We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is now really a bad time to buy?

Comments

-

In the US , "Experts" were forecasting 20% unemployment for May. Results=13,7% only. One thing is sure, no one understand what is going on. I think the best strategy now is to go for viewings and use all the current predictions to put pressure to get a big discount ( if possible) because in 3 or 4 months we may figure out that most of the predictions were wrong.0

-

you don't ask you don't get, but be prepared for the vendor to say no to the full 10%BikingBud said:

No I'm making no assumptions. I am commenting that I would be looking for a reduction of at least 10% and would expect other people here to do similar purely because they are members of moneysavingexpert.com:MobileSaver said:BikingBud said:

reduce by 10% -nannyto2 said:Surely in 3-4 months when furlough is lifted

we seem hell bent on unnecessarily paying over the odds for housing. WHY?You are making a huge assumption that in 3 to 4 months you will be able to buy the same house for 10% less and you will still be able to get the same mortgage on the same terms.Some posters on this forum have been making the same flawed assumption for around 15 years now and even today are still paying their landlord's mortgage instead of their own... so what will you do in four months if the price of the house you are after has not dropped 10%?Now you may consider that makes me the spawn of the devil but that's your issue not mine.

I'm suggesting people can save c £25K per 150K borrowed over the life of the mortgage by negotiating a reduction.

Do you pay asking price for everything?

It's extremely rare that I do "It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

"It is prudent when shopping for something important, not to limit yourself to Pound land/Estate Agents"

G_M/ Bowlhead99 RIP0 -

What percentage reduction in your rent did you request?BikingBud said:

No I'm making no assumptions. I am commenting that I would be looking for a reduction of at least 10% and would expect other people here to do similar purely because they are members of moneysavingexpert.com:MobileSaver said:BikingBud said:

reduce by 10% -nannyto2 said:Surely in 3-4 months when furlough is lifted

we seem hell bent on unnecessarily paying over the odds for housing. WHY?You are making a huge assumption that in 3 to 4 months you will be able to buy the same house for 10% less and you will still be able to get the same mortgage on the same terms.Some posters on this forum have been making the same flawed assumption for around 15 years now and even today are still paying their landlord's mortgage instead of their own... so what will you do in four months if the price of the house you are after has not dropped 10%?

Do you pay asking price for everything? Gather ye rosebuds while ye may2

Gather ye rosebuds while ye may2 -

I have no doubt that opinions will differ on this, forever.

@eidand I did not say you can 10% off anything! If you read it that way then again that is your interpretation. My savings are fine thanks mate but you have no idea about my personal circumstance and I'm not going to air them on here just to score points.

I am sure that when considering the value of any asset, we would all agree that past performance is no guarantee of potential future gains. Why should it be any different for housing? People want to treat it as an asset, as their pension fund, as their legacy to the children/grandchildren. Some people bought a very low prices, supported by very low interest rates, and have been lucky riding the wave of the market. All waves will break at some point, when or how spectacularly is random and unpredictable. Anybody that argues otherwise is fooling themselves.

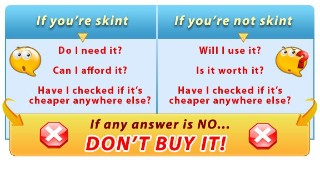

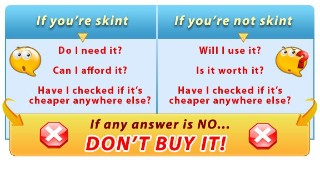

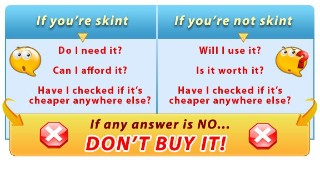

But those that would always wish to get the best possible value will always strive to do that. Sites such as this that prompt changes to behaviours and provide advice on how to save pennies by moving bank accounts due to a drop in interest rates and link to sites such as CamelCamelCamel and many other great money saving opportunities. Yet we cannot discuss getting the best possible deal on a house that will save us many tens of thousands of pound through life. Quite bizarre really.

Yes, yes there are many variables, location, int rate, fixed int rate, period of advance etc, etc but the thing that makes the most difference is price paid. Reduce that even by 10% and you see the illustration above. Multiply it or divide it as you see fit. It is an illustration of the real world model that should influence our behaviour as; moneysavers, tight wads, skinflints, Yorkies, Jocks or any groups that may have a reputation for being careful/frugal.

I've always considered anybody that willingly and continually pays full price for everything to be somewhat lacking ability to think rationally.

Yes you do need to buy some things at certain time and flex is limited but for those that did not buy previously, maybe because they were only 7 in the late nineties, there maybe an opportunity to exploit house prices now. Allow them that freedom to do their own research and decide what is best for them. Do not label them as pariahs because they want to offer less than some people previously paid.

Let's use the 10% reduction again. £135k v £150k

10% deposit is £1500 cheaper. How much sooner could you save 13.5k vice 15k?

25k per year gross (poverty line)~ £1700 pm net how far does that go for a family with 2 kids and rent/bils to pay? Maybe more likely you need to look at a house in a higher bracket so more difficult with less disposable. Negotiating the cost down and reap the rewards now, lower deposit and earlier purchase, and in the long term, lower total interest paid.

What would be your plan to close the gap? To save the minimum 10% deposit to enable you to get out of the rent trap? To get on a mortgage where you were able to service the total monthly outgoing more easily.

1 -

I'd really love to know some real figures. Like how much rent people are paying and how long you've been paying it? And likewise, mortgage amounts in comparison to rents. Are they more or less?0

-

Who said I'm renting?jimbog said:

What percentage reduction in your rent did you request?BikingBud said:No I'm making no assumptions. I am commenting that I would be looking for a reduction of at least 10% and would expect other people here to do similar purely because they are members of moneysavingexpert.com:

Do you pay asking price for everything?

But why not ask for a reduction as a renter, as a new tenant try to barter down from £1800 PCM to £1500 or if you are a long term tenant defer any rises based upon a good relationship and steady long term income. Yes again there any many regional differences and markets but if you don't ask you don't get and simply suggesting that this approach is wrong or underhand or morally corrupt or deceitful goes entirely agains the whole premise of the site.1 -

And I can just as easily walk away as well, but if people continue to feed the house price increase mantra then we are doing ourselves and our children and grandchildren a disservice and only feeding the coffers of those that lend money. I know where I would prefer the 25k to be, if any of you think it's insignificant and not worth the effort perhaps you'd like to send me yourscsgohan4 said:

you don't ask you don't get, but be prepared for the vendor to say no to the full 10%BikingBud said:

No I'm making no assumptions. I am commenting that I would be looking for a reduction of at least 10% and would expect other people here to do similar purely because they are members of moneysavingexpert.com:MobileSaver said:BikingBud said:

reduce by 10% -nannyto2 said:Surely in 3-4 months when furlough is lifted

we seem hell bent on unnecessarily paying over the odds for housing. WHY?You are making a huge assumption that in 3 to 4 months you will be able to buy the same house for 10% less and you will still be able to get the same mortgage on the same terms.Some posters on this forum have been making the same flawed assumption for around 15 years now and even today are still paying their landlord's mortgage instead of their own... so what will you do in four months if the price of the house you are after has not dropped 10%?Now you may consider that makes me the spawn of the devil but that's your issue not mine.

I'm suggesting people can save c £25K per 150K borrowed over the life of the mortgage by negotiating a reduction.

Do you pay asking price for everything?

It's extremely rare that I do

Think I'm about done with this now.0 -

Straw man argumentBikingBud said:

simply suggesting that this approach is wrong or underhand or morally corrupt or deceitful goes entirely agains the whole premise of the site.jimbog said:

What percentage reduction in your rent did you request?BikingBud said:No I'm making no assumptions. I am commenting that I would be looking for a reduction of at least 10% and would expect other people here to do similar purely because they are members of moneysavingexpert.com:

Do you pay asking price for everything? Gather ye rosebuds while ye may2

Gather ye rosebuds while ye may2 -

BikingBud said:I am commenting that I would be looking for a reduction of at least 10%

Now you may consider that makes me the spawn of the devil but that's your issue not mine.I don't think that makes you the spawn of the devil at all but it could be a foolish stance to take; it's difficult to know as you chose not to answer my question so I will ask again...What will you do in four months if the price of the house you are after has not dropped 10%?BikingBud said:I'm suggesting people can save c £25K per 150K borrowed over the life of the mortgage by negotiating a reduction.Yes, of course, they could but conversely by waiting four months they could miss out on their dream house because someone else beats them to it, the house they want may not reduce at all and indeed go up in price, interest rates may rise, they may need a bigger deposit and of course every month they are paying their landlord's mortgage instead of their own.Your focus on the house price to the exclusion of everything else is exactly the mistake a certain poster here made which has led him to still be renting fifteen years later. Is that a good strategy to be promoting on a money saving web site?

I find that very hard to believe. What percentage of items do you negotiate a discount at your local supermarket? At your local takeaway? Local pub? Local cinema? Amazon?BikingBud said:Do you pay asking price for everything? It's extremely rare that I do

It's extremely rare that I do

Every generation blames the one before...

Mike + The Mechanics - The Living Years4 -

Your HPC bias is coming to the fore now... The vast majority of people buy a house as a home first and foremost not as an investment.BikingBud said:People want to treat it as an asset, as their pension fund, as their legacy to the children/grandchildren.BikingBud said:Yes, yes there are many variables, location, int rate, fixed int rate, period of advance etc, etc but the thing that makes the most difference is price paid.Negotiating the cost down and reap the rewards now, lower deposit and earlier purchase, and in the long term, lower total interest paid.You are completely missing the point that this is not a pile of bricks you are buying. You can't just go to another builder's merchant and buy exactly the same pile of bricks from someone else. Practically no-one decides to buy a house today, looks on Rightmove and buys a house the next day; there's a limited supply and there are numerous variables as to whether a house is suitable, price being only one factor.Every generation blames the one before...

Mike + The Mechanics - The Living Years4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards