We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Council Tax Challenge at tribunal

jmmo20

Posts: 105 Forumite

Hi,

I've read quite a lot about challenging tax bands so I thought I had everything figured out. This is in relation to a new build property we purchased last year.

The VOA assigned an outrageously high tax band (F) for a standard 3 bed home on the smallish side of the scale. This means £2700 per year in our area.

Things got a bit funkier when my neighbour got their tax band reduced to E for the same size of property, the only difference theirs is a end-of-terrace and ours is semi-detached.

My question specifically:

We got the decision letter from the VOA. They are comparing our property with some massive properties nearby. When I checked the supporting information they are listing my property as having 160 square metres in floor area. This is incorrect, my house is 129 sq.m. Since they are overreporting my house as being 25% larger, they are comparing my property with some properties that were HUGE as per 1991 standards, and therefore much more higher end at the time.

I have the EPC document that states 129 sq.m. I have made my own measurements and that is 128sq.m

The EPC document and my calculations include all interior area: hallways, kitchen, reception rooms, bedrooms, bathrooms, toilet. Does not include the garage as it's not insulated and therefore not fit for habitation. In any case the garage is 17 sq.m.

Should I just write to the tribunal telling them the VOA used the wrong information? IS that likely to succeed? What else would you recommend in this situation? I got back to the VOA with this information and they have 100% refused to engage.

Cheers!

I've read quite a lot about challenging tax bands so I thought I had everything figured out. This is in relation to a new build property we purchased last year.

The VOA assigned an outrageously high tax band (F) for a standard 3 bed home on the smallish side of the scale. This means £2700 per year in our area.

Things got a bit funkier when my neighbour got their tax band reduced to E for the same size of property, the only difference theirs is a end-of-terrace and ours is semi-detached.

My question specifically:

We got the decision letter from the VOA. They are comparing our property with some massive properties nearby. When I checked the supporting information they are listing my property as having 160 square metres in floor area. This is incorrect, my house is 129 sq.m. Since they are overreporting my house as being 25% larger, they are comparing my property with some properties that were HUGE as per 1991 standards, and therefore much more higher end at the time.

I have the EPC document that states 129 sq.m. I have made my own measurements and that is 128sq.m

The EPC document and my calculations include all interior area: hallways, kitchen, reception rooms, bedrooms, bathrooms, toilet. Does not include the garage as it's not insulated and therefore not fit for habitation. In any case the garage is 17 sq.m.

Should I just write to the tribunal telling them the VOA used the wrong information? IS that likely to succeed? What else would you recommend in this situation? I got back to the VOA with this information and they have 100% refused to engage.

Cheers!

0

Comments

-

Just to be clear, you are pre-tribunal?

This should help:

https://www.valuationtribunal.gov.uk/wp-content/uploads/2018/08/CTV-Appeal-Hearing.pdf

0 -

Yes, It's pre-tribunal. I'm preparing the statement for the tribunal form.

The VOA has gone totally silent and are not responding any of my emails. I managed to find the property they are comparing mine with and it's outrageous. They are HUGE in comparison to our modest home.0 -

How are you measuring your house? The VOA use Gross External Area to measure houses and bungalows, not the internal measurements, so their figure is probably correct for that type of measurement. The VT will be well aware of how the VOA measure properties, so measure the outside of the house and add both floors together. If it is vastly different to the VOA's figure, you could mention it to the VT, a couple of sq metres difference wouldn't be worth mentioning.If you are querying your Council Tax band would you please state whether you are in England, Scotland or Wales0

-

but my house has an integral garage but this garage is not habitable (i.e. no insulation).

The house they are comparing mine with does not have a garage so all the "external area" is habitable.

My problem is that in the future if I decide to convert the garage to a 4th bedroom, VOA will want to increase my council tax!!0 -

Not sure a converted garage would be enough to push you from F to G, especially as you think you are nearer E than G at the moment.0

-

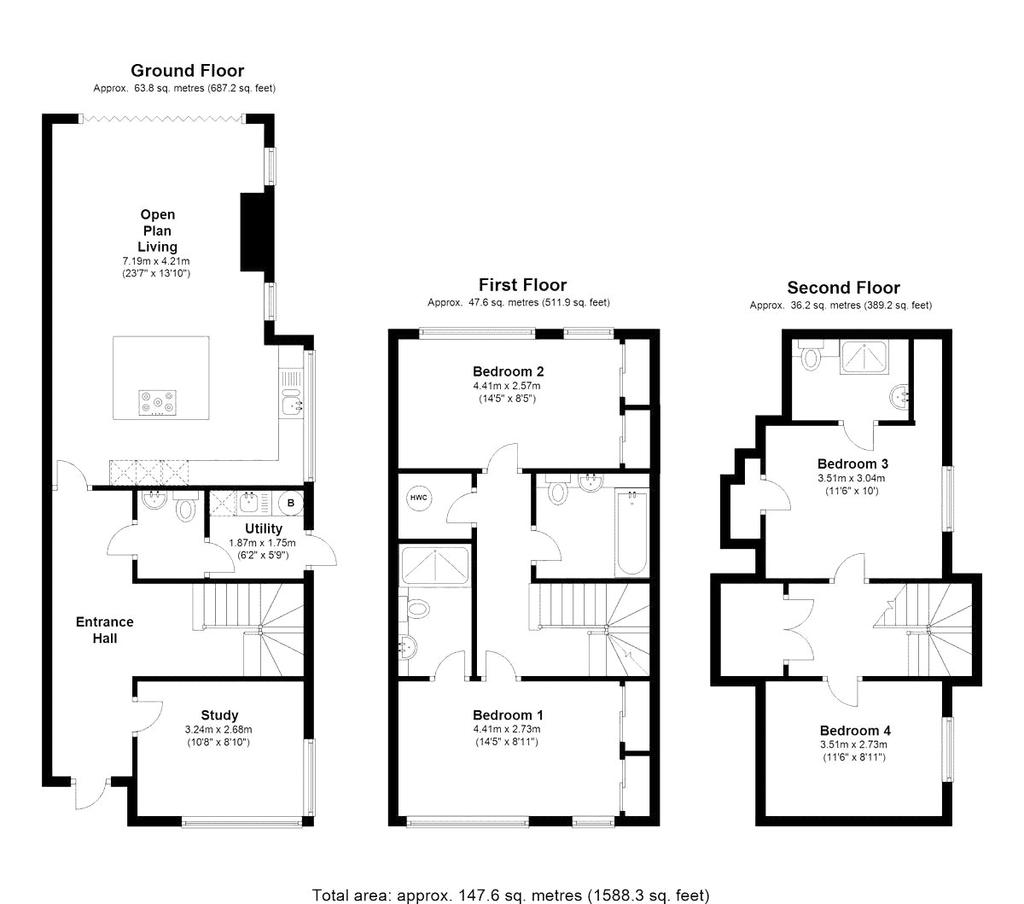

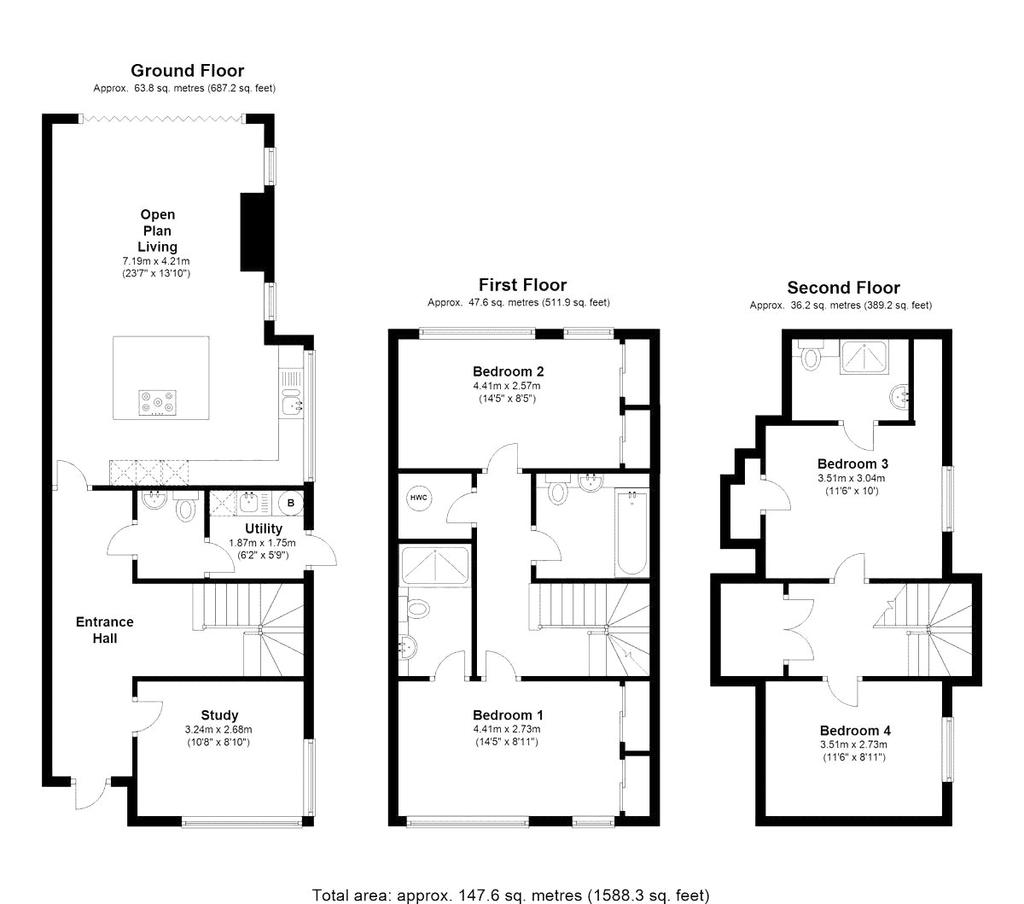

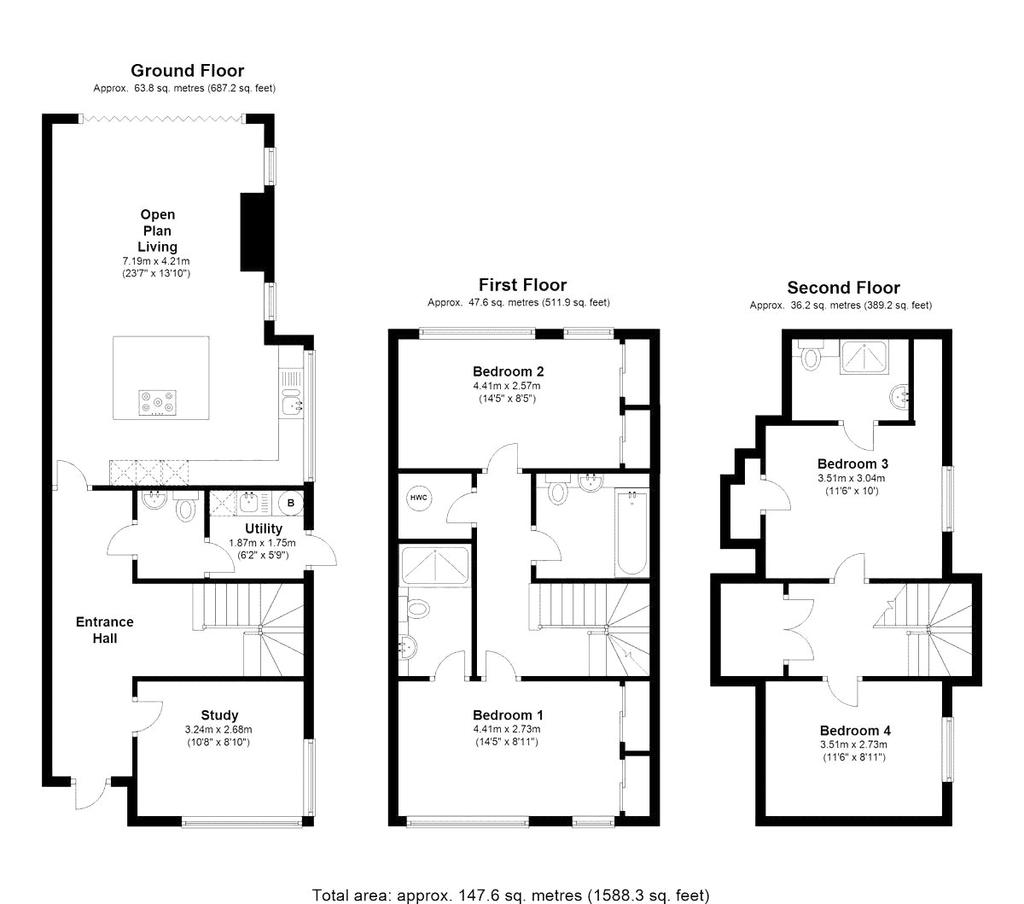

In any case the VOA is quite full of it. I managed to find the floorplans for the newbuild they are comparing my house to. VOA claims it's a 3 bed room house of similar size. BS! It's a massive 4-bedroom-plus-studio house !! I'm quite outraged to be honest. It took us a lot of years saving for our first home now to be bundled up with a house that is significantly larger and more expensive. Why does the VOA claim it's a 3-bed when it's clearly a 4-bed?

0 -

The only thing that CT is based on is the house value. If you're in England or Scotland, it's adjusted to a nominal date of 1st April 1991. If you're in Wales, 1st April 2003.jmmo20 said:but my house has an integral garage but this garage is not habitable (i.e. no insulation).

The house they are comparing mine with does not have a garage so all the "external area" is habitable.

My problem is that in the future if I decide to convert the garage to a 4th bedroom, VOA will want to increase my council tax!!

They know what your house last sold for when.

They know what values in your area did between the valuation date and that sale date.

Floor area isn't the primary determinant - value is.0 -

The VOA do not include the area of the garage in the GEA. A CT band cannot be increased on account of alterations to the dwelling made by the current owner and in any case this is irrelevant to your present query.jmmo20 said:but my house has an integral garage but this garage is not habitable (i.e. no insulation).

The house they are comparing mine with does not have a garage so all the "external area" is habitable.

My problem is that in the future if I decide to convert the garage to a 4th bedroom, VOA will want to increase my council tax!!If you are querying your Council Tax band would you please state whether you are in England, Scotland or Wales0 -

Upload a plan of your house so we can compare. Also please avoid the emotion, it won't help your case.jmmo20 said:In any case the VOA is quite full of it. I managed to find the floorplans for the newbuild they are comparing my house to. VOA claims it's a 3 bed room house of similar size. BS! It's a massive 4-bedroom-plus-studio house !! I'm quite outraged to be honest. It took us a lot of years saving for our first home now to be bundled up with a house that is significantly larger and more expensive. Why does the VOA claim it's a 3-bed when it's clearly a 4-bed? If you are querying your Council Tax band would you please state whether you are in England, Scotland or Wales0

If you are querying your Council Tax band would you please state whether you are in England, Scotland or Wales0 -

I know..lincroft1710 said:

Upload a plan of your house so we can compare. Also please avoid the emotion, it won't help your case.jmmo20 said:In any case the VOA is quite full of it. I managed to find the floorplans for the newbuild they are comparing my house to. VOA claims it's a 3 bed room house of similar size. BS! It's a massive 4-bedroom-plus-studio house !! I'm quite outraged to be honest. It took us a lot of years saving for our first home now to be bundled up with a house that is significantly larger and more expensive. Why does the VOA claim it's a 3-bed when it's clearly a 4-bed?

not as detailed though

not as detailed though

Please see thi s 0

s 0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards