We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Marcus rate drop to 0.70 % from 12 October 2020

Comments

-

Please could you explain this, I can't find it with a search. I was under the impression you needed a balance of 5K at the end of every day of the month to qualify?colsten said:Nope, that's still not the optimal approach, as you don't need to keep a £5K balance to get £5/mth, as discussed in the Halifax Reward thread.0 -

This is where the 1% fixed rate regular savers will come in handy. I've got two RS's with Virgin Money paying 1% and one each with Lloyds and Bank of Scotland, holding minimum balances at the moment but I can fill them up at £1000 each month and withdraw as if an instant saver. A bit fiddly, but better than not having.0

-

I've opened both Coventry and Principality restricted withdrawal accounts and plan to split my instant access savings 45:45:10, with the 10 in Marcus. That way I can have 5 withdrawals a year instead of 2 or 3.1

-

talexuser said:

Please could you explain this, I can't find it with a search. I was under the impression you needed a balance of 5K at the end of every day of the month to qualify?colsten said:Nope, that's still not the optimal approach, as you don't need to keep a £5K balance to get £5/mth, as discussed in the Halifax Reward thread.

No, not if you select the £5 for a £500 spend each month i.e to a NS&I account, which could be withdrawn

1 -

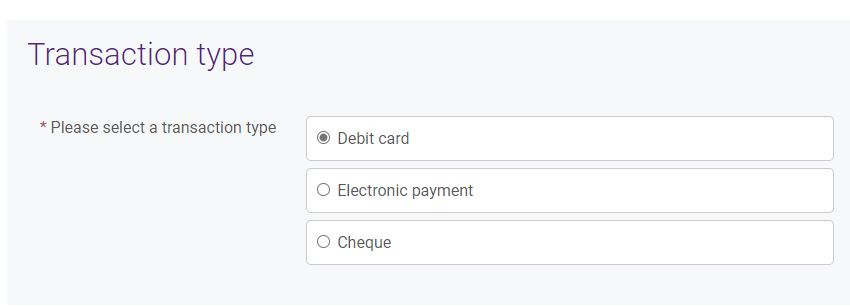

Thanks. I'd forgottem about the £500 debit since I don't really use my debit cards. So a direct debit to a regular saver counts? As it was keeping 5k plus float was the same as having it in Marcus, soon quite a lot better.ischris85 said:No, not if you select the £5 for a £500 spend each month i.e to a NS&I account, which could be withdrawn 0

0 -

I'm going to bump up my crypto.com TGBP holding a bit. 12% - clearly high risk but rewards for past 2 years I've used them are unquestionable. Better than wasting time on massive efforts for crap rate regular savers or savings interest which yields a few quid extra a year5.41 kWp System, E-W. Installed Nov 2017

Lux + 3 x US2000B + 2 x US3000C battery storage. Installed Mar 2020.0 -

I will be doing £500 debit card withdrawal to my Skipton 1.20%.talexuser said:

Thanks. I'd forgottem about the £500 debit since I don't really use my debit cards. So a direct debit to a regular saver counts? As it was keeping 5k plus float was the same as having it in Marcus, soon quite a lot better.ischris85 said:No, not if you select the £5 for a £500 spend each month i.e to a NS&I account, which could be withdrawn

Don't think Direct Debit counts as a Debit card transaction.

0 -

Well this is a shame. The rates will be reducing on my Marcus savings and Nationwide at around the same time. I need to have instant access and have found a 0.95% rate at YBS. I'm not sure if it's worth moving the money as I'm sure that rate will shortly drop as well.0

-

I see, so you just do a manual transfer every month.Speculator said:.Don't think Direct Debit counts as a Debit card transaction.

0 -

yes.talexuser said:

I see, so you just do a manual transfer every month.Speculator said:.Don't think Direct Debit counts as a Debit card transaction.

Was paying £500 pm via debit card to my daughters NS&I Junior ISA but they reduced rate to 1.5%.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards