We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Liquidate entire portfolio until virus is over?

Comments

-

Obviously the car. However I did actually need a new car, and I got a cracking deal wich was actually just as cost effective as buying 2nd hand.Thrugelmir said:

Which will drop the fastest. The value of your new car or the investments you've bought.ZeroSum said:It's funny cos I've just bought a new car, and sold out a load of equities a week before the crash to fund it. Now chucking money back in at a low rate.

So all in all, it worked out quite well.0 -

So I assume you have sold everything and awaiting the sub-5000 day when you bet back in?2010 said:

Yea, like when the ftse100 was 7500 a couple of weeks ago.StevieJ said:As they say on Wall St. 'If you are going to panic, panic early'

Lost 1000 points since then and Dow futures predict another big sell off today in USA.

The trend is downwards but how far, sub 5000 on the ftse is quite feasible.0 -

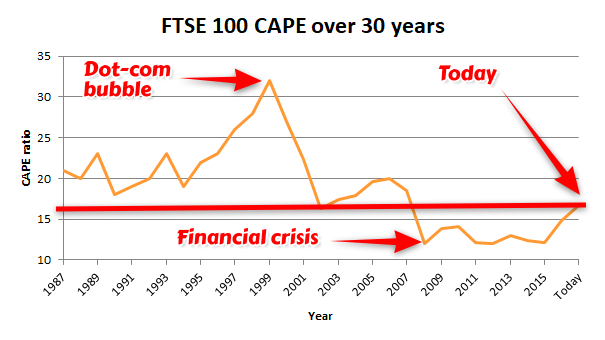

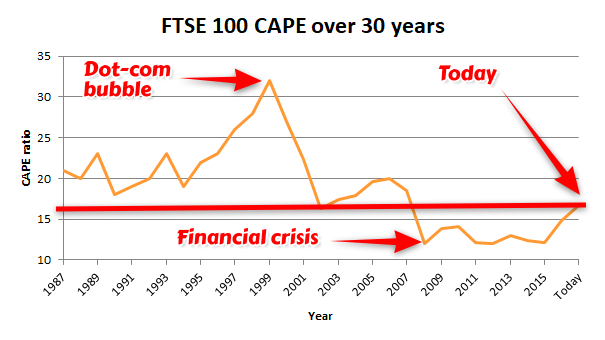

The FTSE 100 CAPE ratio in 1999 was over 30. Today it is 16.

The two are not comparable.

Im A Budding Neil Woodford.1 -

That is what I was thinking, but does that mean lots of investors will be able to time the market correctly?Linton said:

My prediction is that as soon as the number of coronavirus cases begins to level off market prices will rise quite steeply as investors buy in at the bottom.2010 said:

Some people aren`t around in the long term, to wait 20 years for the markets to get back to where they were.EdGasketTheSecond said:Some companies aren't around in the long term; like Carillion, Thomas Cook, and now Flybe

0 -

Some will but I suspect the prices will already have risen significantly before the majority will feel ready to risk it. How many people will want to sell just at the time prices are rising?Audaxer said:

That is what I was thinking, but does that mean lots of investors will be able to time the market correctly?Linton said:

My prediction is that as soon as the number of coronavirus cases begins to level off market prices will rise quite steeply as investors buy in at the bottom.2010 said:

Some people aren`t around in the long term, to wait 20 years for the markets to get back to where they were.EdGasketTheSecond said:Some companies aren't around in the long term; like Carillion, Thomas Cook, and now Flybe

1 -

Nor are the current constituents of the index.benbay001 said:The FTSE 100 CAPE ratio in 1999 was over 30. Today it is 16.

The two are not comparable. 0

0 -

That is what I was thinking, but does that mean lots of investors will be able to time the market correctly?My prediction is that as soon as the number of coronavirus cases begins to level off market prices will rise quite steeply as investors buy in at the bottom.

That assumes it is simply about the virus & numbers infected.

How many small and medium cap companies will go under during the inevitable cash crunch in the coming months?

Will debt defaults trigger another credit crunch in the interim?

Could get a lot worse before it gets better.1 -

So these people who invested in passive funds because no-one can beat the markets now want to outsmart the market.

Crazy.4 -

Maybe you should say "So some of these people..." I'll take a look at the end of the quarter and maybe do some rebalancing of my mostly passive funds. People with VLSxxx will be automatically rebalanced.LobsterMemory said:So these people who invested in passive funds because no-one can beat the markets now want to outsmart the market.

Crazy.“So we beat on, boats against the current, borne back ceaselessly into the past.”1 -

I don't necessarily see the contradiction with owning passive funds and attempting to time the market. Not something I'd do, but I suspect the main motive for holding passives is people don't think active managers are worth their fees over the long run. Conversely, market timing has little to no role in the majority of active funds.LobsterMemory said:So these people who invested in passive funds because no-one can beat the markets now want to outsmart the market.

Crazy."Real knowledge is to know the extent of one's ignorance" - Confucius0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards