We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

FIREside Chats

Comments

-

That certainly does sound interesting Becky!! Keep us posted or come here to mull your optionsMFW 2021 #76 £5,145

MFW 2022 #27 £5,300

MFW 2023 #27 £2,000

MFW 2024 #27 £6,055

MFW 2025 #27 £5,075

MFW 2026 #27 0/£10003 -

I don't know how much faith people have in such things, but I'm pleased to note that we've now passed the Which? retirement income target for a "comfortable" retirement (well, assuming another 5-6 years of NI contributions, which we'll be making bar a lottery win). It's all relative though, as even the "luxurious" figures are for less than we earn at the moment). Still, not bad for 19 years to go (maybe less)?

3 -

If that isn't part of a paid subscription, lease could you post a link (or if it is, a bit of a summary)?edinburgher said:I don't know how much faith people have in such things, but I'm pleased to note that we've now passed the Which? retirement income target for a "comfortable" retirement (well, assuming another 5-6 years of NI contributions, which we'll be making bar a lottery win). It's all relative though, as even the "luxurious" figures are for less than we earn at the moment). Still, not bad for 19 years to go (maybe less)?Save £12k in 2026 #2 I have banked £865.15 in January against a £10k target The 2026 Save £12k in 2026 thread is here

OS Grocery Challenge in 2026 I am sticking with a £3000 annual budget for 2026 - currently £138.39 for January and a bigger target of £300 for February, with lots to stock up on

I also Reverse Meal Plan on that thread and grow much of our own premium price fruit and veg, joining in on the grow your own in 2026 discussion thread

My keep within our budget diary is here3 -

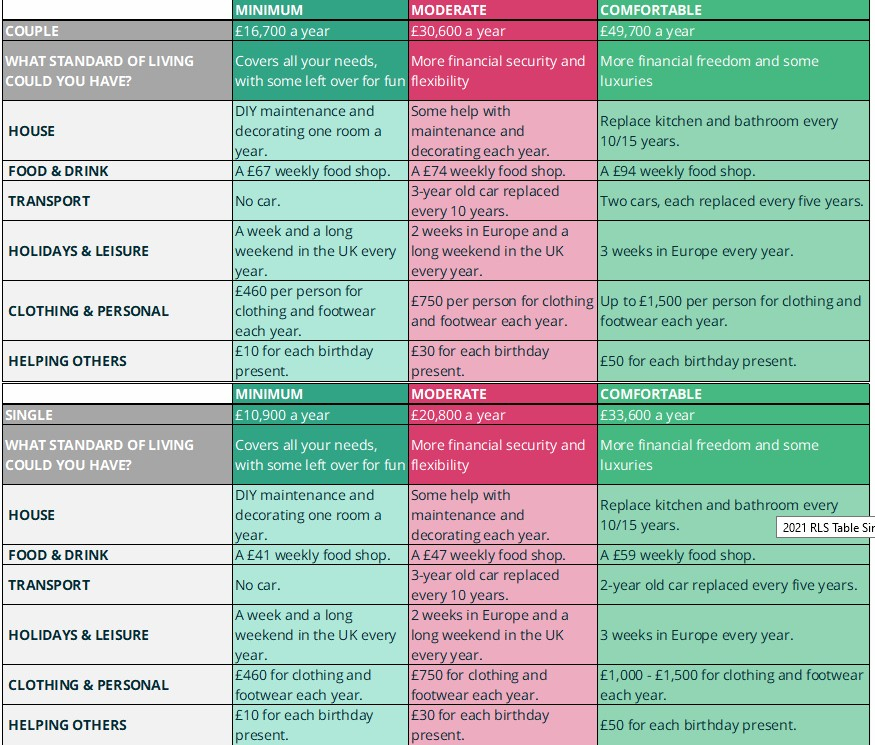

There are two popular retirement income standards - Which and PLSA standards. The PLSA details are below (Which ones are linked above).

6

6 -

Like all things, we probably spend far more on some categories and far less on others

2

2 -

Interesting! Does it assume your own your own home outright?MFW 2021 #76 £5,145

MFW 2022 #27 £5,300

MFW 2023 #27 £2,000

MFW 2024 #27 £6,055

MFW 2025 #27 £5,075

MFW 2026 #27 0/£10002 -

@powerspowers - I hope not, we're £220k off that!2

-

We're officially aiming for £36k (net) a year for a couple with a lump sum contingency but we're on target to achieve closer to £40k, so somewhere between comfortable and luxury for a couple.

Although I suspect our spending will follow a different pattern to that in the table 3

3 -

The Which one assumes you own your own home I think. I've accrued enough already at 51 to be between moderate and comfortable at 67 - but because of DB reductions - would need to accrue a lot more - to have the be at the same level if I want to retire earlier. Currently unless I drastically downsize or manage to transfer a DB pension - I think I will hit moderate by 64 even with the reduction but the figures only work if I have found a way to clear my mortgage.

Great news Becky - that you now have choices.

Achieve FIRE/Mortgage Neutrality in 2030

1) MFW Nov 21 £202K now £169.8K Equity 37.1%

2) £1.5K Net savings after CCs 11/2/26 (but owed £1.4K) so £2.9K

3) Mortgage neutral by 06/30 (AVC £34.8K + Lump Sums DB £4.6K + (25% of SIPP 1.3K) = 40.6/£127.5K target 31.8% 16/11/25

(If took bigger lump sum = 62.7K or 49.2%)

4) FI Age 60 income target £17.1/30K 57% (if mortgage and debts repaid - need more otherwise) (If bigger lump sum £15.8/30K 52.67%)

5) SIPP £5.2K updated 16/1/263 -

Spent some time yesterday having a quick look at OH's pension pots. Need to do some work to understand what we need and what they could provide. Not as much in the, as we had hoped but he has more potential for growth due to higher income / contributions so I am glad we are reviewing this now.

One oddity is that his employer don't appear to pay into his pension - he contributes 10% as salary sacrifice but it comes from a "benefits fund" which he can use for all sorts of benefits (or take as salary) so I guess they are leaving it to employees to decide if they want to use any / all of the fund for pension contributions and that the employer contribution (3% I believe?) is included in that fund.

So effectively he is choosing to take their 3% as contributions and then add another 7% but it shows as him contributing 10%.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards