We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

AJBell fund advice

Comments

-

Normally there are not any transfer fees anymore from the provider, when switching pensions.Scallypud said:

Can my current IFA manage the funds with in AJBell as i don't want to pay transfer fees to another providerAlbermarle said:Suggest you add this sum to the current sum managed by the IFA. You can always decide later to go it alone but it sounds like not just yet.

The IFA may have a one off charge for looking at a new portfolio , or maybe not as you are an existing customer.

The IFA may prefer to switch you to the provider they use/prefer or maybe happy to leave this part with AJ Bell .

You would have to discuss such details with them .1 -

Still tight.Scallypud said:

After 8 years i will reduce my drawdown to 9K as i will have my 8.5K state pensionLinton said:

From historical data I dont believe you will get a safe sustainable inflation linked income of £17.5K from your £245K Sipp. Taking an inflation linked £17.5K from the £416K total pensions may be OK if you are able to be flexible in your drawdown taking less than normal when prices are low. But you will need to monitor how it goes.

Allow for the £8.5k extra for the first 8 years (i.e. £68k) then your £245k drawdown fund becomes £177k.

A drawdown of £9k for life from this is 5% which may still be a bit on the high side.

Taking £6k (i.e. £14.5k for 8 years reducing post SPA to £6k) is more realistic.

Could the £3k p.a. shortfall come from the other £171k fund perhaps - a drawdown rate of 1.75%?

0 -

You need to have an appropriate asset allocation for the overall portfolio. Do you know what it should be? Given your timeline, volatility is your enemy. The simplest solution is a multi-asset fund with at least 40% fixed income. There are a few options available, eg from Vanguard and HSBC. The former has stable allocations, more home bias and more diversification.To make your portfolio any more complicated than this, you would need to read up, study the funds and understand each option. Managing your own portfolio is very easy these days but you do need to have a little education on the subject. Lots of great books available, from the sources that are far better than an average IFA.Ongoing advice from an IFA is expensive. Its thousands of pounds every year. And you incur it even if the IFA managed portfolio loses your money. This cost is only ever justified if the IFA is good and you are ignorant. If you are certain that both of these conditions have been met, and you are not prepared to invest a bit of time in learning, then let the IFA manage everything. Even then you should learn enough to at least understand what the IFA is advising and why.Returns of 4 to 6% are achievable (net of costs). Balanced portfolio owners have had higher returns for quite some time and the future might be the same. But I wouldn’t rely on it.0

-

Also, having 245K sit in cash in AJ Bell is good for AJ Bell but expensive for you. I would put the money to work while I am figuring what to do going forward.0

-

I'm not sure where you are coming from here.garmeg said:Still tight.

Allow for the £8.5k extra for the first 8 years (i.e. £68k) then your £245k drawdown fund becomes £177k.

A drawdown of £9k for life from this is 5% which may still be a bit on the high side.

Taking £6k (i.e. £14.5k for 8 years reducing post SPA to £6k) is more realistic.

Could the £3k p.a. shortfall come from the other £171k fund perhaps - a drawdown rate of 1.75%?

If i drawdown 17.5K from the 245K drawdown fund. After 8 years i should have approx 167K if the fund has a 3% growth. My 171K fund after 8 years with 3% growth will be approx 228K giving me a total fund 395K.

Is there something i am missing?

I know the 3% is not guaranteed1 -

Ignoring growth for the sake of prudence. Seems fair enough as you may want your drawdown income to grow and we haven't allowed for that either.Scallypud said:

I'm not sure where you are coming from here.garmeg said:Still tight.

Allow for the £8.5k extra for the first 8 years (i.e. £68k) then your £245k drawdown fund becomes £177k.

A drawdown of £9k for life from this is 5% which may still be a bit on the high side.

Taking £6k (i.e. £14.5k for 8 years reducing post SPA to £6k) is more realistic.

Could the £3k p.a. shortfall come from the other £171k fund perhaps - a drawdown rate of 1.75%?

If i drawdown 17.5K from the 245K drawdown fund. After 8 years i should have approx 167K if the fund has a 3% growth. My 171K fund after 8 years with 3% growth will be approx 228K giving me a total fund 395K.

Is there something i am missing?

I know the 3% is not guaranteed

We are both assuming both funds will be used, and in that case the drawdown required looks sustainable. Previous replies only used the £245k fund which on its own would not support your requirement.1 -

InflationScallypud said:

I'm not sure where you are coming from here.garmeg said:Still tight.

Allow for the £8.5k extra for the first 8 years (i.e. £68k) then your £245k drawdown fund becomes £177k.

A drawdown of £9k for life from this is 5% which may still be a bit on the high side.

Taking £6k (i.e. £14.5k for 8 years reducing post SPA to £6k) is more realistic.

Could the £3k p.a. shortfall come from the other £171k fund perhaps - a drawdown rate of 1.75%?

If i drawdown 17.5K from the 245K drawdown fund. After 8 years i should have approx 167K if the fund has a 3% growth. My 171K fund after 8 years with 3% growth will be approx 228K giving me a total fund 395K.

Is there something i am missing?

I know the 3% is not guaranteed0 -

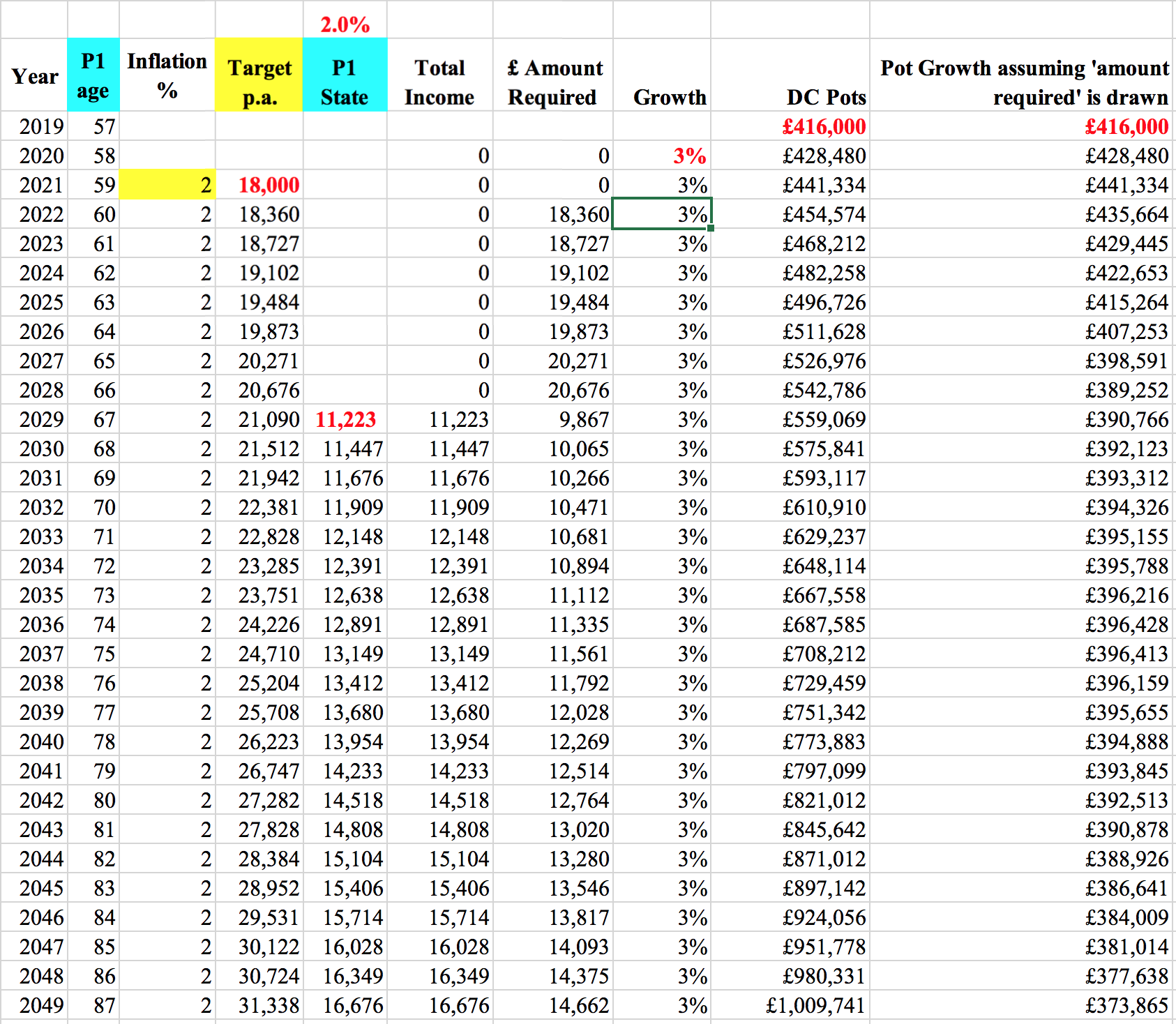

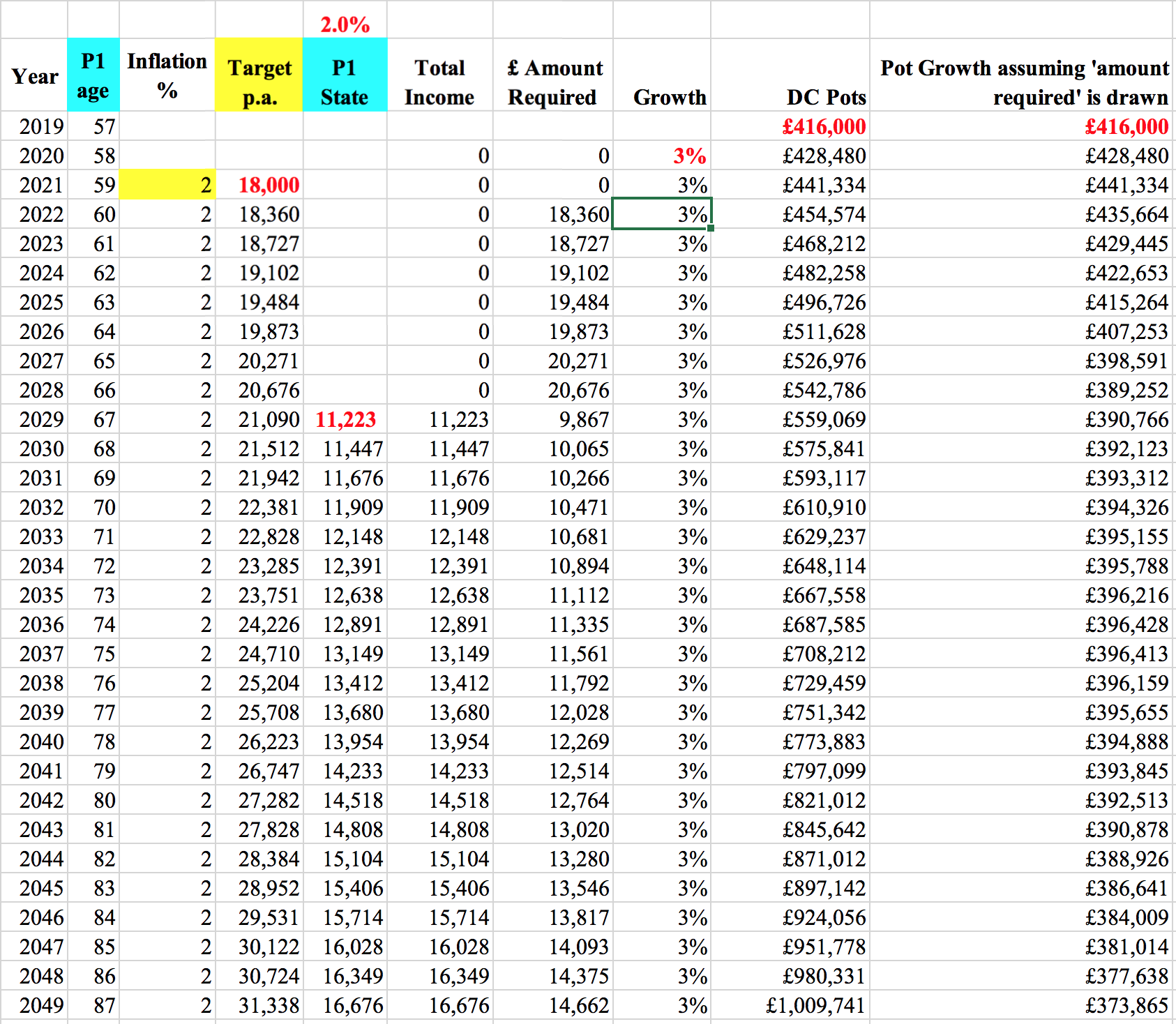

Curious.

My magic spreaddie suggest that you should be fine, even if you only average 2% to last until you are 100.

Maybe I have misread the numbers. If so, let me know!

Sample below - assuming you want 18k at todays money, rising at 2% (3rd column - note it says 'inflation, but today inflation is under 1% !!).

If you would like a copy to play with numbers, let me know - it is pretty basic really.

If you get 3%, happy days, all good: the last column shows how much the two pots you describe end up each year, after taking the income in the "£ Amount Required" column:

If I have misunderstood some of the numbers, let me know.

I have put the State pension as if it gets a 2% rise each year - slightly lower than how things stand today - remember, as things stand, there is a "triple lock" protection that guarantees the state pension would increase by the greatest of the following three measures:- Average earnings

- Prices, as measured by the Consumer Prices Index (CPI)

- 2.5 per cent

Of course the "Growth" column will vary from year to year, perhaps wildly, so it is wise to play with it and drop some negative years in, particularly early on, but if you can keep some cash funds (ours are in Premium Bonds), and have the ability to "pause" the drawdown, then you can help mitigate downturns.

In terms of "advising you where to invest" - you will NOT get that here: advice comes with the need for regulations and training, and although there are one or two such advisors here, they would not give you a simple answer given the little information we all read here - plus, that would rather take away the mystery of finance

If I were unsure of things, I would probably pop it all in a Vanguard LifeStrategy 80, or perhaps LS60, to capture the essence of "invest in the world".

YES, there is a lot more information , as dunstonh & others outlined, that would be needed to get to the bottom of what the best thing for YOU is, but who knows what tomorrow can bring!

But that is just my personal suggestion, just an invisible individual on the internet!

Plan for tomorrow, enjoy today!1 -

"plus, that would rather take away the mystery of finance"cfw1994 said:Curious.

My magic spreaddie suggest that you should be fine, even if you only average 2% to last until you are 100.

Maybe I have misread the numbers. If so, let me know!

Sample below - assuming you want 18k at todays money, rising at 2% (3rd column - note it says 'inflation, but today inflation is under 1% !!).

If you would like a copy to play with numbers, let me know - it is pretty basic really.

If you get 3%, happy days, all good: the last column shows how much the two pots you describe end up each year, after taking the income in the "£ Amount Required" column:

If I have misunderstood some of the numbers, let me know.

I have put the State pension as if it gets a 2% rise each year - slightly lower than how things stand today - remember, as things stand, there is a "triple lock" protection that guarantees the state pension would increase by the greatest of the following three measures:- Average earnings

- Prices, as measured by the Consumer Prices Index (CPI)

- 2.5 per cent

Of course the "Growth" column will vary from year to year, perhaps wildly, so it is wise to play with it and drop some negative years in, particularly early on, but if you can keep some cash funds (ours are in Premium Bonds), and have the ability to "pause" the drawdown, then you can help mitigate downturns.

In terms of "advising you where to invest" - you will NOT get that here: advice comes with the need for regulations and training, and although there are one or two such advisors here, they would not give you a simple answer given the little information we all read here - plus, that would rather take away the mystery of finance

If I were unsure of things, I would probably pop it all in a Vanguard LifeStrategy 80, or perhaps LS60, to capture the essence of "invest in the world".

YES, there is a lot more information , as dunstonh & others outlined, that would be needed to get to the bottom of what the best thing for YOU is, but who knows what tomorrow can bring!

But that is just my personal suggestion, just an invisible individual on the internet!

In what way?0 -

I think you are underestimating your knowledge, in absolute terms and also relative to the typical private investor. I also think you are underestimating the time taken to build that knowledge.Deleted_User said:You need to have an appropriate asset allocation for the overall portfolio. Do you know what it should be? Given your timeline, volatility is your enemy. The simplest solution is a multi-asset fund with at least 40% fixed income. There are a few options available, eg from Vanguard and HSBC. The former has stable allocations, more home bias and more diversification.To make your portfolio any more complicated than this, you would need to read up, study the funds and understand each option. Managing your own portfolio is very easy these days but you do need to have a little education on the subject. Lots of great books available, from the sources that are far better than an average IFA.Ongoing advice from an IFA is expensive. Its thousands of pounds every year. And you incur it even if the IFA managed portfolio loses your money. This cost is only ever justified if the IFA is good and you are ignorant. If you are certain that both of these conditions have been met, and you are not prepared to invest a bit of time in learning, then let the IFA manage everything. Even then you should learn enough to at least understand what the IFA is advising and why.Returns of 4 to 6% are achievable (net of costs). Balanced portfolio owners have had higher returns for quite some time and the future might be the same. But I wouldn’t rely on it.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards