We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Mortgage broker - ask me anything

Comments

-

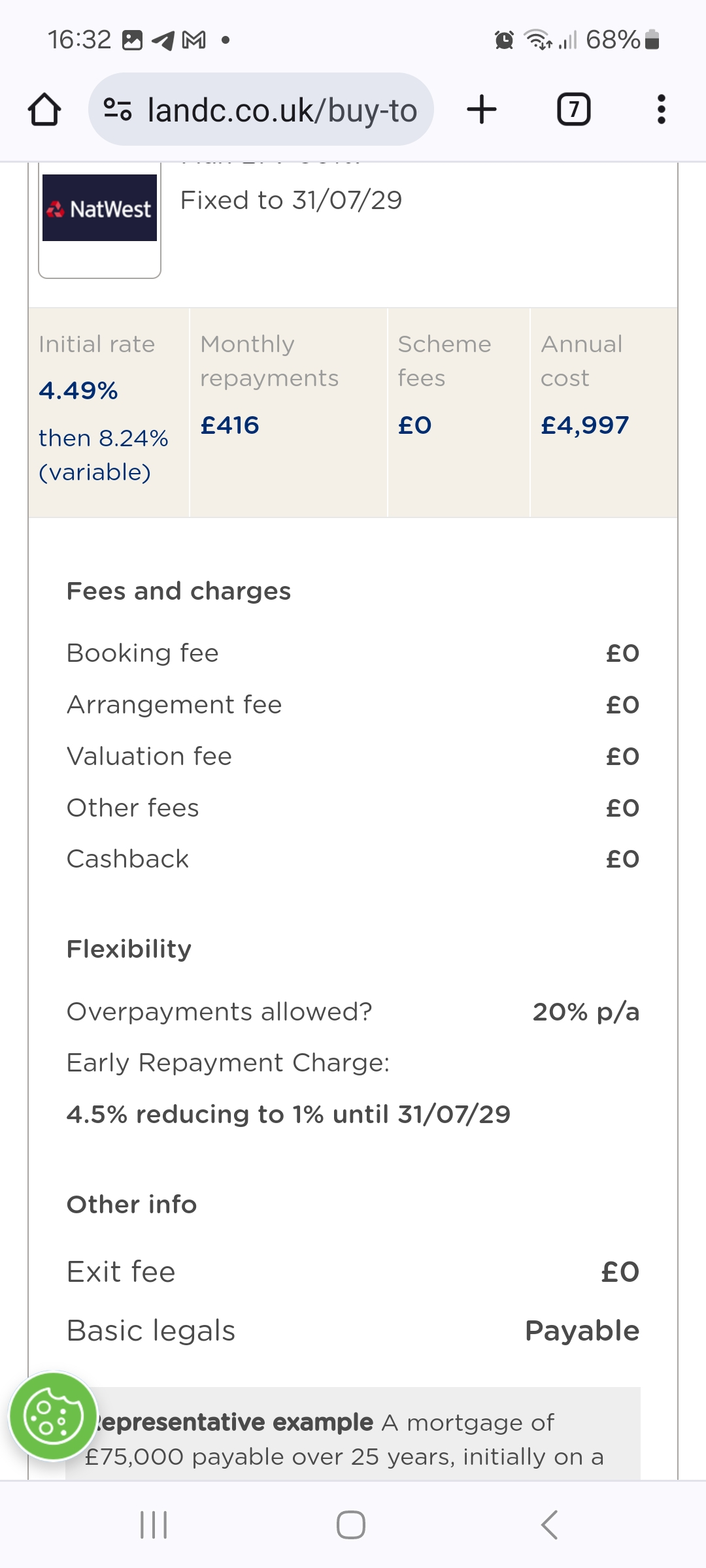

Iam looking at the likes of this.

0 -

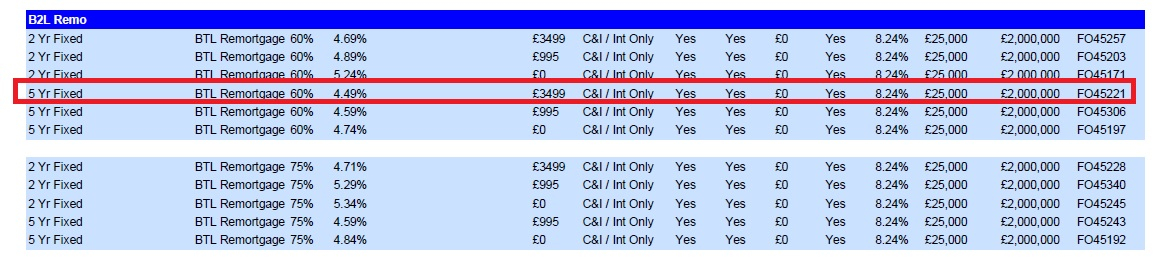

@rottieland There are low LTV BTL remo rates that start from 2.79%, but they come with a stonking large lender product fee so overall might well be more expensive than a ~5% rate with a smaller/no fee. So I wouldn't just go by the rate.Rottieland said:Buy-2-let mortgages rates.

Can anyone tell me if these price comparison sites have the rates correct or is it all a gimmick.

I've been on l+c and there is rates from 3.7% + fees and up.

But a local financial advisor is saying there more like 6% at the minute

For the specific NatWest product that you've shared, that looks like a 60% LTV BTL remo product with a 4.59% rate, but as far as I can tell it has a lender product fee of 3k+. Probably won't make sense for your 110k-ish mortgage.

You can check the rates for yourself. For example for the NatWest one, just google "natwest for intermediaries products" and the go through their product guide (usually available as a pdf to download) and look for the BTL remortgage section to see if the product advertised exists.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

I have a mortgage offer (HSBC) and am waiting for the conveyancer's to do their bit. The rates have dropped by 0.03% which I think works out about £2 a month (and they might drop again!). If I ask the broker if I can have the new rate, how does it affect the mortgage offer and timeline? Is it like a whole new application that might take 2 or more weeks and risks getting rejected? I don't want to do anything that might jeopardise this purchase, but a saving is a saving.Debt Free: 01/01/2020

Mortgage: 11/09/20240 -

@jami74 Haven’t done a post-offer switch for HSBC recently but generally speaking it shouldn’t take more than a few days to reissue the offer with the new product and it normally doesn’t require any new documentation or underwriting.Jami74 said:I have a mortgage offer (HSBC) and am waiting for the conveyancer's to do their bit. The rates have dropped by 0.03% which I think works out about £2 a month (and they might drop again!). If I ask the broker if I can have the new rate, how does it affect the mortgage offer and timeline? Is it like a whole new application that might take 2 or more weeks and risks getting rejected? I don't want to do anything that might jeopardise this purchase, but a saving is a saving.

Their system will likely ‘rescore’ the app but as long as your credit profile hasn’t deteriorated materially since the original application, it should be fine.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

How common is it for lenders to contact applicant’s business accountant directly? I’ve been asked for a letter confirming some details regarding my employment, and the accountant for the business I work for (small, family business) prepared this document for me last night, but from today he is going away on holidays and won’t be checking emails for 3!!! weeks. He also works for a very small company so no one will be checking his emails for him during this time. This is likely the last document my lender needs before accepting the mortgage application, so I’m just worried they’ll want to get in touch with him directly to verify details and this would delay us by a month! If the letter he wrote before leaving includes all the necessary info, how likely is it they want to contact him directly?0

-

@vp0007 If the letter ticks off all the info the lender has asked for, and the underwriter doesn’t have any plausibility issues with the application, then there’s really no need for the lender to contact the accountant directly or raise any further queries.Vp0007 said:How common is it for lenders to contact applicant’s business accountant directly? I’ve been asked for a letter confirming some details regarding my employment, and the accountant for the business I work for (small, family business) prepared this document for me last night, but from today he is going away on holidays and won’t be checking emails for 3!!! weeks. He also works for a very small company so no one will be checking his emails for him during this time. This is likely the last document my lender needs before accepting the mortgage application, so I’m just worried they’ll want to get in touch with him directly to verify details and this would delay us by a month! If the letter he wrote before leaving includes all the necessary info, how likely is it they want to contact him directly?I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

Is it normal for lendrs to ask for a proof of payment for self assessment? I was taken aback by the request for a proof of payment, I googled for anyone saying this is a requirement, can't find anything. I offered a business account bank statement that matches the SA records, but he said no, get your accountant to send this. This is with HSBC.I pay self assessment from my bank account, but my accountant files for it and send me references to pay.I'm FTB, not an expert, all my comments are from personal experience and not a professional advice.Mortgage debt start date = 11/2024 = 175k (5.19% interest rate, 20 year term)

- Q4/2024 = 139.3k (5.19% -> 4.94%)

- Q1/2025 = 125.3k (4.94% -> 4.69%)

- Q2/2025 = 108.9K(4.69% -> 4.44%)

- Q3/2025 = 92.2k (4.44% -> 4.19%)

- Q4/2025 = 44k (4.19% -> 3.94%)

- Q1/2026 = 41k (3.94%)

0 -

@jemma01 Usually they’re happy to use the TYO showing a zero balance to confirm that there isn’t an o/s tax balance.Jemma01 said:Is it normal for lendrs to ask for a proof of payment for self assessment? I was taken aback by the request for a proof of payment, I googled for anyone saying this is a requirement, can't find anything. I offered a business account bank statement that matches the SA records, but he said no, get your accountant to send this. This is with HSBC.I pay self assessment from my bank account, but my accountant files for it and send me references to pay.

With self-employment, underwriters have a lot of leeway to ask for whatever they think necessary and it can be subjective unfortunately.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

What I would have said!K_S said:

@jemma01 Usually they’re happy to use the TYO showing a zero balance to confirm that there isn’t an o/s tax balance.Jemma01 said:Is it normal for lendrs to ask for a proof of payment for self assessment? I was taken aback by the request for a proof of payment, I googled for anyone saying this is a requirement, can't find anything. I offered a business account bank statement that matches the SA records, but he said no, get your accountant to send this. This is with HSBC.I pay self assessment from my bank account, but my accountant files for it and send me references to pay.

With self-employment, underwriters have a lot of leeway to ask for whatever they think necessary and it can be subjective unfortunately.I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.2 -

Hi (this is the most helpful thread on the MSE, for sure!)

I have a Santander mortgage offer which expires in September 2024. I am still waiting for my buyer to be approved by housing association, so I don't expect to complete until about August or worst case scenario September.

I applied with my current credit balances and it is not a condition to clear the balance before completion.

I have a Barclaycard with 0% interest on the balance of £4,700 until July 2025 - currently about £8,000 remaining credit.

I also have a NatWest CC with 0% interest on the balance of £7,000 until July 2024 - currently only £600 remaining credit.

I want to move the NatWest balance to the Barclaycard, so that I don't start incurring interest at APR from July 2024.

To avoid 2 months of high interest before completion, can I move the balance to the other card? Or best not to make any changes at all and just swallow the high APR until the mortgage is drawn down? My outgoing payments will be higher because although the Barclays balance is 0% and I have less owed on it, it has a much higher monthly payment than Natwest.

Thanks for your advice!!Current debt-free wannabe stats:Credit card: £8,524.31 | Loan: £3,224.80 | Student Loan (Plan 1): £5,768.55 | Total: £17,517.66Debt-free target: 21-Mar-2027

Debt-free diary0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards