We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Recently changed job - qualify for any asisstance

Comments

-

Please see my earlier post on separate thread earlier this afternoon:Rose_Hill12345 said:Hi Everyone

I have been posting on here fairly regularly in the last week regarding the new Coronavirus Job Retention Scheme. Following the guidance which was released last Thursday, it has come to light that the scheme does not cover anyone who started or was due to start a new job after 28 February 2020. This has been causing major problems because new starters are finding that their job offers or contracts are being either withdrawn completely or deferred to a later date.

Over the last week, I have been in contact with my MP and highlighted to them the following problems regarding the scheme:- The wording currently says that only employees who are on pay roll as at 28 February 2020 are eligible, meaning that those who were in the middle of changing jobs cannot be furloughed by their new employers and are not sure if they can be furloughed by their current/former employers instead.

- Former employers (possibly, erroneously) believe that they are not allowed to furlough an employee in my position, because the scheme appears to cover only to those who would otherwise be facing redundancy, even though this may not actually be the case. The confusion seems to have been caused by the inconsistent wording of the guidance which uses the terms “redundancy” and “laid off” (which actually means temporary cessation of work but is often colloquially used as another term for redundancy) interchangeably. Note that The Covid-19: Support for Business Guidance specifically states "Under the Coronavirus Job Retention Scheme, all UK employers with a PAYE scheme will be able to access support to continue paying part of their employees’ salary for those that would otherwise have been laid off during this crisis".

The above issues leave those who were changing jobs in a difficult position where neither the new/former employer can help them.

I reminded my MP that she told me last week that the government’s intention behind the scheme was that anyone who was employed on the date of the announcement of the scheme will be covered. She had also told me that the reason for introducing the cut-off date of 28 February 2020 was simply to prevent businesses suddenly hiring lots of new employees and asking the government to pay for them. That being the case, I have asked my MP why it is that I, and others in my position, are being excluded from the scheme when that is clearly not what the government had intended to happen.

My MP has conceded that the wording of the guidance is unclear and inconsistent. She says that it has come to her attention that a number of employers are taking different approaches, which is causing real problems for those who were changing jobs. She has assured me that she and other ministers will look into the wording of the guidance again so that anyone in receipt of a job offer or who has handed in their notice to start a new job will not be unfairly penalised.

Essentially, it seems to me that the government’s intention behind the scheme was actually to ensure that anyone who is an employee on PAYE and unable to work due to Covid-19 should be covered.

As for how to get around the issue for now, my MP thinks that the government had probably intended that anyone who had received a job offer before 28 February 2020 should be covered by the scheme and that their new employer should have been able to furlough them. However, she accepts the guidance does not currently allow the new employer to do that. In which case, my MP has pointed me in the direction of ACAS which is, apparently, advising people who are still working their notice period to ask to be furloughed by the former employer instead.

Anyone who is in this difficult situation should definitely telephone ACAS for support and advice on how to negotiate with their former employers. However, note that another major flaw with this is that the former employer is under no obligation to agree to it. I don't know what, if anything, the government could do about that...

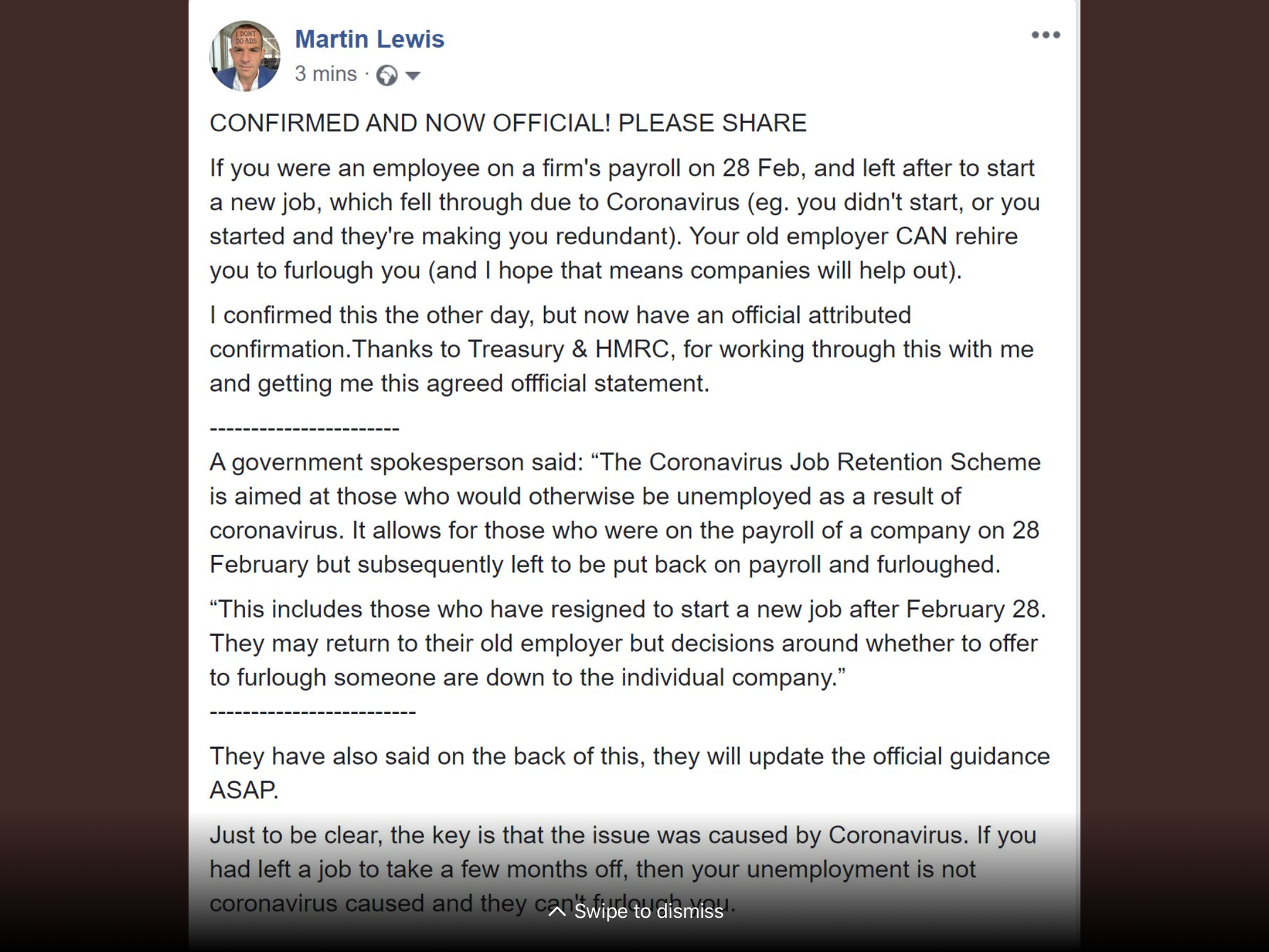

Whilst writing, I have seen that Martin Lewis is now online advising people to ask their former employers to furlough them. Look up the Money Saving Expert article called "Coronavirus: Self-employed and Employment Help". (Sorry, I am a new user so cannot yet post links on here).

I have asked my MP to keep me updated on progress and of any changes to the guidance.

In the meantime, I would add that the date of 28 February 2020 seems to be an arbitrary date which the government selected purely to ensure that only those who were genuinely on the PAYE system and making NI contributions would be eligible. In my view, this date is unnecessary because, surely, evidence of payslips and NI contributions made up to the date that the scheme was first announced (20 March 2020) should be sufficient to show HMRC that the claim is legitimate. Ideally, the government will change this cut-off date of 28 February 2020 so that it allows employers to furlough new starters immediately, rather than face the difficult decision of having to terminate their new employment contracts altogether (and, essentially, forcing a potential breach of contract claim). However, I don't know how it all works in practice and there may well be some reason why that is not possible. If the government does not change the cut-off date of 28 February 2020, then the only avenue for people switching jobs would still be to ask the former employer to furlough the ex-employee instead. As we've already discussed at length on these threads, the likelihood of that happening is low as there is simply no incentive for a former employer to do that.

I've noticed a few articles are starting to crop up online about this issue so it does seem that senior ministers are now starting to become aware of the problem.

Finally, I've come across a petition on change.org called "Review the government furlough scheme to include workers who started their job this month". It has 12,442 signatures at the time of writing this post. Definitely worth signing and sharing. Hopefully this will motivate the government to do something.

Note: after typing all of the above I have just read an article which states that 28 February 2020 is the date that HMRC has sight of all payroll data for February. I'm not sure if this is correct but it may explain why that particular date was chosen.0 -

Hopefully this will be looked at soon but in the meantime please sign and share the change.org petition mentioned in a previous post.

0 -

Supposed to be a change in the guidance very soon.0

-

Hi Jeremy - interesting, where did you hear that?!

0 -

Martins announced it on Twitter, not the change you were hoping for apparently It’s just clarifying that ex employers are entitled to rehire staff, the 28th of feb date will still be relevant.Rose_Hill12345 said:Hi Jeremy - interesting, where did you hear that?! Seems an absolutely ludicrous way to change a policy, but it’s not helping most people anyway, the ex employer can still obviously say no0

Seems an absolutely ludicrous way to change a policy, but it’s not helping most people anyway, the ex employer can still obviously say no0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards