We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Global Tracker - Methodology and questions

Comments

-

ChilliBob said:Questions:

1. Any flaws in the methodology (see below)?

2. Tracking error/difference vs OCF? – Is double the OCF worth it for smaller tracking error?

3. Yield – you see this on all the sites, but it never seems to get mentioned on blogs comparing indexes?

Methodology:

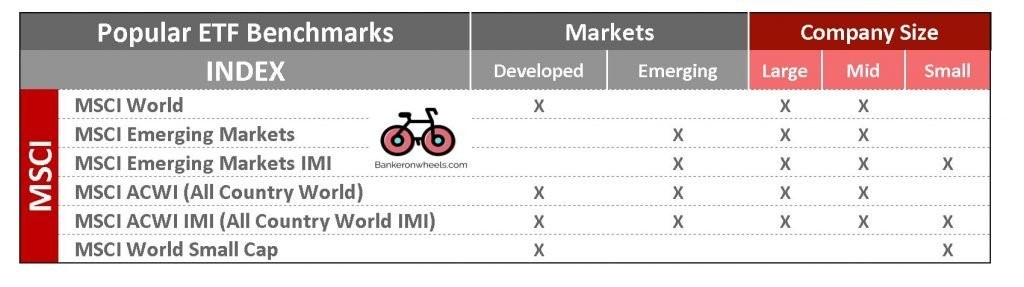

Choose the index I want to track. I want to be as broad as possible, and found this useful pic:

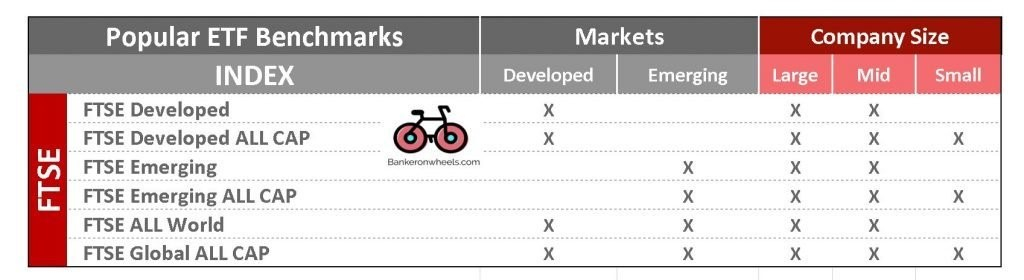

· So FTSE All World or MSCI ACWI IMI are the broadest and the ones I’m interested in

I think you've done a good job with that. I'd want my IFA to go at least that deep, so no over-analysis for me.I can see your spreadsheet headings, nothing else, but I'd omit/ignore the past returns as they say nothing useful about the future returns that we don't know qualitatively eg: EM is more risky but should have better returns; small cap and value are likely factors with more reward.You didn't mention derivatives. Some funds use derivatives more than others, called 'synthetic' funds. It's a bit risky, but they likely all do it at least to a small degree. They also commonly lend their underlying holdings short term; what if the borrower defaults? I think you can only hope that the big companies you're contemplating do such dangerous things less than start-up fund managers who are trying to squeeze blood out of a stone.Size of the fund and liquidity (is that the term?) can be important determinants of buy/sell spread which you'd prefer be small.I cringe when I see 'initial fee' and 'redemption fee'. Are we still putting up with those? A 2% initial fee means that every dividend or distribution the fund pays you is reduced by 2% of its value, I think.I would guess that if the OCF is larger by the same amount that the tracking error is small, there's no difference. If so, what does the future hold? Does the company have a history of reducing fees? Are they likely to improve their tracking error?I'd forget the yield. You either receive your share of the underlying businesses/bonds as dividends/coupons, or as share value increase if the profits are not paid out as dividends. Either way you get the benefit.I don't understand why you say FTSE All World is broader than All Cap; there's no 'small' in All World. The risk adjusted difference in return will probably be negligible.You mentioned diversifying manager risk. I don't think you need worry about the fund manager with an index tracking fund as there's very little discretion (despite my comments above about security lending etc!). It's with active funds that you take 'manager risk', that the 'genius' ones get a brain tumour, or become alcoholic, or the wife runs off with the kids and the neighbour.0 -

I don't think any of the mainstream global tracker funds that would be popular on large platforms have those, because people would just use the ones that track the same index and don't have them. Some funds put initial fees in their documentation for retail investors but in practice the platforms will 'discount' them away to nothing by having the fund manager waive them.JohnWinder saidI cringe when I see 'initial fee' and 'redemption fee'. Are we still putting up with those? A 2% initial fee means that every dividend or distribution the fund pays you is reduced by 2% of its value, I think.

Funds do sometimes reserve the right to charge a redemption fee to avoid a liquidity issue and high costs of sale borne by remaining investors if someone demanded to redeem £100m of holdings without notice. You wouldn't expect to practically pay it as a retail investor in a tracker fund.

An initial fee is paid when you subscribe, so just has the effect that you have less money actually invested. As a consequence, you'd get less money from future distributions or redemptions because you didn't have as much invested in actual assets as you'd have had if there wasn't an initial fee. But it's not a charge levied on the distributions.

Sometimes tracker funds that are growing in size through receipt of new investor capital and are invested into markets with high transaction costs (e.g. UK FTSE All-Share has 0.5% stamp duty on purchases) will have a 'dilution levy' which generally functions as an initial fee on newly invested capital so that the cost of deploying the new cash into underlying investments is more fairly borne by the people subscribing the new capital, rather than resulting in a lower performance and tracking error for the rest of the investors who are already in the fund. Vanguard UK had that for a time, some years ago, and it would have the effect of improving the performance charts which are shown as NAV changes excluding such levies, when compared to rivals who didn't do it that way. They also had them on their lifestrategy mixed asset fund range which started off being a higher UK equity allocation than it is today.

They don't currently have them as they are no longer growing their investor base as rapidly, now they have been operating for longer, but the fund docs do allow them to reintroduce it. In practice for OEICS the costs of net subscriptions or redemptions will generally be absorbed through swing pricing meaning there can be some element of subscription or redemption 'cost' to an investing or divesting investor without an explicit charge being made.

1 -

Thanks @JohnWinder some interesting points there.

I'm tracking whether the fund does physical full replication, sampling, or synthetic, favouring in that order.

In terms of size, most of the ones I'm looking at are massive anyway as they're likely to be huge providers like HSBC/Blackrock etc.

A lot of the columns are more checkers really - so as @bowlhead99 says it's unlikely you'll find a decent global tracker that would have initial fees or redemption fees. Likewise, finding one that's not UCITs compliant is also unlikely! - GBP currency and not domiciled in UK/Ireland also rare, but one to check for.

Yield - interesting, cheers, the first comment on yield which I'd been pondering the importance over in my head. I guess that's saying in theory with very similar fees/tracking errors you'd expect the managers to all get the same/similar dividends from those stocks. As an investor you either get value back in the firm of dividends being passed along, or increase in value, or a mix of the two. I guess if you were using dividends as an income stream it might be more relevant. I'm not too fussed either way as mine are set to reinvest.

FTSE Global All Cap would be the widest possible, correct, however, I didn't find much tracking that index if I recall correctly.

In terms of manager risk, it was more the FSCS protection - so not diversification because of risk of the fund doing rubbish, but of the manager being caught out doing something dodgy - unlikely - but it can and has happened. Regarding active diversification yeah 100% agree!

@bowlhead99 - Thanks for the extra detail there on fees. I read about dilution levy on the Monevator pages too actually. It's an interesting one but seems less relevant in the current climate you're saying?

For the record the order with iWeb for the HSBC tracker for this year's ISA lot is going through, but this is still interesting for future investments coming up shortly0 -

JohnWinder said:They also commonly lend their underlying holdings short term; what if the borrower defaults? I think you can only hope that the big companies you're contemplating do such dangerous things less than start-up fund managers who are trying to squeeze blood out of a stone.Asset lending programmes can generate valuable additional income to be divided between the client and fund manager who ensures the borrower provides sufficient collateral to secure the loan. Cash collateral is then reinvested in money market funds to provide some further return. Blackrock claims to have had 3 borrowers default since 1981 and in each case the collateral was sufficient that there was no loss to investors. If run properly the risk is extremely low and it boosts client returns.

I can think of at least one high performing active manager that I suspect might already be an alcoholic.JohnWinder said:It's with active funds that you take 'manager risk', that the 'genius' ones get a brain tumour, or become alcoholic, or the wife runs off with the kids and the neighbour.0 -

I think the last part of that response caught my eye! I'd be very surprised if more aren't like that, or have other vices they indulge in regularly!0

-

There is probably a sweet spot where just the right amount of vice is a performance enhancer. In my uni days playing pool I was always better after a pint or two as I loosened up and made bolder moves that paid off... though keep going and there were somewhat diminishing returns!ChilliBob said:I think the last part of that response caught my eye! I'd be very surprised if more aren't like that, or have other vices they indulge in regularly!0 -

Relieved that you chose pool as your example there, I thought you were about to overshare way too much information....bowlhead99 said:

There is probably a sweet spot where just the right amount of vice is a performance enhancer. In my uni days playing pool I was always better after a pint or two as I loosened up and made bolder moves that paid off... though keep going and there were somewhat diminishing returns!ChilliBob said:I think the last part of that response caught my eye! I'd be very surprised if more aren't like that, or have other vices they indulge in regularly! 0

0 -

Ha ha yeah totally. Exactly the same when it comes to pool, but mine would increase from a pretty poor level to start with!

Now a couple of Friday lunchtime beers and back to the office.. That's a long afternoon, not sure of the code quality I'd generate either!0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards