We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Suggestions for a speculative punt?

Comments

-

StevetheMattMan said:

So, if you want a speculative punt then maybe opt for the hospitality industry in the UK, as from further investigation it seems that I am not the only one to suffer from the speculation punt in that arena.People who have sold their good stocks in hospitality industry during the recent fear of delta variant that is why they are losing money investing in individual stock. In this situation people are buying more, or at least not selling it."Economy grows as hospitality firms bounce back from lockdowns"In my personal opinion, Those who can not see their stocks in "red" for a few months should not get involved in investing in individual stock.0 -

Moe_The_Bartender said:

I really doubt that retail investors have the firepower to move share prices significantly.Thrugelmir said:

I'm struggling to remember a time when (many) share prices were so volatile. There's a lot of cash being injected into the markets by retail investors who appear to be doing little more than speculating. Which is causing wild gyrations. Companies themselves are still generally coming to terms with the ongoing issues created by the pandemic.Madeinireland101 said:

Anyway - I’m pleased to say I’m nearly £5k upIt has happened many times in the past with penny stocks with the price of a few cents / pennies with very low float.Keep in mind many big institutional investors are not allowed to buy this type of stock.

Some people are following influential channel/chatrooms/news for stocks to wait the signal for buy/sell doing swing trading. They later become bag holders

For that reason, unless they fully do their own due diligence and understand the price movement people should never ever buy the penny stocks with low float of the price of a few cents/pennies when the price has gone up significantly.

1 -

Thanks true under normal circumstances - but most shares fell off the cliff in early 2020 so as long as there are reasonable chances of them recovering then I think they are a decent bet compared to most 😀Grenage said:

Alternatively, one could look at the 5+ year chart and view that all it's done is go down. Previous prices are of little use in picking shares.Madeinireland101 said:

Yes it’s my best performer and no one really knows where it will go but when I look at the 7 day chart it looks like it’s going up a very steep mountain - switch then to the 3 year chart and you’ll see its hardly a blip after coming down a very wide and high mountain so no reason to think it can’t keep going up to get to a recovery position 😀sevenhills said:Madeinireland101 said:

These were Harbour Energy, Rolls Royce, Capita and very recently Cineworld. How did I select them? - well in the main I looked at the last 3 year charts and where the company hasn’t recovered from the crash in early 2020 and had a great multiple to get to back to its former state - these type of companies were on my agenda. I did do some other basic research just to try and ensure there wasn’t other factors holding back the share.Capita has done great over the last 5 days, 40% up; I haven't sold my shares in Capita yet, I am hoping for the price to keep rising, although there may be a pause first.I wouldn't have said Capita was a volatile stock, so 40% in a week was a surprise.1 -

Moe_The_Bartender said:

I really doubt that retail investors have the firepower to move share prices significantly.Thrugelmir said:

I'm struggling to remember a time when (many) share prices were so volatile. There's a lot of cash being injected into the markets by retail investors who appear to be doing little more than speculating. Which is causing wild gyrations. Companies themselves are still generally coming to terms with the ongoing issues created by the pandemic.Madeinireland101 said:

Anyway - I’m pleased to say I’m nearly £5k upThis is another evidence how retail investors could also have the firepower to move share prices significantly. This is particularly true for a penny stock (e.g OTC penny stock) at the price of few pennies with market caps of just a few million US$ than it is very possible.Reasonable number of retail investors have a few miliion in cash that they could play to move the stock price. Let alone in case they form an alliance to syncronise the movement.0 -

Madeinireland101 said:

Thanks true under normal circumstances - but most shares fell off the cliff in early 2020 so as long as there are reasonable chances of them recovering then I think they are a decent bet compared to most 😀Grenage said:

Alternatively, one could look at the 5+ year chart and view that all it's done is go down. Previous prices are of little use in picking shares.Madeinireland101 said:

Yes it’s my best performer and no one really knows where it will go but when I look at the 7 day chart it looks like it’s going up a very steep mountain - switch then to the 3 year chart and you’ll see its hardly a blip after coming down a very wide and high mountain so no reason to think it can’t keep going up to get to a recovery position 😀sevenhills said:Madeinireland101 said:

These were Harbour Energy, Rolls Royce, Capita and very recently Cineworld. How did I select them? - well in the main I looked at the last 3 year charts and where the company hasn’t recovered from the crash in early 2020 and had a great multiple to get to back to its former state - these type of companies were on my agenda. I did do some other basic research just to try and ensure there wasn’t other factors holding back the share.Capita has done great over the last 5 days, 40% up; I haven't sold my shares in Capita yet, I am hoping for the price to keep rising, although there may be a pause first.I wouldn't have said Capita was a volatile stock, so 40% in a week was a surprise.Very true. This is where the informed traders will have the edge against those who randomly choose the stock without a proper weighting the risk vs reward.

People who base their decision solely based on fundamental, will miss a lot opportunities.

Examples of where you purely based your decision on fundamental that youwould have missed a lot of opportunities in COVID-19 Re-opening stocks, multi bagger high growth stocks.

Another example where solely fundamental base in picking up the winners is not a good strategy are the Chinese stocks. Take example on BABA (Alibaba) nowadays. Based on fundamental alone who could fail BABA, very profitable, a few hundred billion US$ in cash, very good P/E ratio. See what happen when the politics and power are coming into equation.

1 -

Cus said:Based on this thread I had a punt on the following, putting the same amount in each of the below, around the 22nd Jan. The brackets are where they stand now to the nearest percentage point:

Anglo Pacific Group PLC: down 1%

Blue Prism Group PLC: down 45%

Clarivate PLC: down 20%

Dekel Agri-vision PLC: down 18%

Fastly Inc: down 54%

Gfinity PLC: down 22%

Hylliion holdings: down 43%

Ince Group PLC: up 61%

Seeing machines LTD: down 16%

Versarien PLC: down 45%

So who ever suggested Ince group - thanks. For the rest of you, try harder 😁

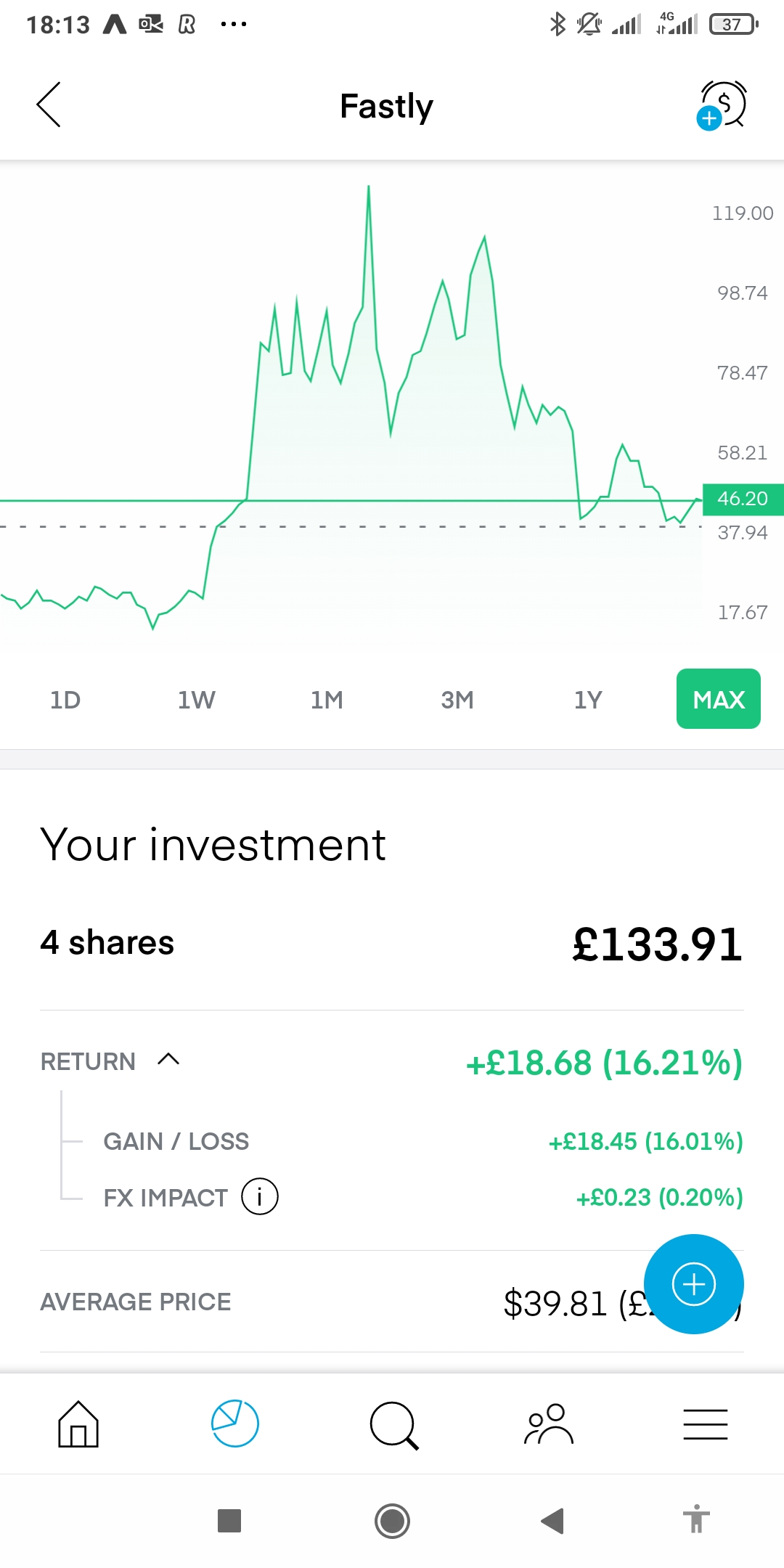

I wonder how well is your Fastly Inc is performing now?? I just check it mine is already up 16.21%.

I am not the first person who first introduce this stock. I will sell it again when it reaches around $50 and re-enter when it drops significantly. It normally happens when there is a bad news such as missing the target during the earning season. My approach for the volatile stock like this is "buy low, sell high". Or at least sell part of it during the happy days and re-enter when the price drop significantly. Also to buy in a small chunk so there is a good opportunity to exit by double it down when the thing is not working as expected.

Hyliions (HYLN) start picking up. It should reach around $10.50 when there is no bad news signaling the market correction such as when the FED start announcing the tapering of assests buy back.

The other stocks on your list is not me suggeting them. So will let other people to comment it.

0 -

The ECB do not want to call it "tapering" of Bond purchases but prefer to call it purchase with a moderately lower pace"

https://www.wsj.com/articles/ecb-eases-stimulus-program-amid-robust-growth-11631188908

Central bank says it will conduct bond purchases as a ‘moderately lower pace’

Normally with news like this, it will send the stock price down for a while as there will be less liquidity in Market.

FED might be doing the same action this year. So it is just a matter of time bfore FED start doing the same thing. I am preparing more cash sitting in the sideline to buy the dip.

0 -

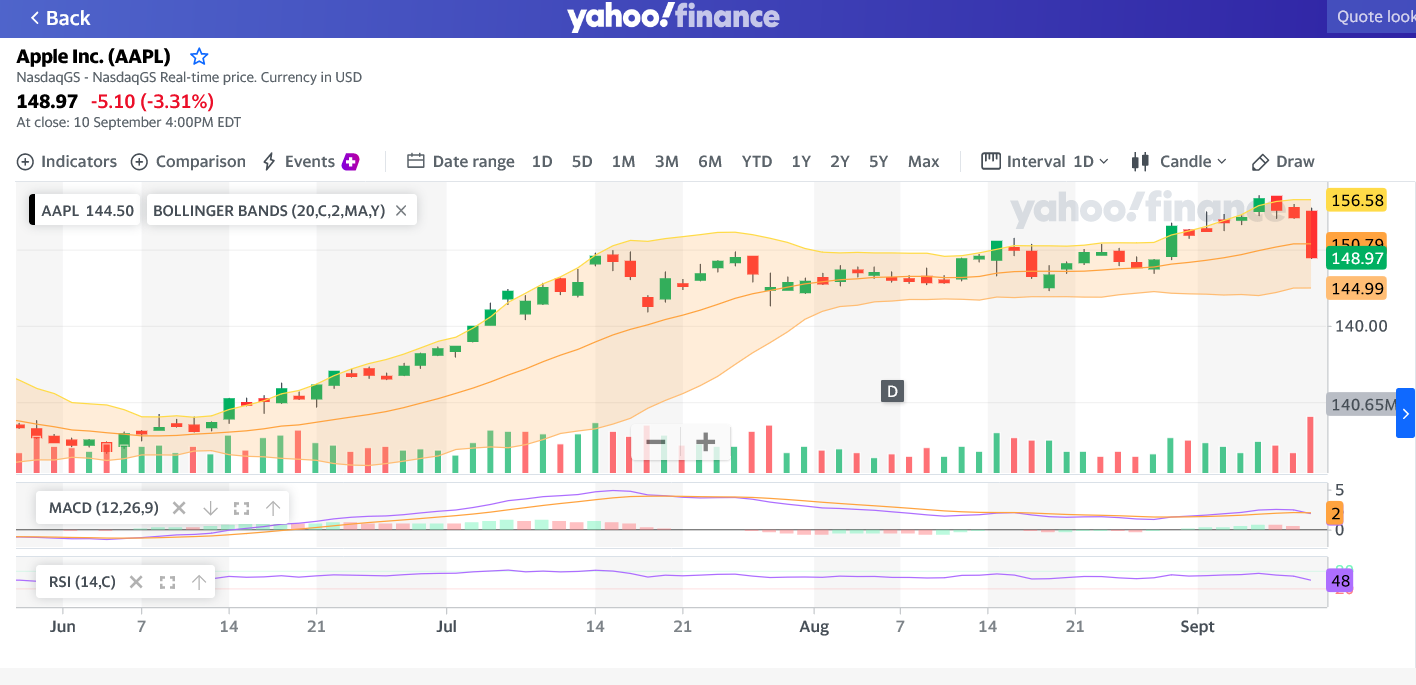

The news like this which is less to do with fundamental is a good example to exploit the contrarian strategy. I believe that it is only a matter of time before it bounces back to All Time High (ATH) and sell it for profit and move money to a more profitable swing trading.

Let alone AAPL new initiative working on Internet Satellites Phone which could be a game changer of mobile communication.

I will wait until it falls below the lower boundary of the bollinger band and attack. That is what I intend do. Please do your own DD if you want to do any swing trading.

0 -

Seeing machines was a speculative punt with a view to holding for the future. DMS is in the pipeline and will be live in new car models this year. Dyor obvs but I'm very optimistic.Cus said:Based on this thread I had a punt on the following, putting the same amount in each of the below, around the 22nd Jan. The brackets are where they stand now to the nearest percentage point:

Anglo Pacific Group PLC: down 1%

Blue Prism Group PLC: down 45%

Clarivate PLC: down 20%

Dekel Agri-vision PLC: down 18%

Fastly Inc: down 54%

Gfinity PLC: down 22%

Hylliion holdings: down 43%

Ince Group PLC: up 61%

Seeing machines LTD: down 16%

Versarien PLC: down 45%

So who ever suggested Ince group - thanks. For the rest of you, try harder 😁0 -

Seeing Machines Ltd has a 2.5% spread. I wish you luck with this. The market makers will certainly welcome the business but life and money are too short for me to even be looking at anything else in the same list.eatmyshorts said:

Seeing machines was a speculative punt with a view to holdingCus said:Based on this thread I had a punt on the following, putting the same amount in each of the below, around the 22nd Jan. The brackets are where they stand now to the nearest percentage point:

Anglo Pacific Group PLC: down 1%

Blue Prism Group PLC: down 45%

Clarivate PLC: down 20%

Dekel Agri-vision PLC: down 18%

Fastly Inc: down 54%

Gfinity PLC: down 22%

Hylliion holdings: down 43%

Ince Group PLC: up 61%

Seeing machines LTD: down 16%

Versarien PLC: down 45%

So who ever suggested Ince group - thanks. For the rest of you, try harder 😁0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=tPHO9KsyJgs&t=329s

https://www.youtube.com/watch?v=tPHO9KsyJgs&t=329s