We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Scottish Widows to AJ Bell

SteveC3

Posts: 44 Forumite

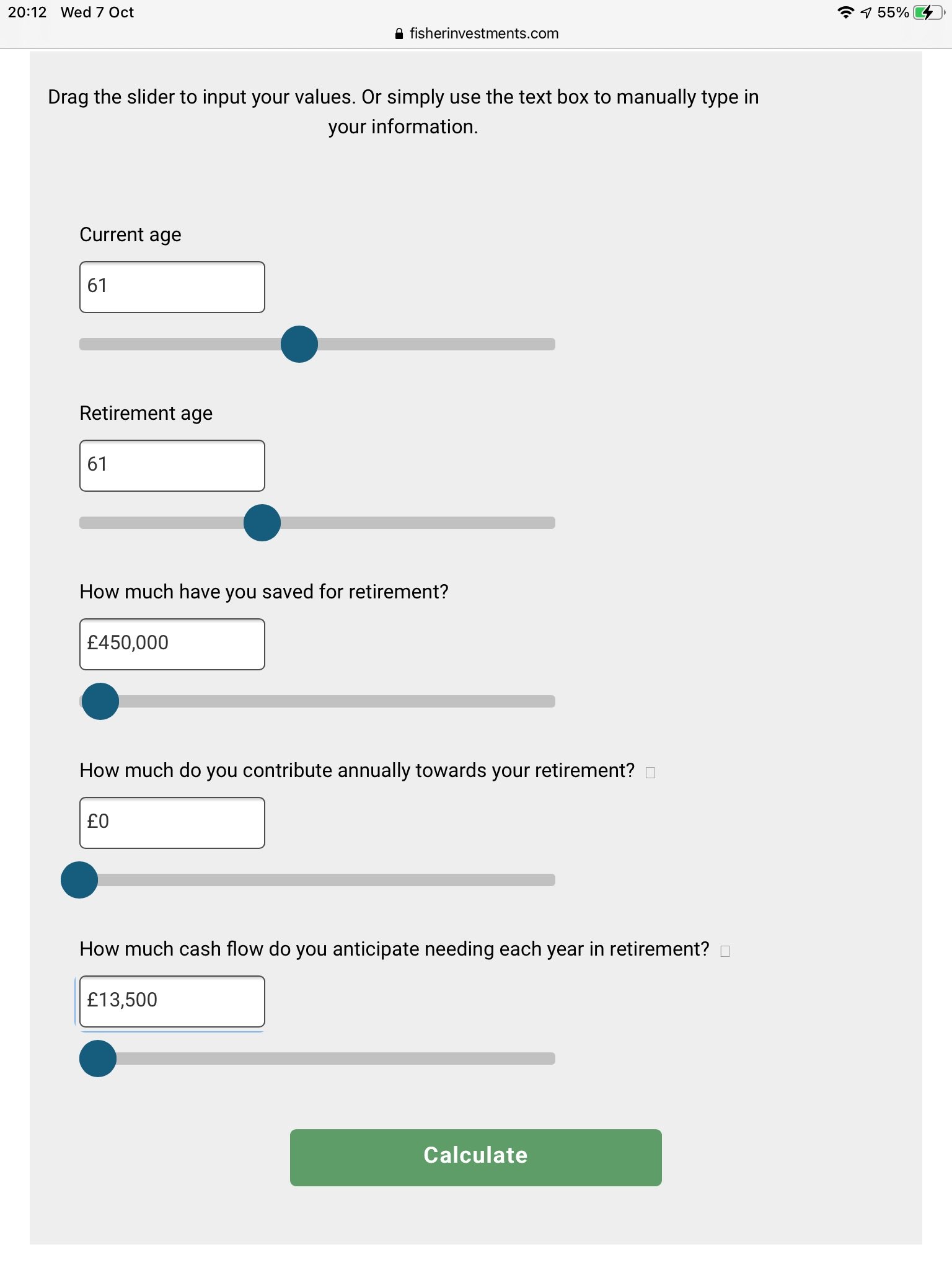

As I'm leaving work this week (Age 61), I have been mulling over the drawdown options. My current SW Portfolio funds have been less than spectacular and accessing incomes seems painful. I have around 450k and I'm looking to move it to AJ Bell. Costs are similar, but the fund choice within AJ Bell seems a lot better for the price. I'm happy to vary income over volatile periods and was therefore thinking of placing, say 50% into a Global tracker (Fidelity world Index) and the rest in a 50/50ish fund. I'll be looking to take 3% a year initially, but will monitor and modify as needs be. I may want to take some additional lump sums until SP age of 66.

I would appreciate any comments or suggestions.

Many thanks

I would appreciate any comments or suggestions.

Many thanks

0

Comments

-

I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.The comments I post are my personal opinion. While I try to check everything is correct before posting, I can and do make mistakes, so always try to check official information sources before relying on my posts.0 -

Is your SW scheme occupational or private?

If occupational be sure to check you are not entitled to protected tax free cash (>25%) first, which will normally be lost in a pension transfer.. I had 41% tax free cash in my occupational scheme. I transferred out to AJ Bell 2 years ago without losing this benefit, but it was quite complicated and certain conditions needed to be met, which will not happen with a bog standard pension transfer.

“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

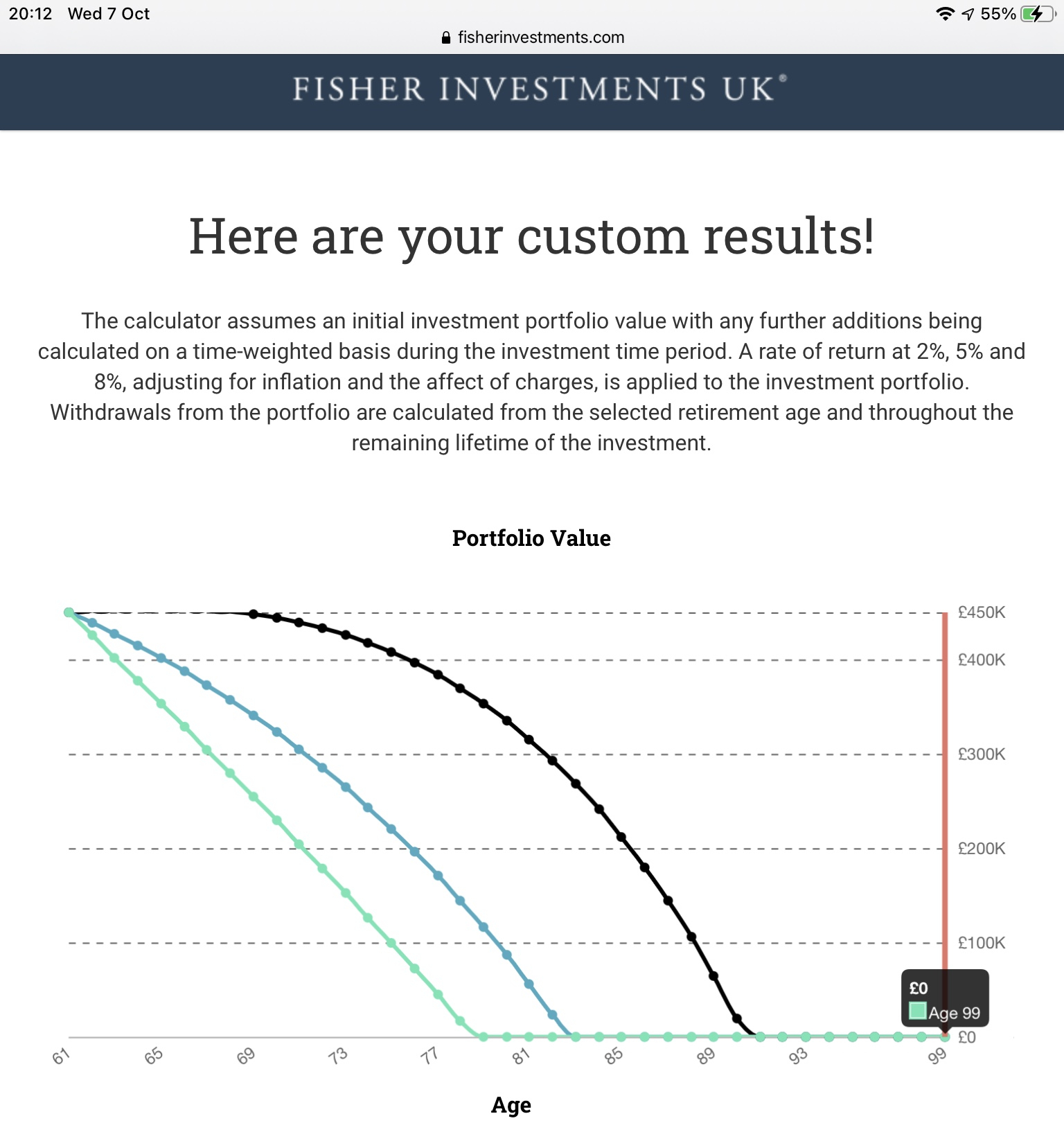

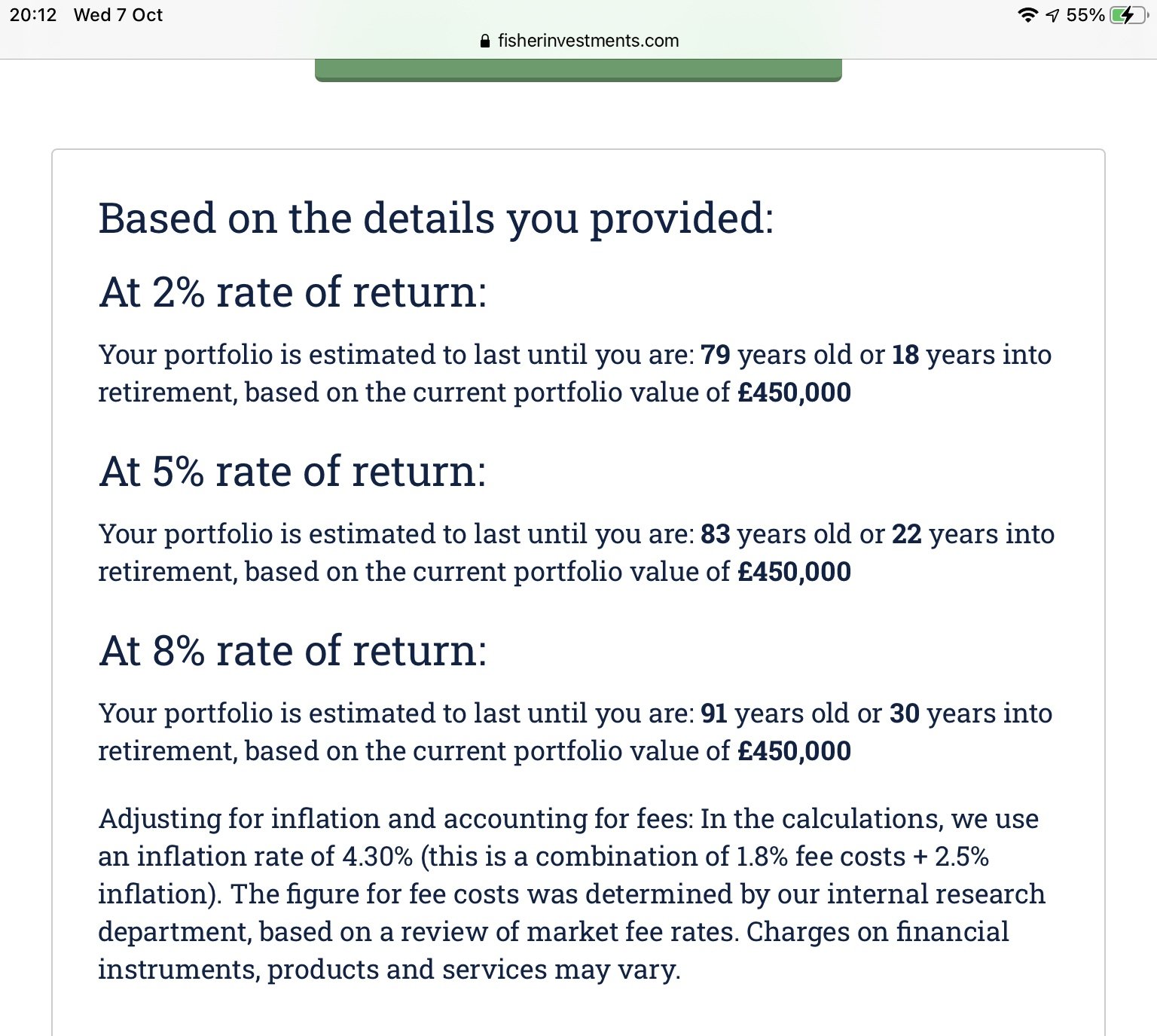

You say 3% is safe and i would like to say it is but the calculator on Fisher Investments make it look a bit marginal at lower growth rates but their numbers look a bit pessimistic to me.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.I did exactly this move because access was painful and the fund choice was quite limited. AJ Bell have been very good; I've only ever had good service from them.

A withdrawal rate of 3% should be fine under all conditions, but you might be able to withdraw more safe if you have any DB pensions and a full state pension. If you've not obtained a recent state pension forecast, I would suggest you do so.

0

0 -

It's an occupational scheme with no extra tax free cash. What about funds selection with AJ Bell? I'm thinking of mainly equities in a tracker for say 50% to leave untouched for 5 to 10yrs and a 50/50 fund for the remainder from which I will draw from in the early years. Any recommendations on their funds?0

-

I must confess I don't use their funds, and most FA's would frown upon my own high risk/not so properly diversified asset allocation. I'm not personally a tracker fan. I have seen some successful active managers have added real value, well above the premium in fees charged. I'm a fan of SMT and Fundsmith. Others will disagree.SteveC3 said:It's an occupational scheme with no extra tax free cash. What about funds selection with AJ Bell? I'm thinking of mainly equities in a tracker for say 50% to leave untouched for 5 to 10yrs and a 50/50 fund for the remainder from which I will draw from in the early years. Any recommendations on their funds?“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

I was actually looking at the Fundsmith Equity fund within AJ Bell!Steve182 said:

I must confess I don't use their funds, and most FA's would frown upon my own high risk/not so properly diversified asset allocation. I'm not personally a tracker fan. I have seen some successful active managers have added real value, well above the premium in fees charged. I'm a fan of SMT and Fundsmith. Others will disagree.SteveC3 said:It's an occupational scheme with no extra tax free cash. What about funds selection with AJ Bell? I'm thinking of mainly equities in a tracker for say 50% to leave untouched for 5 to 10yrs and a 50/50 fund for the remainder from which I will draw from in the early years. Any recommendations on their funds?0 -

Rathbone Global Opportunities and Blue Whale Growth are two more good funds.Steve182 said:

I must confess I don't use their funds, and most FA's would frown upon my own high risk/not so properly diversified asset allocation. I'm not personally a tracker fan. I have seen some successful active managers have added real value, well above the premium in fees charged. I'm a fan of SMT and Fundsmith. Others will disagree.SteveC3 said:It's an occupational scheme with no extra tax free cash. What about funds selection with AJ Bell? I'm thinking of mainly equities in a tracker for say 50% to leave untouched for 5 to 10yrs and a 50/50 fund for the remainder from which I will draw from in the early years. Any recommendations on their funds?

i hold both of these.

Mind you Woodford was very good, until he wasn't.0 -

Fundsmith has a fairly low risk rating on Trustnet (for equities). Currently it's 74. That means it's supposed to be 26% less volatile than FTSE100, which I'm sure it's outperformed every year since its inceptionSteveC3 said:

I was actually looking at the Fundsmith Equity fund within AJ Bell!Steve182 said:

I must confess I don't use their funds, and most FA's would frown upon my own high risk/not so properly diversified asset allocation. I'm not personally a tracker fan. I have seen some successful active managers have added real value, well above the premium in fees charged. I'm a fan of SMT and Fundsmith. Others will disagree.SteveC3 said:It's an occupational scheme with no extra tax free cash. What about funds selection with AJ Bell? I'm thinking of mainly equities in a tracker for say 50% to leave untouched for 5 to 10yrs and a 50/50 fund for the remainder from which I will draw from in the early years. Any recommendations on their funds?

https://www.trustnet.com/factsheets/o/lsx3/fundsmith-equity-t-acc

Usual caveat about past performance being no guarantee etc etc ....

“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

My very basic analogy on Woodford... making a comparison with the building trade...garmeg said:

Rathbone Global Opportunities and Blue Whale Growth are two more good funds.Steve182 said:

I must confess I don't use their funds, and most FA's would frown upon my own high risk/not so properly diversified asset allocation. I'm not personally a tracker fan. I have seen some successful active managers have added real value, well above the premium in fees charged. I'm a fan of SMT and Fundsmith. Others will disagree.SteveC3 said:It's an occupational scheme with no extra tax free cash. What about funds selection with AJ Bell? I'm thinking of mainly equities in a tracker for say 50% to leave untouched for 5 to 10yrs and a 50/50 fund for the remainder from which I will draw from in the early years. Any recommendations on their funds?

i hold both of these.

Mind you Woodford was very good, until he wasn't.

Woodford had been an excellent carpenter for years, but one day he thought he could make more money as a bricklayer. So he decided to open a bricklaying business, and encouraged people to invest in it. Everyone knew he had been a successful builder for years so they all backed him. Problem was that all his prior experience was in carpentry, and he had never laid a brick in his life. Most people (investors) didn't realise this .......no wonder it all came tumbling down..“Like a bunch of cod fishermen after all the cod’s been overfished, they don’t catch a lot of cod, but they keep on fishing in the same waters. That’s what’s happened to all these value investors. Maybe they should move to where the fish are.” Charlie Munger, vice chairman, Berkshire Hathaway0 -

For tracker funds, aren’t you better off with Vanguard platform? Or even iWeb if it’s a one off investment. Not sure if AJ Bell has a cap.SteveC3 said:It's an occupational scheme with no extra tax free cash. What about funds selection with AJ Bell? I'm thinking of mainly equities in a tracker for say 50% to leave untouched for 5 to 10yrs and a 50/50 fund for the remainder from which I will draw from in the early years. Any recommendations on their funds?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards