We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Fidelity

barmeysmb1

Posts: 37 Forumite

Hi - just opened a S & S ISA via Cavendish, with their Fidelity Platform, with a view of buying some shares directly.

Started with a very tiny amount of £50 cash to buy shares currently priced at 373p, which by my calculation, should allow purchasing 13 units.

However, i can only add 10 units.

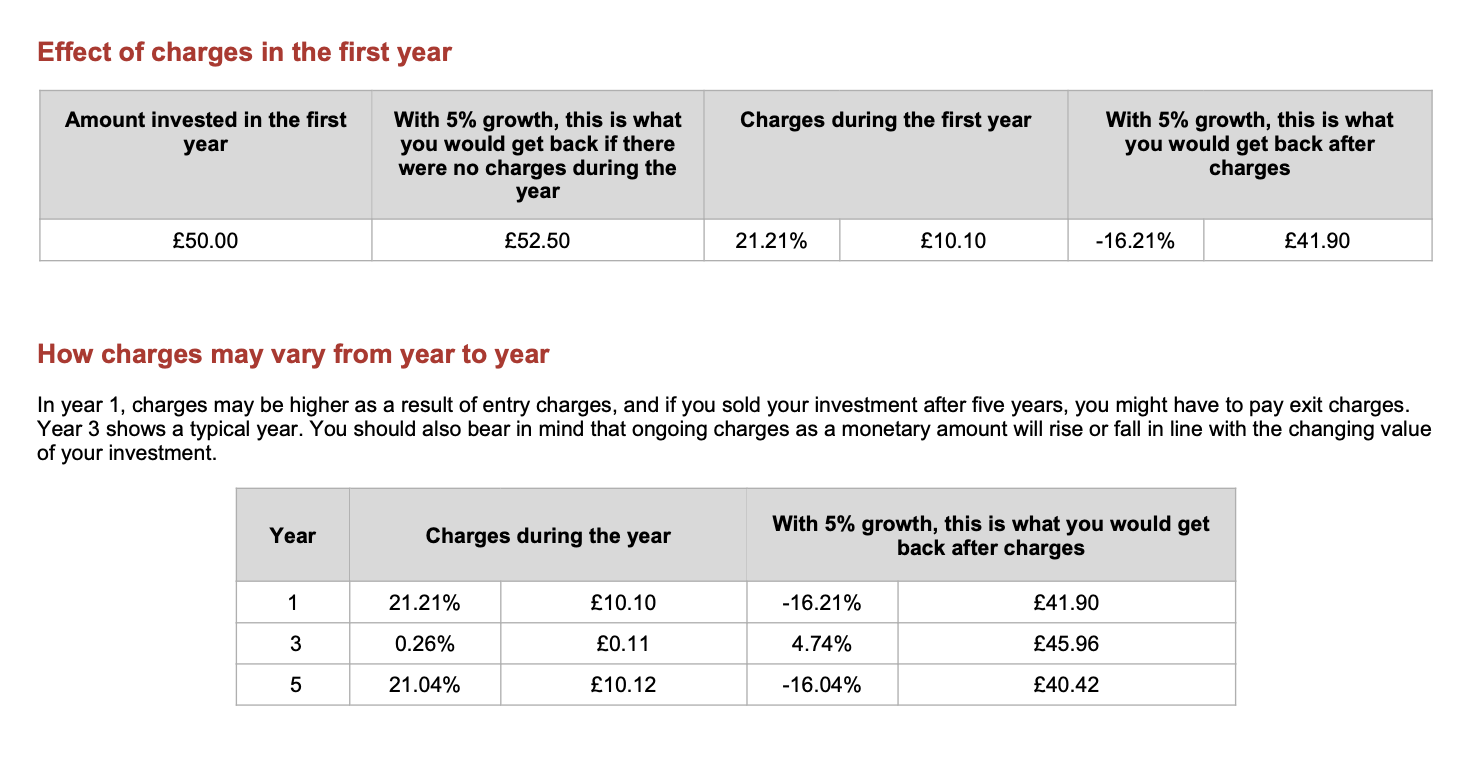

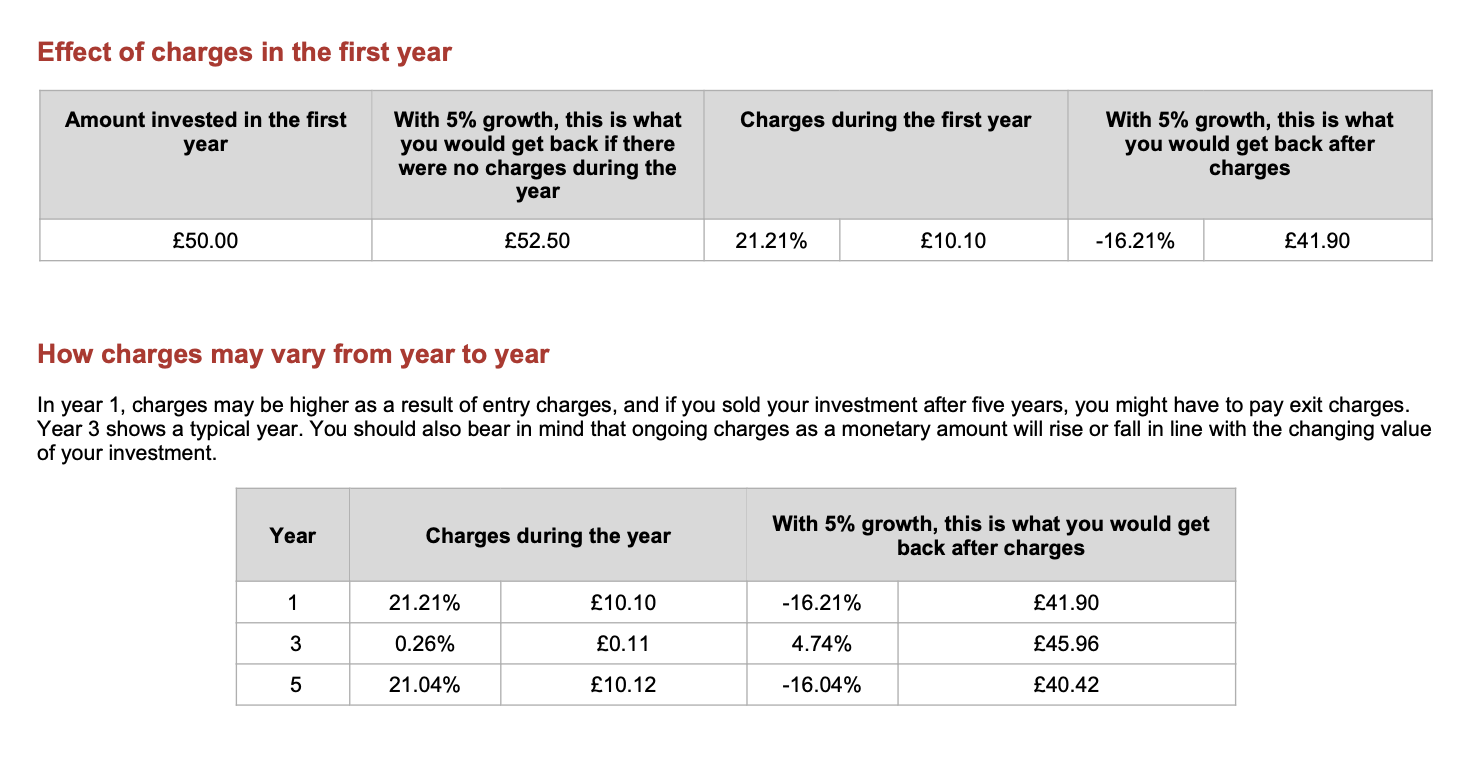

Looking at the 'illustration' i can see some high percentages of what might be potential charges based on growth - but can't really make sense of it.

See image attached.

Is is that charges vary depends on how well my selected shares perform ?

Bit lost - any help appreciated.

Started with a very tiny amount of £50 cash to buy shares currently priced at 373p, which by my calculation, should allow purchasing 13 units.

However, i can only add 10 units.

Looking at the 'illustration' i can see some high percentages of what might be potential charges based on growth - but can't really make sense of it.

See image attached.

Is is that charges vary depends on how well my selected shares perform ?

Bit lost - any help appreciated.

0

Comments

-

They charge £10 per transaction when buying (and selling) shares, so your £50 can only buy up to £40 worth of shares, which illustrates why buying in such small quantities is such a bad idea, as the £20 of buying and selling charges would mean that you'd need 50% growth just to break even. Buying individual shares is also a bad idea, but that's a different debate....

https://www.cavendishonline.co.uk/our-fees-2

1 -

Thanks eskbanker - straight to the point, appreciated.

Point noted - i'm still a newbie but at the same time realise individual shares can be a bad idea.

I want to ultimately diversify over a number of individual shares i've been eyeing up - around 20 or so - is there a more preferable platform with lesser charges - or is that more suited to another type of tax free wrapper ?0 -

You can model the cheapest way of doing what you plan by plugging your numbers into comparison sites such as:https://www.boringmoney.co.uk/calculator/

S&S ISAs are generally an advisable wrapper, although SIPPs are an alternative option if you're investing for retirement, but having paid into Cavendish you can't pay into another S&S ISA for the remaining three weeks of this tax year.

It's still generally considered to be a much better idea to buy collective investments, i.e. funds, rather than shares, at least when starting out, in order to achieve sensible diversification at low cost....2 -

Great links - thanks.

Looking at the monevator broker chart, indeed shows £10 charge buying/selling for Cavendish

Under Fidelity though it shows nothing "-" - does that mean, i could simply open an account via Fidelity directly (and close the one i opened) - i'd avoid this £10 charge ?0 -

ah...."but having paid into Cavendish you can't pay into another S&S ISA for the remaining three weeks of this tax year."

So for the next 3 weeks - i'm stuck to Cavendish, at least for this ISA and need to wait now ?0 -

No, it also shows £10 for Fidelity, but at a higher level as this applies across their product range. Comparison sites and tables are useful indicators, but can't ever be guaranteed to be 100% accurate so always research more thoroughly on the actual provider website for the definitive info: https://www.fidelity.co.uk/services/charges-fees/#399842barmeysmb1 said:Great links - thanks.

Looking at the monevator broker chart, indeed shows £10 charge buying/selling for Cavendish

Under Fidelity though it shows nothing "-" - does that mean, i could simply open an account via Fidelity directly (and close the one i opened) - i'd avoid this £10 charge ?2 -

I think you're reading the monevator broker chart incorrectly.Free buying and selling of shares, as distinct from funds, is not available anywhere AFAIK.It makes no sense trying to buy individual shares at £50 per share. The practical minimum should be more like £2,000 per share.Since you would need at least 15 or 20 different shares to be reasonably diversified, and since that's probably just UK shares also to buy some funds to cover other stock markets of the world, you probably need about £100,000+ invested in shares (in total, both directly and via indirectly funds) before buying individual shares is reasonably cost-effective.And even then, it's not really worth doing.1

-

Thank you eskbanker and tropic_of_Username011

I'm new so will

really research with the links provided, so appreciated

Now i understand the scale a bit more - the £50 was just as a bit of a learning of the functionality of Fidelity, prior to actually transferring in a lot of funds and then finding out i'm a bit stuck

So, i'm hearing that buying shares directly (and later selling shortterm) - effectively `trading` is not really that workable, at least on a small scale.

Are there any good recommendations with regards to medium risk funds / areas i should focus on ?

I'm happy to invest long term - and i hear the general advice of investing in whatever companies you consider are good businesses and those i value - the only thing is, i guess - funds have these pre-selected by the fund manager, managing these right ?

0 -

With small amounts of money you are generally looking at a mixed asset fund series (e.g Vanguard LifeStrategy, HSBC Global Strategy, etc) at a suitable risk level (for your volatility tollerance and anticipated period to withdrawal) on a platform that charges percentage fees. You can buy funds for a £0 trade cost on Cavendish but they will charge 0.25% ongoing. It would be crazy to pay £10 to directly buy small quantities of exchange traded assets.

1 -

Thanks for the replies, i'd like some help understanding the theory a bit....

Let's just say for a moment - i decided to trade (i know, i know :-) )

I buy £10k worth, of one share type only, at £1 per share, so £10,000 shares - yes totally against advice.

For buying that, Fidelity will charge £10 (Fundsmith charge)

And that share price doubles in price 10 days later (just for example) - so i then decide to sell.

For selling that, Fidelity will charge £10 (Fundsmith charge)

So at this point, now - i've got £20k, less the £20 charge = £19,980

For arguments-sake - putting aside all the 'no guarantees' etc - what are the gotchas here ?

ie - is it hard to sell that many shares ?

- my assumption is that £20 is the total cost to buy / sell the shares (£10 buy all 10,000 / £10 sell all 10,000)

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards