We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

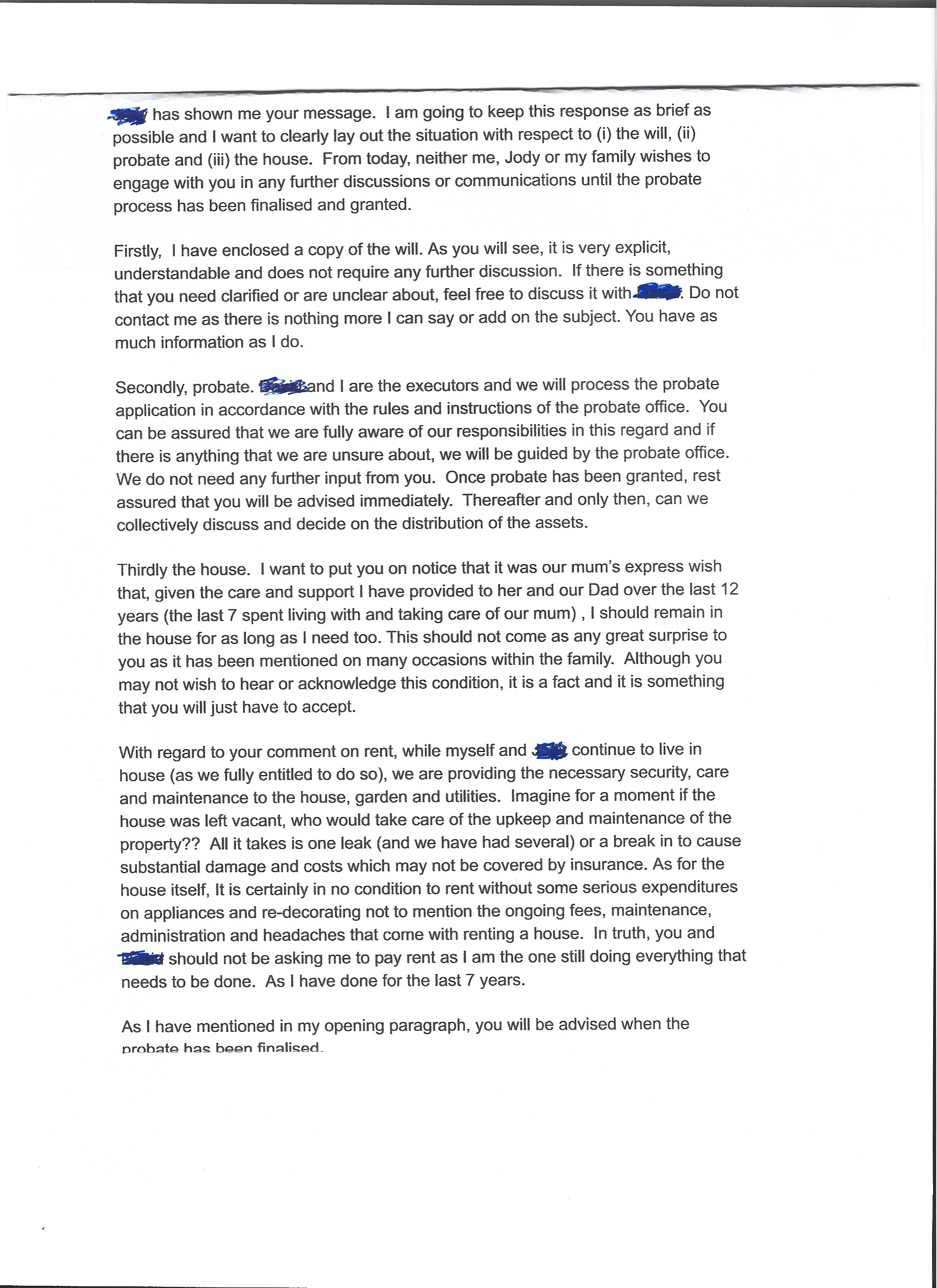

One beneficiary is living in the family home . Will shares the property to the three children .

Comments

-

RAS said:The benefits issue doesn't kick in until after probate is granted.

However if the assets are illiquid, I think it's not until they are available providing they are not being deliberately kept from use. Although it's also possible that those in receipt might have to repay some benefits received after probate.

So worst case scenario is that all 3 beneficiaries could have their benefits stopped (or reclaimed) if the matter is allowed to drift on, unresolved.

Surely the can can't be kicked down the road indefinitely...to avoid having to declare the asset?How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

So worst case scenario is that all 3 beneficiaries could have their benefits stopped (or reclaimed) if the matter is allowed to drift on, unresolved.

I am not particularly knowledgeable in this area but I would expect there to be a considerable grace period before benefits were stopped - executor's year and all that.

As @RAS indicates, all things being equal, it is on receipt of the funds that the beneficiaries' problems will start

0 -

RetSol said:So worst case scenario is that all 3 beneficiaries could have their benefits stopped (or reclaimed) if the matter is allowed to drift on, unresolved.

I am not particularly knowledgeable in this area but I would expect there to be a considerable grace period before benefits were stopped - executor's year and all that.

As @RAS indicates, all things being equal, it is on receipt of the funds that the beneficiaries' problems will start

But isn't there a risk in that gray area between obtaining probate and then distribution.

Could it be that probate is applied for and granted....and THEN nothing further happens.How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

There are other live threads, more recent than the one I referred which deal with the problem.

In one case dad is selling and was hoping to give his children the assets, which won't work, not least as I think he's still married to mum who is on benefits. He paid her a lump sum years ago but they've never done a formal settlement. The other is someone with mental health problems who hasn't accepted a bequest because they are scared of the problems with the "DSS." Just freaked out about coping with the changes in their claim and reclaiming. Their paralysis has actually made it more difficult even though they are not motivated to defraud.

If you've have not made a mistake, you've made nothing1 -

Okay thanks for all your help . My sister is on a pension , her son is running his delivery business from the address . If I do get a large amount ,it will effect my benefits .Once I receive my pension, benefits stop . Although I may still qualify for housing benefits . So happy to wait .0

-

OK, @LUTONTOWN1, you appear to have a dilemma.

On the one hand, you do not wish to rush the sale of the property. The longer it takes, the better for you up to a point

On the other hand, the longer your sister lives in the property undisturbed the more difficult it will be to dislodge her eventually.

You and your sister agree about one thing - neither of you wants a quick sale of the property.

0 -

Lutontown1

Can we go back to basics?

1. Have you actually checked in whose name the house is currently registered? Is there any possibility it is outside the estate? Cost £3 from the Land Registry.

2. You still haven't confirmed whether probate has been granted or not?

Do have other thoughts but maybe get those answers first?If you've have not made a mistake, you've made nothing0 -

The deeds of house are in my mothers name . Probate has not yet been granted .

1

1 -

OK, so they are going to obtain probate.

Unless however your mother's will gives your sister a life interest in the property, then you are entitled to have your one third share in the value of the estate.

Hopefully one or two other people can comment now that you've clarified things. You may wan to edit the title (and refuses to distribute the estate). That would help people understand the problem.

Hopefully xylophone Keep_pedaling or TBagpuss will be ack to comment,

If you've have not made a mistake, you've made nothing2 -

I could say that my father told me he wanted everything to go to me ! I could say I discussed it with both my sister and brother ,and we agreed to give it to a charity . What has happened and has been said between us all ,is irrelevant . As previously stated , my sister did attempt to influence my mothers decision on the Will . The solicitor however would not allow my sister into the office where he discussed it with her . The new Will was made after my father died and basically has the same conditions they had in their joint Will .0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards