We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

It's not all about the debt anymore........

Comments

-

Thanks Aspiration, I am looking after my well-being, I’m very lucky to have supportive friends and family, I’m able to recognise when it’s getting too much and I do ask for help and tell my family I’m not feeling great. They are fantastic and have said they are here to support me all the way.Aspiration said:Treading Water just wanted to say I think you’re absolutely making the right decision in how you handle this.Don’t be pressurised, you’ve got to make the right decision for yourself and family and not be pushed in to any situation.Also your Ex will have to pay a lot for legal advice and in my experience of dealing with legal disputes, people realise quickly they cost a lot!

Hope you’re ok and managing to look after your wellbeing.LBM Debt at: £47454:eek:Current total 26th Oct 2020 £ 25,808.041 -

No not at the moment, my ex has said he will contact via a solicitor and is arranging house valuations as he is not happy with mine. I used mainstream, well known estate agents so I’m not sure what the issue is. I think it’s game play on his part, his refusing to make them at a time that suits us both and has said it’s my problem if I’m not there, he will just let himself in and get them done.Honeysucklelou2 said:Are you going through the mediation route?LBM Debt at: £47454:eek:Current total 26th Oct 2020 £ 25,808.040 -

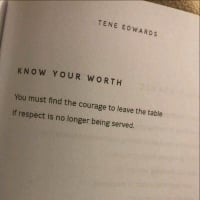

I taken time to process everything that has been happening lately and I feel this is the kick I needed. I’ve been working hard to get my debt paid off but in reality until it’s gone it limits my choices and opportunities, I’m so sick of the worry and feeling like I’m stuck. So I’m going to double my efforts and get the financial and life freedom I’m craving for.

Today I am resolved to leave the past and stop it affecting my future, whilst endeavouring to be true to myself and not get caught in toxic game play, that’s not me and I will not be drawn into others drama triangles, I’m going to be the genuine, congruent, authentic version of me.

Feeling renewed today, hoping to update on a bit more debt busting very soon!LBM Debt at: £47454:eek:Current total 26th Oct 2020 £ 25,808.041 -

Sorry you are having to cope with a difficult ex. Divorce is never easy but much better if done amicably but sadly your ex seems to causing problems. The debt is holding you back so yes getting rid of it ASAP would be a great first step. Don't be pressured on the house. Is he looking for a payout from you?I’m a Forum Ambassador and I support the Forum Team on the Debt free Wannabe, Budgeting and Banking and Savings and Investment boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

The 365 Day 1p Challenge 2025 #1 £667.95/£667.95

Save £12k in 2025 #1 £12000/£145000 -

Oh goodness, sorry to hear about your tough times. Keep writing, keep going, little bits.

Hope the diary and support helps you.Signiture dated 23/09/2025

3-month emergency fund (Cash ISA and PBonds): £5,382/ + £1,500 = £6,882 /£7,500 (Target 1)

Stocks and shares ISA: £2,232.94

Additional pension contributions £0 (target £450pcm)

Overpayment on mortgage: 1% at a time (£1,518)

Big Renno...and appliances. Front of the house, fridge freezer, dishwasher and washing machine)0 -

Thanks very much for your comment.enthusiasticsaver said:Sorry you are having to cope with a difficult ex. Divorce is never easy but much better if done amicably but sadly your ex seems to causing problems. The debt is holding you back so yes getting rid of it ASAP would be a great first step. Don't be pressured on the house. Is he looking for a payout from you?

To be honest I’m not sure what he wants, it started with him wanting 50% share of the equity and to come off the mortgage, I cannot afford 50% and feel as though that is unfair as we have a child together (which he no longer sees or has contact with) so I offered a 70/30 split amazingly I did get a provisional mortgage offer but I would have had to lend £4000 off a family member to get the 30% equity, which now makes me feel uncomfortable. He declined this and said he feels I’ve had the house undervalued and he is arranging for estate agents to value the house himself. I’ve said I want to be present at the valuations as it’s my home and I’m not happy for them to be walking around my home, so he said he will arrange them at his own convenience, he will let me know dates/times and he doesn’t care if I’m there or not. I think he will text me on the day and say the estate agent has arrived and they are going in.

I thought his motivation was money but I’m not so sure now because of emails/calls/texts I’ve received so I think it’s to cause as much pain as possible.

In truth I feel a bit lost, I have had legal advice, but I think in the end I will have to let it play out and decide on the best way forward when I find out what he wants.LBM Debt at: £47454:eek:Current total 26th Oct 2020 £ 25,808.040 -

Thanks for the support, it does help! What I learnt from this forum is there is always an answer, it might not be easy and it will need compromise but there is always a solution.DrCarrie said:Oh goodness, sorry to hear about your tough times. Keep writing, keep going, little bits.

Hope the diary and support helps you.

xxLBM Debt at: £47454:eek:Current total 26th Oct 2020 £ 25,808.040 -

Keep your head up. Do not accept high valuations, property market is definitely slowing (I have several friends with houses on the market at the moment in the SE which are all having to reduce the price they want to sell at from the original estate agent guide price). Its a tricky time but a valuation by an estate agent doesnt mean a property will sell for that.

I'm not a lawyer, but if he has moved out can you not change the locks? Better to get a lawyer's advice on that, but I would have thought if he had moved out then you can change them. I

Also, I hope he is paying child support, definitely something to get sorted. Don't let him guilt you on that, he has to pay towards his child, that is not just your job. Even if he doesn't want to see your child (which I think you said?), he still has to pay!Current mortgage (1 Jun 2022): £289,501 - originally £351,999 got to love London sized mortgages!

OP Goal 2022 = 3.75% in OPs: £6,975 / £13,200

Emergency Fund Target: 3 months saved ✅

1 -

Thanks for the words of support, unfortunately I’m not allowed to change the locks, but I’m actually doing ok, I’m just taking one step at a time.rugbymadfamily said:Keep your head up. Do not accept high valuations, property market is definitely slowing (I have several friends with houses on the market at the moment in the SE which are all having to reduce the price they want to sell at from the original estate agent guide price). Its a tricky time but a valuation by an estate agent doesnt mean a property will sell for that.

I'm not a lawyer, but if he has moved out can you not change the locks? Better to get a lawyer's advice on that, but I would have thought if he had moved out then you can change them. I

Also, I hope he is paying child support, definitely something to get sorted. Don't let him guilt you on that, he has to pay towards his child, that is not just your job. Even if he doesn't want to see your child (which I think you said?), he still has to pay!LBM Debt at: £47454:eek:Current total 26th Oct 2020 £ 25,808.042 -

So, I have doubled my efforts on debt busting and I am £50 away from the next debt being gone! I’m hoping to achieve this by the end of Nov but just need to be careful and not get too over enthusiastic and leave myself to short to get through the month.Then on to the next one!LBM Debt at: £47454:eek:Current total 26th Oct 2020 £ 25,808.042

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards