We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Liquidate entire portfolio until virus is over?

Comments

-

There were two parts, the second was getting back into the market when the "virus was over", as ever, how are you going to make that call? In a strict interpretation, it's hard to see when the virus will ever be "over", contained is probably more likely but even then it will be hard to know the point in time when that could be said to have happened.

1 -

Staying put certainly served me well. Again.

Staying put certainly served me well. Again.

I am one of the Dogs of the Index.5 -

That's the problem with this strategy of course. AIUI the OP has bet not only his own farm but those of his family too so they've increased their net worth buy 10% in 3 months. If it was me I'd buy back into the market now and be delighted I could now buy 10% more shares.coyrls said:There were two parts, the second was getting back into the market when the "virus was over", as ever, how are you going to make that call? In a strict interpretation, it's hard to see when the virus will ever be "over", contained is probably more likely but even then it will be hard to know the point in time when that could be said to have happened.

I suspect the OP and typical liquidator is looking for a better return.0 -

Well all I'll say is I'm glad I didn't do what the headline suggested. I opened my S&S ISA 3 years ago funding it sometimes regularly at £200 a month, sometimes throwing in a four figure lump sum and in all cases buying VLS80. Before the crash it was up roughly 9%, at the bottom it was down -12%. As I type this today it's now back to 8.8%. Only maybe 6 months of purchases, those from May to December 2019 as I made none in Jan/Feb 2020 are now actually in negative value but even then only by a couple of percent. All previous purchases are still in profit, the early ones by 20% which were still in positive gains at the bottom of the market. The losses I've got from May-Dec 2019 are more than compensated for by the money I threw in in March which is up over 10%.Proof that time in the market is valid.0

-

I am also in the 'ride-it-out' camp.ChesterDog said:Staying put certainly served me well. Again.

My portfolio is now back to where it was 3 months ago. I am more than content that I followed the collective advice of the MSE sages and stayed put.

What happens over the next months/years is anyone's guess and I see no reason to change strategy or to adjust asset allocation. Timing the market formed no part of my strategy in January, and nothing that has happened since has changed my view.

1 -

coyrls said:There were two parts, the second was getting back into the market when the "virus was over", as ever, how are you going to make that call? In a strict interpretation, it's hard to see when the virus will ever be "over", contained is probably more likely but even then it will be hard to know the point in time when that could be said to have happened.The point at which "the virus is over" is the same as the one where "the uncertainty has reduced" "things have settled down" "blah blah" in every previous crash. It is the point at which there are no further gains to be made by buying shares before people unable to cope with communal panic have added themselves back into the aggregate demand; in other words, when stockmarkets are back to peak levels and market timers have lost any opportunity to recover their losses."I'll buy back in when Covid has gone away" is like saying "I'll buy back in when Western economies have resolved their deep-seated debt issues". Or when an anxiety-ridden parent says to their child "You can have a car when I'm certain you won't crash it". It means exactly the same thing as "I'll never invest in the stockmarket" but makes a pretence at rationality.4

-

I was planning to make the shift anyway, sold out of:

- EdenTree Higher Income Fund

- Marlborough Multi Cap Income Fund

- Royal London Sterling Extra Yield Bond

- Schroder Small Cap Discovery

Just waiting to get shot of what's left of the Woodford fund (now called LF Equity Income) and i'll drop that into SWDA too.

0 -

I think the title should have been "liquidate portfolio until market has turned (and market thinks virus is over)I was in the "fortunate" position of holding cash not investments for other reasons. The fall allowed me to buy in at a lower level than before the virus though I did not time the bottom exactly.My finger is never far from the "sell" button in case it all goes wrong again, e.g massive second surge.I will also be hovering over the button in the run up to Q2 GDP figures. I think they are going to be nasty. It's a question of more or less nasty than the market has priced in.0

-

My finger is never far from the "sell" button in case it all goes wrong again, e.g massive second surge.If there's a massive second surge it will be too late to press the sell button. Did you mean the buy button or did you not learn the lesson from your accidental successful timing the market?I will also be hovering over the button in the run up to Q2 GDP figures. I think they are going to be nasty. It's a question of more or less nasty than the market has priced in.At which level of published Q2 OECD GDP growth will the market go up if it's higher or down if it's lower?If the answer is "I have no idea" you're proposing to place a spread bet with no idea what the offered spread is. It's no different to me saying "I think that Surrey will score a certain number of runs in the next county cricket match, but I'm not going to tell you what it is. Would you like to bet that they'll score higher or lower?"When Q2 GDP figures are released, all the economic activity which makes up Q2 GDP will either have happened (most of it weeks or months ago) or it won't. You can't ask for a better example of something that the market has already priced in. The publication of GDP figures often causes a spike in the markets one way or the other but traders use all sorts of news items to justify pressing buttons throughout their working day. It's still indistinguishable from randomness and there is no evidence that anyone can beat the market by predicting whether published GDP figures will be higher or lower than expected.

1 -

ChesterDog said:

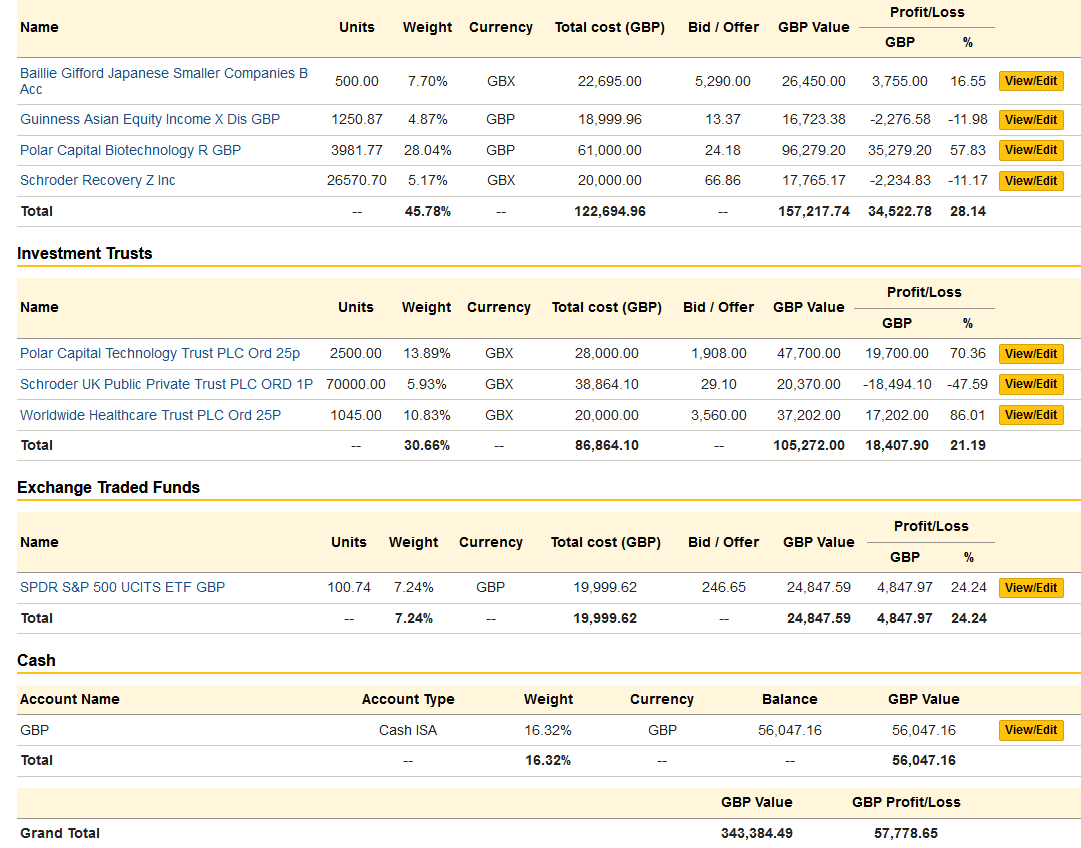

Staying put certainly served me well. Again.Likewise - apart from the addition of the S&P 500 ETF (bought 120320) nothing has been changed in my portfolio since the start of the year. This is my main portfolio:

Staying put certainly served me well. Again.Likewise - apart from the addition of the S&P 500 ETF (bought 120320) nothing has been changed in my portfolio since the start of the year. This is my main portfolio:

There are a couple of funds in my actual portfolio that are not listed on trustnet portfolio tracker, but apart from them (about 10% of the total, and counted as cash - they have not done well, but that is all I will say about them here) and the Japanese smaller companies fund % gains being off because I sold some and there is no way on trustnet to tell it that (as far as I'm aware), the trustnet portfolio tracker (and screen shots of it above) is accurate. Apologies for the large blank gaps, which were put there to stop my previous image hosting company from overwriting the data with their water mark - then I discovered I could upload pictured direct!

There are a couple of funds in my actual portfolio that are not listed on trustnet portfolio tracker, but apart from them (about 10% of the total, and counted as cash - they have not done well, but that is all I will say about them here) and the Japanese smaller companies fund % gains being off because I sold some and there is no way on trustnet to tell it that (as far as I'm aware), the trustnet portfolio tracker (and screen shots of it above) is accurate. Apologies for the large blank gaps, which were put there to stop my previous image hosting company from overwriting the data with their water mark - then I discovered I could upload pictured direct!

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards