corporate bond fund. Only a quarter of the bonds are rated AAA-A vs over three quarters for the Vanguard fund, so considerably more credit risk is being taken on for those returns, which is fine while the companies can service their debts.Are you talking about the short duration fund? If you want AAA short duration bonds you are not going to get much in the way of returns; this fund's strategy is to pick from across the credit range to get its returns - although you did not mention that 48% of its holdings are BBB so the majority count as investment grade.And re. underperformance during the Covid crash, it did no worse than Vanguard's global fund if you start the chart on the first day of the dip, 6 March 2020.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards