We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

USS - General discussion

Comments

-

Sorry to hear that. One thing that isn’t clear is whether you are being made redundant (I.e., you have no choice - you’re fired) or have the option to ‘gamble’ (apply for VR or not)? If the latter, then one ‘bargaining’ tool would be to offer to reduce your hours such that deferring your VR until you turn 60 won’t cost the Uni very much. For example, assuming you are on a 3-month notice contract then you would expect to work roughly 60 days before leaving. If you don’t want to ask the Uni to pay for more than 60 days then given that you have pretty much a full year to go before turning 60 that would mean reducing your hours to one day a week. Which, in the end, would mean comparing two scenarios: [1] living off one day a week salary for ~12 months but with no ‘hit’ to the pension vs [2] taking the ‘hit’ in 3 months’ time. I would crunch the numbers for those two scenarios and decide whether [1] is something that would work for you (and be something to put on the table in the context of VR negotiations).1

-

Thanks for this. I am pretty certain we (there are four of us in the same role at the uni) are all for the chop. I can't imagine they'd be willing to offer me one day a week for a year, but I guess it's worth asking.Barralad77 said:Sorry to hear that. One thing that isn’t clear is whether you are being made redundant (I.e., you have no choice - you’re fired) or have the option to ‘gamble’ (apply for VR or not)? If the latter, then one ‘bargaining’ tool would be to offer to reduce your hours such that deferring your VR until you turn 60 won’t cost the Uni very much. For example, assuming you are on a 3-month notice contract then you would expect to work roughly 60 days before leaving. If you don’t want to ask the Uni to pay for more than 60 days then given that you have pretty much a full year to go before turning 60 that would mean reducing your hours to one day a week. Which, in the end, would mean comparing two scenarios: [1] living off one day a week salary for ~12 months but with no ‘hit’ to the pension vs [2] taking the ‘hit’ in 3 months’ time. I would crunch the numbers for those two scenarios and decide whether [1] is something that would work for you (and be something to put on the table in the context of VR negotiations).

The other part of my question was what to do to maximise my pension with the money coming my way (and indeed from my other savings)? Should I pay in a lump sum, increase my contributions, or both?

One other thing I forgot to mention is most of my USS service was built up prior to leaving in 2016 before rejoining in September 2023. My Benefit Statement in 2016 had just under 18 years and 230 days service.0 -

Well, I don’t know your particular situation but most Unis would - I imagine - prefer someone to take VR than to make them CR. That’s what’s behind my suggestion that you discuss the possibility of you taking VR at little to no extra cost to the Uni vs them making you CR. That said, VR settlements are typically more favourable than CR settlements, but that forces the Uni to weigh up the relative costs to them. In other words, would they prefer it if you stepped forwards, offering to take VR, but reducing your hours etc, vs having to select someone to take CR, with the additional effort that goes into that (e.g., justifying why person A should be made redundant rather than person B ). I suspect that the latter scenario is one that many Unis would prefer to avoid if possible, so you stepping forwards with your proposal to go P/T and so on might be attractive to them.1

-

Did anyone find out a more substantive reason as to why the figures on the modeller changed post April 1st?Twigwidge said:@Barralad77 No in fact the only things that she mentioned were the 1.7% uplift (instead of the 2.5% baked into the model) and possible underperformance of investments as the likely causes in the drop, I got the impression that she did not really know and suggested that I get a new quote for the most accurate figures. I am surprised that more people are not posting about this on here to be honest0 -

Unfortunately not but the investment builder portion has taken another hammering today, presumably reflecting the stock market, I just hope it bounces back as quick when (and if) the stock market doesAsimovs_nightfall said:

Did anyone find out a more substantive reason as to why the figures on the modeller changed post April 1st?Twigwidge said:@Barralad77 No in fact the only things that she mentioned were the 1.7% uplift (instead of the 2.5% baked into the model) and possible underperformance of investments as the likely causes in the drop, I got the impression that she did not really know and suggested that I get a new quote for the most accurate figures. I am surprised that more people are not posting about this on here to be honest0 -

More AVCs.

To buy? Or not to buy?

🤔0 -

My OH puts an extra £1200 a month into the IB.PJM_62 said:More AVCs.

To buy? Or not to buy?

🤔

It is strange on the main pension that it shows a figure built to today…but when she puts age 55 in (in 2 years) it drops from today’s figure. I can’t work out why it would.0 -

One big point to note: if you're still an active member you can retire at 60+ (with employer consent) and there's no ERF reduction on the benefits prior to Oct 2011. (There is an ERF for post-2011 years). However, if you stop being an active member that 60 changes to age 63.5 (don't know where that number came from). So , if you leave at 59.9 , then take the pension at 60 there would be a big hit on the ERF for 3.5 years early. I'd try to spin it out part-time until 60.Morgan-Green said:Hello folks

I was told last week, on my 59th birthday no less, that I am being made redundant from my role. It's early days in the process but I'm inclined to try and ride out the year to my 60th and then draw down my pension from USS. I'm tempted to take the voluntary redundancy package on offer and try to top up my pension with it, but what is the best approach in doing this?

I should add I'm recently mortgage-free (yay!) with a current salary of £66k, and the modeller is quoting a pension at 60 of £19k with a £57k lump sum and £7.1k in the investment builder. This takes a big hit if I take it now, which is why I'd rather do all I can to wait a year and top it up as much as is allowed while I still employed.

I also have around £100k in savings.

Any advice would be most gratefully received!0 -

Do you know where the USS say this, as I had assumed that retiring at 60 would still reduce by 3.5 years ERFs (if an active member) on pre 2011 benefits? thanksMarlowMallard said:

One big point to note: if you're still an active member you can retire at 60+ (with employer consent) and there's no ERF reduction on the benefits prior to Oct 2011. (There is an ERF for post-2011 years). However, if you stop being an active member that 60 changes to age 63.5 (don't know where that number came from). So , if you leave at 59.9 , then take the pension at 60 there would be a big hit on the ERF for 3.5 years early. I'd try to spin it out part-time until 60.Morgan-Green said:Hello folks

I was told last week, on my 59th birthday no less, that I am being made redundant from my role. It's early days in the process but I'm inclined to try and ride out the year to my 60th and then draw down my pension from USS. I'm tempted to take the voluntary redundancy package on offer and try to top up my pension with it, but what is the best approach in doing this?

I should add I'm recently mortgage-free (yay!) with a current salary of £66k, and the modeller is quoting a pension at 60 of £19k with a £57k lump sum and £7.1k in the investment builder. This takes a big hit if I take it now, which is why I'd rather do all I can to wait a year and top it up as much as is allowed while I still employed.

I also have around £100k in savings.

Any advice would be most gratefully received! 0

0 -

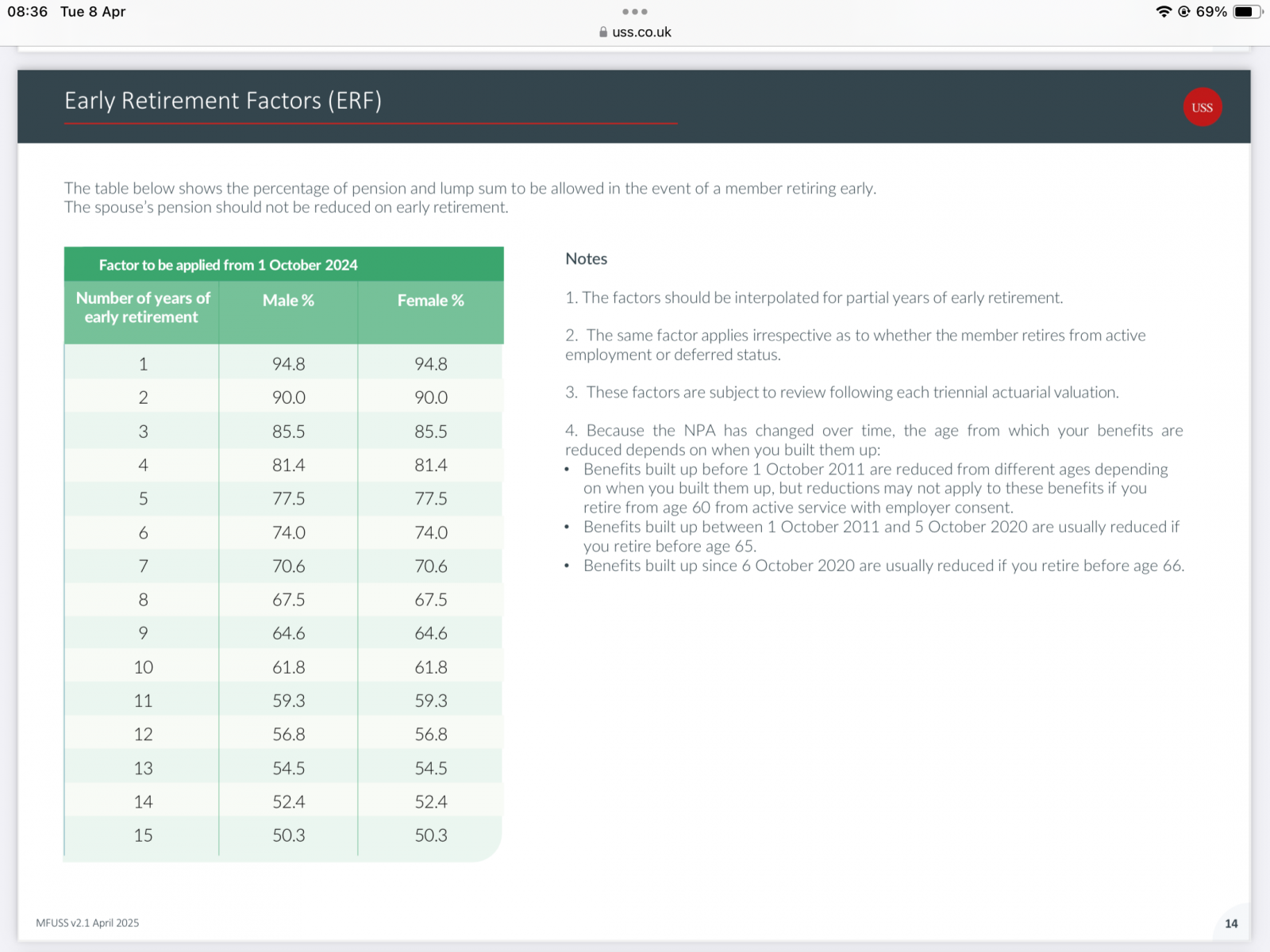

See Note 4.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards