We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

What flat fee investment platforms are there?

I keep reading that Vanguard is good for low cost investing. The homepage of the Vanguard website itself carries the following quote from the Consumer Association Which? (which gave it a recommended Investment Platform provider award in May 2020, 2 years in a row): "A simple way to invest, at a fraction of the cost of its rivals"

The Vanguard website says it ongoing charges are 0.20% on average and its account fee is 0.15% per year. They give the example that if someone invested £20,000 in the LifeStrategy 60% fund, it would cost them £82 a year.

According to my calculations, this mean that if someone had £40,000 invested in the same fund they would pay £164, if £60,000 they would pay £246, if £80,000 they would pay £328, if £100,000 they would pay £410 (although Vanguard caps fees at a maximum annual charge of £375).

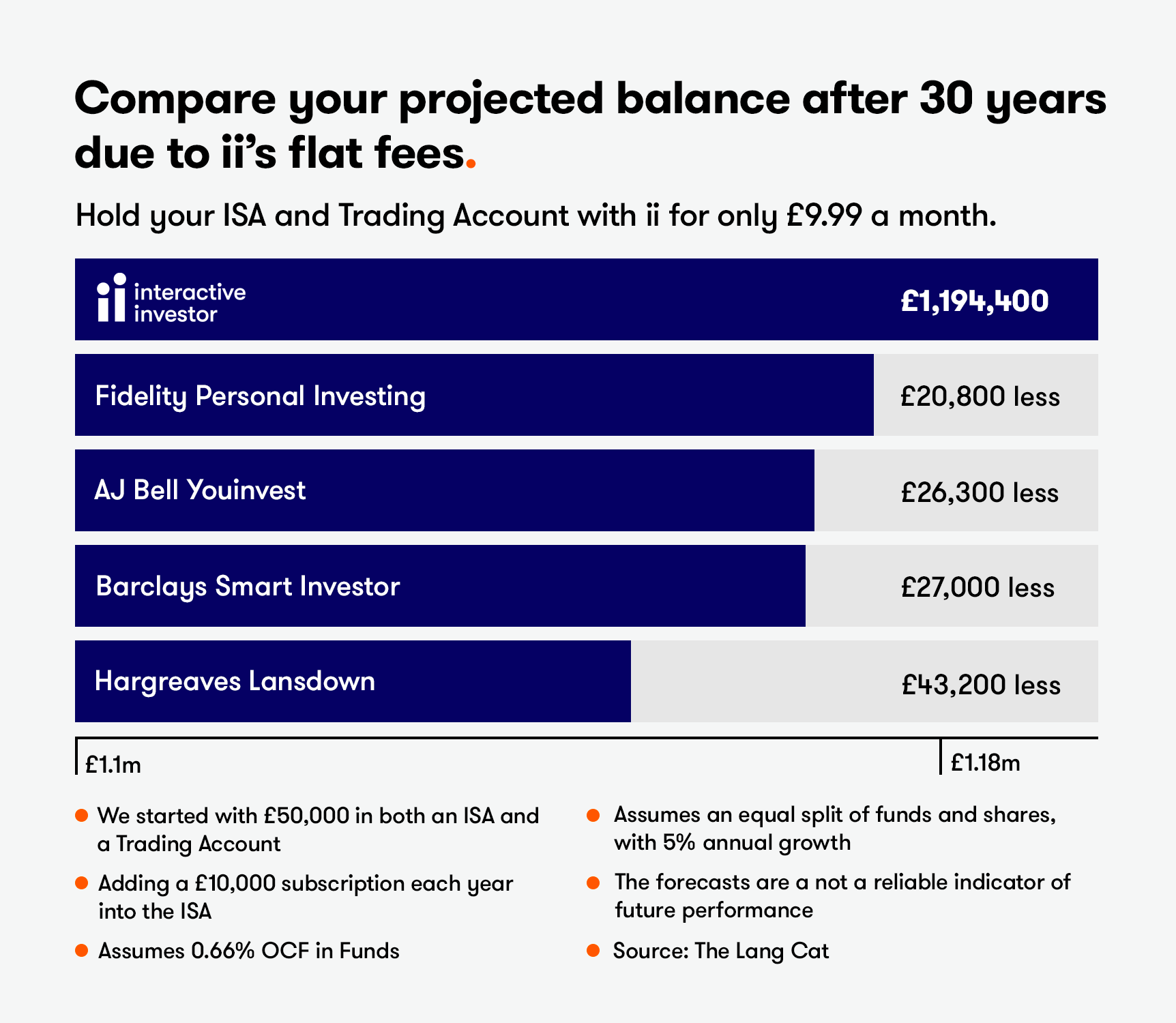

This doesn’t seem to be as low cost as some flat fee platforms such as Interactive Investor. Is it generally the case that flat fee investment platforms are cheaper (as long as you are not trading very much )? Is it the case that Vanguard (as a percentage fee platform) only works out as low cost if you have a small portfolio?

If so, what other flat-fee investment platforms are out there?

Many thanks.

Comments

-

Notice that Interactive Investor does not mention Vanguard when looking at Platform costs at: https://www.ii.co.uk/

0 -

There's a widespread misconception on "flat fees" driven primarily by the industry marketing behemoth. For example, all platforms are "flat fee" providers (with the exception of Best Invest) when it comes to investing in exchange traded instruments - but they like to keep quiet about this.

1 -

What are exchange traded instruments? How do they differ from funds? Thanks.0

-

Funds are not traded on an exchange but other investments are . Such as individual company shares , Exchange traded Funds and Investment Trusts . You always have to pay a dealing charge when you buy and sell.2021 said:What are exchange traded instruments? How do they differ from funds? Thanks.

Some % charging based platforms have a different charging structure for these exchange traded instruments than for funds that normally works out cheaper.

However you should not buy any investment just on the basis of reduced platform costs .

Is it the case that Vanguard (as a percentage fee platform) only works out as low cost if you have a small portfolio?

Vanguard is particularly suitable for lower size portfolios for people who are happy to have only the choice of Vanguard funds .

Regarding other cost comparisons , you have to be careful as some platforms charge extra for a SIPP ( some don't) some charge extra for drawdown and/or each individual withdrawal and various other charges .

You can check all the details for yourself herehttps://monevator.com/compare-uk-cheapest-online-brokers/

1 -

It is a free market and different companies have taken different charging models. Only you really know what investments you hold, how much they are worth and how they are being held. From that information you can then work out which one offers you the best value for your situation.I don't care about your first world problems; I have enough of my own!2

-

You need to separate out the fund fees (which you will pay wherever you buy the fund) from the platform fees which you will pay to the provider of the platform. In the Vanguard example they run both but with II you will need to include fund fees as well.Remember the saying: if it looks too good to be true it almost certainly is.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

Notice that Interactive Investor does not mention Vanguard when looking at Platform costs at:

Notice that Interactive Investor does not mention Vanguard when looking at Platform costs at: