We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

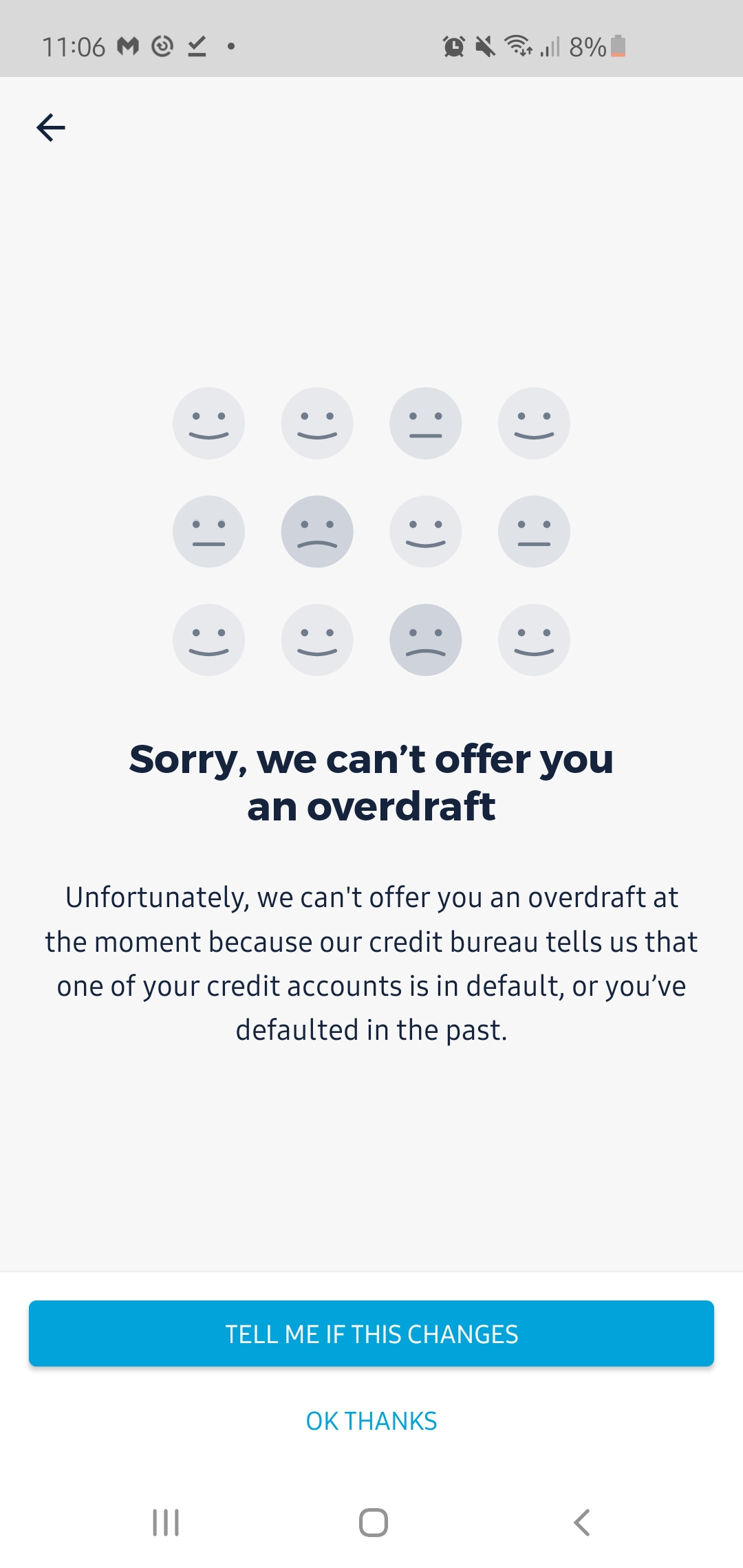

Transunion telling monzo I have a default when i don't!

jazzyja

Posts: 400 Forumite

So I recently signed up to monzo. Just curious I clicked on the overdrafts section (just to see rates really, I dont actually want one) and I was faced with a message that they can't offer me one as I have a credit account in default?! I dont! I've scoured my transunion file cant see any defaults so I'm confused. I've emailed monzo and raised a dispute with transunion but not sure what they can do when there's no default showing. Sometime last year I tried to increase my overdraft with my RBS account ive held for many years and they declined me....now im wondering if this is why! Has anyone ever had this before? Its bizarre. I'm planning on applying for a mortgage next year so I'm really worried now. Thanks

0

Comments

-

I think its generic I see it on there aswel accept i do have defaults0

-

Well....ive just looked at my closed accounts and I have a defaulted account from 5 bloody years ago! Didn't even see it. Its showing as settled though and i do remember paying it. It was only £80! Cryyyy. I really hope this doesn't scarper my mortgage chances! It falls off April 2021liggerz87 said:I think its generic I see it on there aswel accept i do have defaults0 -

Why do you want an overdraft?0

-

I dont. I just clicked on the section curious to see how their rates differ to RBS who i have a current account with and it came up with that. I was confused but ive found a settled default from 5 years ago in the closed accounts sectionD3xt3r5L4b said:Why do you want an overdraft? didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 0

didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 0 -

With a broker. And paying considerably higher rates.jazzyja said:

I dont. I just clicked on the section curious to see how their rates differ to RBS who i have a current account with and it came up with that. I was confused but ive found a settled default from 5 years ago in the closed accounts sectionD3xt3r5L4b said:Why do you want an overdraft? didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 0

didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 0 -

All account history for 6 years is kept on file - so anyone that checks your history will see everything that's listed there. At least you're very close to seeing it removed. Does the default date look correct? From your own recollection or evidence of payments - just make sure that the date is about right. It has been known for some companies not to place an account in default as early as they should, and if you can prove that the default date is wrong, it could be amended (but not removed) - it's fairly unlikely this will be the case, but there's no harm in mentioning it, just on the off-chance.jazzyja said:

I dont. I just clicked on the section curious to see how their rates differ to RBS who i have a current account with and it came up with that. I was confused but ive found a settled default from 5 years ago in the closed accounts sectionD3xt3r5L4b said:Why do you want an overdraft? didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 0

didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 0 -

For a 5 year old settled default really?D3xt3r5L4b said:

With a broker. And paying considerably higher rates.jazzyja said:

I dont. I just clicked on the section curious to see how their rates differ to RBS who i have a current account with and it came up with that. I was confused but ive found a settled default from 5 years ago in the closed accounts sectionD3xt3r5L4b said:Why do you want an overdraft? didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 1

didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 1 -

cymruchris said:

All account history for 6 years is kept on file - so anyone that checks your history will see everything that's listed there. At least you're very close to seeing it removed. Does the default date look correct? From your own recollection or evidence of payments - just make sure that the date is about right. It has been known for some companies not to place an account in default as early as they should, and if you can prove that the default date is wrong, it could be amended (but not removed) - it's fairly unlikely this will be the case, but there's no harm in mentioning it, just on the off-chance.jazzyja said:

I dont. I just clicked on the section curious to see how their rates differ to RBS who i have a current account with and it came up with that. I was confused but ive found a settled default from 5 years ago in the closed accounts sectionD3xt3r5L4b said:Why do you want an overdraft? didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage

didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage

This is a good point yes. I cant actually remember what date I paid it. I suppose I could try and scour my emails see if its in there. The irony is the same company allowed me to open another acount 2 years later. Which I've never missed a payment oncymruchris said:

All account history for 6 years is kept on file - so anyone that checks your history will see everything that's listed there. At least you're very close to seeing it removed. Does the default date look correct? From your own recollection or evidence of payments - just make sure that the date is about right. It has been known for some companies not to place an account in default as early as they should, and if you can prove that the default date is wrong, it could be amended (but not removed) - it's fairly unlikely this will be the case, but there's no harm in mentioning it, just on the off-chance.jazzyja said:

I dont. I just clicked on the section curious to see how their rates differ to RBS who i have a current account with and it came up with that. I was confused but ive found a settled default from 5 years ago in the closed accounts sectionD3xt3r5L4b said:Why do you want an overdraft? didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 0

didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage 0 -

I had 6 missed payments and a unsettled default on a telecoms account around 180ish which was about 4 years old when I got my last mortgage it didn’t affect rates or LTV although I used a broker due to my income not being straight forward as in from one source who found me a high street lender. In hindsight I could have not used a broker had I had the time and energy to ring all lenders or check lending criteria1

-

Not really, it's a myth that adverse always = higher rates.D3xt3r5L4b said:

With a broker. And paying considerably higher rates.jazzyja said:

I dont. I just clicked on the section curious to see how their rates differ to RBS who i have a current account with and it came up with that. I was confused but ive found a settled default from 5 years ago in the closed accounts sectionD3xt3r5L4b said:Why do you want an overdraft? didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage

didn't realise they looked so far back. Im abit gutted to be honest. I mean if I've no chance of getting an overdraft how am I ever going to get a mortgage

Once three years have passed since the last piece of adverse data entered on an individual's credit file, a lot of mainstream lenders consider an application.

An all of market broker will help find an appropriate lender for your circumstances. Don't worry, it's a small negative from a long time ago. Monzo in this instance are being unusually strict.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards