We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

We're aware that some users are experiencing technical issues which the team are working to resolve. See the Community Noticeboard for more info. Thank you for your patience.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Underweighting the US using index funds

Options

Comments

-

The simplest way to achieve reduced US weighting from a global fund is to add a global-ex-US fund?0

-

For clarification, the mentions of cycle, over what period of time would one define a cycle?0

-

Agreed, Vanguard keeps telling me that I need more international stocks so last week I just bought VTIAX which is an international equity fund ex-US.MaxiRobriguez said:The simplest way to achieve reduced US weighting from a global fund is to add a global-ex-US fund?“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

It’s not a period of time, it’s good times followed by bad. You don’t know how long each portion of that will last. https://en.m.wikipedia.org/wiki/Business_cycleBillycock said:For clarification, the mentions of cycle, over what period of time would one define a cycle?0 -

It would be but are there any available on UK platforms? I have not seen one.MaxiRobriguez said:The simplest way to achieve reduced US weighting from a global fund is to add a global-ex-US fund?1 -

So the assumption is that the US is over valued and therefore growth may be slower than other regions or a larger correction may occur. Does history suggest that this assumption is likely to be correct ?0

-

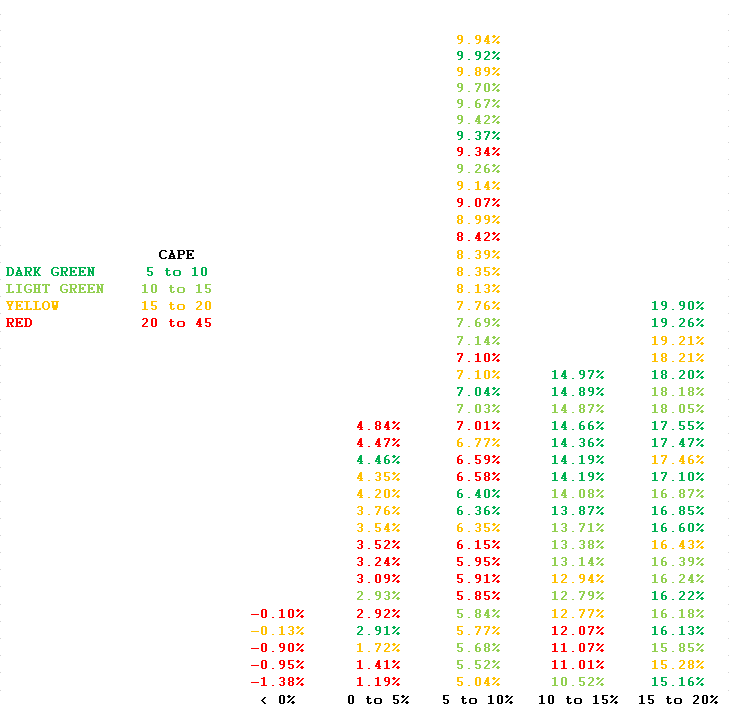

Not growth in the companies but it suggests that equity returns are typically lower for the next 10 years when prices are higher. Red is where we are at right now and dark green is cheap.Bobziz said:So the assumption is that the US is over valued and therefore growth may be slower than other regions or a larger correction may occur. Does history suggest that this assumption is likely to be correct ?

2 -

yeah reversion to the mean implies periods of higher returns are followed by periods of lower returns.Bobziz said:So the assumption is that the US is over valued and therefore growth may be slower than other regions or a larger correction may occur. Does history suggest that this assumption is likely to be correct ?

No one has ever become poor by giving1 -

Ok understood, so when referring to cycles its somewhat nonsensical unless the actual period is specified, could be talking about light years ago.MX5huggy said:

It’s not a period of time, it’s good times followed by bad. You don’t know how long each portion of that will last. https://en.m.wikipedia.org/wiki/Business_cycleBillycock said:For clarification, the mentions of cycle, over what period of time would one define a cycle?0 -

I've been looking at not seen one. I haven't got that much invested but would like to add some balance away from the top 10 holdings in my fundPrism said:

It would be but are there any available on UK platforms? I have not seen one.MaxiRobriguez said:The simplest way to achieve reduced US weighting from a global fund is to add a global-ex-US fund?Make £2023 in 2023 (#36) £3479.30/£2023

Make £2024 in 2024...1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 350.9K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244K Work, Benefits & Business

- 598.8K Mortgages, Homes & Bills

- 176.9K Life & Family

- 257.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards