We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cant sell my flat due to being under 30sqm

Comments

-

It's a bit small to spend lockdown, if there's no outside space.

No reliance should be placed on the above! Absolutely none, do you hear?0 -

I'm living in a friends annex at the moment that's about the same size as that flat. I'm sure it has a door that leads outside.GDB2222 said:It's a bit small to spend lockdown, if there's no outside space.

1 -

NameUnavailable said:

I'm living in a friends annex at the moment that's about the same size as that flat. I'm sure it has a door that leads outside.GDB2222 said:It's a bit small to spend lockdown, if there's no outside space.

During the first lockdown, people were limited to a single period of outside exercise per day. Plus, it was a wonderful spring, so it must have been frustrating for people who just wanted to sit outside.No reliance should be placed on the above! Absolutely none, do you hear?0 -

Bit of an aside but these would love to be 30sqm.

'Dog kennel' flats in Barnet will be 40% smaller than Travelodge room | Housing | The Guardian

1 -

Rubbish.Alan2020 said:

Residential mortgages are a regulated product and banks themselves are regulated. They cannot do as they please. Ultimately the property has zero value because someone said you cannot rent and the banks decided not to offer a mortgage. Both are wrong.Billy_B_North said:

That’s ludicrous.

Banks can choose who they lend to, and at what rate. It is their shareholder’s capital at risk, and no-one is going to force them to lend against poor security?

You forget that banks are not a utility, they are not a public service, they are businesses who exist to make a profit.You do realise I am talking of the UK here, which is for all intents and purposes a socialist country. We both cannot just open a bank or start a lottery or even sell shares to the public or even evict people for not paying rent. Banks have to toe the socialist line, tax is collected and social security paid to the needy and the not so needy. A visit to the US will quickly enlighten you about how certain businesses are expected to behave in the UK.

No-one’s going to force a bank to lend against a property that they don’t want to, and having worked in banking in both the US and the UK I have to wonder where you are getting this from.

I don’t think that this is the thread for you to post your uninformed flights of fancy.0 -

2017. Two years before the OP bought the place they're struggling to sell.Jaybee_16 said:Bit of an aside but these would love to be 30sqm.

'Dog kennel' flats in Barnet will be 40% smaller than Travelodge room | Housing | The Guardian

Legal to build does not mean lenders must accept them as security.

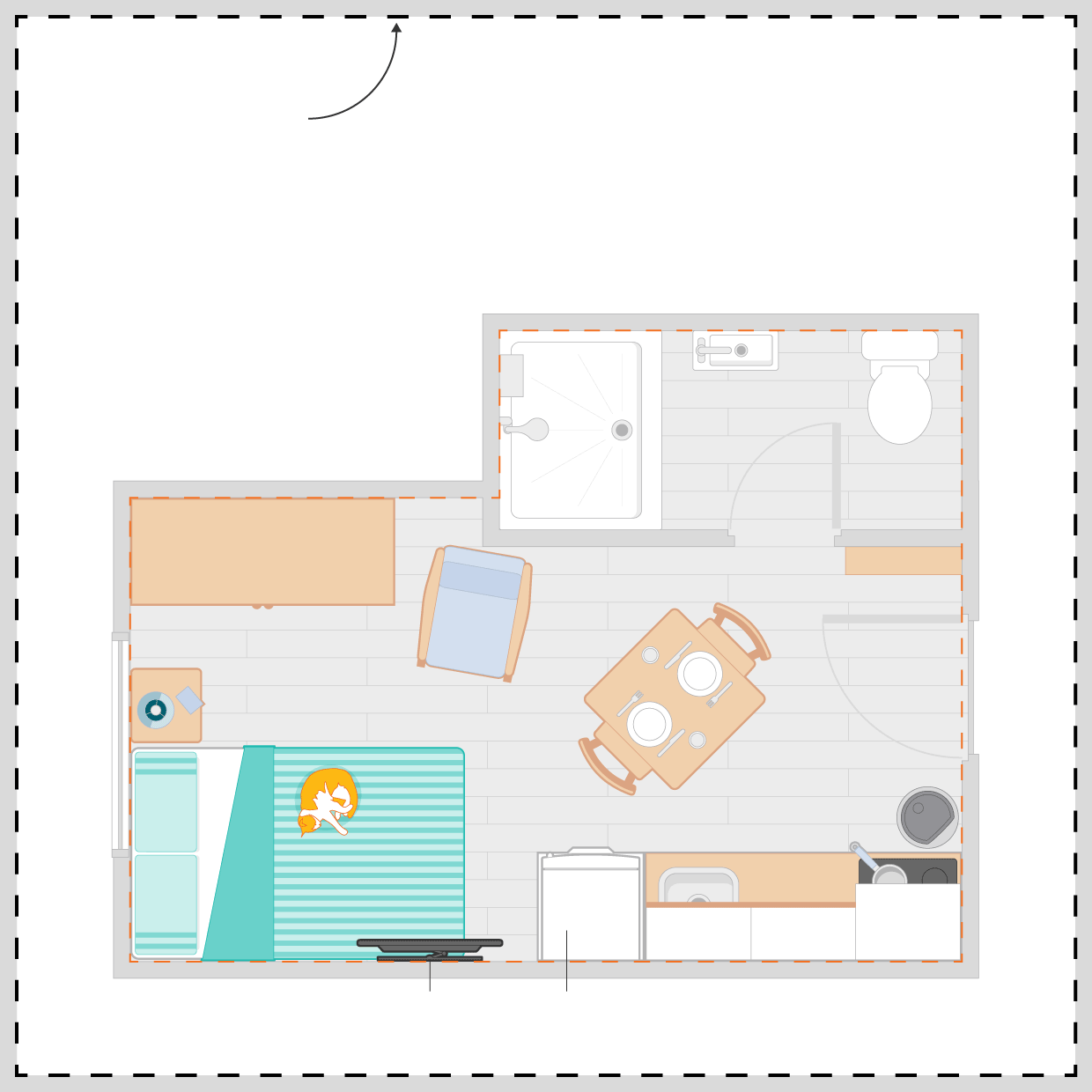

Outer dotted line is the 37m2 standard, with the 16m2 flat superimposed. The OP's 26m2 is almost exactly half-way between the two.

That floorplan shows the problem - at least that doesn't waste space partitioning into three "rooms". The OP's would be better as a single open-plan.0 -

OP, just being curious, why are you selling?

0 -

Downsizing!Titus_Wadd said:OP, just being curious, why are you selling?11 -

Billy_B_North said:

I lived in the US for a number of years and still own properties there. I'm with Billy B North. US banks tend to be even pickier than UK banks on flats.

Rubbish.Alan2020 said:A visit to the US will quickly enlighten you about how certain businesses are expected to behave in the UK.

No-one’s going to force a bank to lend against a property that they don’t want to, and having worked in banking in both the US and the UK I have to wonder where you are getting this from.

I don’t think that this is the thread for you to post your uninformed flights of fancy.

Things vary by lender, but most US banks will not lend on properties under 400 square feet, even in areas like New York City (sometimes 600 square feet in areas where small properties are not the norm). Flats in small buildings of four or fewer units often require waivers (if common / typical in the area), or buyers need to use very expensive portfolio lenders (if not). During the financial crisis, flats in buildings of less than ten units sometimes had trouble with lenders. Duplexes tend to be a headache to finance, except in certain areas where typical. Many/most US lenders will also not lend on units in buildings where < 80% of units are owner-occupied, and virtually no one will lend if owner-occupancy falls below 51% because the mortgages are federally uninsurable. Lenders also consider building finances when determining whether to loan. If your building isn't putting 10% of the annual operating into a reserve fund, your mortgage may get denied. US "co-op" buildings can and usually do carry corporate debt - an underlying mortgage - which is another thing lenders need to assess.

The UK conveyancing process is nutty. But, aside from that, the UK system seems fast, easy, and cheap compared to the US system when it comes to buying flats/fractional ownership properties. And no matter how much people complain about service charges in the UK, they are significantly cheaper than anything in any major US city.

3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards