We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

TSB reduces branch network by a third and loses 900 jobs

Comments

-

I'm certainly not trying to claim that it'll be as easy to conduct branch-based transactions after this, and to be fair I don't believe that TSB (as with all the others) are saying this either - their message is effectively 'if you really don't want to use our other channels then here are your remaining options', even though they won't have any inside info about specifically which post offices are remaining open.JamesPeter said:

That is all well and good, however the Post Office in the village I live in closed down in February and the TSB in the local town 14 miles away is also now closing next year (incidentally, TSB in their 'closing down review' proposal mention our ((now former)) village post office as being open for business for TSB customers to use instead of the closing branch)! The only other bank in this town is HSBC and I have my other current account there (came in very handy when TSB managed to lose all my data in their systems crash back in 2018).The only Post Office in the town has shrunk from a large building with lots of teller positions to being inside a small branch of WH Smith, with only two teller positions (one of which I have never seen open). The queue on some days streches out of the door onto the street - particularly around Christmas time or when an e-bay seller with loads of parcels to send is at the head of the queue.

0 -

The fact that some people, mostly elderly, refuse to use modern technologies isn't a reason to ask the government to force commercial companies to continue to operate in outmoded ways. Where else do we see such a level of intervention to protect people from the modern world? No doubt some people would be happier with dictated memos being sent to the typing pool, lunchtime boozing, drink driving, and smoking in hospitals. But we don't have those things any more. Same with bank branches.

I saw something on the news about a bloke of 70 proudly stating that he doesn't know how to use a computer and won't use phone banking either and thus his local branch is a "lifeline". I thought he was absolutely ridiculous. We have a few people at work still working at over 70 (no idea why they don't need the money) and all can use a computer just fine. Heck I know people in their 80s who use all sorts of technology. Most people who were in the workplace in the 90s and 2000s would have seen and used technology although I suppose those doing manual jobs may not.1 -

Which means that they are being cut out of that part of society that doesn't accept cash.eskbanker said:

They're not being cut out of society! They can continue to use cash if they prefer, but can only do so when spending money in places that'll accept it,London7766551 said:

there is a large chunk of the population that are old and have always used cash and always will. They are being cut out of society, I have seen it with my own eyes, people being turned away from places.eskbanker said:it's not an inalienable right for customers to insist on preferred means of payment. Many would no doubt be happier to pay with Luncheon Vouchers, Green Shield stamps, ten bob notes, etc, etc, but managed to move on from thoseHaven't seen any of those for a long time.However, I don't see insisting on paying in the legal tender of the country (Yes, I do know legal tender is strictly only relevant for paying debts) for customer-present purchases as unreasonable, except in the current plague-ridden conditions.Cards are wonderful, until they don't work, at which point they are useless. Cash still works in power cuts, internet outages, and when your bank thinks your card should be blocked.

Eco Miser

Saving money for well over half a century2 -

Not everyone is as able as your grandmother sadly. When you have paid for cash for 70 plus years, there are many reasons why a card payment isn't something everyone can do. Being able to understand the process etc. It may seem very simple to us, but to others it seems a complicated thing. It isn't pandering to anyone to make sure everyone is able to take part in society.Takmon said:

My grandmother in her 90's hasn't been to a branch in years and much prefers to pay by card and do telephone banking because it means she doesn't have to waste time going to the bank and also doesn't like the idea of carrying around cash just in case. There is no reason elderly people can't use cards and just because they are stubborn doesn't mean we have to pander to them.London7766551 said:

Vast numbers of people still use cash and do not have a card or app. Put simply, there is a large chunk of the population that are old and have always used cash and always will. They are being cut out of society, I have seen it with my own eyes, people being turned away from places. I don't know about you but i'd like to think in my old age society still supports us, because when we are old, very old, I am sure we will be past it and know little of the modern way of life whatever it may be. In 20 years it may be a different story, but we need to support the old generation of cash people while they are here.eskbanker said:

Many businesses legitimately choose not to accept cash payments, why should government intervene to force them to wind the clock back?London7766551 said:The government must again state to businesses they must accept cash

The majority of banks already have such physical banking arrangements with Post Offices and encourage its use when closing branches....London7766551 said:In my mind this means each bank pays to set up an independent common branch network across the UK that operates a branch in each town of a certain size, which allows customers (from any main bank) to carry out tasks much the same as they do now in individual bank branches at the common branch instead without the need for several banks in one town having branches.

[...]

Extensive use of the post office network of branches could come in use.

https://www.postoffice.co.uk/everydaybanking

Edit: TSB being one such example, in the press release at the start of the thread:In addition, TSB is further enhancing its partnership with the Post Office including adding the ability to deposit and withdraw cash using a card, for both business and personal customers, and collect coin change from pre-agreed locations.

In addition cash offers privacy. I am not happy to sign over total control of money to these card companies, if it was a government (privacy aside) payment network perhaps, but they are not. They are multinational companies who want your data and a profit by selling that data. In addition what happens when all cash is gone? they have total control. Much the same with Amazon and other companies and physical shops. Cash is also used by many low income families to budget.

I'm aware you can carry out tasks as the post office already, however I do not believe the services it offers are sufficient to replace a branch. But the banks would like us to think they are I am sure.

Bank branches are redundant and a waste of time and are thing of the past which will soon be phased out and cash is going the same way because card payments and similar are so much easier and more convenient.

Yes I know they are redundant, as I said in my post above. However what is important is that people that need access to a branch, are still able to get access. I was suggesting a solution rather than say all bank branches must stay open.1 -

They can continue to use cash if they prefer? 90% of places won't take it anymore under current conditions. And many will use Covid as an excuse to ditch it for good. So yes, they are being cut out. It isn't a right at the moment, but in my view a business should be forced to accept cash using the law. Of course people can move on, but once you get to a certain age it can be very difficult. If we are a decent society, then we must cater for all parts of it. Please remember how fast the change is happening. Over the past 10 years, and try to imagine being someone who has used cash for 70 years. Another aspect is that there is a risk parts of society will become cut off to services or businesses everyone else can access. One example I have seen with my own eyes is pubs. Several pubs I visited turned away people who had cash only. This can extend to restaurants, public transport, taxis etc as the year goes on. Some people can't even get a bank account. They can only use cash. They have no choice.eskbanker said:

They're not being cut out of society! They can continue to use cash if they prefer, but can only do so when spending money in places that'll accept it, otherwise they need to change their habits - it's not an inalienable right for customers to insist on preferred means of payment. Many would no doubt be happier to pay with Luncheon Vouchers, Green Shield stamps, ten bob notes, etc, etc, but managed to move on from those - likewise the number of businesses that'll accept cheques continues to decline inexorably despite them being favoured by some....London7766551 said:

there is a large chunk of the population that are old and have always used cash and always will. They are being cut out of society, I have seen it with my own eyes, people being turned away from places.

I thought that most who subscribed to that 'shadowy control' line of argument were violently opposed to the idea of government centralisation, so that's a novel twist on that one!London7766551 said:

In addition cash offers privacy. I am not happy to sign over total control of money to these card companies, if it was a government (privacy aside) payment network perhaps, but they are not. They are multinational companies who want your data and a profit by selling that data. In addition what happens when all cash is gone? they have total control.

Sure, but that doesn't mean that there should be government intervention to force companies to allow this to be perpetuated!London7766551 said:

Cash is also used by many low income families to budget.

It seems to me that the tasks that can be carried out at post offices are clearly spelt out above - I don't think anyone would try to claim that they're a direct like-for-like replacements for bank branches, but your idea of a parallel full-function common shared bank is just fantasy I'm afraid. I do agree with other posters who've observed that it's unreasonable for banks to expect customers to turn up to branches for activities like ID verification, while simultaneously heavily reducing their physical presence, when there are alternatives available.London7766551 said:I'm aware you can carry out tasks as the post office already, however I do not believe the services it offers are sufficient to replace a branch. But the banks would like us to think they are I am sure.

Well, as I said privacy aside. A British system would be under the control of us. It is much harder for governments to control Visa and Master-card etc.

The "I'm alight Jack" mentality isn't very British. Many poor families can only budget with cash. They find it very hard to budget with a card. Should we just say screw them? While it is not the fault of banks people can't budget on a card, the reality is that these people exist and the government has a duty to assist.

In that case I am curious as to your first post regarding post offices. I suggested they were not a replacement for branches, hence my suggestion for common branches. Indeed the banks must change a lot too if they are to go digital only. HSBC already has this ambition that I am aware of.

We will see about the fantasy. Banks have a shock coming if they think they can just get rid of cash and shut up shop everywhere.

0 -

I'm not really referring to fools like this guy who actively refuse to adapt, more about people who are not able to adapt so easily. Again I would ask people to consider how these people have grown up, some were not even educated. They may not be able to read or do maths. It wasn't like today.Dr_Crypto said:The fact that some people, mostly elderly, refuse to use modern technologies isn't a reason to ask the government to force commercial companies to continue to operate in outmoded ways. Where else do we see such a level of intervention to protect people from the modern world? No doubt some people would be happier with dictated memos being sent to the typing pool, lunchtime boozing, drink driving, and smoking in hospitals. But we don't have those things any more. Same with bank branches.

I saw something on the news about a bloke of 70 proudly stating that he doesn't know how to use a computer and won't use phone banking either and thus his local branch is a "lifeline". I thought he was absolutely ridiculous. We have a few people at work still working at over 70 (no idea why they don't need the money) and all can use a computer just fine. Heck I know people in their 80s who use all sorts of technology. Most people who were in the workplace in the 90s and 2000s would have seen and used technology although I suppose those doing manual jobs may not.

I would also say that even if the law did force someone providing a service to accept cash. Most people would use a card anyway. It would be the odd customer, that would use cash. I don't really see why this is a bad thing. There is the cost of getting the cash into their account, to the bank from the till etc. But card companies also charge fees. And when cash is gone, I am sure these will rise as much as they can do it in the law.0 -

Yes a very true and good point. While it is only every now and then, cash is king and several times in the past on lunch etc I have had to pay in cash at a well known sandwich type establishment because their card machines were broken.Eco_Miser said:

Which means that they are being cut out of that part of society that doesn't accept cash.eskbanker said:

They're not being cut out of society! They can continue to use cash if they prefer, but can only do so when spending money in places that'll accept it,London7766551 said:

there is a large chunk of the population that are old and have always used cash and always will. They are being cut out of society, I have seen it with my own eyes, people being turned away from places.eskbanker said:it's not an inalienable right for customers to insist on preferred means of payment. Many would no doubt be happier to pay with Luncheon Vouchers, Green Shield stamps, ten bob notes, etc, etc, but managed to move on from thoseHaven't seen any of those for a long time.However, I don't see insisting on paying in the legal tender of the country (Yes, I do know legal tender is strictly only relevant for paying debts) for customer-present purchases as unreasonable, except in the current plague-ridden conditions.Cards are wonderful, until they don't work, at which point they are useless. Cash still works in power cuts, internet outages, and when your bank thinks your card should be blocked.1 -

I suppose it depends on one's definition of 'society' but to me there's a significant difference between 'being cut out of society' and 'not being able to pay some businesses by cash'.Eco_Miser said:

Which means that they are being cut out of that part of society that doesn't accept cash.eskbanker said:

They're not being cut out of society! They can continue to use cash if they prefer, but can only do so when spending money in places that'll accept it,London7766551 said:

there is a large chunk of the population that are old and have always used cash and always will. They are being cut out of society, I have seen it with my own eyes, people being turned away from places.

It's not up to customers of any business to unilaterally insist on anything, as long as the business is complying with the law and its Ts & Cs. I do get that some obviously feel that the law should be changed though, but unless or until that happens then it remains valid for businesses to choose which payment methods they accept. As you point out, current conditions make it even less likely that businesses would be forced to accept grubby bits of paper(/plastic) and metal.Eco_Miser said:eskbanker said:it's not an inalienable right for customers to insist on preferred means of payment. Many would no doubt be happier to pay with Luncheon Vouchers, Green Shield stamps, ten bob notes, etc, etc, but managed to move on from thoseHaven't seen any of those for a long time.However, I don't see insisting on paying in the legal tender of the country (Yes, I do know legal tender is strictly only relevant for paying debts) for customer-present purchases as unreasonable, except in the current plague-ridden conditions.1 -

I don't see any inconsistency in the remarks about post offices. My earlier post was about how banks tend to cite the fact that some facilities are available in post offices when closing branches, but my later comment related to them not being direct like-for-like replacements, i.e. post offices don't offer full branch facilities for opening accounts or mortgages, etc.London7766551 said:In that case I am curious as to your first post regarding post offices. I suggested they were not a replacement for branches, hence my suggestion for common branches. Indeed the banks must change a lot too if they are to go digital only. HSBC already has this ambition that I am aware of.

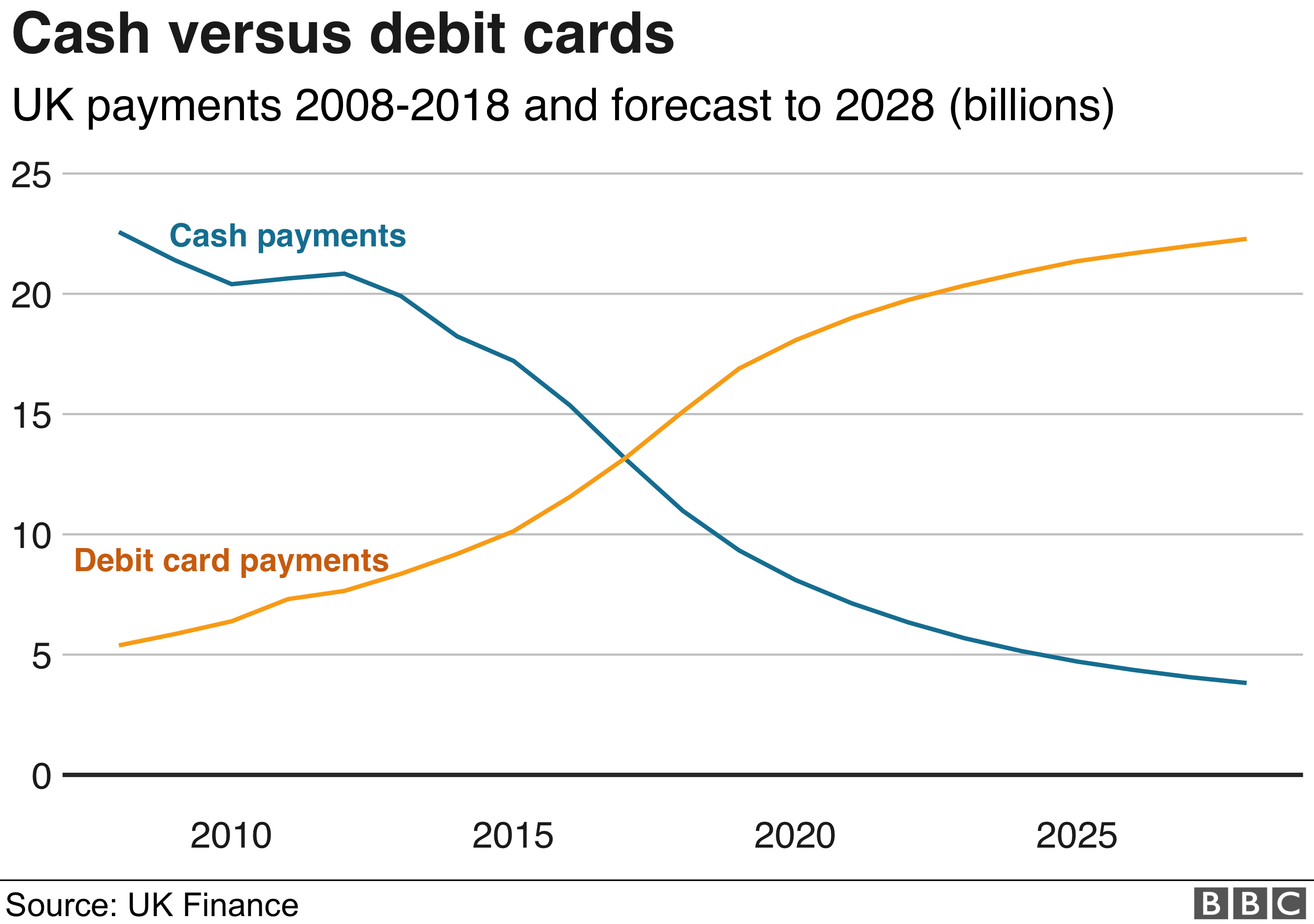

Sounds like a strawman to me - which bank has said they can get rid of cash? Clearly cash usage continues to fall but I don't think anyone is saying it'll stop at any point in the foreseeable future, which is why the curve below flattens:London7766551 said:

We will see about the fantasy. Banks have a shock coming if they think they can just get rid of cash....

To me branch closures are a different issue from declining use of cash - not completely unrelated but certainly not intertwined in the way you seem to be suggesting.London7766551 said:

....and shut up shop everywhere.0 -

There's no doubt that technology-based payment methods can suffer from outages that don't affect old-fashioned ones, but that doesn't necessarily mean that the response should be to preserve the latter at all costs via legislative/regulatory mandates! Taking that example, a shop unable to accept card payments on multiple occasions because of technology failures will increasingly find that they're losing business - perhaps some might see the best response as being to continue to take cash but I imagine that many would realise that they need to find more reliable technology from their suppliers....London7766551 said:

Yes a very true and good point. While it is only every now and then, cash is king and several times in the past on lunch etc I have had to pay in cash at a well known sandwich type establishment because their card machines were broken.Eco_Miser said:Cards are wonderful, until they don't work, at which point they are useless. Cash still works in power cuts, internet outages, and when your bank thinks your card should be blocked.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards