We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Scottish Widows to AJ Bell

Comments

-

Your stats on most active funds underperforming the market may will be true. However, I started investing just over 4 years ago with SMT, LTGE, Baillie Gifford Shin Nippon and a bit later Independent investment trust.michaels said:At least half of all active funds will underperform an index, or probably a higher percentage once you include the extra fees. What makes you think you can pick one of the 75% of winners rather than the 75% of losers? Do you have some inside information that is not in the market?

I moved form SW to II as I reduced my total fees from .75% to <.2% and have a wiser choice of funds - so 0.55% of outperformance without having to try to guess which fund manager will be lucky next year.

I still hold SMT and LTGE. I sold out of Independent at a loss then switched from Shin Nippon to Fundsmith at the beginning of this year, which was bad timing. While I have picked the odd loser (eg Independent investment trust), on average my actively managed trusts/funds have easily outperformed their benchmarks, some by a significant margin.“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

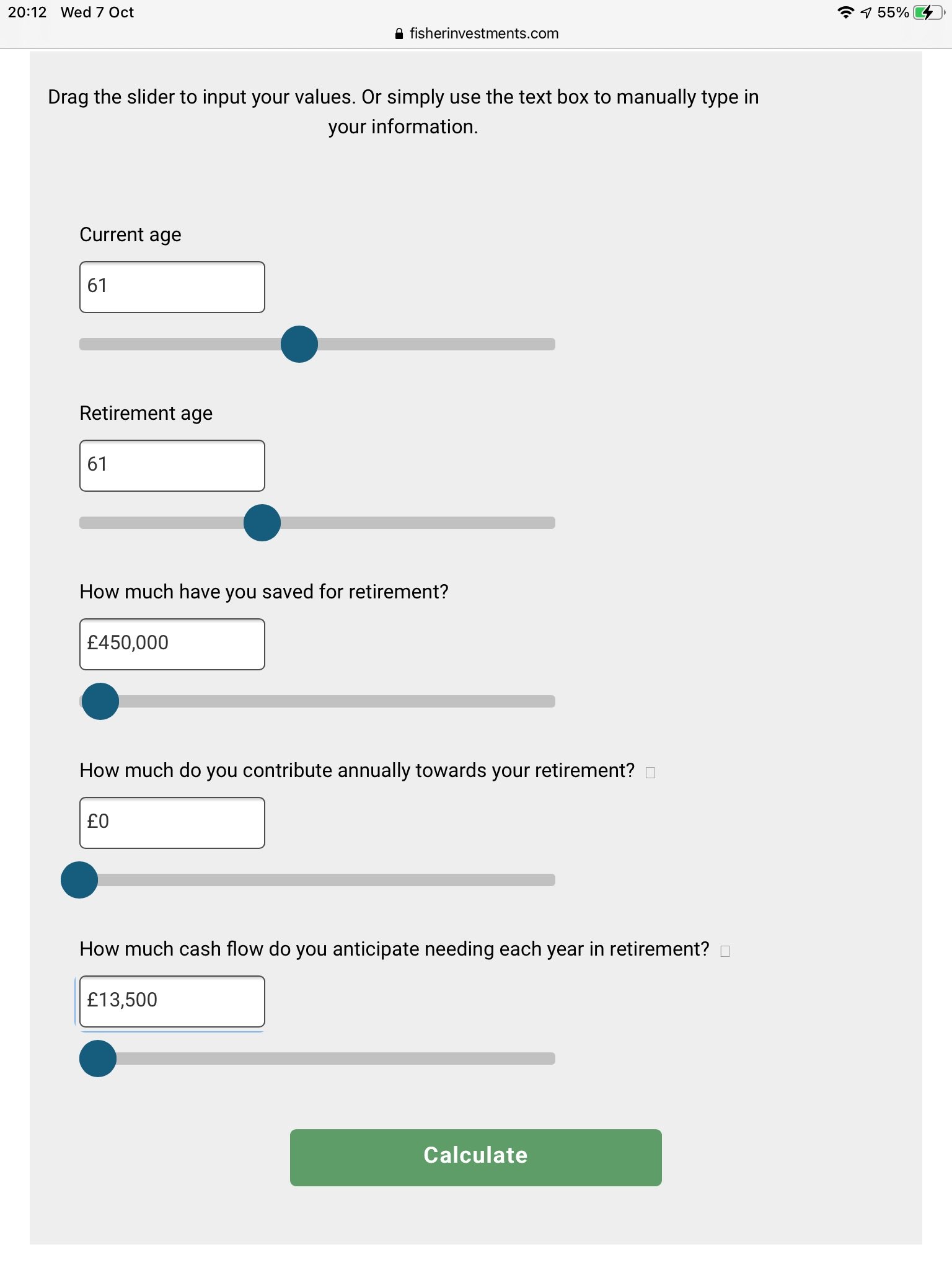

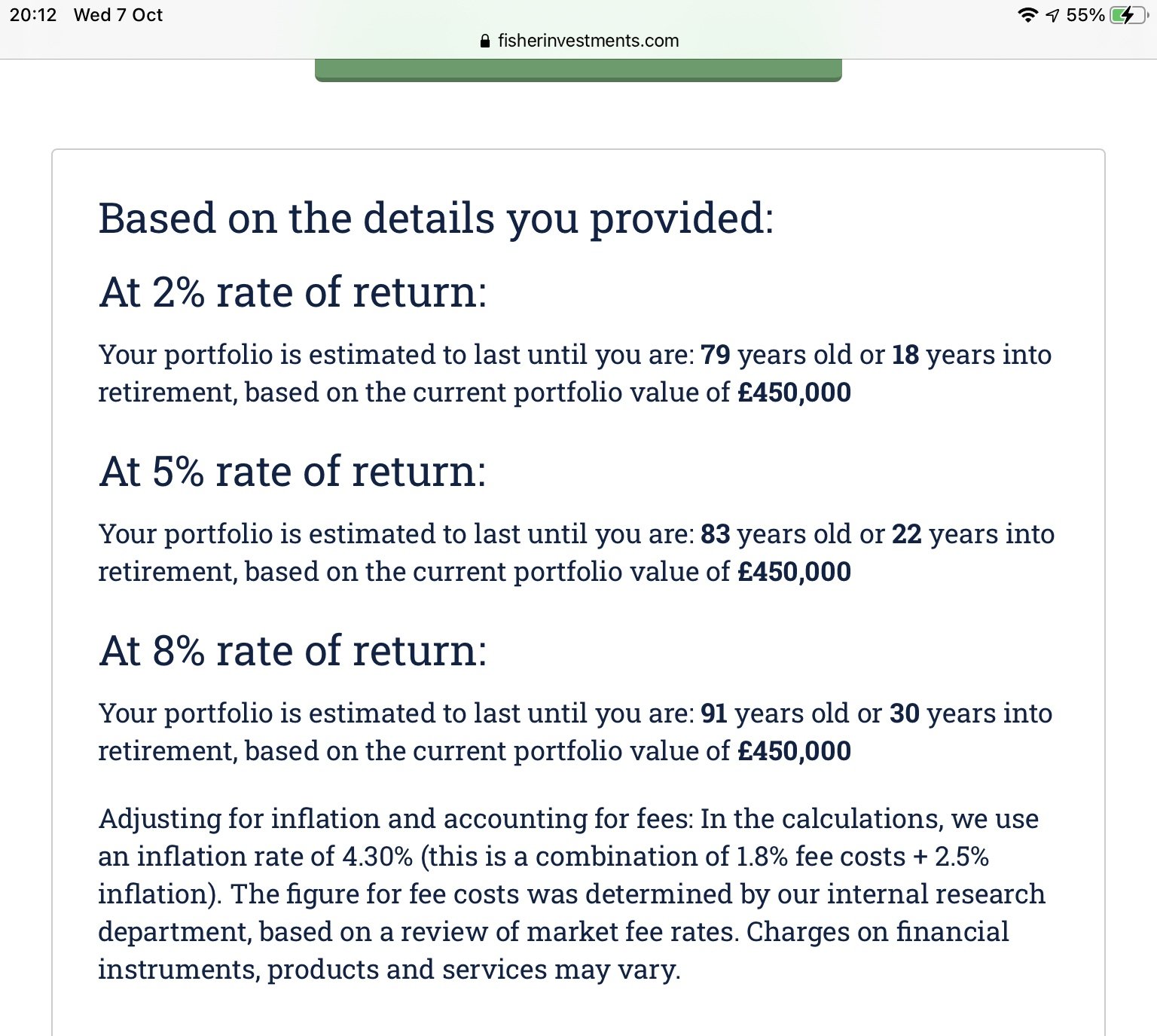

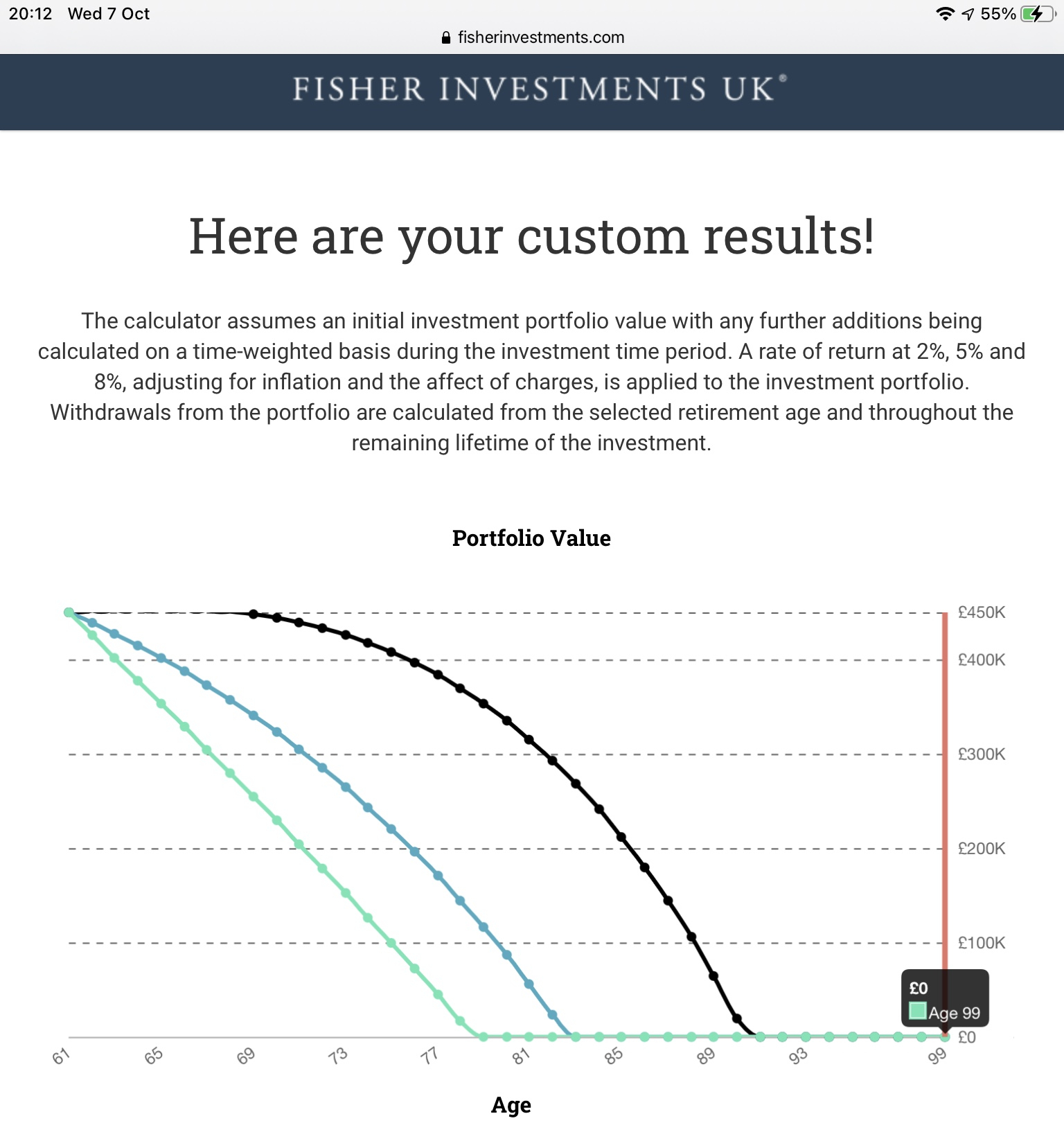

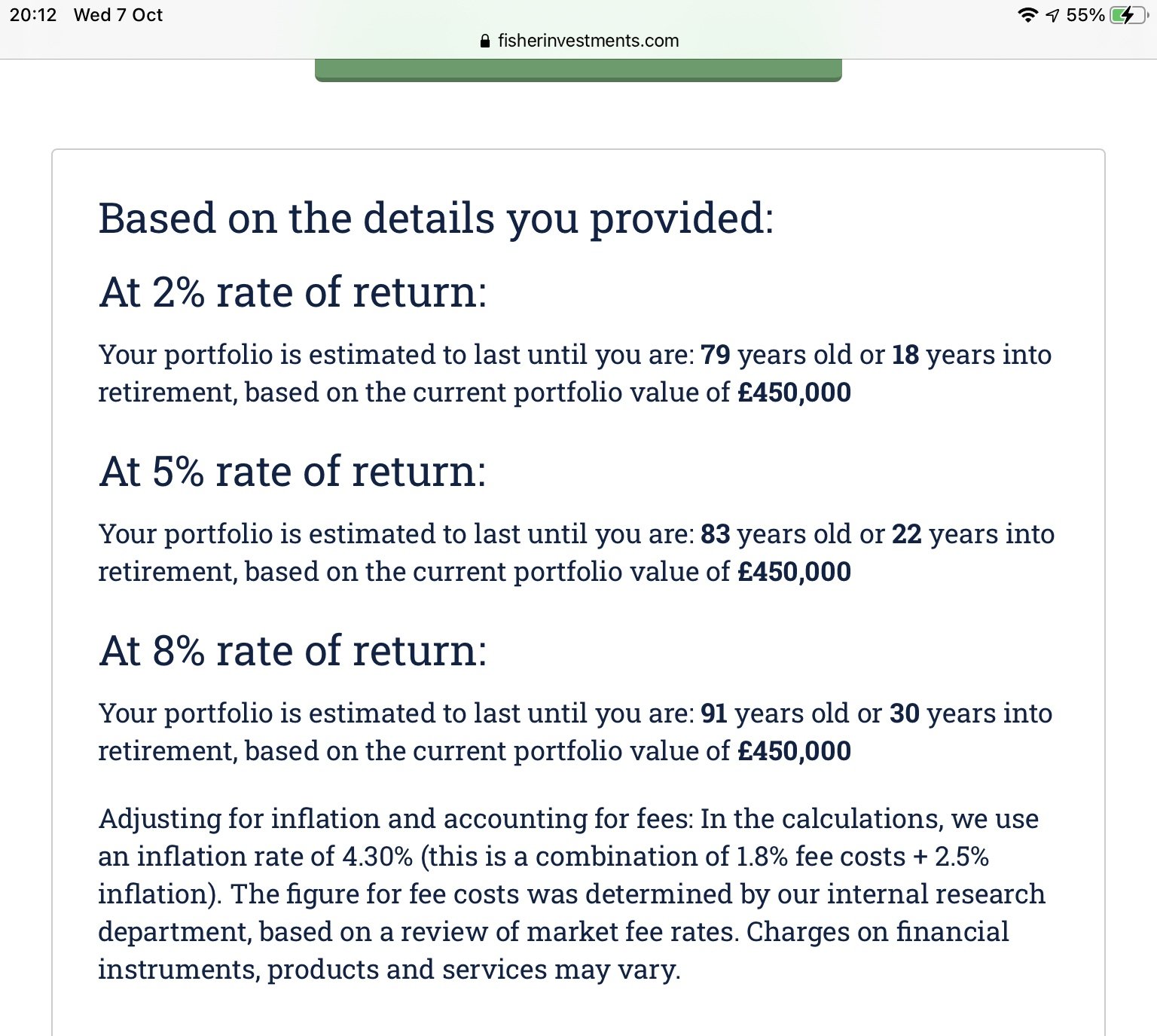

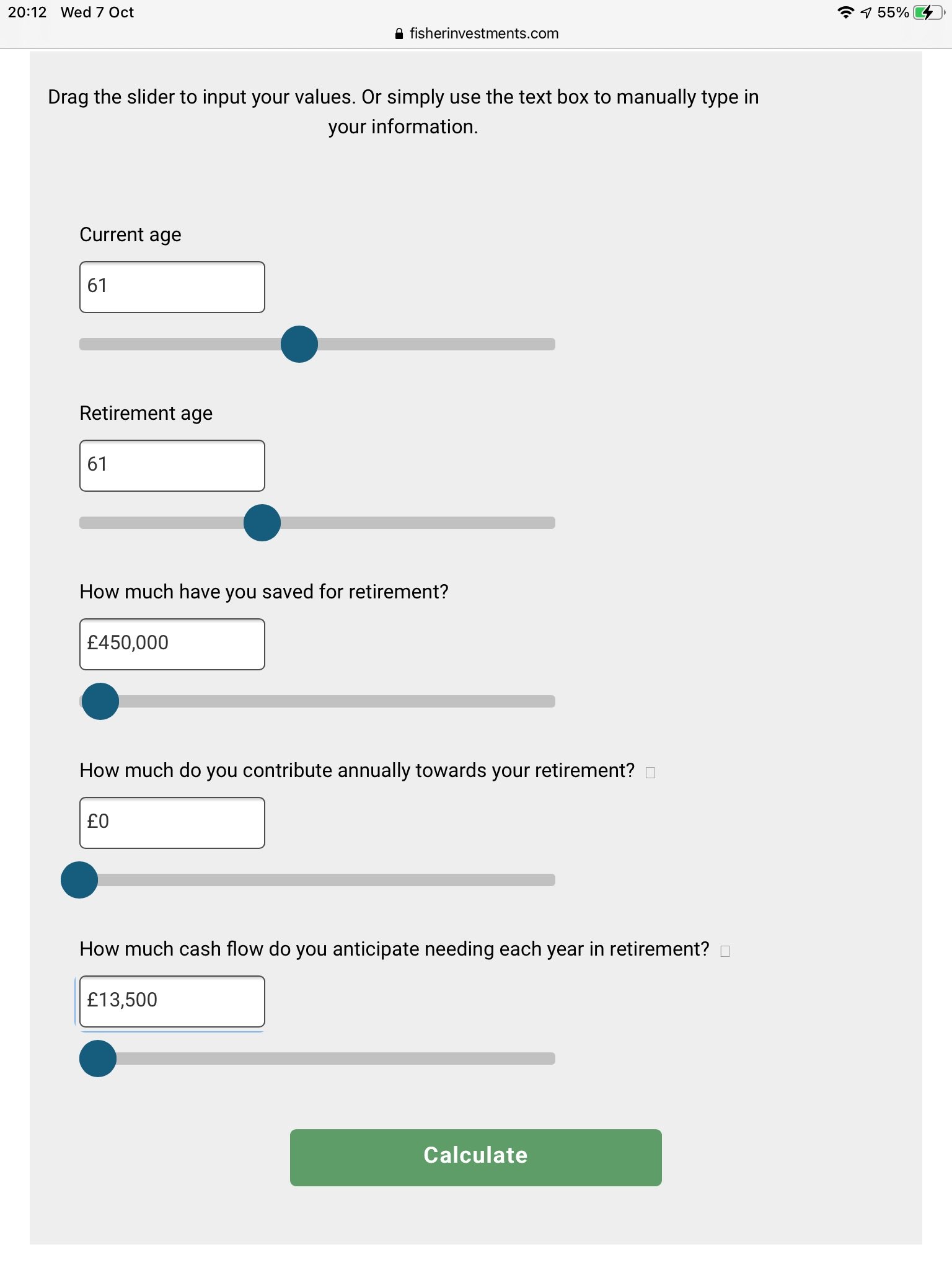

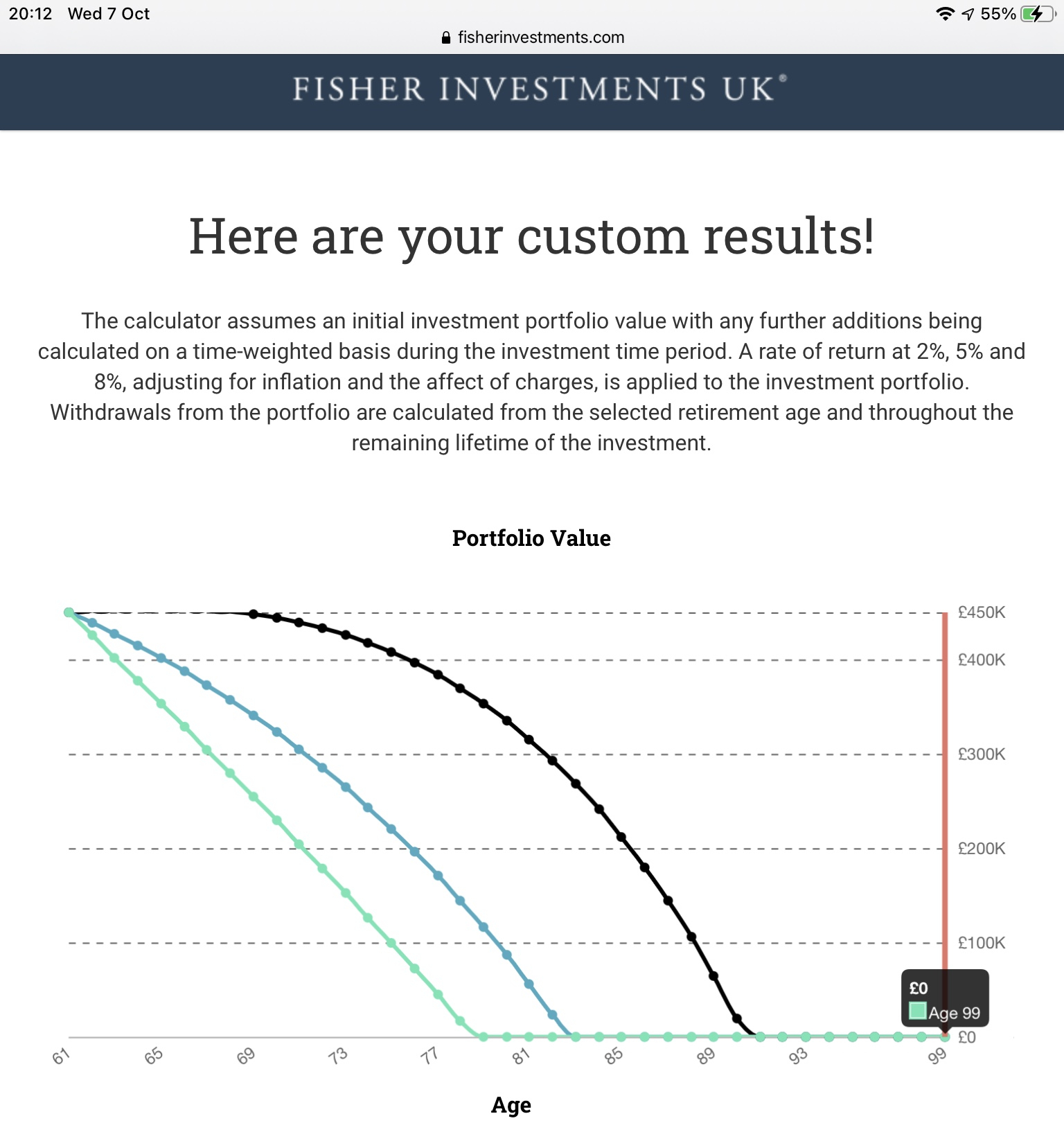

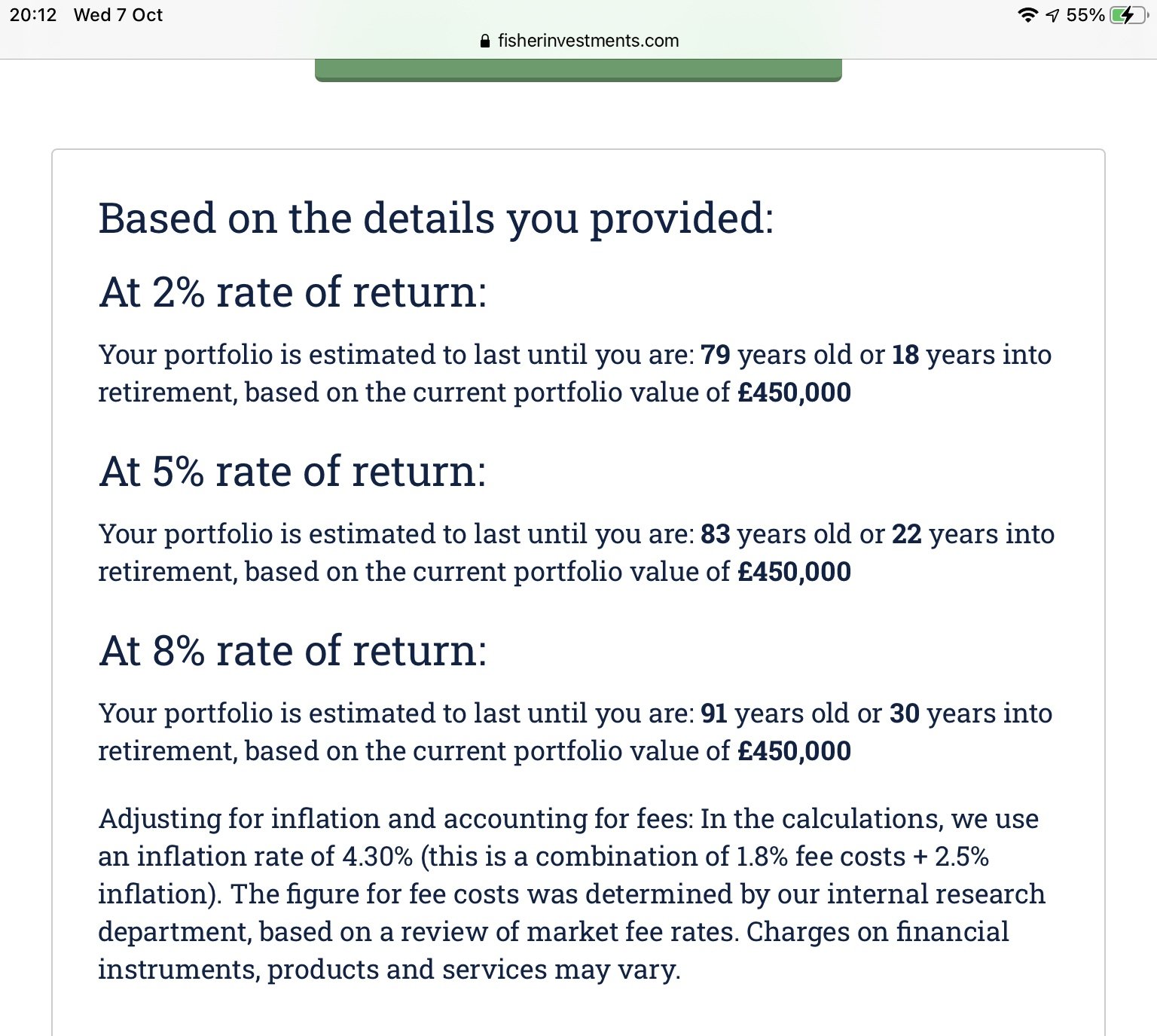

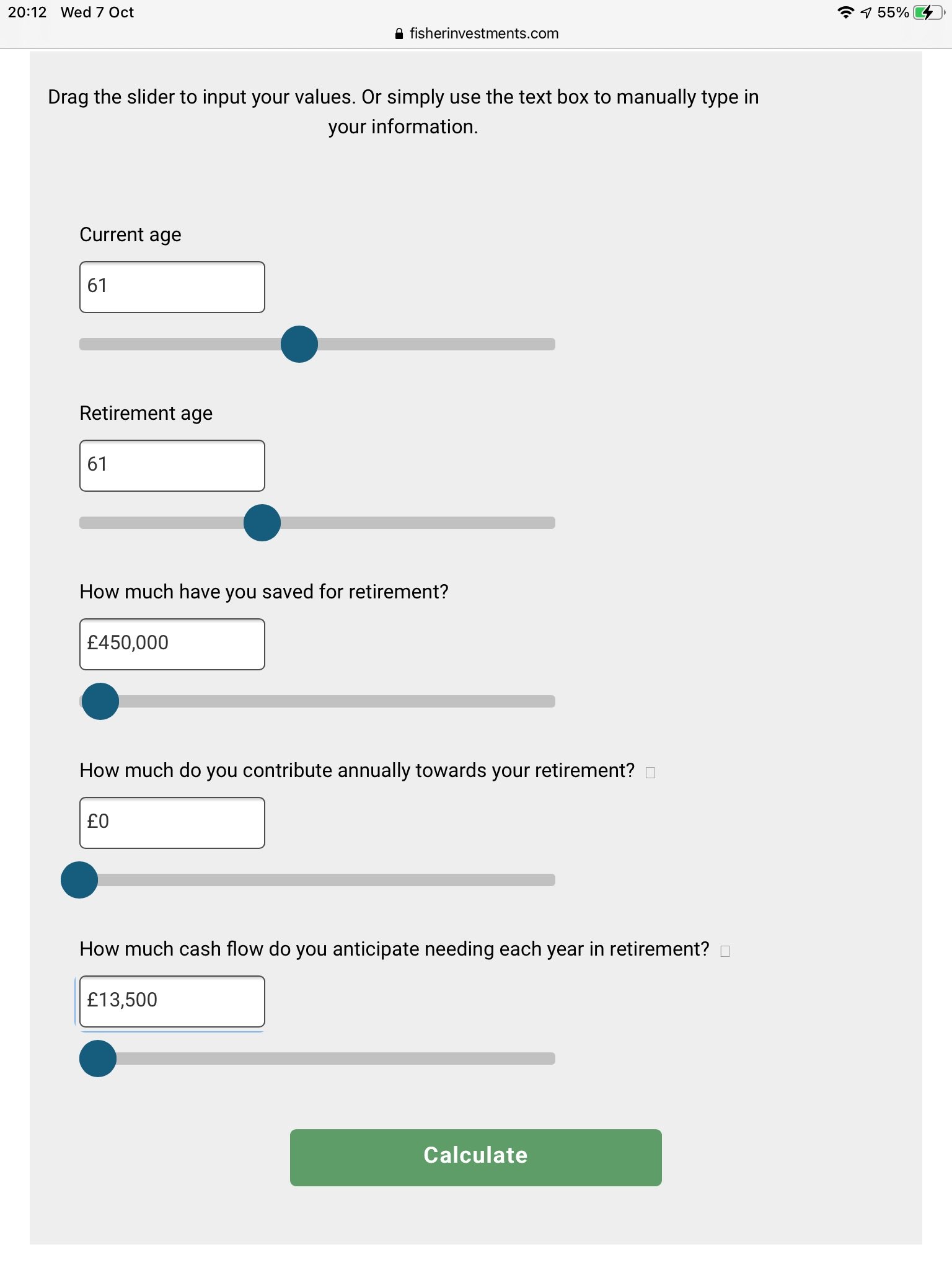

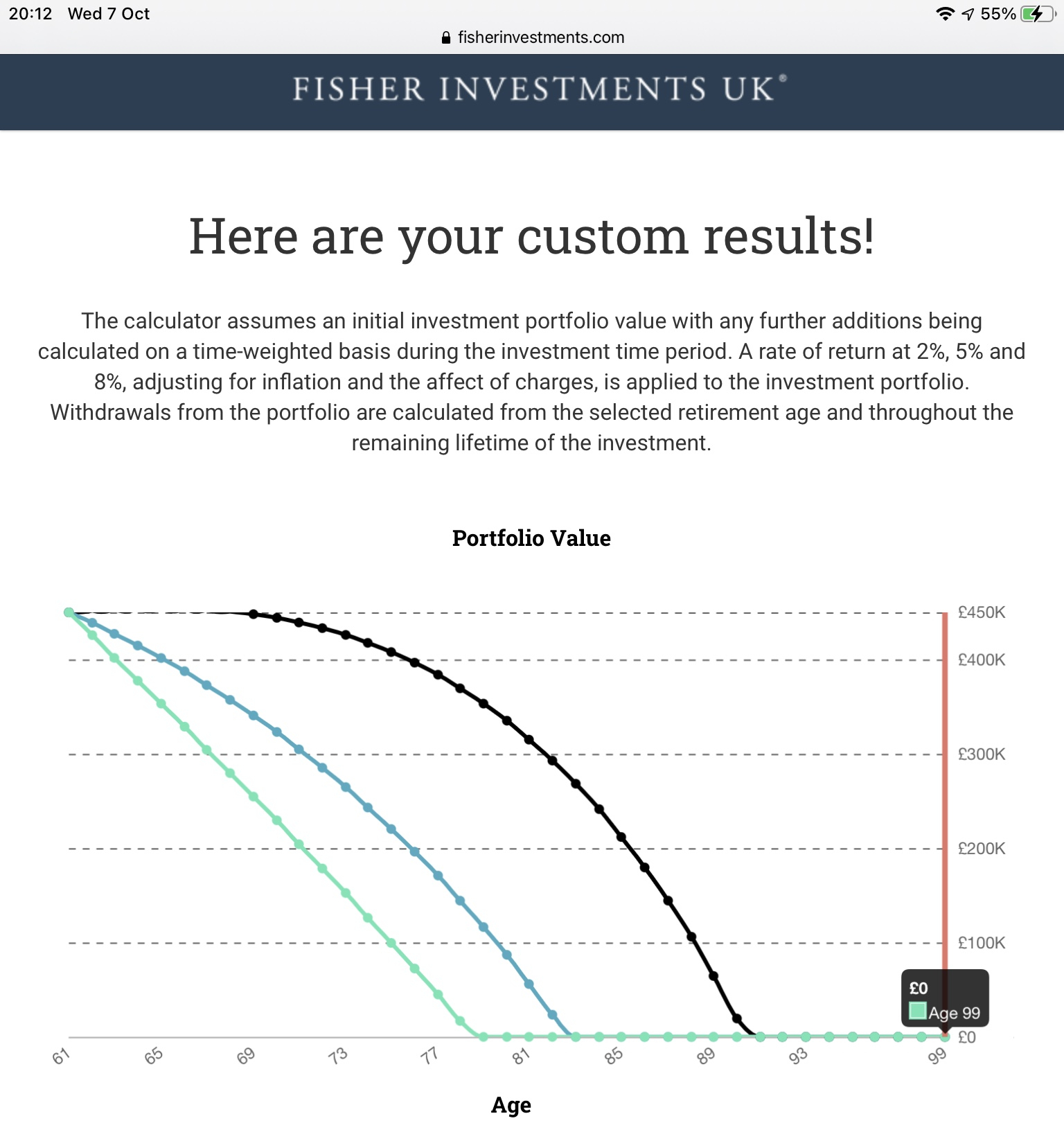

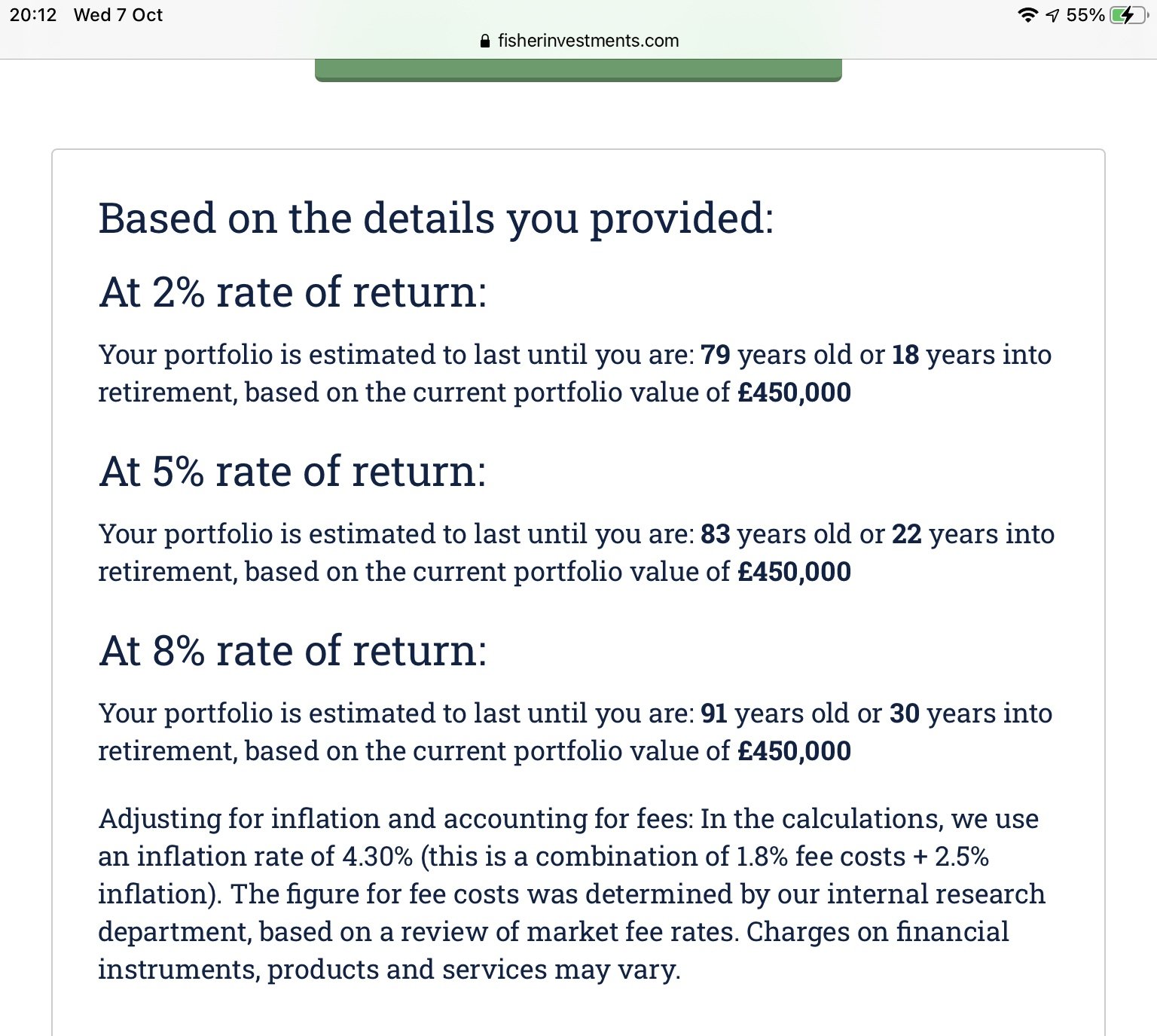

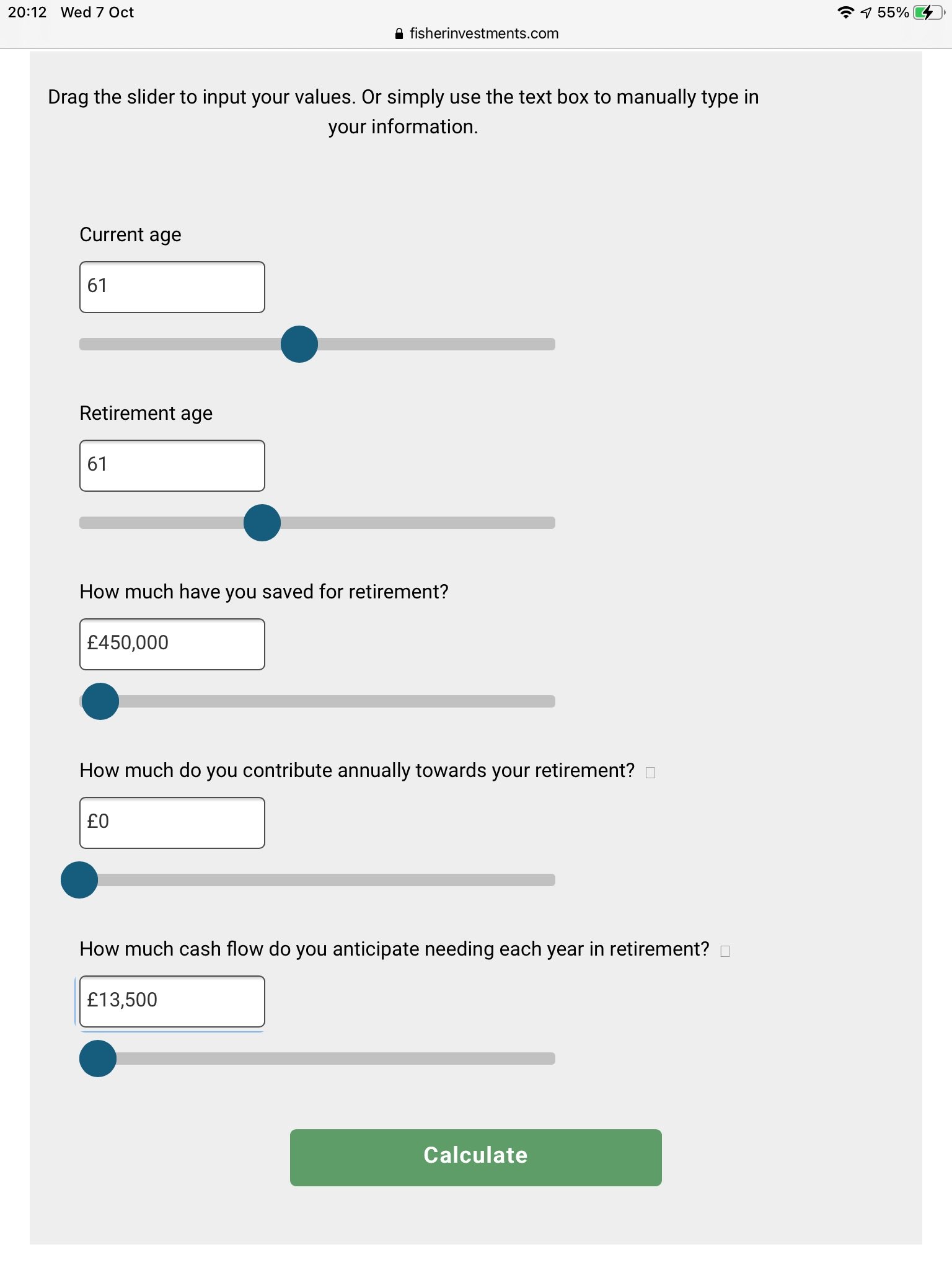

Thanks for posting the results from the Fisher Calculator. Their number looked wrong, so I modelled them in Excel.garmeg said:

You say 3% is safe and i would like to say it is but the calculator on Fisher Investments make it look a bit marginal at lower growth rates but their numbers look a bit pessimistic to me.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.

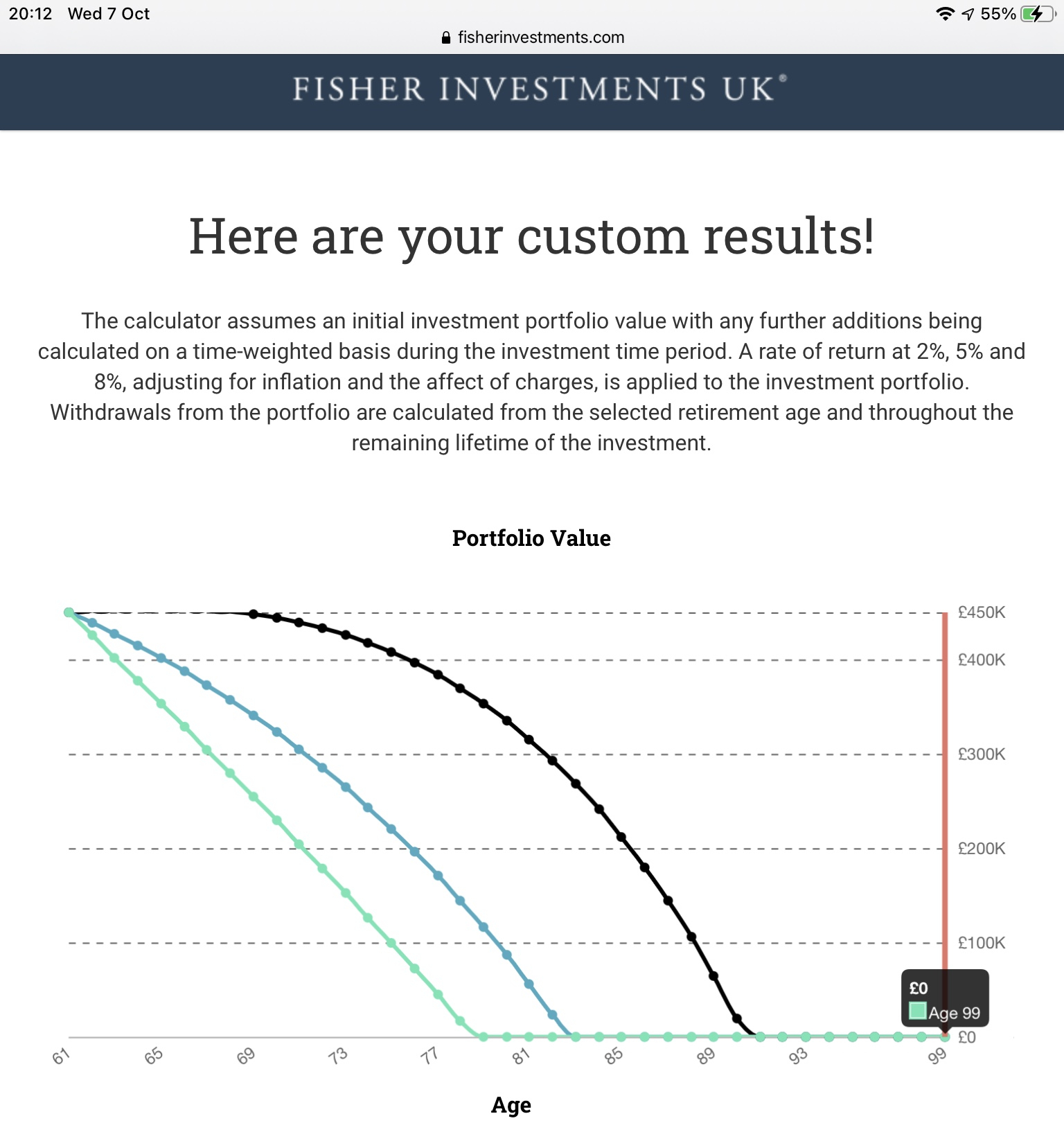

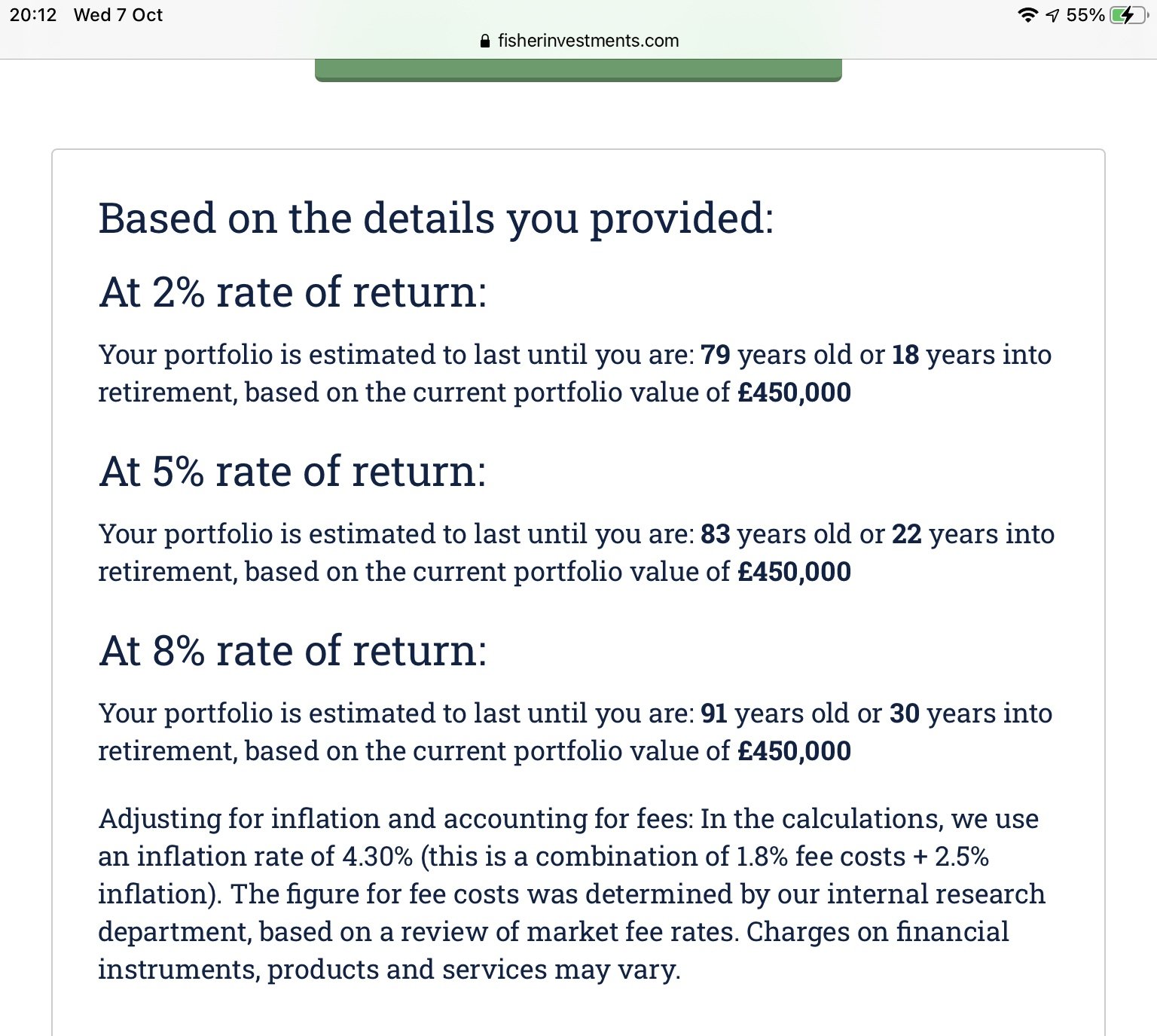

First thing to notice is that their charges are huge at 1.8% - customer withdraws £13,500 pa, Fisher charge £8,100!!!

I pay 0.62% total fees on my retirement portfolio with AJ Bell; and this is high because I favour active investments. The annual charge at 0.62% on a £450K portfolio would be £2,790, so you have £5,310 more remaining invested every year.

Perhaps I should have caveated my statement of 3% should be fine under all conditions, providing you only pay reasonable charges. Fisher's charges are so outrageous that if you kept £450,000 as cash, you could withdraw £13,500 in the first year and increase it in line with CPI, and it would still last longer than Fisher's projection at a 2% rate of return!

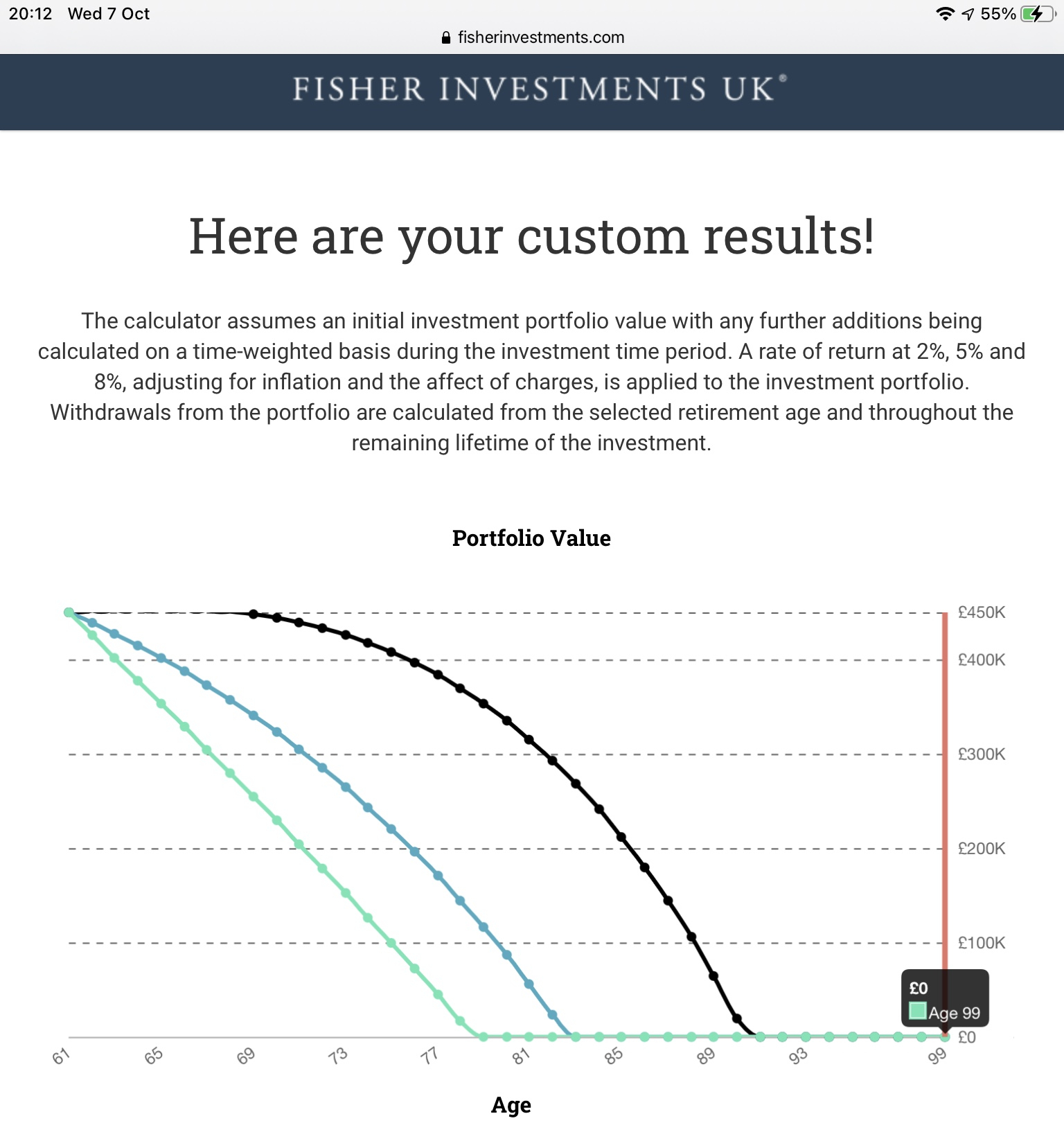

But even if you can get past their charges, their model is flawed - their graph shows that the portfolio value never goes above its original value, but with an 8% rate of return it should never go BELOW the initial value!

The comments I post are my personal opinion. While I try to check everything is correct before posting, I can and do make mistakes, so always try to check official information sources before relying on my posts.0 -

Perhaps my choice of words as 'pessimistic' was being charitable.tacpot12 said:

Thanks for posting the results from the Fisher Calculator. Their number looked wrong, so I modelled them in Excel.garmeg said:

You say 3% is safe and i would like to say it is but the calculator on Fisher Investments make it look a bit marginal at lower growth rates but their numbers look a bit pessimistic to me.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.

First thing to notice is that their charges are huge at 1.8% - customer withdraws £13,500 pa, Fisher charge £8,100!!!

I pay 0.62% total fees on my retirement portfolio with AJ Bell; and this is high because I favour active investments. The annual charge at 0.62% on a £450K portfolio would be £2,790, so you have £5,310 more remaining invested every year.

Perhaps I should have caveated my statement of 3% should be fine under all conditions, providing you only pay reasonable charges. Fisher's charges are so outrageous that if you kept £450,000 as cash, you could withdraw £13,500 in the first year and increase it in line with CPI, and it would still last longer than Fisher's projection at a 2% rate of return!

But even if you can get past their charges, their model is flawed - their graph shows that the portfolio value never goes above its original value, but with an 8% rate of return it should never go BELOW the initial value!

They did look wrong but i thought i was missing something especially the result of the 8% projection.

I would love to retire now at 56.

Two reasons I wont retire yet ...

(1) Covid has messed up anything i would like to do, and

(2) Not sure I have enough funds to do so yet. But I am quite close. I think.0 -

Do any of the AJ Bells ready made portfolios look reasonable as a retirement drawdown plan? I'm having trouble picking a range. I'm looking at maybe 25% Fundsmith equity, 25% Fidelity index world, but struggling with the "lower risk" funds to diversify and maybe rely on for the next 4 to 5 years?0

-

AJ Bell have an income portfolio fund paying about 4% which is similar to an oft-quoted safe withdrawal rate. Doesn'f float my boat though.SteveC3 said:Do any of the AJ Bells ready made portfolios look reasonable as a retirement drawdown plan? I'm having trouble picking a range. I'm looking at maybe 25% Fundsmith equity, 25% Fidelity index world, but struggling with the "lower risk" funds to diversify and maybe rely on for the next 4 to 5 years?0 -

From other threads you can see a total charge of 1.8% , or even more, is not actually that unusual . As an example >>tacpot12 said:

Thanks for posting the results from the Fisher Calculator. Their number looked wrong, so I modelled them in Excel.garmeg said:

You say 3% is safe and i would like to say it is but the calculator on Fisher Investments make it look a bit marginal at lower growth rates but their numbers look a bit pessimistic to me.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.

First thing to notice is that their charges are huge at 1.8% - customer withdraws £13,500 pa, Fisher charge £8,100!!!

I pay 0.62% total fees on my retirement portfolio with AJ Bell; and this is high because I favour active investments. The annual charge at 0.62% on a £450K portfolio would be £2,790, so you have £5,310 more remaining invested every year.

Perhaps I should have caveated my statement of 3% should be fine under all conditions, providing you only pay reasonable charges. Fisher's charges are so outrageous that if you kept £450,000 as cash, you could withdraw £13,500 in the first year and increase it in line with CPI, and it would still last longer than Fisher's projection at a 2% rate of return!

But even if you can get past their charges, their model is flawed - their graph shows that the portfolio value never goes above its original value, but with an 8% rate of return it should never go BELOW the initial value!

0.5% IFA

0.5% DFM

0.8% platform and fund costs

Of course seems a lot for a DIYer, but I guess the argument is that a professionally managed portfolio will perform better , maybe..

0 -

That is very rarely the argument. IFAs do not claim their portfolios will perform better, rather they will avoid pitfalls and invest according to their clients' needs and risk tolerance. In addition the clients have an element of protection against bad advice.Albermarle said:

Of course seems a lot for a DIYer, but I guess the argument is that a professionally managed portfolio will perform better , maybe..tacpot12 said:

Thanks for posting the results from the Fisher Calculator. Their number looked wrong, so I modelled them in Excel.garmeg said:

You say 3% is safe and i would like to say it is but the calculator on Fisher Investments make it look a bit marginal at lower growth rates but their numbers look a bit pessimistic to me.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.

First thing to notice is that their charges are huge at 1.8% - customer withdraws £13,500 pa, Fisher charge £8,100!!!

I pay 0.62% total fees on my retirement portfolio with AJ Bell; and this is high because I favour active investments. The annual charge at 0.62% on a £450K portfolio would be £2,790, so you have £5,310 more remaining invested every year.

Perhaps I should have caveated my statement of 3% should be fine under all conditions, providing you only pay reasonable charges. Fisher's charges are so outrageous that if you kept £450,000 as cash, you could withdraw £13,500 in the first year and increase it in line with CPI, and it would still last longer than Fisher's projection at a 2% rate of return!

But even if you can get past their charges, their model is flawed - their graph shows that the portfolio value never goes above its original value, but with an 8% rate of return it should never go BELOW the initial value!

0 -

You are right - I should have said that a professionally managed portfolio will manage the clients situation more appropriately , maybe...coyrls said:

That is very rarely the argument. IFAs do not claim their portfolios will perform better, rather they will avoid pitfalls and invest according to their clients' needs and risk tolerance. In addition the clients have an element of protection against bad advice.Albermarle said:

Of course seems a lot for a DIYer, but I guess the argument is that a professionally managed portfolio will perform better , maybe..tacpot12 said:

Thanks for posting the results from the Fisher Calculator. Their number looked wrong, so I modelled them in Excel.garmeg said:

You say 3% is safe and i would like to say it is but the calculator on Fisher Investments make it look a bit marginal at lower growth rates but their numbers look a bit pessimistic to me.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.

First thing to notice is that their charges are huge at 1.8% - customer withdraws £13,500 pa, Fisher charge £8,100!!!

I pay 0.62% total fees on my retirement portfolio with AJ Bell; and this is high because I favour active investments. The annual charge at 0.62% on a £450K portfolio would be £2,790, so you have £5,310 more remaining invested every year.

Perhaps I should have caveated my statement of 3% should be fine under all conditions, providing you only pay reasonable charges. Fisher's charges are so outrageous that if you kept £450,000 as cash, you could withdraw £13,500 in the first year and increase it in line with CPI, and it would still last longer than Fisher's projection at a 2% rate of return!

But even if you can get past their charges, their model is flawed - their graph shows that the portfolio value never goes above its original value, but with an 8% rate of return it should never go BELOW the initial value!0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards