We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Is it still worth switching from Santander 123 to the Lite version?

koru

Posts: 1,546 Forumite

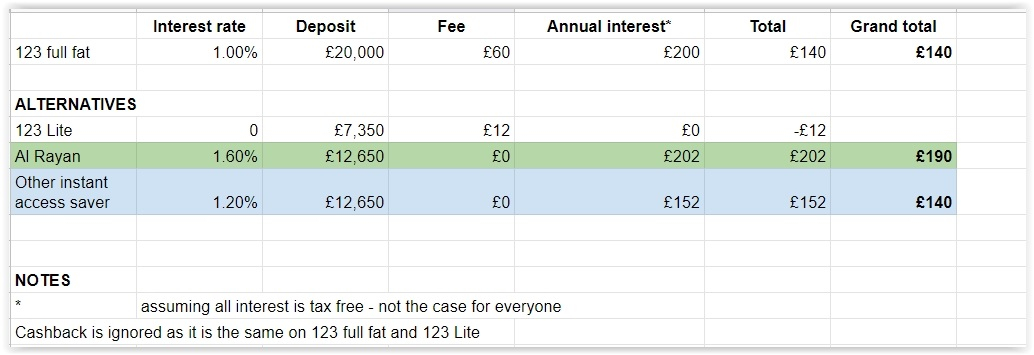

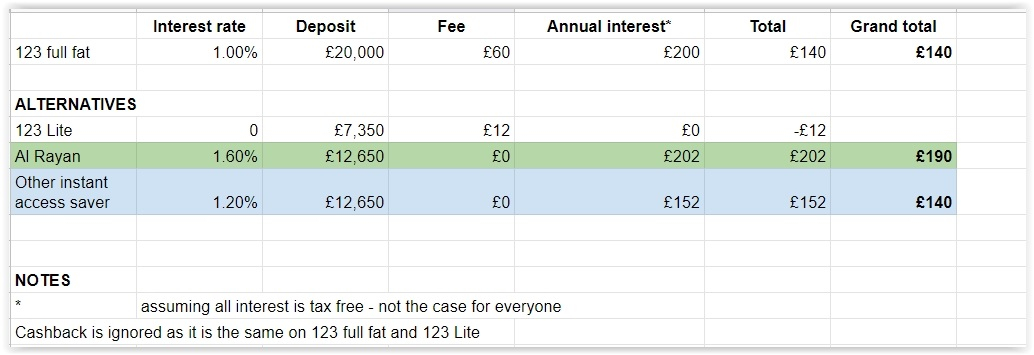

As the new lower interest rate on S123 hits about now, many will be following Martin's advice from a few months ago to downgrade to S123 Lite. Downgrading might still be beneficial, but before you do, consider whether recent falls in instant access rates have changed the equation for you.

The current best instant access rate is Marcus at 1.2%. Although that is a bit higher than the new 1% rate on S123, it is only 0.2% better. And if you switch to S123 Lite, you can't switch all your S123 balance to Marcus, because you need a 'float' in your current account to cover outgoings. With S123, you get 1% on the whole amount (up to £20k), including the float, but with S123 Lite you get 0%, so the net effect on interest depends on how big a balance you have in S123 Lite. Compared to S123, you get an extra 0.2% on what you move to Marcus, but you lose 1% on the float you leave in your S123 Lite.

Even if there isn't an interest benefit (or it is lower than if Marcus had not dropped its rates), switching to S123 Lite still saves £48 of annual fees. So, it might still save you money, but it might be worth redoing the maths for you.

I've decided to stick with S123, because it has an important benefit for me, which is that I don't need to watch the balance carefully to make sure I don't go overdrawn. I can just leave about £10-20k in it, which is enough to make sure that I never go overdrawn by accident. If I monitored my balance daily on S123 Lite, I could probably make sure my balance never went above £100 at the end of each day, so the rest could be earning an extra 0.2% in Marcus (and I'd pay £48 less fees). But I would continually have to be moving money back and forth and if I made a mistake I might go overdrawn. For me, it isn't worth it.

I'm not saying no-one should switch. Just that it isn't the right decision for everyone.

The current best instant access rate is Marcus at 1.2%. Although that is a bit higher than the new 1% rate on S123, it is only 0.2% better. And if you switch to S123 Lite, you can't switch all your S123 balance to Marcus, because you need a 'float' in your current account to cover outgoings. With S123, you get 1% on the whole amount (up to £20k), including the float, but with S123 Lite you get 0%, so the net effect on interest depends on how big a balance you have in S123 Lite. Compared to S123, you get an extra 0.2% on what you move to Marcus, but you lose 1% on the float you leave in your S123 Lite.

Even if there isn't an interest benefit (or it is lower than if Marcus had not dropped its rates), switching to S123 Lite still saves £48 of annual fees. So, it might still save you money, but it might be worth redoing the maths for you.

I've decided to stick with S123, because it has an important benefit for me, which is that I don't need to watch the balance carefully to make sure I don't go overdrawn. I can just leave about £10-20k in it, which is enough to make sure that I never go overdrawn by accident. If I monitored my balance daily on S123 Lite, I could probably make sure my balance never went above £100 at the end of each day, so the rest could be earning an extra 0.2% in Marcus (and I'd pay £48 less fees). But I would continually have to be moving money back and forth and if I made a mistake I might go overdrawn. For me, it isn't worth it.

I'm not saying no-one should switch. Just that it isn't the right decision for everyone.

koru

3

Comments

-

At 1.2% in your savings account, you can leave £7,350 in your Santander Lite before it costs you more than the full-fat 123. That is enough for many people's regular monthly outgoings. Many people also still have savings accounts that will pay more than 1.2% for some time yet.

1 -

I think you'll find the difference between the revised Santander interest and the Marcus account is more than 0.2%, its closer to three quarters of a percent.koru said:The current best instant access rate is Marcus at 1.2%. Although that is a bit higher than the new 1% rate on S123, it is only 0.2% better. And if you switch to S123 Lite, you can't switch all your S123 balance to Marcus, because you need a 'float' in your current account to cover outgoings. With S123, you get 1% on the whole amount (up to £20k), including the float, but with S123 Lite you get 0%, so the net effect on interest depends on how big a balance you have in S123 Lite. Compared to S123, you get an extra 0.2% on what you move to Marcus, but you lose 1% on the float you leave in your S123 Lite.0 -

You'll need to explain which bit of 1.2% - 1.0% = 0.2% is wrong.Neil_Jones said:

I think you'll find the difference between the revised Santander interest and the Marcus account is more than 0.2%, its closer to three quarters of a percent.koru said:The current best instant access rate is Marcus at 1.2%. Although that is a bit higher than the new 1% rate on S123, it is only 0.2% better. And if you switch to S123 Lite, you can't switch all your S123 balance to Marcus, because you need a 'float' in your current account to cover outgoings. With S123, you get 1% on the whole amount (up to £20k), including the float, but with S123 Lite you get 0%, so the net effect on interest depends on how big a balance you have in S123 Lite. Compared to S123, you get an extra 0.2% on what you move to Marcus, but you lose 1% on the float you leave in your S123 Lite.koru0 -

@koru, Mr Lewis does tend to shout about things a bit and yes, this is a money saving site. However, the suggestions than anyone keeping the full 123 account must be mad is perhaps overkill.

If the account works well for you that is all you need to know. Whether is costs you £5 per month or a bit more in lost opportunity is irrelevant if it is worth it for you.

In my opinion, reports of the death of this particular duck are somewhat exaggerated.

2 -

Thanks. That's a useful way to look at it. The break even Lite balance is £7350. So, you only get a net benefit to the extent that your average balance on the S123 Lite is less than £7350.colsten said:At 1.2% in your savings account, you can leave £7,350 in your Santander Lite before it costs you more than the full-fat 123. That is enough for many people's regular monthly outgoings. Many people also still have savings accounts that will pay more than 1.2% for some time yet.

If you manage the Lite really carefully, keeping the balance at zero each day, you could (in theory) benefit by 7350 @ 1.2% = £88. For me, it isn't viable to put so much effort into that, so I'd need a much higher balance. So maybe I could save £10 or £20.koru1 -

To be fair, I think the money at stake was somewhat higher when Martin pronounced that S123 was demised.RG2015 said:@koru, Mr Lewis does tend to shout about things a bit and yes, this is a money saving site. However, the suggestions than anyone keeping the full 123 account must be mad is perhaps overkill.

If the account works well for you that is all you need to know. Whether is costs you £5 per month or a bit more in lost opportunity is irrelevant if it is worth it for you.

In my opinion, reports of the death of this particular duck are somewhat exaggerated.

I was just a bit surprised when I did the maths again today and found that it is now pretty marginal (for me). It takes more than £20 for me to bother switching energy supplier and the same is true here.koru0 -

If your only alternative is a 1.2% account, yes, £7,350 is the cut-off. I would think it is safe to assume that that's much more than many people need as a float at any one point in time in their current account.koru said:So, you only get a net benefit to the extent that your average balance on the S123 Lite is less than £7350.koru said:If you manage the Lite really carefully, keeping the balance at zero each day, you could (in theory) benefit by 7350 @ 1.2% = £88.

Or £7,350 @ 1.6% = £117ish. Personally, I would never manage my account down to £0 (not without the help of yet-to-be-invented automation, anyway)

I agree with you. Different people have different requirements. At 1.5% in Santander, there wasn't enough incentive for me to ditch the account. Although the cut to 1% made me move to 123 Lite now, I can easily see that there are people for whom it makes perfect sense to stick with the full-fat 123.

1 -

I use the Santander 123 for the same reason as the OP and really like the fact that I can put a big chunk in and then leave it alone for several months without having to constantly feed it as the standing orders to regular savers etc get paid out, but the breaking news that the interest rate is going down to 0.6% on the 3rd August might make me think long and hard whether I will need to split my largish sum across the other high interest bank accounts - though that will depend on whether they keep their current rates or reduce them too (which in the current environment would not be too surprising to me).0

-

Well, it defiantly will be after 3rd Aug, when the 123 goes down to 0.60%0

-

I am one of those people who downgrade to 123 lite.

What I did was move most of the payment date of my bill to beginning of the month. Then left £300 in the account after those bills gone through.

I have a club lloyds for daily expense and credit card bills.

And Marcus for savings.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards