We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

USS - General discussion

Comments

-

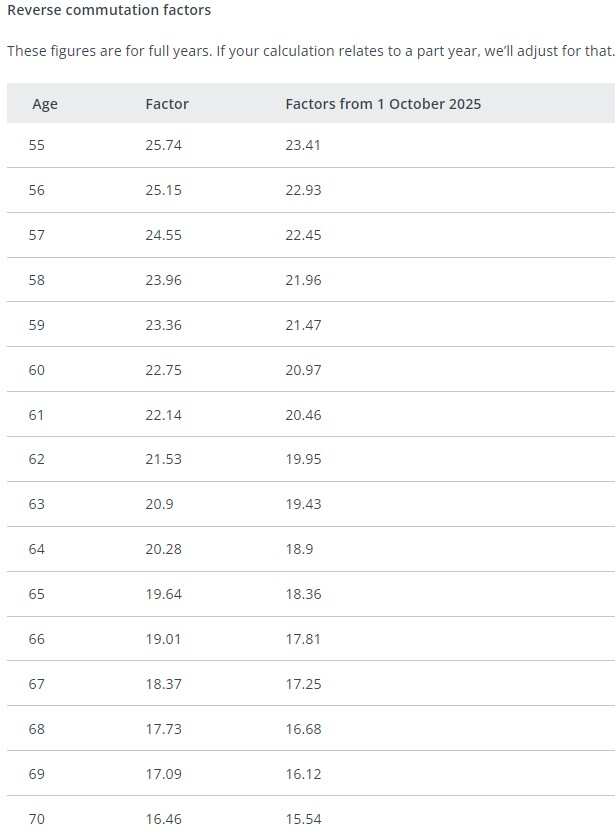

@Barralad77 I think some of the difference / sharp change in the modeller values is to do with the fact that "benefits are shown in today’s terms", perhaps that is why if you look each day the numbers gradually creep up (mine are by a couple of £ a day, so if that carries it will be +~£700 over the year), I guess that the modeller steps into a new year on 1 April and resets things. This combined with the drop from assumed 2.5% to real 1.7% increase gives (in my spreadsheet) roughly the drop I had.One other thing I've noticed is at some point it's been reported that the commutation factors will changed (as from 1st Oct 2025):

these are now a little more favorable when exchanging lump sump for extra pension (say at 60yrs old sacrificing £10k of LS will now give extra £477 pension p.a rather that an extra £440).

0 -

Thanks @mini850. I still can’t figure how the modeller works. Prior to April 1st the projected value at 60 + 0 for me was ‘X’ and this had been rising by a fixed amount each day through 2024-25. Since April 1st it continues to rise by that same daily amount, but now the value of ‘X’ is many £00s lower than it was two weeks ago. If the modeller is applying pretty much the same increase each day, and there is no difference in what this daily increase is across 2024-25 and now 2025-26 then I still can’t fathom why a projected figure for later this year should be so different. From the way you’ve described it, the value of ‘X’ increases by a certain amount for 365 days and then, at the end of the year, all of that combined increase is removed in a reset*. I’m not sure what might be happening, but think I’ll accept defeat. It’s a defined benefit scheme; it is a fixed value that is earned via set contributions. I can’t see why the value would go down given the ‘fixedness’ of those elements? I can see how it would go up, via annual uplifts every April, but not go down. Indeed, I can’t see any value in a modeller where that is even possible. What’s the point of providing a modeller which tells you you will receive ‘X’ at whichever point you retire if it turns out that you’ll actually get significantly less than that? Who wants such a model? Anyone?

Interesting point about the RC factors changing. I guess USS could have announced these changes via whatever means (on the platform, via email, whatever….) but thought it best not to do that lest people know what’s actually going on (which seems to be their MO in such matters).

*even this hypothetical scenario doesn’t explain the difference I’m seeing, as the drop is more than double the total accrued daily increases across the year. It sounds as though your annuity rises by £2 per day or £730 per year, and your valuation is now roughly £700 lower. But for me, my annuity rises by only £370 per year (roughly £1 per day) and yet my valuation is - once I’ve factored in the 0.8% difference in the 2025 uplift - still £700+ lower, just as yours appears to be.0 -

No that's not right... if you leave USS at (say) 50, do something else , then take the pension at 65, the ERF is only 0 or 1 year, not 15 So the ERF applies from the difference between when you start drawing pension until NPA ; but there is a special exemption that if you are over 60 AND in active membership when you take the pension, they "waive" the ERF on pre-Oct-2011 service.Barralad77 said:(snip)

. I think this is the case for all NPAs. By which I mean that if you stop contributing (e.g.,) 4 years before the ERF reduces to 1.0 then the ERF doesn’t ’improve’ over that four year period. The ERF that applies when you stop contributing is the one that will be applied regardless of when you finally start taking the pension.

If you've left active membership before 60, then the NPA seems to be 63.5 for pre-Oct-2011 service .0 -

Thanks. I wasn’t completely sure I’d got that right, so thanks for clarifying.

0 -

Barralad77 said:Thanks @mini850. I still can’t figure how the modeller works. Prior to April 1st the projected value at 60 + 0 for me was ‘X’ and this had been rising by a fixed amount each day through 2024-25. Since April 1st it continues to rise by that same daily amount, but now the value of ‘X’ is many £00s lower than it was two weeks ago. If the modeller is applying pretty much the same increase each day, and there is no difference in what this daily increase is across 2024-25 and now 2025-26 then I still can’t fathom why a projected figure for later this year should be so different. From the way you’ve described it, the value of ‘X’ increases by a certain amount for 365 days and then, at the end of the year, all of that combined increase is removed in a reset*. I’m not sure what might be happening, but think I’ll accept defeat. It’s a defined benefit scheme; it is a fixed value that is earned via set contributions. I can’t see why the value would go down given the ‘fixedness’ of those elements? I can see how it would go up, via annual uplifts every April, but not go down. Indeed, I can’t see any value in a modeller where that is even possible. What’s the point of providing a modeller which tells you you will receive ‘X’ at whichever point you retire if it turns out that you’ll actually get significantly less than that? Who wants such a model? Anyone?

Interesting point about the RC factors changing. I guess USS could have announced these changes via whatever means (on the platform, via email, whatever….) but thought it best not to do that lest people know what’s actually going on (which seems to be their MO in such matters).

*even this hypothetical scenario doesn’t explain the difference I’m seeing, as the drop is more than double the total accrued daily increases across the year. It sounds as though your annuity rises by £2 per day or £730 per year, and your valuation is now roughly £700 lower. But for me, my annuity rises by only £370 per year (roughly £1 per day) and yet my valuation is - once I’ve factored in the 0.8% difference in the 2025 uplift - still £700+ lower, just as yours appears to be.

Me neither (re figuring out how the modeller works), but I do think that it is trying to give equivalent present value and suspect this is done by year - so you get steps (particularly if actual changes deviate from assumptions). Anyway as you say it's defined benefit so as we approach actual retirement the values should converge to what we can calculate directly. BTW I checked the increment today and it's now closer to £1/day.0 -

I agree. If I was using the modeller to give me a projected figure for, say, 6 years from now and saw it drop by as much as mine has done I might be willing to accept that they’d revised down the assumed annual uplift figure (e.g., from 2.5 to 2.0) that would be applied each year moving forward. But I was projecting to a point that was (on 31/03) 8 months away and is now 7.5 months away. Doubling the drop in the annual uplift (i.e., 2 x 0.8) still goes nowhere towards explaining the difference I’m seeing. The difference for my projection for the end of November has dropped by more than 5%.0

-

A 5% drop certainly puts the usefulness of the modeller as a planning tool into doubt. Are you on the USS Member Voice website? Might be worth posting a new topic querying this - I'd do so myself but it would be better coming from someone who knows they are directly affected and has the numbers to hand to back it up.Barralad77 said:I agree. If I was using the modeller to give me a projected figure for, say, 6 years from now and saw it drop by as much as mine has done I might be willing to accept that they’d revised down the assumed annual uplift figure (e.g., from 2.5 to 2.0) that would be applied each year moving forward. But I was projecting to a point that was (on 31/03) 8 months away and is now 7.5 months away. Doubling the drop in the annual uplift (i.e., 2 x 0.8) still goes nowhere towards explaining the difference I’m seeing. The difference for my projection for the end of November has dropped by more than 5%.

EEM0 -

There is now an item on Member Voice about this, but it didn't have any responses when I looked. Maybe we should add some...0

-

Just added mine0

-

I believe the Member Voice is panel based so do inform us if any news.uss_hamish said:There is now an item on Member Voice about this, but it didn't have any responses when I looked. Maybe we should add some...

Related, I've just had my quote and it differs by 3.8% to the model (standard option).

I should have added, quote is 3.8% higher.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards