We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Advice re leaving card open

Tiddleshalifax

Posts: 221 Forumite

so, the story so far!

since I was 18, I’ve spent irrationally!! I racked up 5.5k on one card, 1800 on another and 1100 on a next account.

I’m 33 now,

about 6m before the first lockdown, back end 2019, I made the decision that I was going to get it cleared as we wanted to move house and I’d always kept it secret from my husband. I’m fortunate that we are in steady jobs unaffected by the pandemic.

The card with 1800 has now been cleared completely. I owe 500 on the next account and 1400 approx on the other card.

With the 1800 balance, I spoke to the bank and agreed a payment plan with them freezing the card. It’s now closed as agreed.

with the next account, I’ve been paying the minimum payment until recently simply because the other was such a high balance that I focused on that.

since I was 18, I’ve spent irrationally!! I racked up 5.5k on one card, 1800 on another and 1100 on a next account.

I’m 33 now,

about 6m before the first lockdown, back end 2019, I made the decision that I was going to get it cleared as we wanted to move house and I’d always kept it secret from my husband. I’m fortunate that we are in steady jobs unaffected by the pandemic.

The card with 1800 has now been cleared completely. I owe 500 on the next account and 1400 approx on the other card.

With the 1800 balance, I spoke to the bank and agreed a payment plan with them freezing the card. It’s now closed as agreed.

with the next account, I’ve been paying the minimum payment until recently simply because the other was such a high balance that I focused on that.

We’ve now sold our house & we’re in the process of buying - and my husband (who now knows) has offered to clear the accounts with his savings in the next couple of months - (he will have savings after we move) but my question is,

I think I should close both accounts (next will go for sure)

but I’m wondering if this would have an adverse effect on my credit rating?

I think I should close both accounts (next will go for sure)

but I’m wondering if this would have an adverse effect on my credit rating?

It’s a good rating as I’ve never missed or had late payments! Part of me is considering having the limit on my credit card capped at 1k for emergencies only? My husband has said he will keep hold of the card if I choose to do this!

I do have restraint now though as I don’t want to be in this position again!!

Sorry for the long post

0

Comments

-

Don't close old cards (though the Next account would be ok), it will trash your rating to have nothing available - lenders like long term stability such as a long held card used monthly and paid off in full. If your partner takes away your card then it'll get closed anyway through lack of use and ruins any chance you have to keep up your credit rating for future borrowing.Payment plans / freezing interest do count against your credit rating though so if you want to keep a good rating and indeed, improve it, then, at the very least, a card setup to pay in full by DD every month from your income (maybe set the payment day 1-2 days after pay day) is a good thing e.g. for cashback or rewards and section 75 protection.0

-

Oh brilliant.When I set up the payment plan, they didn’t freeze interest - the card was still useable but I did close that one as the lender was terrible with me anyway!I’ve spoken to my husband, we’ve decided we will do our big shop on the card each month and pay it in full (once I’ve cleared this big balance) when the statement goes through.Thanks for your response0

-

If they applied AP markers for the payment arrangements you might struggle to get a mortgage without the help of a broker (and you might still struggle depending on how recent they are.)Tiddleshalifax said:Oh brilliant.When I set up the payment plan, they didn’t freeze interest - the card was still useable but I did close that one as the lender was terrible with me anyway!I’ve spoken to my husband, we’ve decided we will do our big shop on the card each month and pay it in full (once I’ve cleared this big balance) when the statement goes through.Thanks for your response0 -

What do you mean AP markers?ThisnotThat said:

If they applied AP markers for the payment arrangements you might struggle to get a mortgage without the help of a broker (and you might still struggle depending on how recent they are.)Tiddleshalifax said:Oh brilliant.When I set up the payment plan, they didn’t freeze interest - the card was still useable but I did close that one as the lender was terrible with me anyway!I’ve spoken to my husband, we’ve decided we will do our big shop on the card each month and pay it in full (once I’ve cleared this big balance) when the statement goes through.Thanks for your responseIt hasn’t impacted my credit rating as the card remained active and reported normal and active until I closed it ? I just set up a direct debit to clear the account rather than paying the minimum payment.

we are using a broker and our application is in.0 -

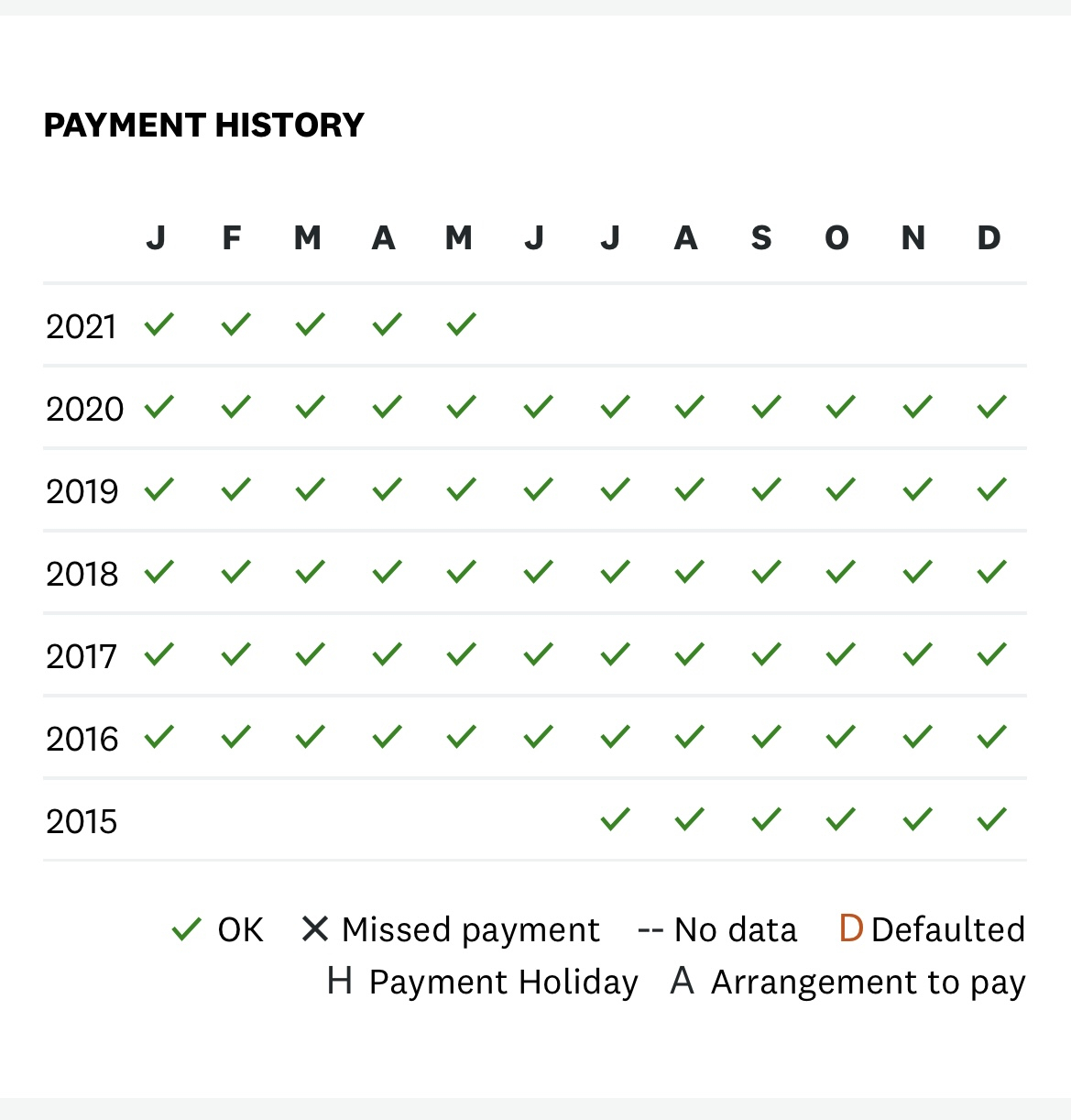

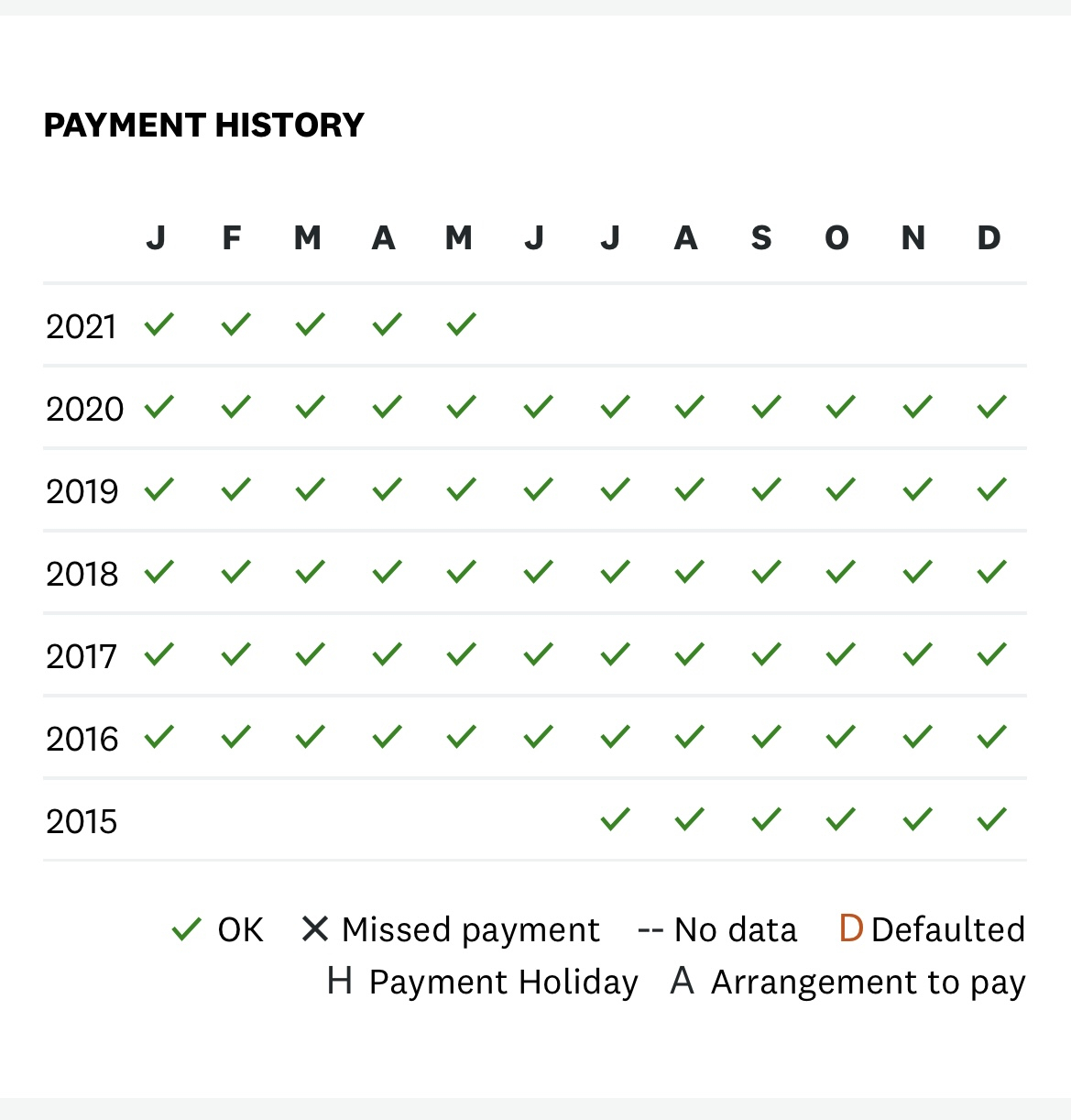

I’ve had a look. No A marker?

I’ve had a look. No A marker?

0 -

Should be fine, need to check all three CRAs though.Tiddleshalifax said: I’ve had a look. No A marker? 1

I’ve had a look. No A marker? 1 -

Are they all free to check? Sorry I’m a novice it appears0

-

Yes https://www.moneysavingexpert.com/creditclub/ for Experian and https://www.clearscore.com/ for Equifax.Tiddleshalifax said:Are they all free to check? Sorry I’m a novice it appears1 -

Thanks for that! It doesn’t actually show with the money saving one so that’s odd. But it’s not recorded as a A/AP plan so hopefully that won’t be an issueThisnotThat said:

Yes https://www.moneysavingexpert.com/creditclub/ for Experian and https://www.clearscore.com/ for Equifax.I Tiddleshalifax said:Are they all free to check? Sorry I’m a novice it appears 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards