We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

Tax credits customers will continue to receive payments even if working fewer hours due to COVID-19

This is the information about changes in hours for tax credits being extended for longer than 8 weeks:

Update from HMRC today confirms that working hours rules have been relaxed to enable tax credits claims to continue -

‘Those working reduced hours due to coronavirus or those being furloughed by their employer will not have their tax credits payments affected if they are still employed or self-employed.

These customers do not need to contact HMRC about this change. We will treat customers as working their normal hours until the Job Retention Scheme and Self-Employment Income Support Scheme close, even if they are not using either scheme.

We’ll use the information we hold about the number of hours they normally work.

Customers can still report any other changes in income, childcare and hours in the normal way. However, they must tell us if they or their partner lose their job, are made redundant or cease trading.’

Comments

-

Bump for people claiming tax credits to see."All shall be well, and all shall be well, and all manner of thing shall be well."

0

0 -

Bumping for people claiming tax credits to see."All shall be well, and all shall be well, and all manner of thing shall be well."

1

1 -

I'd like to know what happens regarding working hours once the Job Retention Scheme ends. At the end of May the Self Employed Income Support Scheme copy was taken off the page this post mentions. However, the HMRC App itself still states working working hours have been relaxed until BOTH self employed and Job Retention scheme close.

To put it simply, if it is both schemes then working hours have been relaxed until April next year as the Self Employed Scheme has been extended. However, if the government have now changed their mind (as the page suggests), the App is wrong and relaxed hours will end in October this year when the Job Retention Scheme ends.

This could be crucial for some, especially for those who have to work 30 hours.

1 -

I have looked into this further, as my understanding was that CJRS was the determining factor in the ending of the WTC hours worked relaxation. The first mention of the point was in a press release dated 4 May 2020, which does not appear to have been amended. It refers to both employed and self employed, but uses only CJRS as determining how long the relaxation lasts. See

https://www.gov.uk/government/news/tax-credits-customers-will-continue-to-receive-payments-even-if-working-fewer-hours-due-to-covid-19

There is reference to SEISS as an alternative end date here, dated 23 May 2020:

https://revenuebenefits.org.uk/blog/coronavirus-update-working-hours

The actual situation appears to be neither. The legislation is here:

https://www.legislation.gov.uk/uksi/2020/534/made

For ease of understanding, there is an explanatory note:

https://www.legislation.gov.uk/uksi/2020/534/pdfs/uksiem_20200534_en.pdf

In particular:

"7.7 The government’s policy intent is that, for the period of the CJRS, furloughed workers and the self-employed should not be disadvantaged by losing entitlement to support they would “normally” get from tax credits.

7.8 This instrument makes changes to allow WTC entitlement to continue for up to 8 weeks after the CJRS ends in order for claimants to establish their normal hours worked.

7.9 This instrument also makes changes to allow claimants impacted by the coronavirus pandemic but not participating in the CJRS or SEISS to continue to satisfy the ‘hours normally worked’ and working ‘for’ or ‘in expectation of payment’ conditions of WTC."

I welcome anyone else's thoughts on what is rather difficult legislation (at least at this time of night), but it seems to me that new regulation 7E(7) says a coronavirus impacted worker (which a self employed person has to be to take advantage of the relaxation) ceases to be such when CJRS (not SEISS) ends, but there is a further period of grace of 8 weeks (and possibly 12, but the wording is obscure).1 -

Thanks for the input. However it should also be noted that regardless of what the government suggest, the press release WAS amended. Wayback Machine states it happened between 17th - 26th May.

On the 17th May the page mentioned SEISS as a determining factor. This is what the original poster quoted.

This then changed and SEISS was deleted, when I suspected amendments were confirmed that you have quoted. (Sorry I can't post links regarding Wayback machine as I have not been a member long enough).

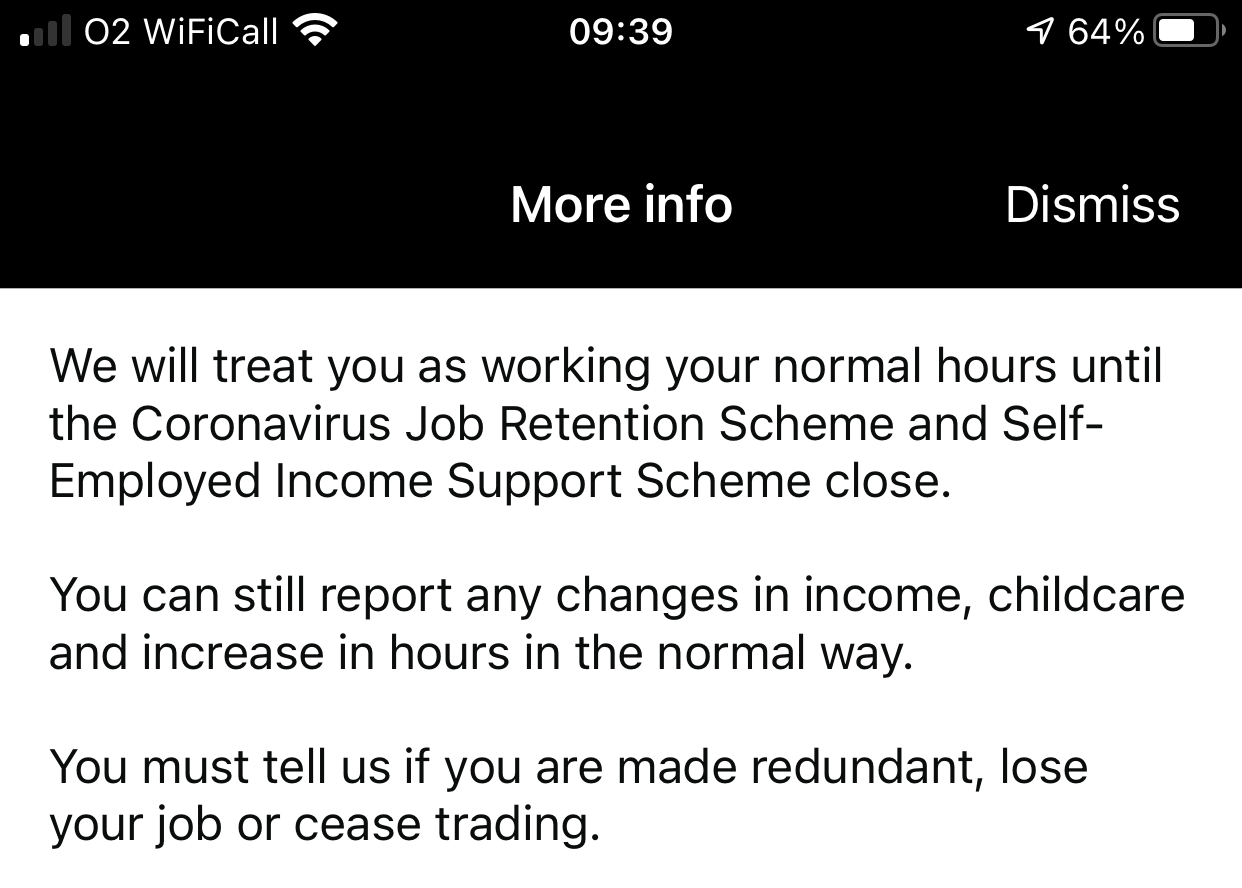

As I also mentioned what confuses matters even further, is the HMRC App since May has stated the following when clicking on the 'more info' link at the top of the tax credits page which says how much your tax credits payment is each month:

"We will treat you as working your normal hours until The Coronavirus Job Retention scheme and self-employed income support scheme close".

If this isn't the case and it is just CJRS, this should be clarified and this should be changed, as many I suspect will not be reporting changes in hours until April next year. This will then obviously affect many who can ill afford to pay the money back.

1 -

For mikeb300 who was unable to post links. From wayback machine

Press release on 4th May "Those working reduced hours due to coronavirus or those being furloughed by their employer will not have their tax credits payments affected if they are still employed or self-employed. We will treat customers as working their normal hours until the Job Retention Scheme and Self-Employment Income Support Scheme close, even if they are not using either scheme."

Between 17th and 26th May it changed to "Those working reduced hours due to coronavirus or those being furloughed by their employer will not have their tax credits payments affected if they are still employed or self-employed. These customers do not need to contact HMRC about this change. We will treat customers as working their normal hours until the Job Retention Scheme closes, even if they are not using the scheme."

It's actually quite alarming that the current page still appears to be a record of a press release made on 4th May with no indication that the content has been edited since publication - that seems to me to create a a false narrative,Information I post is for England unless otherwise stated. Some rules may be different in other parts of UK.1 -

Thanks for pointing me to this wayback machine. I agree with you that the government should not imply that the original press release was never amended. Unfortunately I don't think it helps, as the law supersedes the guidance. I suspect the amendment was an error that was quietly buried.1

-

As I also mentioned, it doesn't help that within the HMRC App itself it states 'Do not update your hours if they have decreased due to COVID-19' with a 'More info' link at the top of the tax credits page. When you click on it, you see the following screenshot. This suggests it is both. Either way it is a mess, and unless it is clarified, there could be quite a number who will be left owing money to HMRC.

1 -

I agree it is a mess. It may be that HMRC will be forced to follow their own App if it comes to it. Otherwise perhaps it is a matter to raise with an MP.1

-

I have contacted HMRC via webchat regarding this. They informed me the web app is incorrect, it is just CRJS and NOT SEISS even though their own app states otherwise. It does appear as mentioned earlier in this thread that the amendment was 'quietly buried', although HMRC forgot to change their own app. Nonetheless, I have had conflicting advice through this Webchat before. Even in this circumstance, the person mentioned they weren't sure regarding the grace period of 8 weeks mentioned in this thread as things change on a daily basis.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244K Work, Benefits & Business

- 599K Mortgages, Homes & Bills

- 177K Life & Family

- 257.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards