We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Heir Hunter

Comments

-

Any fees charges will be subject to VAT on top. I doubt whether the 85% has gone on fees, it is quite possible that further beneficiaries have turned up or that some creditors may have come out of the woodwork since the original contact was made. As residuary beneficiary you are entitled to a copy of the estate accounts.1

-

Their fee will be whats left after expenses like solicitors.

Ask for an inventory and account and who applied for the grant of administration.

As a beneficiary of 3 it should be fairly easy to work out who the other 2 might be any siblings or cousins would be the first to call.

1 -

Formally write by snail-mail to the senior partner - dont bother with the phoneNever pay on an estimated bill. Always read and understand your bill1

-

I think the part that would make me particularly annoyed would be the fact that the OP did not agree to the heir hunters working for him in making the claim - interesting to see if they can produce your "signed contract" to do so?

1 -

Hi everyone

The estate is my great-great-grand father's relative.I am almost 50 so this person must have been born in the 19th century.So, there are unlikely to be any creditors and since only one month has elapsed between the offer to administer and the cheque appearing, it is unlikely that new beneficiearies have been found.The heir hunter company according to their website uses solicitors as intermediaries, but the only information the company revealed in the letter with the cheque was the name of the deceased. No date of birth, no place of birth, and I suspect not even their full name.Again, they have still not replied to our telephone calls.Is there a way of finding who the adminitrator is who took out the letters of administration?

The estate is my great-great-grand father's relative.I am almost 50 so this person must have been born in the 19th century.So, there are unlikely to be any creditors and since only one month has elapsed between the offer to administer and the cheque appearing, it is unlikely that new beneficiearies have been found.The heir hunter company according to their website uses solicitors as intermediaries, but the only information the company revealed in the letter with the cheque was the name of the deceased. No date of birth, no place of birth, and I suspect not even their full name.Again, they have still not replied to our telephone calls.Is there a way of finding who the adminitrator is who took out the letters of administration?

0 -

With a relationship that distant it seems probable that more relatives popped out of the woodwork. With 5 (or is it 4?) generations and the original estate not even being a direct paternal/maternal link I'd be very surprised if there were only 3 descendants. Don't forget it only takes one relative to be discovered for an entire new family tree needing to be added.Best of luck in your endeavours however.2

-

Is there a way of finding who the administrator is who took out the letters of administration?0

-

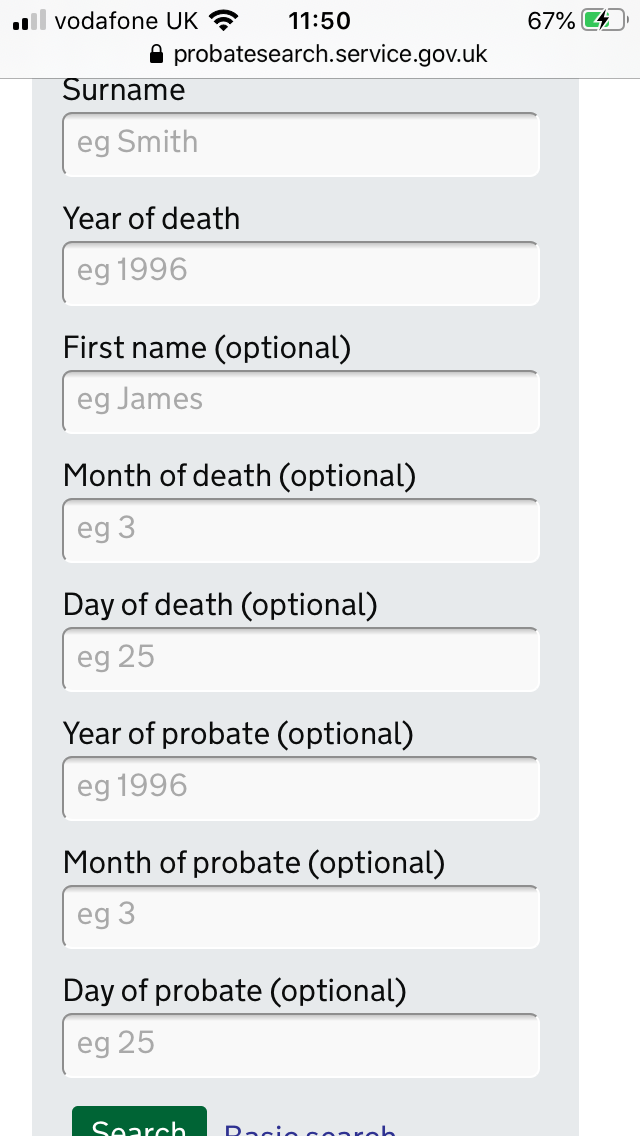

You can go on the government website and pay £1.50 for a copy of the letter of administration. I think you need the name of the relative and the date and year they passed away and what month and year the letters of administration would have been granted. Good luckCalumFinnerty said:Is there a way of finding who the administrator is who took out the letters of administration?1 -

Hopefully this helps - the website is at the top

1 -

is the relationship really that distant? Second cousins can't inherit under intestacy, whereas I think a first cousin once removed could take the parents share.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards