We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggestions for a speculative punt?

Comments

-

This "miner" is going bonkers!!!

https://www.hl.co.uk/shares/shares-search-results/a/argo-blockchain-plc-ord/company-information

One person caring about another represents life's greatest value.0 -

msallen said:

I'm an x-o user myself, but even at half the cost of HL, the charges there are way too high for this sort of investment. This is where free platforms like Trading212 have a place - just don't get tempted into anything more exotic like CFDs.Thrugelmir said:

Open a GIA account with X-O. Trades then would just be £5.95p. No account fees.Dandytf said:

Thanks for some minor positive reply, appreciated.bowlhead99 said:msallen said:

I've had to read this a few times to make sure it does actually say what I think it says (I should have just scrolled down as bowlhead had already deciphered it to mean the same). Are you f***in' crazy?

Looking on the bright side, although you lose huge percentages of money to fees this way, it isn't a large absolute amount of money. The investor would have had a harsher lesson if they had put a meaningful amount of money (hundreds or thousands) into a 'punt' company and it had gone bust or crashed in value. This way, the £24 of transaction fees incurred to buy and sell a meaningless amount of shares is just something that would have been frittered away on some other form of entertainment.

Setting 11.95 trade costs apart, this makes for some satisfaction-Sell:66.00p Buy:68.00p 1.50p (2.26%)

1.50p (2.26%)

Lesson learned on the Costs. Though not to be repeated.

Thanks MsersPeople could still play with leverage even with S&S ISA accountExample:3x Amazon, 3X Facebook, 3X Aaple, etc.

2 -

Username999 said:This "miner" is going bonkers!!!

https://www.hl.co.uk/shares/shares-search-results/a/argo-blockchain-plc-ord/company-informationIndeed. Bitcoin go Crazy so is blockchain. Any stocks relating to Bitcoin mining go crazy recently.

The analysts, hedge funds and Institutional investors which are forward looking rather than relying on dinosaurs’ stocks, have predicted three areas that will grow much fasters in the next decade

Block Chain, Genomic/Gene editing revolution, EV and sustainability stocks.

The other sectors are online gambling, Marjuana/Cannabis Stocks due to legalisation in North America, Canada and probably later most part of the worlds.

1 -

Not bad calls from a couple of months ago, if I do say so myself: the AA recovered from 23p to 34p while waiting for the 35p takeover ; Shell rebounded from 850p to 1400p - I had suggested $50 oil could take a couple of years but we have it already; bookies paid out on the US election after a few days, although I hedged off some of my position as the results had started to come in overnight so I didn't make as much as I could have...bowlhead99 said:

I see RDSB is now a full 70% below its all-time high £28 share price that was reached around a year and a half ago, so have had a 'punt' on them at least not having much further to fall this year, though I'm not expecting the gains to come overnight. One to tuck away at the back of the pension.bowlhead99 said:

I see Shell is around about where it was at the worst of March, while BP has fallen even lower despite having temporarily gone up 50% by June. Instead of the ordinary equities I bought a couple of thousand of their 8% preference shares in mid to late March which are up 20% since then, plus the 4p dividend over the half year.pappadruid said:Failing that, mainstream stocks such as BP and L&G, banks all very cheap at the moment.

As the ordinaries are now lower than March's price I've put them back on my watch list, but wouldn't be a 'short term' speculative punt. There's unlikely to be a lot of short term news flow to drive BP higher until oil prices recover somewhat in the coming years - could take 2-3 years before we see $50 a barrel again. Meanwhile the market didn't respond particularly favourably to the idea of cutting the dividend to invest in greener stuff. They have plans to increase their green investing from $0.5bn to $5bn over the next decade but the $0.5bn is just a fraction of their budget and so really it is uncharted territory for them, and they need oil to be flowing at good prices to be able to fund it if they don't want to cut the dividend further. While the long term doesn't bode well for a company too entrenched in 'old economy' oil, shares bought at £2 or so may be worth putting away for a few years.

Shell are faring a bit better perhaps and have seen a future in renewables ('the writing's on the wall') for some time. A contrast to Exxon who are basically sticking their head in the (oil and LNG) sands, and trying to make the most out of there existing expertise in hydrocarbon revenues as a cash cow while it lasts. There are certainly lots of different ways to play the sector, but for a 'speculative punt' thread you would normally expect to see explorers and miners etc with low chances to multi-bag, rather than multibillion behemoths which may be expected to take a while to release value.

The AA share price is now back to where it was a few months ago before the potential private equity takeover was announced, with the deadline for a bid being extended a couple of times now, so perhaps it will never happen. In the hope of some short term upside I've put back in the profits that I'd taken out in August, no doubt it will fall if the bid goes away or is a lowball one, especially with the Covid situation not really receding as quickly as might have been hoped when the interest was first announced.

My other punt for the week is just a literal bet on Biden to win the election ; the bookies odds are not as long as they were a few months ago but I've added a bit to my existing position. You can get a 50% gain if he wins vs a 100% loss if he doesn't. I called it wrong last time when Clinton was the favourite so hopefully this time is different

In looking at what the bookies are offering, you can get 1 to 25 on Biden winning at least one state that Trump won last time around. In these days of banks offering 1% interest for a fixed one year deposit, a 4% return in a week seems very attractive and surely he'll get one of them, right....? 0

0 -

Not really a "punt" but Roman Abramovich part owned steelmaker company EVR.L (Evraz PLC) in the FTSE100, has continued it's up trend since March when it was 200 pence to where it is now 515 pence.

It paid high dividends too.One person caring about another represents life's greatest value.0 -

He is also I believe still a major shareholder in AFC, which in the last 18 months has risen from under 5p to around 80p (or thereabouts) today. As I have mentioned previously . I am also a shareholder in AFC and was topping-up under 5p.

3 -

Old_Lifer said:He is also I believe still a major shareholder in AFC, which in the last 18 months has risen from under 5p to around 80p (or thereabouts) today. As I have mentioned previously . I am also a shareholder in AFC and was topping-up under 5p.

He's done well recently, now worth $14B. 'Friend' of Mr Putin no doubt!

You've done well with AFC too.

One person caring about another represents life's greatest value.0 -

Username999 said:adindas said:

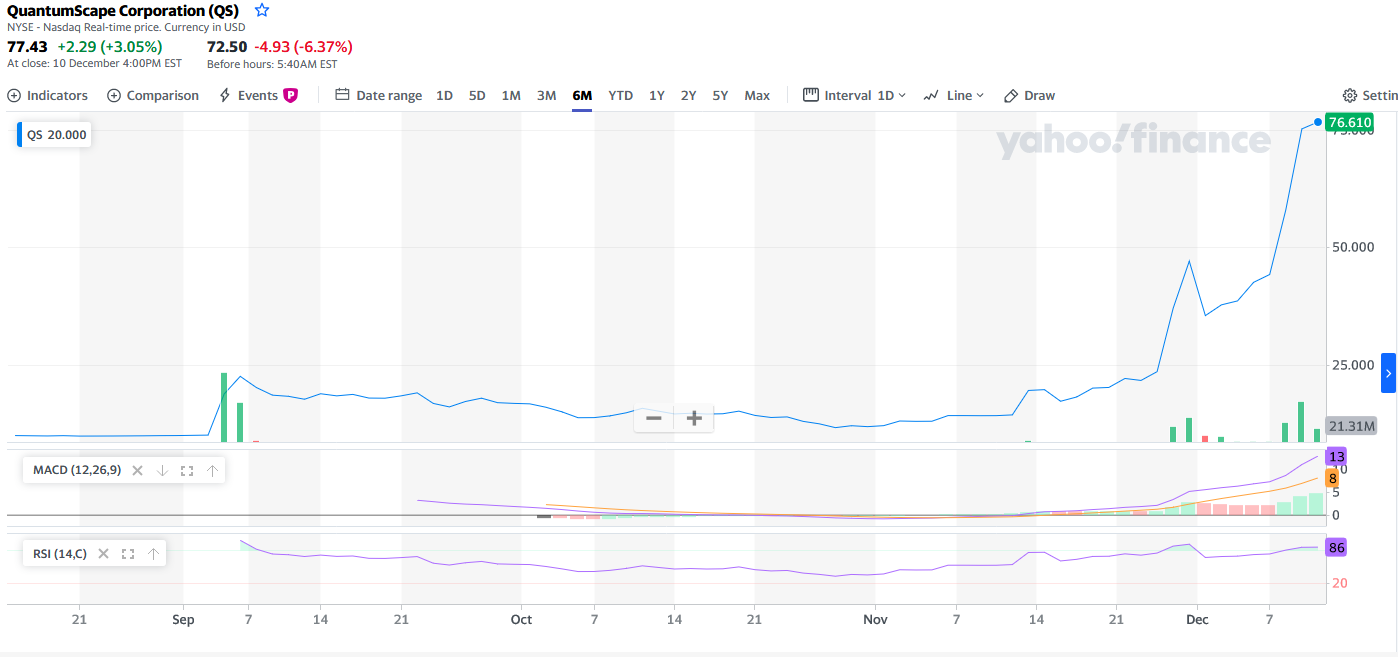

Without the catalyst, the cooperation with tesla, this might still repeat the success case of Quantumscape (has turned up to become 7X) which merged with Kensington Capital Acquisition (KCAC) (see the chart above).

Quantumscape taken a beating, down 40% today.

Down below $50 from the high of $132.

Indeed.

People should not be buying SPAC stock (or eX-SPAC Stock) which was originally priced @$10 at their peak @ $132. SPAC stock is a hype stock and It simply does not make sense which such increase from $10 to $132 with no fundamental change in business with such short period of time.

But given people bought it early November 2020 at around $12 given the current price of $70 it is still 5.8X.

The key strategy to play with SPAC stock is to identify a SPAC with good management, targeting a good sector, significantly high trust value (and Market Cap) so hopefully they will acquire a unicorn (not a mickey mouse company) and the waiting time will be much shorter than two years, get there as early as possible before anyone else do when they are still close to NAV price around $10-12.

It also needs to differentiate between trading and investing with SPAC. The stock like Hyliion for instance many people including me have sold Hyyliion (SHLL) with almost 100% gain, but later reenter as a long term investment at around $16.

1 -

I am always intrigued on how people decide to sell or not when shares rapidly rise. For example, as you were buying at under 5 (you say topping up so I assume you already had some at higher prices, previous years it's been up to 60) then when it got to 35 only a few months later, did you sell? Then it drops to 15, do you buy again? Now 80, are you out? If not, when is out?Old_Lifer said:He is also I believe still a major shareholder in AFC, which in the last 18 months has risen from under 5p to around 80p (or thereabouts) today. As I have mentioned previously . I am also a shareholder in AFC and was topping-up under 5p.

1 -

I started buying shares in AFC just under 5 years ago but I had been following the company for around 3 years before that. My first purchase of shares was around 14p and I made further top-ups from time to time when there was a sharp dip in the share price. For a short while the shares could be bought for under 4p and I made a couple of top-ups below 5p and other top-ups around the 10p level. Overall my average is slightly less than 8p. Of course, anyone making a single purchase of shares at 14p would for a short while have been sitting on a 75% loss when the shares went below 4p. This is the reason Forum members often advise new investors not to invest in the shares of single companies but to invest in Funds instead. For some people a drop of just 5% in the value of their Fund is a cause for concern but a loss of 75% (though not an actual loss if they don't sell) would keep them awake at nights.Developing a new product takes years, with changes of direction along the way and lengthy periods of testing and tweaking of the product. Many investors underestimate the length of time it can take to bring a product to market and sell, convinced that the company is always about to go commercial but never does.After a large rise some investors will sell and take a profit and some will sell in the hope of buying back later at a lower price . When a large rise has taken place, a fall of 20 or 30 percent is not unusual and thereafter a share may trade in a narrow range for weeks or months before resuming any upward trend.I gave up trying to make a quick profit decades ago and take a long-term view. As long as I am convinced the company will be successful I will continue to hold the shares. I may sell a few shares after a large rise and invest the proceeds into one of my ITs in my main portfolio.If you are new to investing, may I suggest that you start by investing in Funds. I have been investing for over 50 years and it was only after about 10 years, that I bought my first share.4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards