We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Pension recovery performance 2020

Comments

-

Over the last 12 months my 3 DC pots, which are all invested in their particular equivalent of "lifestyle to drawdown" and at about the point of starting to slightly reduce risk, are up ~1%, ~1% and ~7% (thankfully the one gaining 7% is the largest) and my SIPP, which last year represented about 1/4 of my total pension and which I am much more adventurous with, is up ~26%.

My SIPP has only been in existence for 2-3 years though so I may still be experiencing beginner's luck!1 -

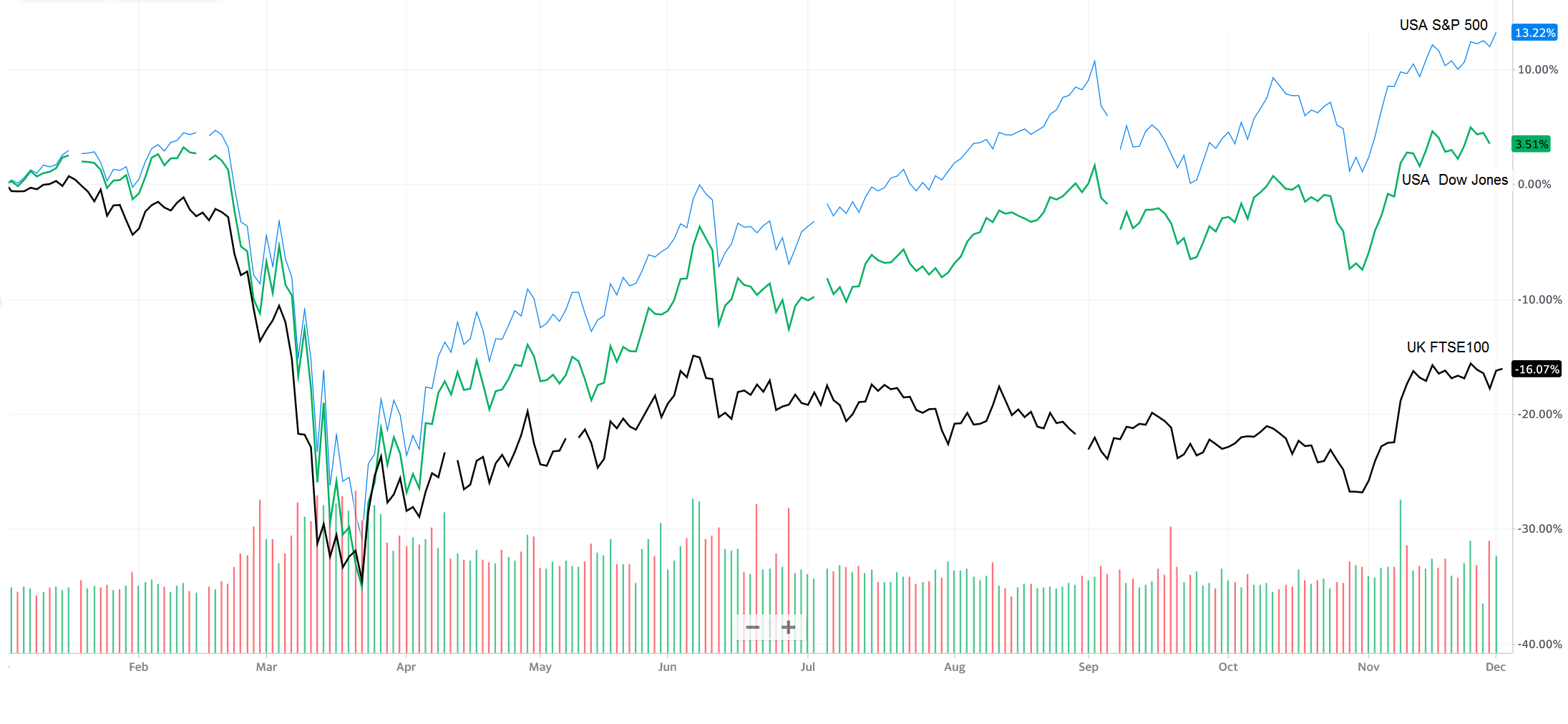

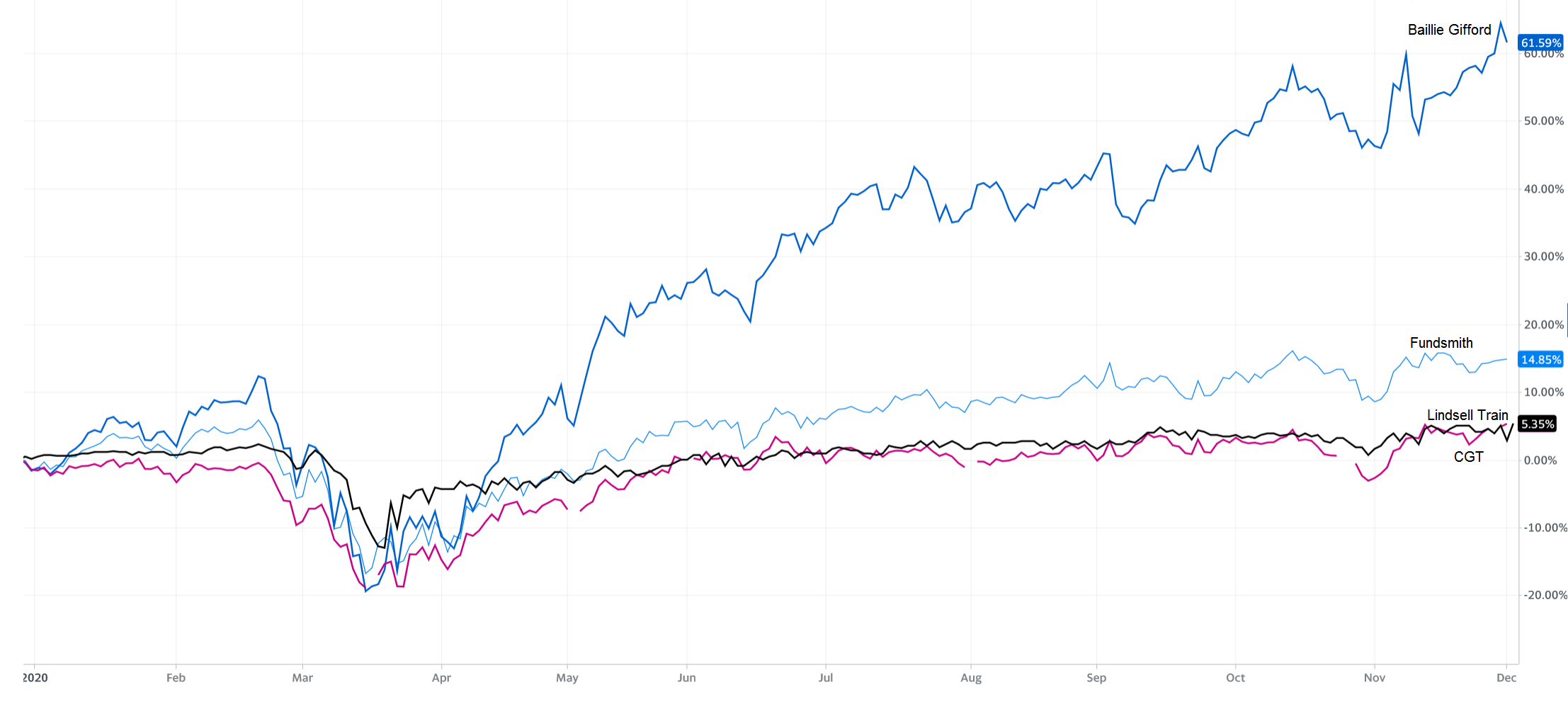

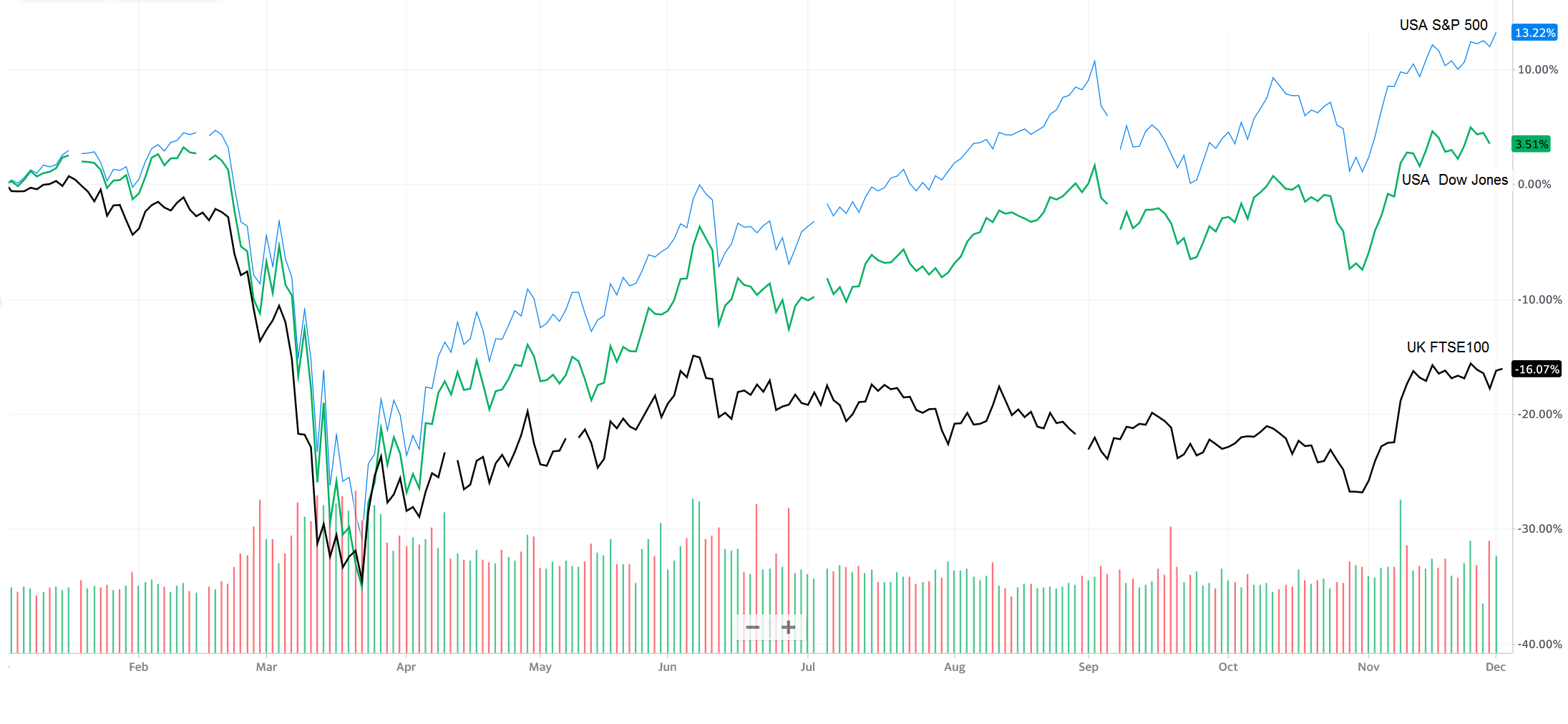

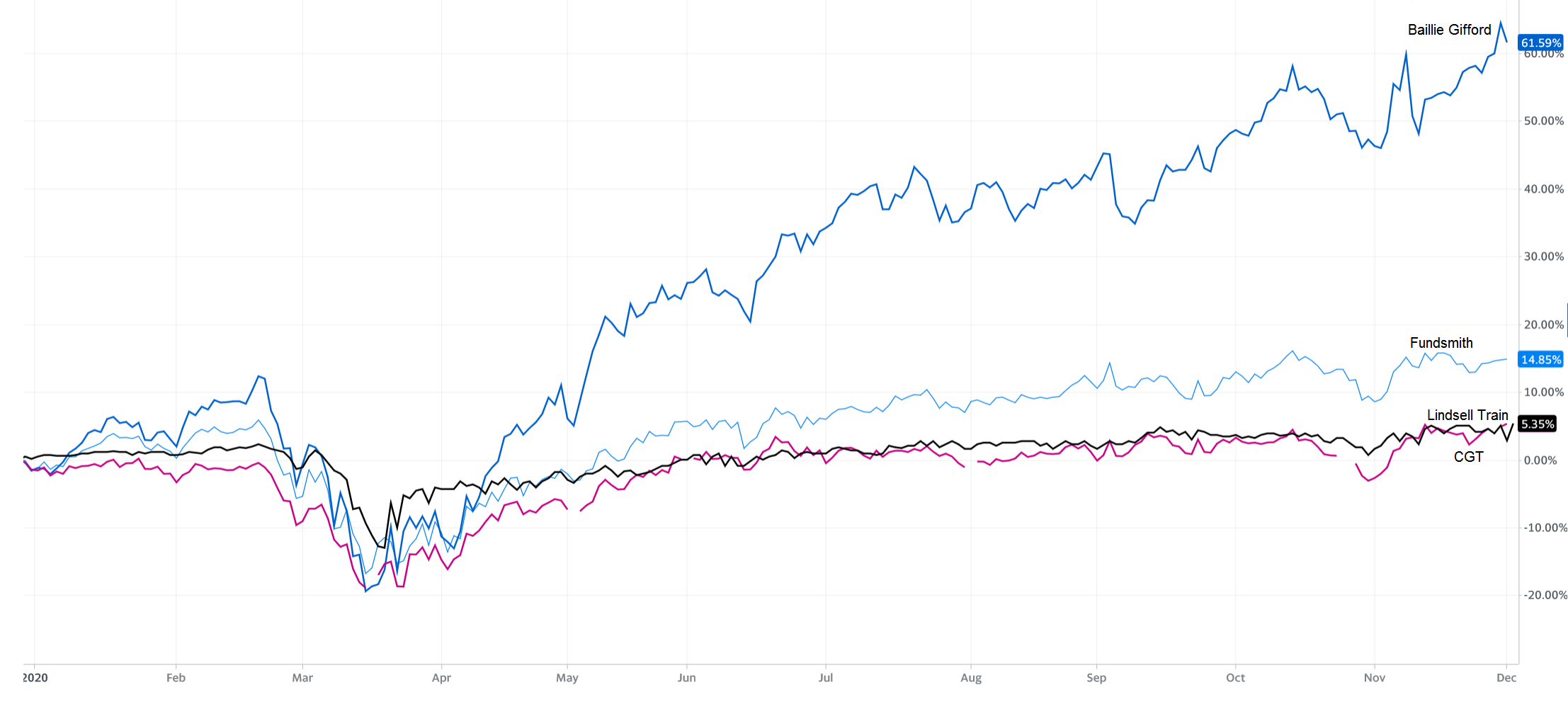

I held on and am down. I don't consider myself a "winner" here.Secret2ndAccount said:These threads always seem to be populated by the winners. You won't get many people coming here to tell you they sold everything at the bottom of the market, then failed to get back in as it recovered.Here is a year-to-date chart of the FTSE 100 index, compared to two popular US indices - the Dow Jones (which is a poorly calculated but popular measure) and the S&P500 which is a much better measure of the wider market. If you prefer to go for something actively managed, here are some of the most popular funds around this forum:Baillie Gifford Global DiscoveryFundsmith EquityLindsell Train Global Equitythose three are pretty growth oriented (and therefore towards the right hand side of the risk scale). For those seeking to preserve capital with some prospect of growth too, a popular choice is Capital Gearing Trust

If you prefer to go for something actively managed, here are some of the most popular funds around this forum:Baillie Gifford Global DiscoveryFundsmith EquityLindsell Train Global Equitythose three are pretty growth oriented (and therefore towards the right hand side of the risk scale). For those seeking to preserve capital with some prospect of growth too, a popular choice is Capital Gearing Trust Baillie Gifford is a big fan of Tesla, which has distorted the picture somewhat. Past performance is not a guarantee of future returns, although BG has provided good returns over a period of several years to give them their due.1

Baillie Gifford is a big fan of Tesla, which has distorted the picture somewhat. Past performance is not a guarantee of future returns, although BG has provided good returns over a period of several years to give them their due.1 -

Very interesting charts. Thanks. 👍Secret2ndAccount said:These threads always seem to be populated by the winners. You won't get many people coming here to tell you they sold everything at the bottom of the market, then failed to get back in as it recovered.Here is a year-to-date chart of the FTSE 100 index, compared to two popular US indices - the Dow Jones (which is a poorly calculated but popular measure) and the S&P500 which is a much better measure of the wider market. If you prefer to go for something actively managed, here are some of the most popular funds around this forum:Baillie Gifford Global DiscoveryFundsmith EquityLindsell Train Global Equitythose three are pretty growth oriented (and therefore towards the right hand side of the risk scale). For those seeking to preserve capital with some prospect of growth too, a popular choice is Capital Gearing Trust

If you prefer to go for something actively managed, here are some of the most popular funds around this forum:Baillie Gifford Global DiscoveryFundsmith EquityLindsell Train Global Equitythose three are pretty growth oriented (and therefore towards the right hand side of the risk scale). For those seeking to preserve capital with some prospect of growth too, a popular choice is Capital Gearing Trust Baillie Gifford is a big fan of Tesla, which has distorted the picture somewhat. Past performance is not a guarantee of future returns, although BG has provided good returns over a period of several years to give them their due.1

Baillie Gifford is a big fan of Tesla, which has distorted the picture somewhat. Past performance is not a guarantee of future returns, although BG has provided good returns over a period of several years to give them their due.1 -

He is using income funds. This is a bad criterion which does not meet anyone’s real objectives and reduces diversification for zero benefit.itwasntme001 said:Joey_Soap said:Still about 10 per cent down overall. Due entirely due to being too over exposed to FTSE100 income stocks. Lesson has been learned.

The problem is you don't know that in 5 years time these same FTSE100 stocks won't actually do better than US stocks. They may. You need to ask yourself why you chose the stocks you did, if they fit your objectives and if you are honest with yourself, you will come to a decision whether or not you need to change your allocations.0 -

1. reporting returns at arbitrary points in time is meaningless. Having said this, maximum drawdown from peak can be useful.2. Ditto for short periods of time. 10 or 20 year portfolio returns are a bit more interesting.3. Only time weighted returns can be compared meaningfully.4. Reporting returns without specifying your asset allocation is also meaningless.5. No confidence in most poster’s ability to calculate their returns. If you really want to know whether your investment vehicles performed as expected, compare against an appropriate benchmark.1

-

I really wish this individual wouldn't fabricate untruths about my posts. My portfolio has not held a single income fund since around 2014.Deleted_User said:

He is using income funds. This is a bad criterion which does not meet anyone’s real objectives and reduces diversification for zero benefit.itwasntme001 said:Joey_Soap said:Still about 10 per cent down overall. Due entirely due to being too over exposed to FTSE100 income stocks. Lesson has been learned.

The problem is you don't know that in 5 years time these same FTSE100 stocks won't actually do better than US stocks. They may. You need to ask yourself why you chose the stocks you did, if they fit your objectives and if you are honest with yourself, you will come to a decision whether or not you need to change your allocations.

0 -

I am sorry, you said “income stocks”. Are you holding them directly rather than through funds? The same point applies. The size of a dividend is a simple but poor criterion for selecting stocks.Joey_Soap said:

I really wish this individual wouldn't fabricate untruths about my posts. My portfolio has not held a single income fund since around 2014.Deleted_User said:

He is using income funds. This is a bad criterion which does not meet anyone’s real objectives and reduces diversification for zero benefit.itwasntme001 said:Joey_Soap said:Still about 10 per cent down overall. Due entirely due to being too over exposed to FTSE100 income stocks. Lesson has been learned.

The problem is you don't know that in 5 years time these same FTSE100 stocks won't actually do better than US stocks. They may. You need to ask yourself why you chose the stocks you did, if they fit your objectives and if you are honest with yourself, you will come to a decision whether or not you need to change your allocations.0 -

Deleted_User said:1. reporting returns at arbitrary points in time is meaningless. Having said this, maximum drawdown from peak can be useful.2. Ditto for short periods of time. 10 or 20 year portfolio returns are a bit more interesting.3. Only time weighted returns can be compared meaningfully.4. Reporting returns without specifying your asset allocation is also meaningless.5. No confidence in most poster’s ability to calculate their returns. If you really want to know whether your investment vehicles performed as expected, compare against an appropriate benchmark.Agree with all of this except maybe point 3. Surely it depends on why we are comparing performance?0

-

That’s true. If one wants to compare how portfolios perform then he/she should use time weighted returns over a reasonable period of time and a predefined set of dates. If one wants to advertise then he/she should pick a couple of dates that suit his purpose, carefully select what to report and then publish meaningless and unsustainable numbers to attract more punters.itwasntme001 said:Deleted_User said:1. reporting returns at arbitrary points in time is meaningless. Having said this, maximum drawdown from peak can be useful.2. Ditto for short periods of time. 10 or 20 year portfolio returns are a bit more interesting.3. Only time weighted returns can be compared meaningfully.4. Reporting returns without specifying your asset allocation is also meaningless.5. No confidence in most poster’s ability to calculate their returns. If you really want to know whether your investment vehicles performed as expected, compare against an appropriate benchmark.Agree with all of this except maybe point 3. Surely it depends on why we are comparing performance?1 -

As Mordko points out most of these figures are meaningless since we are not in competition with each other and we all have different risk levels and goals. However lets not let that get in the way of a story - my pension is up 19.6% for the year, although it was down 17% at one point. My investments and savings outside of my pension are up about 15% but dropped only to -10% along the way.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards