We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Wealth Management companies: web site location of reviews from existing customers?

Comments

-

The "MAEF Wealth Management" website is new. Not a good sign, when you want to invest money with someone. I suggest you run their website address through the following two website checkers: (a) scamadviser.com/ (b) scamdoc.com/

If your relative has no investment experience and the sums are large, then maybe they should consult a registered/ regulated IFA.

If the sums are not so large then I suggest they use the following "rules of thumb" to help in avoiding scams.

Relative safe savings from a (bank or building societies, NS&I) : best max 5 year return = 1.5% (at the moment).

If a bond is not from the above , then it is an investment, so they could loose all their money.

As a guide to investment I suggest the FTSE 100 yield = 3%.

If its twice the yield on the FTSE 100, don't touch it ( even with a barge pole)!

2 -

I think you need to be on guard. Equally, we need to be careful how we respond.

Those are not retail investments and are not meant to be sold to retail consumers this way. Those rates are not real rates of return unless you buy them at issue.

There is (or was) a genuine firm called Mes Assurances Et Finances. There is a strong possibility of a clone scam here and your relative is not dealing with the real genuine company but a scammer pretending to be from that company. The genuine company, where they still exist, is also a victim here as it is their good name that is being cloned.

Clone scams are rife at the moment. The general format is that the scammer picks a genuine company. Sometimes a former company or obscure company but also sometimes mainstream brands as well, and sets up a fake website and pretends to be from a genuine company. Often they also set up scam comparison sites the draw people in.

They use real investment instruments but misrepresent them as retail investments when they are not. They are not savings accounts. They are 100% capital at risk direct investments which have no guarantees and no FSCS protection. That doesn't really matter though because any money sent to the scammer will not be placed in those investments.

I will repeat in bold just to make it clear. Mes Assurances Et Finances is a genuine company (or was as it appears to no longer exist). The scammer has absolutely nothing to do with them.

Apart from the fact they are not retail investments and the way you described them does not tally, there are some other tell tale signs. Some circumstantial.

1 - Website maefwealthmanagement.co.uk was set up on the 9th Jan 2021 for one year. So, its only been active a month. It has a nameserver to orangewebsite. An Icelandic hosting company that accepts bitcoin, amongst other payments. Bitcoin payments being untraceable.

2 - The website "about us" claims to do activities that do not tally with the real company and the FCA register does not show the company having the required regulatory permissions to give investment advice to retail consumers.

3 - The FCA register tells us that the firm was a Former PSD agent. Not current. The FCA register would also show all trading names as they are required to register with the FCA. There is no MAEF Wealth Management

4 - According to a translation of French companies register, The company Mes Assurances Et Finances was struck off the Register of Trade and Companies (RCS) of Nice on 02/06/2015 Mes Assurances Et Finances (Nice, 06000) : siret, TVA, adresse... (lefigaro.fr)

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

That is a garbage collection of words that does not make any sense and does not match how they are traded. Its designed to appeal to confused people who wouldnt have a clue but make them think they are getting something special.KevinLondon said:My reference to 'liquidation' that had been relayed to me appears in the 2 emails that I have just received as follows:"As an institution, we currently have access to a UK Treasury GILT via a corporate client liquidation which offers investors a guaranteed fixed return of 6% per annum. These being on a first-come basis for existing clients or upon receipt of application."==

"Today we have received a liquidation request from a corporate client offering the highest protected product on the UK market, fully protected by the UK Treasury up to £5,000,000 paying 8.75% They are also liquidation a corporate bond with The Bank of Scotland that is offering a massive 13.625% fixed rate but not covered by the FSCS."

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.3 -

Double bargepole ...Eyeful said:The "MAEF Wealth Management" website is new. Not a good sign, when you want to invest money with someone. I suggest you run their website address through the following two website checkers: (a) scamadviser.com/ (b) scamdoc.com/

If your relative has no investment experience and the sums are large, then maybe they should consult a registered/ regulated IFA.

If the sums are not so large then I suggest they use the following "rules of thumb" to help in avoiding scams.

Relative safe savings from a (bank or building societies, NS&I) : best max 5 year return = 1.5% (at the moment).

If a bond is not from the above , then it is an investment, so they could loose all their money.

As a guide to investment I suggest the FTSE 100 yield = 3%.

If its twice the yield on the FTSE 100, don't touch it ( even with a barge pole)!

1

1 -

I think the French firm Mes Assurances et Finances (MAEF) in Nice is genuine but that this may possibly be a clone scam.

Edit: looks like the French company was liquidated 8 years ago ...

https://www.procedurecollective.fr/fr/liquidation-judiciaire/598748/mes-assurances-et-finances.aspx

1 -

Dear responders,I just wanted to pass on my appreciation for all of your in-depth responses; I will relay them on to my relative verbatim.Perhaps surprisingly, my main concern is not the fact that it is been pointed out that the wealth management company looks suspect, nor that that the bonds are not intended for retail sale, especially with no price or fees being initially provided, but the fact that a well known interest rate search site led my relative down this path in the first place. Some sites should carry financial health warnings in a 72pt font.

[Personally, if I had been absolutely set on bonds then I would have used a company such as Hargreaves Lansdown that I have actually been aware of for many years. They also bother to to break down their current charges, e.g., 'Stocks and Shares ISA over 5 years assuming 4.00% growth', for the 'National Grid Gas 8.75% 2025'.]

Thank you all again,

Kevin

1 -

Are you able to reproduce (and share) the exact navigation path followed?KevinLondon said:the fact that a well known interest rate search site led my relative down this path in the first place1 -

I suggest that you advise your relative to look elsewhere. Quoting interest rates of bonds based on their issue price without explanation is highly and suspiciously misleading. The bonds cannot be bought at that price.

For example:Issuer: UK Treasury

(You can find the GILT online searching this number)

Maturity Date: 07/12/2028

ISIN: GB0002404191

Issue date: 29/01/1998

Payment Frequency: Bi-annually (8th Jun & 8th Dec)

Interest rate: 6% FIXED

Accessibility: 14 days

Protection: £5,000,000 UK Treasury Insurancewhich was issued at £100 will now cost you £143. So the effective interest rate is 100/143 X 6%=4.2%. But when the bond matures in 2028 you will only get the issue price, £100, back. This means a capital loss of £43/bond.

Putting these numbers together makes the overall return equivalent to 0.608% per year.0 -

but the fact that a well known interest rate search site led my relative down this path in the first place.I suspect you will find that it was not a well known interest rate search site. None of proper sites would lead to outcomes like this. Try and find out what site she went to. Not what site she thought she went to. Some clone scams have sites of similar names.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

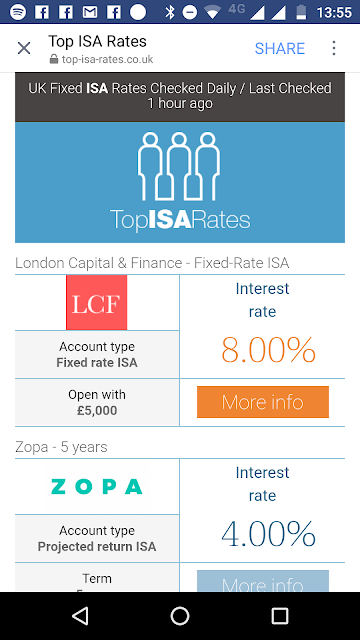

Bear in mind that similar searches for "best ISA rates" ended up guiding people to put their money into investments such as Blackmore Bonds and LCF. If your relative wants investment advice then they are best off going to an Independent Financial adviser so that they avoid these scams.

https://damn-lies-and-statistics.blogspot.com/2018/04/top-savings-isa-rates-8-percent.html

In many of these it's as much what they don't say as much as what they do. Guaranteed doesn't mean much if the person offering the guarantee has disappeared!

Remember the saying: if it looks too good to be true it almost certainly is.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.7K Banking & Borrowing

- 253.4K Reduce Debt & Boost Income

- 454K Spending & Discounts

- 244.7K Work, Benefits & Business

- 600.2K Mortgages, Homes & Bills

- 177.3K Life & Family

- 258.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards