We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

Are bonds still worth holding when investing for growth.

At the moment I have an 80/20 equities/bonds split and saving as much as possible each month and investing that money long term in a global fund to hopefully grow and fund retirement at some stage in the future.

My question is whether people think bonds are still worth holding at this stage or are they simply a drain on gains that could be made had the money been invested in shares? Perhaps the difference would be minimal or perhaps the small allocation of bonds may even help growth over the long term.

At the moment I'm thinking about moving to 100% equities as I'm solely in the growrh stage of investing. Obviously it's a potentially bumpy ride but so is an 80/20 split and that hasn't bothered me when things have gone pear shaped.

Many thanks to all who respond.

Comments

-

Best to stick to one thread on the topic of bonds.0

-

I didn't want to produce a long rambling question which could be off putting. These are two different questions which I felt warranted separate threads. People can answer one or the other if they have anything constructive to add and i'll be grateful to them. I'd certainly be interested in your viewpoints if you have any.Thrugelmir said:Best to stick to one thread on the topic of bonds.0 -

What are you hoping to achieve with 20% in bonds?0

-

Initially it was probably just to reduce a little of the volatility of equities. It hasn't bothered me when things have taken a dive though which has made me question the worth of holding them at all.0

-

My question is whether people think bonds are still worth holding at this stage or are they simply a drain on gains that could be made had the money been invested in shares?

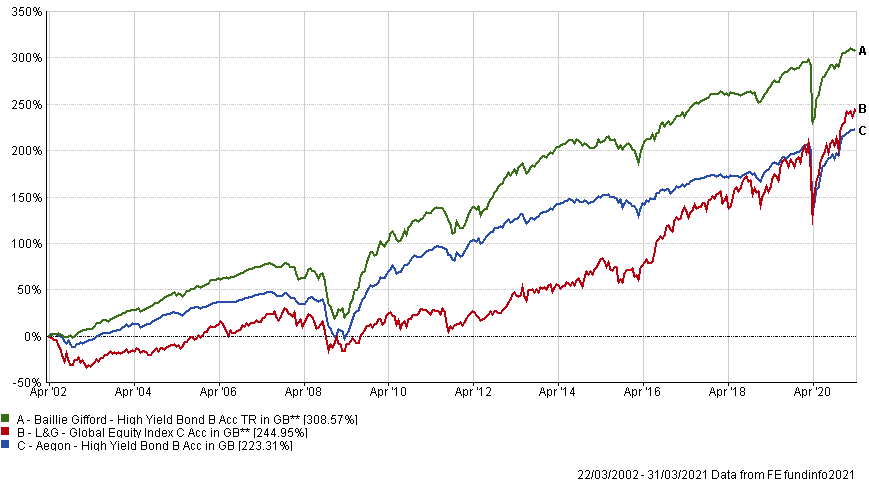

If you took a typical 1-10 scale, you could have bond funds filling risk 2 through to 10. Bonds are not one thing. Some bond funds can return similar levels to equities.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

You must balance risk and reward in a way that suits you. It's not possible to have the growth without risking losses. Yes, holding bonds means that you missed the gains that equities have seen over the last 12 months but you also missed the losses of 13 months ago. You need to make your own decision about what the future will hold. There's no magic ratio and there's no certainty in the equity market.1

-

dunstonh said:My question is whether people think bonds are still worth holding at this stage or are they simply a drain on gains that could be made had the money been invested in shares?

If you took a typical 1-10 scale, you could have bond funds filling risk 2 through to 10. Bonds are not one thing. Some bond funds can return similar levels to equities.

That's always worth remembering. But I suppose if you have one fund holding equities and bonds, then the bonds won't be the highest risk - what would be the point of high risk bonds there other than to juice up the returns when compared with other 80/20 mixed funds by taking more risk that folk might not notice until the risk showed its downside?But your question shouldn't be two mutually exclusive options: worth holding?; or, a drain on returns? They can still be worth holding if they're a drain on returns. Have a look at the very, even not so very, long term returns of investment quality bonds compared with equities: consistent under-performance, but worth holding in certain circumstances for people with particular needs. If bonds are appropriate in your circumstances, then they're appropriate however poor the returns are. The market is what it is, and gives the returns that it has to give; you can't change that. You can only increase your risk if you want to chase higher returns, or accept lower returns.0 -

But I suppose if you have one fund holding equities and bonds, then the bonds won't be the highest risk

High yield bonds can be up there with equities.

what would be the point of high risk bonds there other than to juice up the returns when compared with other 80/20 mixed funds by taking more risk that folk might not notice until the risk showed its downside?Higher risk bonds can offer a bit of diversification away from equities but with similar returns and similar loss potential but not necessarily at the same time (although specific economic events can align them)

But your question shouldn't be two mutually exclusive options: worth holding?; or, a drain on returns? They can still be worth holding if they're a drain on returns. Have a look at the very, even not so very, long term returns of investment quality bonds compared with equities: consistent under-performance, but worth holding in certain circumstances for people with particular needs. If bonds are appropriate in your circumstances, then they're appropriate however poor the returns are. The market is what it is, and gives the returns that it has to give; you can't change that. You can only increase your risk if you want to chase higher returns, or accept lower returns.

But your question shouldn't be two mutually exclusive options: worth holding?; or, a drain on returns? They can still be worth holding if they're a drain on returns. Have a look at the very, even not so very, long term returns of investment quality bonds compared with equities: consistent under-performance, but worth holding in certain circumstances for people with particular needs. If bonds are appropriate in your circumstances, then they're appropriate however poor the returns are. The market is what it is, and gives the returns that it has to give; you can't change that. You can only increase your risk if you want to chase higher returns, or accept lower returns.My point was more along the lines that just holding bonds does not mean you are reducing risk. You could actually be increasing your risk or just staying around the same risk level.

Just like picking 80% equities could be higher risk than 100% equities or lower risk than 60% equities. It is what you pick that matters. Its not enough to just say "in bonds" and assume it is lower risk.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599.2K Mortgages, Homes & Bills

- 177K Life & Family

- 257.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards