We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is now really a bad time to buy?

Comments

-

The availability of liquid funds is only one piece of the puzzle.Parking_Eyerate said:

This is just completely daft. You are talking about the availability of liquid funds. I know that you are absolutely obsessed with liquidity but its meaning is not a co-definition of wealth.Crashy_Time said:

Most sensible people understand that a "wealthy" person can lay their hands on 100k easier and quicker than a "Non wealthy" person, it isn`t any more complicated than that really. Having 100k "equity" in your house doesn`t make you wealthy, for obvious reasons.Norman_Castle said:Crashy_Time said:

You can`t do anything with your "earnings" though if it is always tied up in property, or if house prices crash? True wealth is something you can access when you need it without having to sell the roof over your head.Splatfoot said:We are in the process of selling our house. I have bought and sold at profit 3 times in my life so far. This is the last time, after buying at the end of 2006 just before the crash, as the next house we buy will be with no mortgage. I would never have been able to earn as much money through working as I have done through property. If I'd been renting all these years, I would absolutely be kicking myself.Economic wealth is an accessible fund to trade with. Monetary wealth is net worth. The ability to earn is potential revenue but is not measured as wealth. "True wealth" can be anything you want it to be, in monetary terms it means nothing.If you knew what you were talking about you would be able to explain.0 -

You can’t make up your own mind as to how you define wealth and contradict yourself so much that I really doubt you have any insight into how most people define it. Granny Jones might be able to afford to do whatever she wants because she doesn’t have to spend any of her pension on rent.Crashy_Time said:

Being able to feed yourself and go to the bingo once a week isn`t really how most people define wealth.Parking_Eyerate said:

1) You still haven't provided a source for your "standard" definition of wealth, or "true" wealth etc. Wealth is subjective and if it is now your assertion that only people that earn royalties from world famous songs are 'truly' wealthy then that is ridiculous.Crashy_Time said:

1) Yes, only a small proportion of people are truly wealthy, that is why it is a good example.Parking_Eyerate said:

1) Thanks for the advice but I am aware what a royalty payment is. What isn't clear is your characterisation of it as one of a few (the only?) form of wealth (or "true"/"real" or whichever adjective you choose next wealth). I think the Beatles sold the copyright for their songs long ago, in fact. Paul McCartney tried to get some rights back and settled out of court, so who knows who gets paid when 'Yesterday' is played. It isn't really relevant. In fact decent IP royalties are relevant to such a small proportion of people (successful artists/performers etc.) that I really don't know why you're so obsessed with it. Have you had a one hit wonder?Crashy_Time said:

1) Maybe try googling "royalty payment" and see how much effort is required after the initial creation process, think about the writers of the song "Yesterday", do you think the surviving one still gets paid, and how much effort do you think he has to make regarding being paid this royalty?Parking_Eyerate said:

So it looks like you've now reverted to linking wealth to lack of effort, and added a new term of "real wealth". Please provide a source for your "standard" definition of wealth and explain how you differentiate wealth and "real wealth".Crashy_Time said:

The royalties example is a classic example of wealth from a one off effort that doesn`t need to be repeated on an ongoing basis, so real wealth (probably not a B-movie actor who did one great film though) the "passive income" idea was sold to the public by the real passive income players as BTL.Getting_greyer said:I always saw wealth as a stock. The net balance between assets and liabilities. Is a house an asset? Depends on the circumstances. The royalties example is more of a passive income from the asset of the copyright. Whilst interesting not helpful to op so sorry for that.Crashy_Time said:

You can`t do anything with your "earnings" though if it is always tied up in property, or if house prices crash? True wealth is something you can access when you need it without having to sell the roof over your head.Splatfoot said:We are in the process of selling our house. I have bought and sold at profit 3 times in my life so far. This is the last time, after buying at the end of 2006 just before the crash, as the next house we buy will be with no mortgage. I would never have been able to earn as much money through working as I have done through property. If I'd been renting all these years, I would absolutely be kicking myself.

You can't do anything with a big chunk of your "earnings" though if you will always need them to pay rent, and you can't spend any of them if they are in a frozen fund. You also might be left only being able to spend a reduced % of them if stock markets crash. A superlative of wealth could be said to be not having to access funds because nobody else can sell the roof over your head.

2) You are just trying too hard to have property not be an illiquid asset, it is, everyone knows this. The only fund of mine "frozen" in this crisis was a pension fund with property exposure, everything else could be traded quite easily.

2) Another very transparent attempt at a strawman argument. I have never once said (and nor do I think) that you can immediately sell a house at the click of a mouse. What I have said is that is not relevant to wealth assessment. It is you that is trying too hard to deny that property is an asset and may be considered part of a person's wealth. According to you HMRC, divorce courts, bankruptcy receivers etc. must be deluded when they ask for details of property ownership, why don't you write and tell them how misguided they are?

Were you tempted to prove the 'liquidity' of your remaining assets when they crashed by 40%?

2) Yes, property is an asset, no one is denying it, it doesn`t mean everyone with a property is wealthy though because lot`s of people have property as an asset but only a small proportion of people can be described as "wealthy".

Any way you try to cut it, Granny Jones who owns her bungalow outright for years and can feed herself three decent meals a day isn`t "wealthy".

2) I am glad that you have finally admitted that. Also, I have at no point said that everyone with a property is wealthy, I said it would depend on individual factors (yet another transparent attempt at a strawman argument presumably compelled by your vested interest (VI) condition).

Regarding "Granny Jones", however, that fits comfortably within one of your previous definitions of wealth (I know you have see-sawed about but it shouldn't be that hard for you to remember). I'll quote you below for ease of reference:

You highlighted this section of my post:

and then said this:- if someone has sufficient means they might not need to work for a wage any more but that is to do with their level of wealth

"You are getting the point I made now, we are talking about the definition of wealth, not about the "effort required to come by wealth".

So "Granny Jones" has sufficient means that she doen't need to work for a wage and thus, according to you, is wealthy. Moreover, if 'Granny Jones' feels that she is wealthy then who are you to tell her that she isn't?0 -

The availability of liquid funds is only relevant to liquidity. If one person has £100k in the bank and another owns a £200k house outright, who is wealthier?Crashy_Time said:

The availability of liquid funds is only one piece of the puzzle.Parking_Eyerate said:

This is just completely daft. You are talking about the availability of liquid funds. I know that you are absolutely obsessed with liquidity but its meaning is not a co-definition of wealth.Crashy_Time said:

Most sensible people understand that a "wealthy" person can lay their hands on 100k easier and quicker than a "Non wealthy" person, it isn`t any more complicated than that really. Having 100k "equity" in your house doesn`t make you wealthy, for obvious reasons.Norman_Castle said:Crashy_Time said:

You can`t do anything with your "earnings" though if it is always tied up in property, or if house prices crash? True wealth is something you can access when you need it without having to sell the roof over your head.Splatfoot said:We are in the process of selling our house. I have bought and sold at profit 3 times in my life so far. This is the last time, after buying at the end of 2006 just before the crash, as the next house we buy will be with no mortgage. I would never have been able to earn as much money through working as I have done through property. If I'd been renting all these years, I would absolutely be kicking myself.Economic wealth is an accessible fund to trade with. Monetary wealth is net worth. The ability to earn is potential revenue but is not measured as wealth. "True wealth" can be anything you want it to be, in monetary terms it means nothing.If you knew what you were talking about you would be able to explain.1 -

I bought my current house nearly 3 years ago and predict I will sell it in 2 years time. As I had a fair amount of equity in the previous property and moved to a less expensive area buying is much cheaper than renting. I expect I will sell it for less than I paid for it, anywhere between 20k and 40 k depending how bearish one is, . However over a 5 year period I will have saved myself at least 70k in rent and 90k if I were to rent a similar property ( house next door was rented until end of last year ). So a bit of a no brainer for me.

1 -

Surely in 3-4 months when furlough is lifted and more redundancies is when we are going to see the REAL fall in house prices. I'd personally wait.

2 -

Crashy_Time said:

The availability of liquid funds is only one piece of the puzzle.Parking_Eyerate said:

This is just completely daft. You are talking about the availability of liquid funds. I know that you are absolutely obsessed with liquidity but its meaning is not a co-definition of wealth.Crashy_Time said:

Most sensible people understand that a "wealthy" person can lay their hands on 100k easier and quicker than a "Non wealthy" person, it isn`t any more complicated than that really. Having 100k "equity" in your house doesn`t make you wealthy, for obvious reasons.Norman_Castle said:Crashy_Time said:

You can`t do anything with your "earnings" though if it is always tied up in property, or if house prices crash? True wealth is something you can access when you need it without having to sell the roof over your head.Splatfoot said:We are in the process of selling our house. I have bought and sold at profit 3 times in my life so far. This is the last time, after buying at the end of 2006 just before the crash, as the next house we buy will be with no mortgage. I would never have been able to earn as much money through working as I have done through property. If I'd been renting all these years, I would absolutely be kicking myself.Economic wealth is an accessible fund to trade with. Monetary wealth is net worth. The ability to earn is potential revenue but is not measured as wealth. "True wealth" can be anything you want it to be, in monetary terms it means nothing.If you knew what you were talking about you would be able to explain.Its only you thats puzzled.

2 -

I think I'm in that space, using simple figuresnannyto2 said:Surely in 3-4 months when furlough is lifted and more redundancies is when we are going to see the REAL fall in house prices. I'd personally wait.

£150K @2.5% over 25 years = £673 per month or Total £201878

reduce by 10% -

£135k @2.5% over 25 years = £606 per month = approx £20 k saving or

or exploit option to reduce term by 3 yrs with similar payment

£135k @2.5% over 22 years = £665 per month = approx saving £25 k

Factor as you see fit for figures that fit your circumstances. The fund could cover motoring costs for a car for a period or a number of great holidays. May pay for the kids to get through school/uni etc. So many ways that extra funding could be used but we seem hell bent on unnecessarily paying over the odds for housing.

WHY?1 -

BikingBud said:

reduce by 10% -nannyto2 said:Surely in 3-4 months when furlough is lifted

we seem hell bent on unnecessarily paying over the odds for housing. WHY?You are making a huge assumption that in 3 to 4 months you will be able to buy the same house for 10% less and you will still be able to get the same mortgage on the same terms.Some posters on this forum have been making the same flawed assumption for around 15 years now and even today are still paying their landlord's mortgage instead of their own... so what will you do in four months if the price of the house you are after has not dropped 10%?Every generation blames the one before...

Mike + The Mechanics - The Living Years2 -

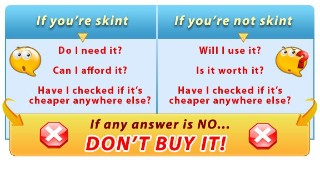

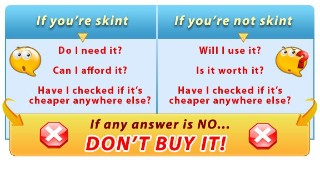

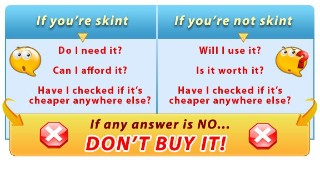

No I'm making no assumptions. I am commenting that I would be looking for a reduction of at least 10% and would expect other people here to do similar purely because they are members of moneysavingexpert.com:MobileSaver said:BikingBud said:

reduce by 10% -nannyto2 said:Surely in 3-4 months when furlough is lifted

we seem hell bent on unnecessarily paying over the odds for housing. WHY?You are making a huge assumption that in 3 to 4 months you will be able to buy the same house for 10% less and you will still be able to get the same mortgage on the same terms.Some posters on this forum have been making the same flawed assumption for around 15 years now and even today are still paying their landlord's mortgage instead of their own... so what will you do in four months if the price of the house you are after has not dropped 10%?Now you may consider that makes me the spawn of the devil but that's your issue not mine.

I'm suggesting people can save c £25K per 150K borrowed over the life of the mortgage by negotiating a reduction.

Do you pay asking price for everything?

It's extremely rare that I do

0 -

You're making a very blunt statement that you can get a 10% discount on anything which is imply not true. You can try and may even succeed, but it depends very much on area and demand. Not everyone is affected by this situation the same way, some not at all even. Some properties are indeed overpriced and one should pay even 20-30% less, but others are priced just right, so you can go in with your 10% reduction as much as you want, you'll be told to take a hike and for good reason.BikingBud said:

No I'm making no assumptions. I am commenting that I would be looking for a reduction of at least 10% and would expect other people here to do similar purely because they are members of moneysavingexpert.com:MobileSaver said:BikingBud said:

reduce by 10% -nannyto2 said:Surely in 3-4 months when furlough is lifted

we seem hell bent on unnecessarily paying over the odds for housing. WHY?You are making a huge assumption that in 3 to 4 months you will be able to buy the same house for 10% less and you will still be able to get the same mortgage on the same terms.Some posters on this forum have been making the same flawed assumption for around 15 years now and even today are still paying their landlord's mortgage instead of their own... so what will you do in four months if the price of the house you are after has not dropped 10%?Now you may consider that makes me the spawn of the devil but that's your issue not mine.

I'm suggesting people can save c £25K per 150K borrowed over the life of the mortgage by negotiating a reduction.

Do you pay asking price for everything?

It's extremely rare that I do

In the time you keep trying to have that 10%, you'll be paying rent and more than likely end up paying more than 10% on it anyway, so there you go. False savings especially for those that have been paying full house prices in rent alone. Think how much you paid in rent so far, then come and tell everyone about your "savings".6

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards