We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What is the best Rewards Current Account that I can shift my direct debits to?

Comments

-

Well, you have just made me check. It does not say anything about residency for eSaver account. I did not check through the entire 121-page t&cs document, but I did last time. And like I said, it was only when I asked about this workaround, that the advisor went off to check with their manager.

Since it does not state any residency pre-condition for the eSaver account, (and it doesn't), then you must admit, that it would be a nice little workaround. (It may have been the Midas savings account that I enquired about, but that one did not have a residency pre-condition that I could find either)

(It may have been the Midas savings account that I enquired about, but that one did not have a residency pre-condition that I could find either)

I work within the voluntary sector, supporting vulnerable people to rebuild their lives.

I love my job 0

0 -

Well that's strange - I could've sworn that I saw it say on the eSaver page but must've got mixed up with what pages I was looking at.Willing2Learn said:Well, you have just made me check. It does not say anything about residency for eSaver account. I did not check through the entire 121-page t&cs document, but I did last time. And like I said, it was only when I asked about this workaround, that the advisor went off to check with their manager.

Since it does not state any residency pre-condition for the eSaver account, (and it doesn't), then you must admit, that it would be a nice little workaround. (It may have been the Midas savings account that I enquired about, but that one did not have a residency pre-condition that I could find either)

(It may have been the Midas savings account that I enquired about, but that one did not have a residency pre-condition that I could find either)

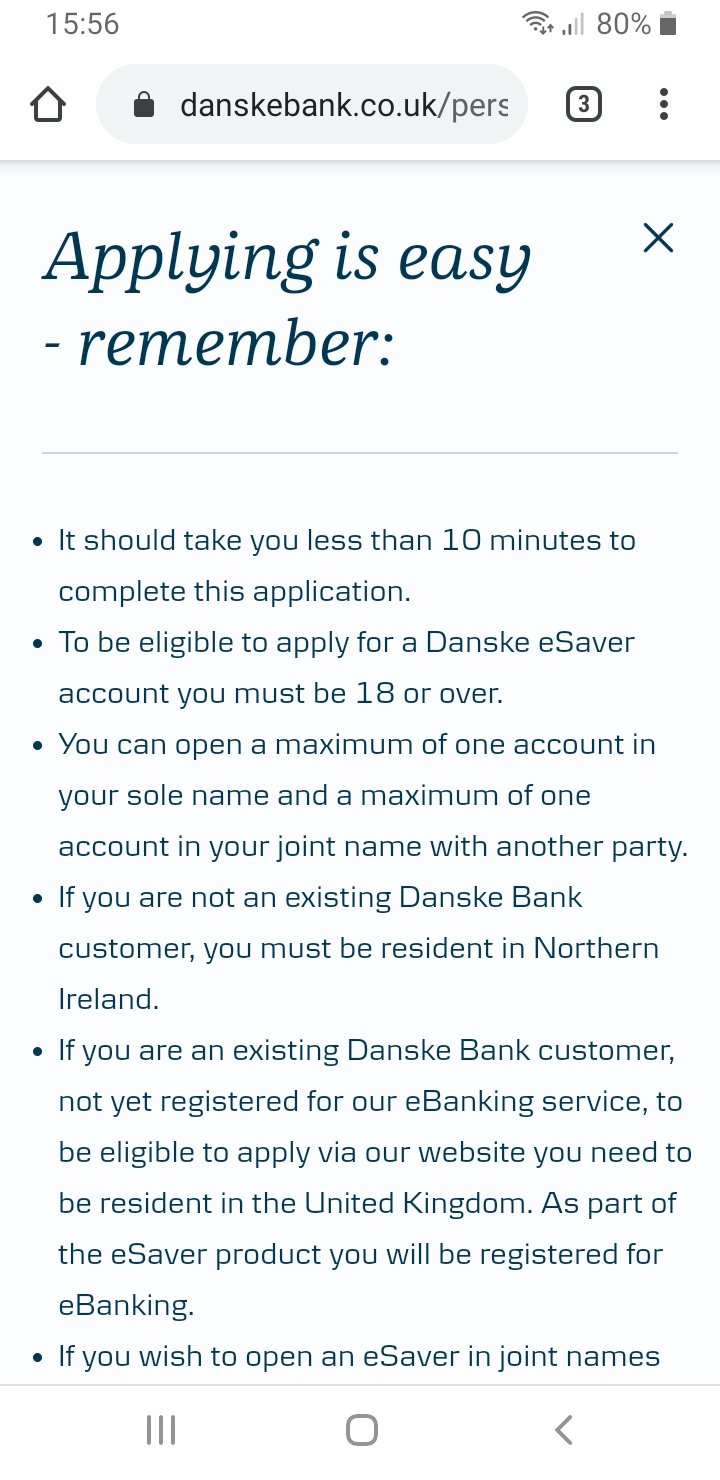

EDIT: It's when you click apply that it says it.

2 -

Well, I never clicked on the 'apply online' button to see what happens. All I can say, for both the eSaver and the Midas accounts, is that it does not specify that in the t&cs and I therefore regard it as a potential loophole, the same one through which I neatly passed through two years ago. lol

Well done to you though, for persevering with your investigations...

I work within the voluntary sector, supporting vulnerable people to rebuild their lives.

I love my job 0

0 -

2 years ago I didn't need to open an eSaver first. They just let me open a cash reward current account straight away.Willing2Learn said:Well, I never clicked on the 'apply online' button to see what happens. All I can say, for both the eSaver and the Midas accounts, is that it does not specify that in the t&cs and I therefore regard it as a potential loophole, the same one through which I neatly passed through two years ago. lol

Well done to you though, for persevering with your investigations... 0

0 -

Barclays is a good one. You get £7 in rewards less then £4 fee, or you can get more if you have other products with them.. like insurance or loans or mortgages.

However, Barclays is one of the few (if not the only) banks who opened their switch offers to existing customers, and also multiple times - so as an existing customer you are eligible for switch offers even if you participated before. I've been getting triple rewards (£36 minus the £4 fee) for 2 years now, as they had a switch offer at least two years in a row. I have a mortgage with them (extra £5 reward) and I'm a premier customer (triple rewards), but regular customers would have gotten double rewards.2 -

itinerant said:Barclays is a good one. You get £7 in rewards less then £4 fee, or you can get more if you have other products with them.. like insurance or loans or mortgages.

However, Barclays is one of the few (if not the only) banks who opened their switch offers to existing customers, and also multiple times - so as an existing customer you are eligible for switch offers even if you participated before. I've been getting triple rewards (£36 minus the £4 fee) for 2 years now, as they had a switch offer at least two years in a row. I have a mortgage with them (extra £5 reward) and I'm a premier customer (triple rewards), but regular customers would have gotten double rewards.Hi, so you get £36 a month?Also what do you mean by getting triple rewards?I'm not familiar with Barclays so don't know the details too well.Thanks0 -

Willing2Learn said:Well, I never clicked on the 'apply online' button to see what happens. All I can say, for both the eSaver and the Midas accounts, is that it does not specify that in the t&cs and I therefore regard it as a potential loophole, the same one through which I neatly passed through two years ago. lol

Well done to you though, for persevering with your investigations... Ed-1 said:

Ed-1 said:

2 years ago I didn't need to open an eSaver first. They just let me open a cash reward current account straight away.Willing2Learn said:Well, I never clicked on the 'apply online' button to see what happens. All I can say, for both the eSaver and the Midas accounts, is that it does not specify that in the t&cs and I therefore regard it as a potential loophole, the same one through which I neatly passed through two years ago. lol

Well done to you though, for persevering with your investigations... Looking at Dankse esaver when i click on application and click No to living in NI it tells me to call them to proceed and doesn't let me open online0

Looking at Dankse esaver when i click on application and click No to living in NI it tells me to call them to proceed and doesn't let me open online0 -

Eagle-eyes...bumbaclart1 said:Looking at Dankse esaver when i click on application and click No to living in NI it tells me to call them to proceed and doesn't let me open online

I work within the voluntary sector, supporting vulnerable people to rebuild their lives.

I love my job 1

1 -

If you are not familiar with Barclays, you wouldn't get the £5 reward for a Barclays mortgage, or the triple rewards for being a premier customer - unless your application for either/both of these is successful.bumbaclart1 said:itinerant said:Barclays is a good one. You get £7 in rewards less then £4 fee, or you can get more if you have other products with them.. like insurance or loans or mortgages.

However, Barclays is one of the few (if not the only) banks who opened their switch offers to existing customers, and also multiple times - so as an existing customer you are eligible for switch offers even if you participated before. I've been getting triple rewards (£36 minus the £4 fee) for 2 years now, as they had a switch offer at least two years in a row. I have a mortgage with them (extra £5 reward) and I'm a premier customer (triple rewards), but regular customers would have gotten double rewards.Hi, so you get £36 a month?Also what do you mean by getting triple rewards?I'm not familiar with Barclays so don't know the details too well.Thanks

As a new customer, you would start with a £7 reward minus a £4 charge - i.e. £3 net gain a month. As and if they might offer another reward for an account switch, you might choose to take up that offer.

1 -

I wonder if they will offer another double / triple this summer for account switch bonus i do hope so2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.3K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards