We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

PCP vs Leasing

brothermalzone

Posts: 37 Forumite

in Motoring

I'm currently looking at purchasing a new Skoda Kodiaq SEL.

Leasing works out at £247 per month over 3 years with £3,200 deposit.

PCP is £315 a month with same deposit (current car trade value).

The lease option obviously looks a lot more attractive due to the lower monthly payments, and I should add that im not intending to keep the car after 3 years...Id like to change to a new one.

The only thing im wondering is that if there is Equity at the end of PCP agreement I could use the money towards the next cars deposit, as oppose to the lease where I'll need to fund a new deposit?

Do you think leasing is better for my circumstances?

Thanks

Leasing works out at £247 per month over 3 years with £3,200 deposit.

PCP is £315 a month with same deposit (current car trade value).

The lease option obviously looks a lot more attractive due to the lower monthly payments, and I should add that im not intending to keep the car after 3 years...Id like to change to a new one.

The only thing im wondering is that if there is Equity at the end of PCP agreement I could use the money towards the next cars deposit, as oppose to the lease where I'll need to fund a new deposit?

Do you think leasing is better for my circumstances?

Thanks

0

Comments

-

And what if there is negative equity? Then you'll have paid £2,500 more in finance payments and still be in the same position.brothermalzone said:The only thing im wondering is that if there is Equity at the end of PCP agreement I could use the money towards the next cars deposit, as oppose to the lease where I'll need to fund a new deposit?

You need to look at the likely residual value against the balloon and see if its likely to be £4,000 or more over... if it is then maybe take the PCP as it looks like they've been too conservative. If its less then I'd be more thinking the lease as your only thinking of £1,500 of gain with a reasonable chance of £2,500 or loss2 -

How much interest is payable on the PCP?

If you anticipate a higher trade value than the GFV and you have the capital, you could settle the PCP loan and save on any interest too.0 -

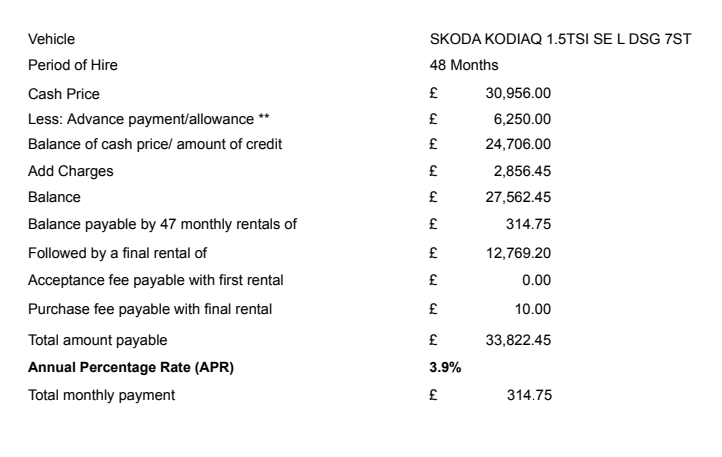

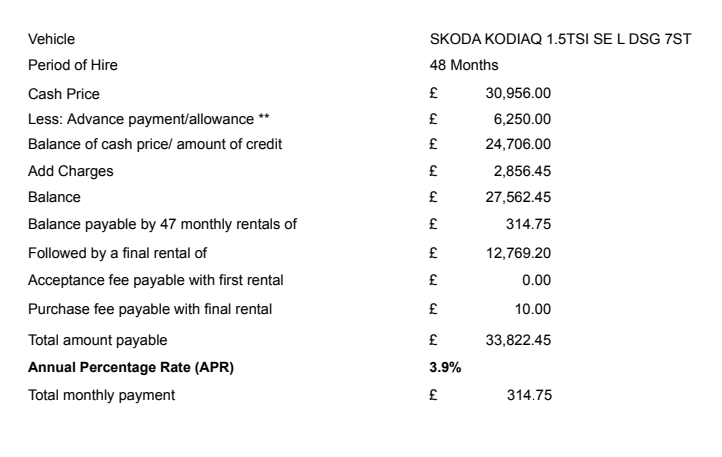

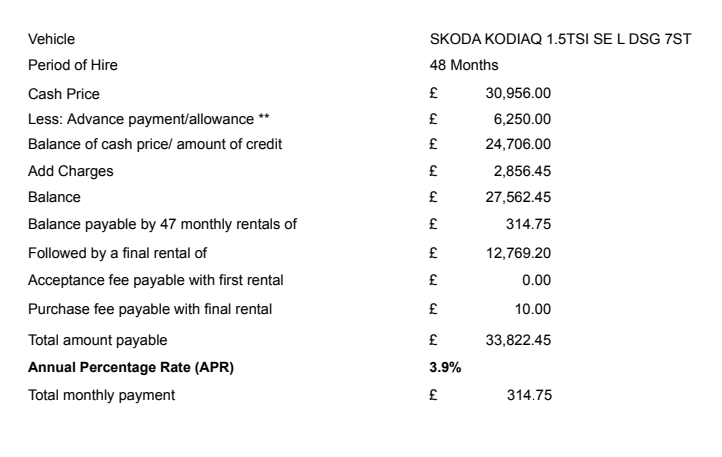

Here's the details for thr PCP. It's actually 48 month as oppose to 36 months like the Lease.DrEskimo said:How much interest is payable on the PCP?

If you anticipate a higher trade value than the GFV and you have the capital, you could settle the PCP loan and save on any interest too. 0

0 -

Unless you're paying a decent sized deposit, and you're not, it's exceptionally rare to have any equity in the car at the end of your PCP, the finance provider's are usually pretty good at getting the GFV correct. As you've no intention of keeping the car then a PCP is not really designed for you, take the lease.

Just one thing to be aware of though, is leasing has fewer options should you fall in to difficulty and need to get out of it early.3 -

The deposit wont affect the equity at the end of the term as the higher the deposit, the lower the monthly payments (and also less interest paid). It doesnt reduce the residual value.neilmcl said:Unless you're paying a decent sized deposit, and you're not, it's exceptionally rare to have any equity in the car at the end of your PCP, the finance provider's are usually pretty good at getting the GFV correct. As you've no intention of keeping the car then a PCP is not really designed for you, take the lease.

Just one thing to be aware of though, is leasing has fewer options should you fall in to difficulty and need to get out of it early.

1 -

I will start by declaring by hand that I am generally not a fan of lease, nor PCP for that matter.brothermalzone said:Skoda Kodiaq SEL.

Leasing works out at £247 per month over 3 years with £3,200 deposit.

PCP is £315 a month with same deposit (current car trade value).

im not intending to keep the car after 3 years...Id like to change to a new one.

The only thing im wondering is that if there is Equity at the end of PCP agreement

Do you think leasing is better for my circumstances?

However, this is the second thread in two days about attractive lease offers from Skoda.

It is almost as though someone made a mistake. There could, of course, be a perfectly genuine reason such as a glut of discontinued engine or trim options that they need to dump, or even just desperation to achieve registration figures (against all the claimed "shortages" of vehicles).

It is also important to check there is no catch in the detail of the deal - steep excess mileage rates?

Having said all that, if the deal is as it says on the tin, then very hard to argue against and hoover the deals up while they continue to be available.

Comparing lease versus PCP, using the OP's figures:

Lease- £11,845 to use the car for three years

- Limited flexibility to change / terminate mid-term

- Just hand the car back after three years (may be able to agree purchase at a price to be determined).

- £14,225 to use the car for three years (£2,380 more than lease)

- More flexibility if you need to change / terminate mid-term

- Can simply pay the whole lot early if you choose

- Right to buy the car at the end at the balloon payment

- There may be equity in the car at the end of the term, but this would need to be more than £2,380 just to break even with the lease.

With the OP's aspiration to change vehicles after three years, the lease looks like a very good option in this case.

As for using equity from the PCP to generate the deposit for the next vehicle, that is by no means certain, but if the OP takes the lease and then puts the remainder of what the PCP monthly payment would be (£315 - £247 = £68 per month) into a savings account, there will be £2,380 deposit available.

Good luck OP and hope you enjoy the car

EDIT:

The lease company may be benefitting from massive corporate discounts that the individual purchaser cannot secure and that may be facilitating the keen rates.

I also understand there has been a recent change in the application of VAT rules that may be impacting the variance between lease and PCP. I am not an expert, but it was around the treatment of the VAT as a hire or whether the PCP was really a sale.1 -

Well first make sure the £30,956 is the most competitive price.brothermalzone said:

Here's the details for thr PCP. It's actually 48 month as oppose to 36 months like the Lease.DrEskimo said:How much interest is payable on the PCP?

If you anticipate a higher trade value than the GFV and you have the capital, you could settle the PCP loan and save on any interest too.

It's harder to compare the 36m lease with a 48m PCP, but basically if you anticipate that the car will be worth same/more than the GFV, then settling the PCP will save you a further ~£2,000 over a 36m PCP by not paying those interest charges.

Remember, the act of trading a car in to a dealership/WBAC/local garage after 2/3yrs is exactly the same regardless of how you buy it.

You could even go one step further and look at 1-2yr old to see if you can get the car even cheaper, knowing that the depreciation from years 2-5 is going to be even cheaper still. There is nothing stopping you trading in a car you have bought, whether brand new or used, every few years and it may be the car is under full warranty during that time, or you can factor in a small additional payment for extending the warranty.1 -

As @motorguy suggests, the deposit will have no effect on the equity at the end of the deal. The GFV will be exactly the same.neilmcl said:Unless you're paying a decent sized deposit, and you're not, it's exceptionally rare to have any equity in the car at the end of your PCP, the finance provider's are usually pretty good at getting the GFV correct. As you've no intention of keeping the car then a PCP is not really designed for you, take the lease.

Just one thing to be aware of though, is leasing has fewer options should you fall in to difficulty and need to get out of it early.

Increasingly the GFVs are being set to lower than market price due to changes in how VAT is charged. So it's entirely possible that there will be equity.1 -

I only just noticed this and comparing a 3 year lease versus 4 year PCP is so difficult - what will the OP do for the fourth year if they take the lease?brothermalzone said:Here's the details for thr PCP. It's actually 48 month as oppose to 36 months like the Lease.

IF it was assumed that the OP would renew the lease on exactly the same deal again (deposit, term, monthly), then by the end of the fourth year, the OP had paid:- Lease = £247*47 + £3,200*2 = £18,009

- PCP = £315*47 + £3,200 = £18,005

To properly compare lease versus PCP, the OP needs to have the same term in both cases, either a longer lease term or a shorter PCP. Both options should be quoted quickly by the supplying companies if requested. It is not unusual for buyers to need to assess these types of variations.

It looks like any discount / incentive is rolled up in the "Advance payment / allowance" line as the OP said £3,200 deposit but the quote says £6,250, so discount around £3k?DrEskimo said:

Well first make sure the £30,956 is the most competitive price.Here's the details for thr PCP. It's actually 48 month as oppose to 36 months like the Lease.

An online broker seems to have the car of the OP's choice at list £32k, save £6.5k, pay £25.5k - devil is always in the detail, that may assume within a PCP or similar (but PCP can be converted to cash after the event):

https://broadspeed.com/new_cars/Skoda/Kodiaq/Choose_Number_Of_Doors/SUV/petrol/Choose_Engine_Size/automatic

If that deal is available, then the OP should be looking to save at least another £3.2k on the PCP (current car trade value) or, take the discount from Skoda PCP and sell the car via another route.

1 -

Skoda website ŠKODA KAROQ 0% APR Deals & Offers | ŠKODA UK (skoda.co.uk) quotes for same model on PCP over 36 months @ 0%. Total cost = £17,467.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards