We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Low salary can't afford to buy anywhere

Comments

-

Lol not a chance of this happening in the public sector anyway where pay freezes have already been announced.testb2b said:wages will catch up eventually with the prices. Wage inflation is required for affordability to improve. £50k will be average wages as the inflation fires up due to all this money printing.10 -

Keep plugging away. Move for work to find a higher salary if you have to (and lodge cheaply, rather than spending on a place solely for yourself). Change your situation. Solo ownership is a feat, but I assure you it can be done even in today's market as a thirty-something. (Edit: I really don't mean to come across as patronising, I know how demoralising it is)0

-

Sunsaru said:

Thats a lot of assumptions to make considering what little the OP has posted.FaceHead said:hazyjo said:So earning around £24-25k pa? So that's around £1650 a month? How much have you managed to save over the years for a deposit?

Given that they've been living with parents and paying low/no rent they should have been able to save at least £500 per month, so over the 15 years they've been working to date that's about £90,000. Combined with the £110,000 mortgage, £200,000 can get a decent 1 bed or grubby 2 bed flat around Enfield.

Perhaps the OP will tell us what they've saved. They seem to think the process of funding a purchase is get job -> borrow money. That's 1% of the effort.

The other 99% of the effort is saving every month a decent chunk of your pay.

How to save money and build a deposit to buy a place is something the OP could actually get helpful advice on through this forum, if they viewed the problem in that way.1 -

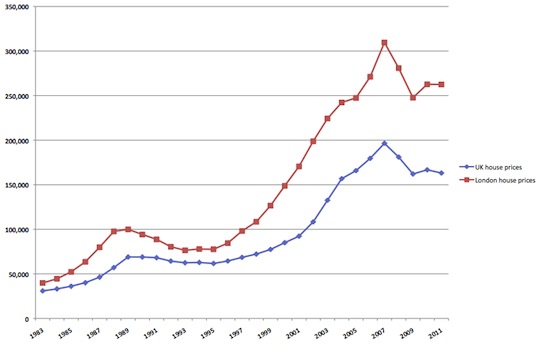

The "London Living Wage" is £21k full-time. You want to buy in London, on a single salary barely more than that? Good luck.

For London average property prices to be around your budget, you're literally about a quarter of a century late.

...except inflation alone takes those mid-90s prices to around the same point as today's.0 -

And this is the head in the sand moment; many seem to think that the SE will continue to run smoothly despite the fact that those people filling to low paid jobs cannot afford to stay.Cakeguts said:If you want to buy somewhere you will need to move to an area where your job with its low salary buys more. That won't be in the South East.

Some regular posters will have them all moving to northern cities where buying property is "easy" as long as you're not discerning and are happy to live in sub standard accommodation!

33 and still aspirational to purchase a house while the rest of your life goes on hold. It's a crazy situation.4 -

Agree with others. Just come back from Manchester where some outlying areas you could buy a 2 bed terrace for that kind of money.As for the comment above, sub-standard property is OK if it's £300k?There's nothing different about the property. It's just cheaper as it's in a less desirable part of the country.0

-

You have 4 main options:

- Stay living with mum and dad

- Find a much better paying job in the area you want to live

- Move to somewhere where property is cheaper and look for a new job there.

- Find a partner and buy a house together (or find a friend in a similar situation to you that you could buy a house with).

2 -

If you really want to buy a property then your choices if you stay where you are will be very limited. Is shared ownership even an option with such a low wage in the south east?

Could you consider moving to a cheaper area perhaps?

Where we live for example your £110k (which doesn't account for any deposit you may have saved) would buy you a range of property from a terraced house, a modern 2 bed flat, 3 bed semi requiring some modernisation, etc. Property here is relatively cheap when compared to the average wage. (Although prices have risen sharply in the last couple of years)

0 -

It's about time there was a government scheme to build new homes all over the country specifically for first time buyers.0

-

We can make relevant suggestions after we know from OP:

- their savings situation

- how far they are willing/can move from where they currently are

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards