We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Ridiculous listing prices

Comments

-

You were talking about sales DURING Covid though! I thought the rush for gardens was all due to Covid?RelievedSheff said:

Well someone clearly is or they wouldn't be selling.Crashy_Time said:

Who do you think is buying them?RelievedSheff said:

Well they are selling so someone is buying them.Crashy_Time said:

The economy and property bubble was in trouble before Covid, people who couldn`t afford bigger properties with bigger gardens then certainly can`t afford it now, and especially if the sellers are going to add 20%! What would the thought process be that drives a seller to do this in the middle of the biggest downturn in living memory?MobileSaver said:NameUnavailable said:I thought it was just me - I have noticed properties coming onto the market this year are 10-20% higher than most comparable properties. I'm not sure what is driving the optimism.....Pure speculation but I would suggest that there is a shortage of properties coming on to the market because many people won't be comfortable with viewings and viewers during the pandemic. Similarly demand has changed over the last 12 months with probably more people than ever before wanting bigger properties and bigger gardens and ideally in less-urban locations. So the sellers who are on the market are thinking why not try and get a better price?Turn it around; if you had something that others want and that you knew was in short supply, would you try and get the highest or the lowest price you could for it?

Who do you suggest that might be?

Is it really any great surprise given we are the middle of a pandemic that the number of properties coming to the market has reduced?

I thought Covid was an anomaly you were ignoring by the way?0 -

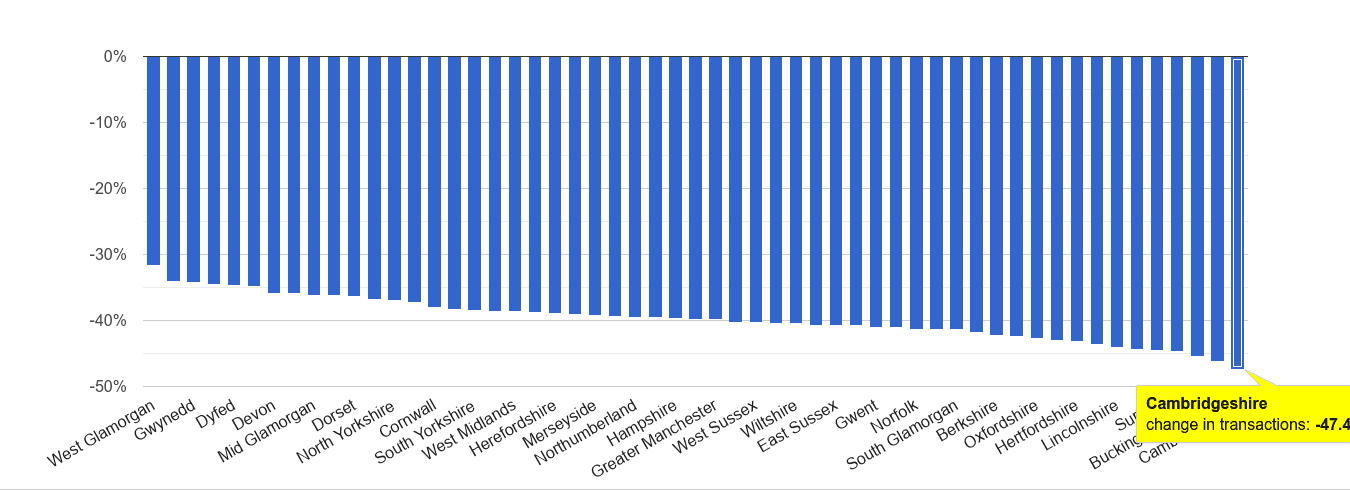

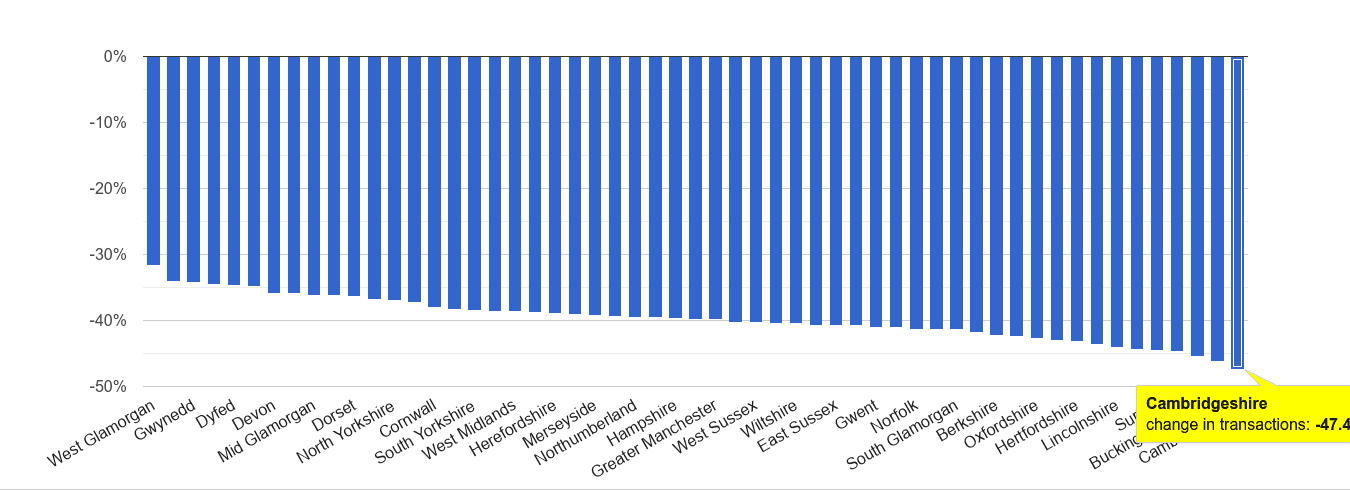

Crashy, what am supposed to take from the plumplot link? I'll attempt to work it out.

1. 34% drop in transactions means prices will fall. This is because the 34% signals buyers are unable to pay the asking price, sellers won't budge so sale falls through. End state more buyers and sellers stay put. The 1.6% increase in prices that occurred in the same time frame is likely to turn negative as sellers become desperate to sell, at the same time as transactions explode.

2. 1.6% increase in average prices is just the tail of years of substantial HPI. This means less people can now afford to pay asking prices. Sellers believe this as the 34% of transactions that didn't happen is due to sellers believing now is a bad time to sell. End state less properties come to market but less people can afford the asking price. End state HPI will plateau without other external factors.

3. The 34% is a reduction in houses going to market means undersupply. Prices have risen by 1.6% as there is more competition for less properties. End state buyers are willing and able to pay more from a smaller selection. HPI continues.

4. The 34% is a signpost that sellers can't afford to move. At the same time buyers can't afford to buy. The 66% that did and the 1.6% increase in prices is just due to central banks/vested interest mind control. But prices will fall.

Am I in the ball park with any of them?0 -

I'm not the one stating that Covid is an anomaly.Crashy_Time said:

You were talking about sales DURING Covid though! I thought the rush for gardens was all due to Covid?RelievedSheff said:

Well someone clearly is or they wouldn't be selling.Crashy_Time said:

Who do you think is buying them?RelievedSheff said:

Well they are selling so someone is buying them.Crashy_Time said:

The economy and property bubble was in trouble before Covid, people who couldn`t afford bigger properties with bigger gardens then certainly can`t afford it now, and especially if the sellers are going to add 20%! What would the thought process be that drives a seller to do this in the middle of the biggest downturn in living memory?MobileSaver said:NameUnavailable said:I thought it was just me - I have noticed properties coming onto the market this year are 10-20% higher than most comparable properties. I'm not sure what is driving the optimism.....Pure speculation but I would suggest that there is a shortage of properties coming on to the market because many people won't be comfortable with viewings and viewers during the pandemic. Similarly demand has changed over the last 12 months with probably more people than ever before wanting bigger properties and bigger gardens and ideally in less-urban locations. So the sellers who are on the market are thinking why not try and get a better price?Turn it around; if you had something that others want and that you knew was in short supply, would you try and get the highest or the lowest price you could for it?

Who do you suggest that might be?

Is it really any great surprise given we are the middle of a pandemic that the number of properties coming to the market has reduced?

I thought Covid was an anomaly you were ignoring by the way?

I don't believe there are any anomalies in the housing market. It is what it is at any given time.

So given we are where we are. What are your house price predictions for this year?0 -

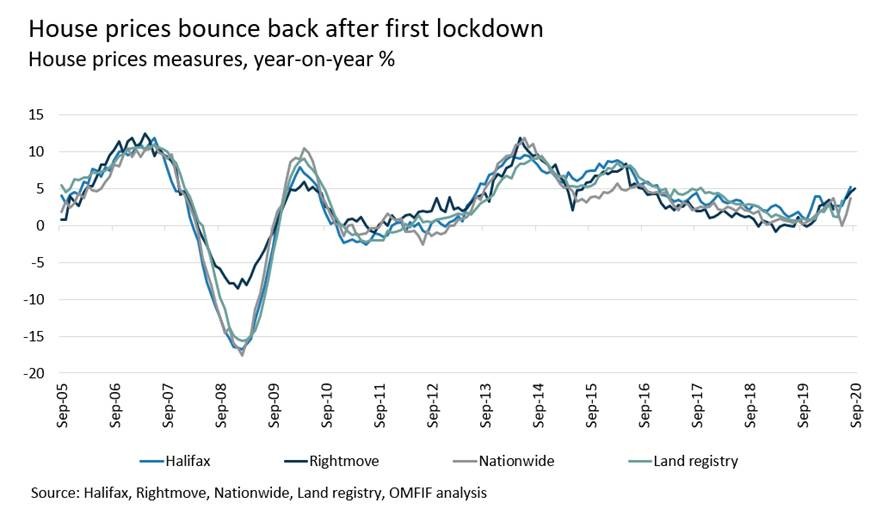

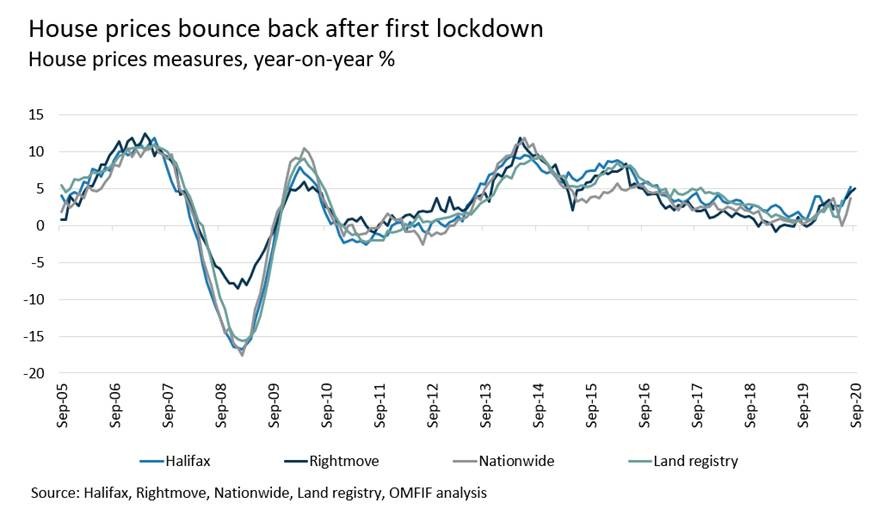

Crashy_Time said:The economy and property bubble was in trouble before CovidReally?!?!How do you explain house prices have been rising for the last ten years if the "property bubble was in trouble"?Crashy_Time said:people who couldn`t afford bigger properties with bigger gardens then certainly can`t afford it now,You keep stating this as a fact and yet report after report proves you wrong (including I might add articles that you yourself have linked to!)Crashy_Time said:What would the thought process be that drives a seller to do this in the middle of the biggest downturn in living memory?Probably acting on actual real-world verifiable facts rather than misguided opinions from HPC fanatics:Prices ended 2020 up 6% on the previous year on pent-up demand and stamp duty holidayHouse prices up 6% is the "biggest downturn in living memory"?!?! LOL

Every generation blames the one before...

Every generation blames the one before...

Mike + The Mechanics - The Living Years1 -

I think we might have stumbled on it...

That "in living memory" line. Crashy clearly doesn't remember 2008.

And if he doesn't remember only a dozen years ago, how could he possibly remember the early 90s?

When was it he sold up in antici... pation of prices falling?2 -

What effect do you think rising rates/inflation will have on the 66%, or the ending of furlough or other props to the economy?Getting_greyer said:Crashy, what am supposed to take from the plumplot link? I'll attempt to work it out.

1. 34% drop in transactions means prices will fall. This is because the 34% signals buyers are unable to pay the asking price, sellers won't budge so sale falls through. End state more buyers and sellers stay put. The 1.6% increase in prices that occurred in the same time frame is likely to turn negative as sellers become desperate to sell, at the same time as transactions explode.

2. 1.6% increase in average prices is just the tail of years of substantial HPI. This means less people can now afford to pay asking prices. Sellers believe this as the 34% of transactions that didn't happen is due to sellers believing now is a bad time to sell. End state less properties come to market but less people can afford the asking price. End state HPI will plateau without other external factors.

3. The 34% is a reduction in houses going to market means undersupply. Prices have risen by 1.6% as there is more competition for less properties. End state buyers are willing and able to pay more from a smaller selection. HPI continues.

4. The 34% is a signpost that sellers can't afford to move. At the same time buyers can't afford to buy. The 66% that did and the 1.6% increase in prices is just due to central banks/vested interest mind control. But prices will fall.

Am I in the ball park with any of them?0 -

Right about where the spike is on that graph I should think.AdrianC said:I think we might have stumbled on it...

That "in living memory" line. Crashy clearly doesn't remember 2008.

And if he doesn't remember only a dozen years ago, how could he possibly remember the early 90s?

When was it he sold up in antici... pation of prices falling?0 -

So just to be clear, you are saying that these headlines are just not true?MobileSaver said:Crashy_Time said:The economy and property bubble was in trouble before CovidReally?!?!How do you explain house prices have been rising for the last ten years if the "property bubble was in trouble"?Crashy_Time said:people who couldn`t afford bigger properties with bigger gardens then certainly can`t afford it now,You keep stating this as a fact and yet report after report proves you wrong (including I might add articles that you yourself have linked to!)Crashy_Time said:What would the thought process be that drives a seller to do this in the middle of the biggest downturn in living memory?Probably acting on actual real-world verifiable facts rather than misguided opinions from HPC fanatics:Prices ended 2020 up 6% on the previous year on pent-up demand and stamp duty holidayHouse prices up 6% is the "biggest downturn in living memory"?!?! LOL

https://metro.co.uk/2021/02/12/uk-economy-shrank-by-9-8-in-2020-faster-than-any-point-in-100-years-14068920/#metro-comments-container

0 -

OK, so we're bringing the labour market into the equation. I will answer this, but can you please acknowledge that I was asking what specifically you were alluding to by posting a link to plumplot. You make a lot of references to transactions being low compared with various base years. I was asking what does that mean. Transactions are low, ok you're link back that up, but what do you think the reason is and what do you think that means going forward. I did offer a few suggestions but I guess you think it's something else?Crashy_Time said:

What effect do you think rising rates/inflation will have on the 66%, or the ending of furlough or other props to the economy?Getting_greyer said:Crashy, what am supposed to take from the plumplot link? I'll attempt to work it out.

1. 34% drop in transactions means prices will fall. This is because the 34% signals buyers are unable to pay the asking price, sellers won't budge so sale falls through. End state more buyers and sellers stay put. The 1.6% increase in prices that occurred in the same time frame is likely to turn negative as sellers become desperate to sell, at the same time as transactions explode.

2. 1.6% increase in average prices is just the tail of years of substantial HPI. This means less people can now afford to pay asking prices. Sellers believe this as the 34% of transactions that didn't happen is due to sellers believing now is a bad time to sell. End state less properties come to market but less people can afford the asking price. End state HPI will plateau without other external factors.

3. The 34% is a reduction in houses going to market means undersupply. Prices have risen by 1.6% as there is more competition for less properties. End state buyers are willing and able to pay more from a smaller selection. HPI continues.

4. The 34% is a signpost that sellers can't afford to move. At the same time buyers can't afford to buy. The 66% that did and the 1.6% increase in prices is just due to central banks/vested interest mind control. But prices will fall.

Am I in the ball park with any of them?0 -

Is it any great surprise that the economy shrank given we have spent at least 6 of the last 12 months in lockdown?Crashy_Time said:

So just to be clear, you are saying that these headlines are just not true?MobileSaver said:Crashy_Time said:The economy and property bubble was in trouble before CovidReally?!?!How do you explain house prices have been rising for the last ten years if the "property bubble was in trouble"?Crashy_Time said:people who couldn`t afford bigger properties with bigger gardens then certainly can`t afford it now,You keep stating this as a fact and yet report after report proves you wrong (including I might add articles that you yourself have linked to!)Crashy_Time said:What would the thought process be that drives a seller to do this in the middle of the biggest downturn in living memory?Probably acting on actual real-world verifiable facts rather than misguided opinions from HPC fanatics:Prices ended 2020 up 6% on the previous year on pent-up demand and stamp duty holidayHouse prices up 6% is the "biggest downturn in living memory"?!?! LOL

https://metro.co.uk/2021/02/12/uk-economy-shrank-by-9-8-in-2020-faster-than-any-point-in-100-years-14068920/#metro-comments-container

Anyway I though Covid was an anomaly and you were disregarding it?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards