We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Property ‘undervalued’ by 15k... is it fair to ask to meet in the middle?

Comments

-

Prevailing market price is what you are realistically in with a shot of achieving for your property, pitching above that at this stage of a property bubble just means you don`t really want to sell IMO.Mickey666 said:

It's nothing to do with 'this point in time'. There are always different motivations for different sellers.Crashy_Time said:

Won`t work at this point in time IMO, we are at basically a watershed moment for monetary policy/public health, and I would argue that at any time the time frames involved make dropping the price an easier option for people who just want to sell and move on with their lives.Mickey666 said:

Only in the short term.Crashy_Time said:

That is the definition of "delusional kite flyer", but in reality they will struggle to get their asking price after a devaluation from the bank.Mickey666 said:Agreed.

Though the interesting thing is that as far as market statistics are concerned, if there is no sale as a result of this down valuation then it remains invisible to the market.

As far as the vendor is concerned, the house is still worth their asking price and they are likely to simply keep it on the market until someone can offer that price AND complete . . . at which point the house IS worth that price and THAT is what the market stats will reflect.

In effect, there is NO down-valuation at all, only a number of discontented potential buyers who didn't offer enough.

'Waiting for the market to come to you' is a well known selling tactic for owners who want a certain price and are prepared to wait for it. Happens all the time. And it works.

For those sellers who "just want to sell and move on with their lives" then dropping their asking price for quick sale obviously makes sense.

For those sellers who are in no rush to sell and want to get the maximum possible price for their property then pitching their asking price above the prevailing market price (whatever that really means) and just waiting until someone offers that price also makes perfect sense.

Both strategies will work at any time, regardless of the prevailing market conditions and state of the economy.0 -

You're a keen advocate of making very low offers because you believe house prices are too high, which most people would regard as being cheeky and shows you're not serious about buying. But there's always a chance that a cheeky low offer would be accepted, perhaps because of all manner of reasons in the seller's life that you don't know about. In which case you win, and win big. Nothing wrong in that.Crashy_Time said:

Prevailing market price is what you are realistically in with a shot of achieving for your property, pitching above that at this stage of a property bubble just means you don`t really want to sell IMO.Mickey666 said:

It's nothing to do with 'this point in time'. There are always different motivations for different sellers.Crashy_Time said:

Won`t work at this point in time IMO, we are at basically a watershed moment for monetary policy/public health, and I would argue that at any time the time frames involved make dropping the price an easier option for people who just want to sell and move on with their lives.Mickey666 said:

Only in the short term.Crashy_Time said:

That is the definition of "delusional kite flyer", but in reality they will struggle to get their asking price after a devaluation from the bank.Mickey666 said:Agreed.

Though the interesting thing is that as far as market statistics are concerned, if there is no sale as a result of this down valuation then it remains invisible to the market.

As far as the vendor is concerned, the house is still worth their asking price and they are likely to simply keep it on the market until someone can offer that price AND complete . . . at which point the house IS worth that price and THAT is what the market stats will reflect.

In effect, there is NO down-valuation at all, only a number of discontented potential buyers who didn't offer enough.

'Waiting for the market to come to you' is a well known selling tactic for owners who want a certain price and are prepared to wait for it. Happens all the time. And it works.

For those sellers who "just want to sell and move on with their lives" then dropping their asking price for quick sale obviously makes sense.

For those sellers who are in no rush to sell and want to get the maximum possible price for their property then pitching their asking price above the prevailing market price (whatever that really means) and just waiting until someone offers that price also makes perfect sense.

Both strategies will work at any time, regardless of the prevailing market conditions and state of the economy.

But the converse is also true. A seller might believe their house is so special that they put it on the market at a very cheeky high price. Like you, most people would probably think this shows they are not serious about selling. But there's always a chance that someone will offer that high price, perhaps because of all manner of reasons in the buyer's life that you don't know about. In which case the seller wins, and wins big. Nothing wrong with that either

1 -

All true, but if mortgage rates rise there will be less chance of the second one happening as much IMO.Mickey666 said:

You're a keen advocate of making very low offers because you believe house prices are too high, which most people would regard as being cheeky and shows you're not serious about buying. But there's always a chance that a cheeky low offer would be accepted, perhaps because of all manner of reasons in the seller's life that you don't know about. In which case you win, and win big. Nothing wrong in that.Crashy_Time said:

Prevailing market price is what you are realistically in with a shot of achieving for your property, pitching above that at this stage of a property bubble just means you don`t really want to sell IMO.Mickey666 said:

It's nothing to do with 'this point in time'. There are always different motivations for different sellers.Crashy_Time said:

Won`t work at this point in time IMO, we are at basically a watershed moment for monetary policy/public health, and I would argue that at any time the time frames involved make dropping the price an easier option for people who just want to sell and move on with their lives.Mickey666 said:

Only in the short term.Crashy_Time said:

That is the definition of "delusional kite flyer", but in reality they will struggle to get their asking price after a devaluation from the bank.Mickey666 said:Agreed.

Though the interesting thing is that as far as market statistics are concerned, if there is no sale as a result of this down valuation then it remains invisible to the market.

As far as the vendor is concerned, the house is still worth their asking price and they are likely to simply keep it on the market until someone can offer that price AND complete . . . at which point the house IS worth that price and THAT is what the market stats will reflect.

In effect, there is NO down-valuation at all, only a number of discontented potential buyers who didn't offer enough.

'Waiting for the market to come to you' is a well known selling tactic for owners who want a certain price and are prepared to wait for it. Happens all the time. And it works.

For those sellers who "just want to sell and move on with their lives" then dropping their asking price for quick sale obviously makes sense.

For those sellers who are in no rush to sell and want to get the maximum possible price for their property then pitching their asking price above the prevailing market price (whatever that really means) and just waiting until someone offers that price also makes perfect sense.

Both strategies will work at any time, regardless of the prevailing market conditions and state of the economy.

But the converse is also true. A seller might believe their house is so special that they put it on the market at a very cheeky high price. Like you, most people would probably think this shows they are not serious about selling. But there's always a chance that someone will offer that high price, perhaps because of all manner of reasons in the buyer's life that you don't know about. In which case the seller wins, and wins big. Nothing wrong with that either 0

0 -

Genuine question, where do you see these rises in mortgage rates. I know they're higher compared to this 12-15 month ago but now?Crashy_Time said:

All true, but if mortgage rates rise there will be less chance of the second one happening as much IMO.Mickey666 said:

You're a keen advocate of making very low offers because you believe house prices are too high, which most people would regard as being cheeky and shows you're not serious about buying. But there's always a chance that a cheeky low offer would be accepted, perhaps because of all manner of reasons in the seller's life that you don't know about. In which case you win, and win big. Nothing wrong in that.Crashy_Time said:

Prevailing market price is what you are realistically in with a shot of achieving for your property, pitching above that at this stage of a property bubble just means you don`t really want to sell IMO.Mickey666 said:

It's nothing to do with 'this point in time'. There are always different motivations for different sellers.Crashy_Time said:

Won`t work at this point in time IMO, we are at basically a watershed moment for monetary policy/public health, and I would argue that at any time the time frames involved make dropping the price an easier option for people who just want to sell and move on with their lives.Mickey666 said:

Only in the short term.Crashy_Time said:

That is the definition of "delusional kite flyer", but in reality they will struggle to get their asking price after a devaluation from the bank.Mickey666 said:Agreed.

Though the interesting thing is that as far as market statistics are concerned, if there is no sale as a result of this down valuation then it remains invisible to the market.

As far as the vendor is concerned, the house is still worth their asking price and they are likely to simply keep it on the market until someone can offer that price AND complete . . . at which point the house IS worth that price and THAT is what the market stats will reflect.

In effect, there is NO down-valuation at all, only a number of discontented potential buyers who didn't offer enough.

'Waiting for the market to come to you' is a well known selling tactic for owners who want a certain price and are prepared to wait for it. Happens all the time. And it works.

For those sellers who "just want to sell and move on with their lives" then dropping their asking price for quick sale obviously makes sense.

For those sellers who are in no rush to sell and want to get the maximum possible price for their property then pitching their asking price above the prevailing market price (whatever that really means) and just waiting until someone offers that price also makes perfect sense.

Both strategies will work at any time, regardless of the prevailing market conditions and state of the economy.

But the converse is also true. A seller might believe their house is so special that they put it on the market at a very cheeky high price. Like you, most people would probably think this shows they are not serious about selling. But there's always a chance that someone will offer that high price, perhaps because of all manner of reasons in the buyer's life that you don't know about. In which case the seller wins, and wins big. Nothing wrong with that either 0

0 -

I'm not so sure. I've had mortgages with interest rates up to 15% (briefly), though mostly in the 8-12% region. I didn't notice it stifling the housing market then and I'm not convinced it would do so again.Crashy_Time said:

All true, but if mortgage rates rise there will be less chance of the second one happening as much IMO.Mickey666 said:

You're a keen advocate of making very low offers because you believe house prices are too high, which most people would regard as being cheeky and shows you're not serious about buying. But there's always a chance that a cheeky low offer would be accepted, perhaps because of all manner of reasons in the seller's life that you don't know about. In which case you win, and win big. Nothing wrong in that.Crashy_Time said:

Prevailing market price is what you are realistically in with a shot of achieving for your property, pitching above that at this stage of a property bubble just means you don`t really want to sell IMO.Mickey666 said:

It's nothing to do with 'this point in time'. There are always different motivations for different sellers.Crashy_Time said:

Won`t work at this point in time IMO, we are at basically a watershed moment for monetary policy/public health, and I would argue that at any time the time frames involved make dropping the price an easier option for people who just want to sell and move on with their lives.Mickey666 said:

Only in the short term.Crashy_Time said:

That is the definition of "delusional kite flyer", but in reality they will struggle to get their asking price after a devaluation from the bank.Mickey666 said:Agreed.

Though the interesting thing is that as far as market statistics are concerned, if there is no sale as a result of this down valuation then it remains invisible to the market.

As far as the vendor is concerned, the house is still worth their asking price and they are likely to simply keep it on the market until someone can offer that price AND complete . . . at which point the house IS worth that price and THAT is what the market stats will reflect.

In effect, there is NO down-valuation at all, only a number of discontented potential buyers who didn't offer enough.

'Waiting for the market to come to you' is a well known selling tactic for owners who want a certain price and are prepared to wait for it. Happens all the time. And it works.

For those sellers who "just want to sell and move on with their lives" then dropping their asking price for quick sale obviously makes sense.

For those sellers who are in no rush to sell and want to get the maximum possible price for their property then pitching their asking price above the prevailing market price (whatever that really means) and just waiting until someone offers that price also makes perfect sense.

Both strategies will work at any time, regardless of the prevailing market conditions and state of the economy.

But the converse is also true. A seller might believe their house is so special that they put it on the market at a very cheeky high price. Like you, most people would probably think this shows they are not serious about selling. But there's always a chance that someone will offer that high price, perhaps because of all manner of reasons in the buyer's life that you don't know about. In which case the seller wins, and wins big. Nothing wrong with that either

Sure, higher interest rates will mean higher mortgage payments but they do nothing to stem the demand for houses because people will still need somewhere to live. So all that will happen is that people will have to spend more on their mortgage (or rent) and be forced to cut back on other spending that is not so essential.

0 -

Lenders have 'stress tested' borrowers to cover that eventualityMickey666 said:Crashy_Time said:

All true, but if mortgage rates rise there will be less chance of the second one happening as much IMO.Mickey666 said:

You're a keen advocate of making very low offers because you believe house prices are too high, which most people would regard as being cheeky and shows you're not serious about buying. But there's always a chance that a cheeky low offer would be accepted, perhaps because of all manner of reasons in the seller's life that you don't know about. In which case you win, and win big. Nothing wrong in that.Crashy_Time said:

Prevailing market price is what you are realistically in with a shot of achieving for your property, pitching above that at this stage of a property bubble just means you don`t really want to sell IMO.Mickey666 said:

It's nothing to do with 'this point in time'. There are always different motivations for different sellers.Crashy_Time said:

Won`t work at this point in time IMO, we are at basically a watershed moment for monetary policy/public health, and I would argue that at any time the time frames involved make dropping the price an easier option for people who just want to sell and move on with their lives.Mickey666 said:

Only in the short term.Crashy_Time said:

That is the definition of "delusional kite flyer", but in reality they will struggle to get their asking price after a devaluation from the bank.Mickey666 said:Agreed.

Though the interesting thing is that as far as market statistics are concerned, if there is no sale as a result of this down valuation then it remains invisible to the market.

As far as the vendor is concerned, the house is still worth their asking price and they are likely to simply keep it on the market until someone can offer that price AND complete . . . at which point the house IS worth that price and THAT is what the market stats will reflect.

In effect, there is NO down-valuation at all, only a number of discontented potential buyers who didn't offer enough.

'Waiting for the market to come to you' is a well known selling tactic for owners who want a certain price and are prepared to wait for it. Happens all the time. And it works.

For those sellers who "just want to sell and move on with their lives" then dropping their asking price for quick sale obviously makes sense.

For those sellers who are in no rush to sell and want to get the maximum possible price for their property then pitching their asking price above the prevailing market price (whatever that really means) and just waiting until someone offers that price also makes perfect sense.

Both strategies will work at any time, regardless of the prevailing market conditions and state of the economy.

But the converse is also true. A seller might believe their house is so special that they put it on the market at a very cheeky high price. Like you, most people would probably think this shows they are not serious about selling. But there's always a chance that someone will offer that high price, perhaps because of all manner of reasons in the buyer's life that you don't know about. In which case the seller wins, and wins big. Nothing wrong with that either

Sure, higher interest rates will mean higher mortgage paymentsGather ye rosebuds while ye may0 -

Which just means the economy collapses (again) and more people can`t pay their (higher) mortgage. Would you class the late 80`s property price collapse and resulting negative equity nightmare as a "stifled" market? It will only take small rises to mortgage rates now to put a lot of people in trouble IMO, the best bet all round for society is very cheap property for ordinary working people.Mickey666 said:

I'm not so sure. I've had mortgages with interest rates up to 15% (briefly), though mostly in the 8-12% region. I didn't notice it stifling the housing market then and I'm not convinced it would do so again.Crashy_Time said:

All true, but if mortgage rates rise there will be less chance of the second one happening as much IMO.Mickey666 said:

You're a keen advocate of making very low offers because you believe house prices are too high, which most people would regard as being cheeky and shows you're not serious about buying. But there's always a chance that a cheeky low offer would be accepted, perhaps because of all manner of reasons in the seller's life that you don't know about. In which case you win, and win big. Nothing wrong in that.Crashy_Time said:

Prevailing market price is what you are realistically in with a shot of achieving for your property, pitching above that at this stage of a property bubble just means you don`t really want to sell IMO.Mickey666 said:

It's nothing to do with 'this point in time'. There are always different motivations for different sellers.Crashy_Time said:

Won`t work at this point in time IMO, we are at basically a watershed moment for monetary policy/public health, and I would argue that at any time the time frames involved make dropping the price an easier option for people who just want to sell and move on with their lives.Mickey666 said:

Only in the short term.Crashy_Time said:

That is the definition of "delusional kite flyer", but in reality they will struggle to get their asking price after a devaluation from the bank.Mickey666 said:Agreed.

Though the interesting thing is that as far as market statistics are concerned, if there is no sale as a result of this down valuation then it remains invisible to the market.

As far as the vendor is concerned, the house is still worth their asking price and they are likely to simply keep it on the market until someone can offer that price AND complete . . . at which point the house IS worth that price and THAT is what the market stats will reflect.

In effect, there is NO down-valuation at all, only a number of discontented potential buyers who didn't offer enough.

'Waiting for the market to come to you' is a well known selling tactic for owners who want a certain price and are prepared to wait for it. Happens all the time. And it works.

For those sellers who "just want to sell and move on with their lives" then dropping their asking price for quick sale obviously makes sense.

For those sellers who are in no rush to sell and want to get the maximum possible price for their property then pitching their asking price above the prevailing market price (whatever that really means) and just waiting until someone offers that price also makes perfect sense.

Both strategies will work at any time, regardless of the prevailing market conditions and state of the economy.

But the converse is also true. A seller might believe their house is so special that they put it on the market at a very cheeky high price. Like you, most people would probably think this shows they are not serious about selling. But there's always a chance that someone will offer that high price, perhaps because of all manner of reasons in the buyer's life that you don't know about. In which case the seller wins, and wins big. Nothing wrong with that either

Sure, higher interest rates will mean higher mortgage payments but they do nothing to stem the demand for houses because people will still need somewhere to live. So all that will happen is that people will have to spend more on their mortgage (or rent) and be forced to cut back on other spending that is not so essential.0 -

I think 'collapse' is a bit dramatic. The economy is always moving up and down but there has been no real 'collapse' since the 1920s depression. Not even covid-19, with it's government-enforced lockdowns has caused 'economic collapse'. A slowdown, yes, but not a collapse. Much of the negative equity 'nightmare' was a result of the, frankly, stupidity of people borrowing 110% mortgages and relying on rising prices to save them . . . which actually they eventually did, if they could hold on long enough.Crashy_Time said:

Which just means the economy collapses (again) and more people can`t pay their (higher) mortgage. Would you class the late 80`s property price collapse and resulting negative equity nightmare as a "stifled" market? It will only take small rises to mortgage rates now to put a lot of people in trouble IMO, the best bet all round for society is very cheap property for ordinary working people.Mickey666 said:

I'm not so sure. I've had mortgages with interest rates up to 15% (briefly), though mostly in the 8-12% region. I didn't notice it stifling the housing market then and I'm not convinced it would do so again.Crashy_Time said:

All true, but if mortgage rates rise there will be less chance of the second one happening as much IMO.Mickey666 said:

You're a keen advocate of making very low offers because you believe house prices are too high, which most people would regard as being cheeky and shows you're not serious about buying. But there's always a chance that a cheeky low offer would be accepted, perhaps because of all manner of reasons in the seller's life that you don't know about. In which case you win, and win big. Nothing wrong in that.Crashy_Time said:

Prevailing market price is what you are realistically in with a shot of achieving for your property, pitching above that at this stage of a property bubble just means you don`t really want to sell IMO.Mickey666 said:

It's nothing to do with 'this point in time'. There are always different motivations for different sellers.Crashy_Time said:

Won`t work at this point in time IMO, we are at basically a watershed moment for monetary policy/public health, and I would argue that at any time the time frames involved make dropping the price an easier option for people who just want to sell and move on with their lives.Mickey666 said:

Only in the short term.Crashy_Time said:

That is the definition of "delusional kite flyer", but in reality they will struggle to get their asking price after a devaluation from the bank.Mickey666 said:Agreed.

Though the interesting thing is that as far as market statistics are concerned, if there is no sale as a result of this down valuation then it remains invisible to the market.

As far as the vendor is concerned, the house is still worth their asking price and they are likely to simply keep it on the market until someone can offer that price AND complete . . . at which point the house IS worth that price and THAT is what the market stats will reflect.

In effect, there is NO down-valuation at all, only a number of discontented potential buyers who didn't offer enough.

'Waiting for the market to come to you' is a well known selling tactic for owners who want a certain price and are prepared to wait for it. Happens all the time. And it works.

For those sellers who "just want to sell and move on with their lives" then dropping their asking price for quick sale obviously makes sense.

For those sellers who are in no rush to sell and want to get the maximum possible price for their property then pitching their asking price above the prevailing market price (whatever that really means) and just waiting until someone offers that price also makes perfect sense.

Both strategies will work at any time, regardless of the prevailing market conditions and state of the economy.

But the converse is also true. A seller might believe their house is so special that they put it on the market at a very cheeky high price. Like you, most people would probably think this shows they are not serious about selling. But there's always a chance that someone will offer that high price, perhaps because of all manner of reasons in the buyer's life that you don't know about. In which case the seller wins, and wins big. Nothing wrong with that either

Sure, higher interest rates will mean higher mortgage payments but they do nothing to stem the demand for houses because people will still need somewhere to live. So all that will happen is that people will have to spend more on their mortgage (or rent) and be forced to cut back on other spending that is not so essential.

But yes, short term it was a nightmare for those people - but whose fault was it really? I'm guessing you'd blame the banks, but it takes two to tango. Irresponsible lending needs an irresponsible borrower. You can defend such a borrower as not being financially literate, but we're not talking here about someone falling into negative equity because house prices dropped a little, we're talking about people who borrowed themselves into negative equity on day one!

The whole sub-prime lending fiasco could be characterised as borrowing being made so easy that people were not responsible or financially literate enough to see the risks of over-extending themselves or their exposure to markets risks.

But regardless of who was really to blame, the inevitable response has been the tightening up of borrowing criteria such that in a time of historically low interest rates when it has never been cheaper to have a mortgage, it is now very difficult/impossible to get high LTV mortgages, with all the implications for needing larger deposits, which as we all know affects FTBs the most.0 -

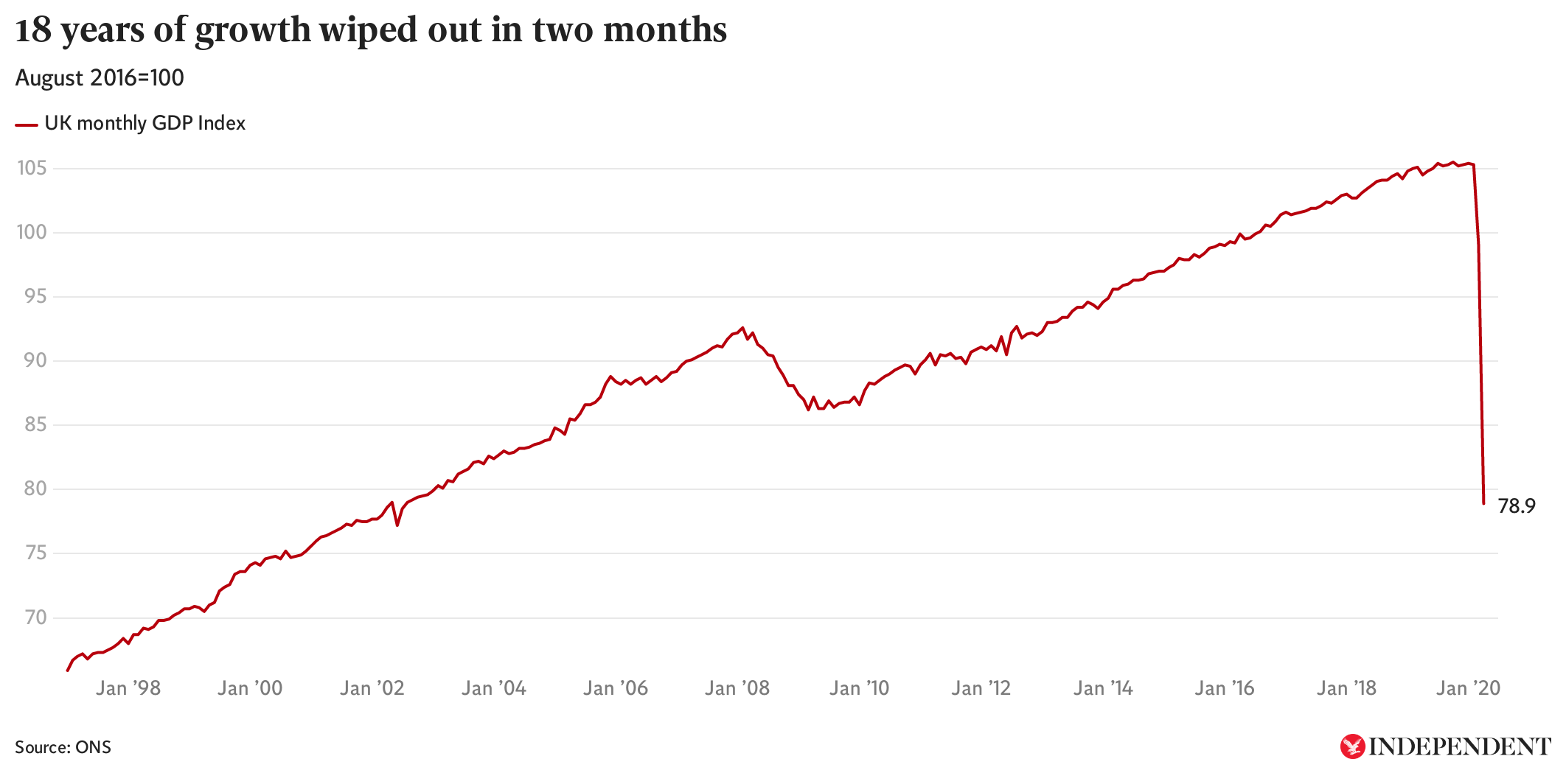

Slowdown might be a tad underplayed.I think 'collapse' is a bit dramatic. The economy is always moving up and down but there has been no real 'collapse' since the 1920s depression. Not even covid-19, with it's government-enforced lockdowns has caused 'economic collapse'. A slowdown, yes, but not a collapse.

...but I agree "collapse" is equally overselling it. The bounceback from those depths has been quick so far.

...and if we put it into long-term perspective...

1920s, post-war, and 2008 clearly visible, but predates Covid.

1 -

The bounceback from lockdown has been quick because the economy didn't collapse, it was deliberately turned down, ie there were no fundamental underlying problems.

I wouldn't be surprised to see record growth over the coming few quarters because there will be a pent-up demand from the majority of people exiting lockdown with money to spend, saved up over the past year because they've not been able to go out or on holidays. Indeed, perhaps many people are already putting those savings towards house deposits, which along with the SDLP holiday, is helping to push up house prices?

That's why I'd say covid is more of a slowdown than a collapse. We can debate the degree of either descriptions, but I think we'd agree it's just a 'blip' in the grand scheme of things . . . assuming the vaccine roll-out helps the world get back to normal.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards