We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

TSB have done that sum (showing workings) for you here https://www.tsb.co.uk/savings/monthly-saver/joebob said:

How much interest would that work out at if you paid maximum in ?ranciduk said:Today TSB upped their monthly saver to 5%1 -

And now, 2 days later, yet another replacement Interest Rates leaflet. Still no change to the open or closed RS accounts.ForumUser7 said:I'm baffled by their policy on this, but again, Loughborough BS has increased their rates and not increased the Regular Saver Issue 1. Seems to be a new rate sheet every couple of weeks!

https://www.theloughborough.co.uk/wp-content/uploads/2020/10/Interest-Rate-Poster-23-January-2023.pdf

Must be spending a fortune on leaflet & poster reprinting for branches.

This time it appears to be that they have simply introduced a 120 day notice ISA. Amazing that they didn't know about this 2 days ago.

source1 -

Perhaps due to the frequent printing costs, they cannot afford to increase rates? 😂happybagger said:

And now, 2 days later, yet another replacement Interest Rates leaflet. Still no change to the open or closed RS accounts.ForumUser7 said:I'm baffled by their policy on this, but again, Loughborough BS has increased their rates and not increased the Regular Saver Issue 1. Seems to be a new rate sheet every couple of weeks!

https://www.theloughborough.co.uk/wp-content/uploads/2020/10/Interest-Rate-Poster-23-January-2023.pdf

Must be spending a fortune on leaflet & poster reprinting for branches.

This time it appears to be that they have simply introduced a 120 day notice ISA. Amazing that they didn't know about this 2 days ago.

sourceIf you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

Wasn’t going to bother with another TSB RS but with current one maturing on 6/2 and the increase to 5% might as well go all in again.0

-

£81.25 on average if you start with an opening deposit and make additional deposits on the same day each month. The same return as HSBC but with withdrawal flexibility. The TSB illustration opens the account on the 1st March but doesn't make a deposit until the 25th, hence the lower interest.joebob said:

How much interest would that work out at if you paid maximum in ?ranciduk said:Today TSB upped their monthly saver to 5%

https://www.moneysavingexpert.com/savings/regular-savings-calculator/

1 -

If £250 was paid in on the first of every month, the interest would be approximately £81.25.joebob said:

How much interest would that work out at if you paid maximum in ?ranciduk said:Today TSB upped their monthly saver to 5%

Quick calculation is £250 x 5% x 6.5 = £81.25

I have calculated a more precise figure starting on 1st Feb 2023 and this comes out at £81.82

If you start on 1st March 2023 the interest will be £81.23

0 -

Re Loughborough (but is relevant to any RS)

My monthly contribution is currently just set at the minimum - due to poor rates.

At the end of each month (my contributions to my many RS go out at the beginning of the month) I check the rates of the various RS I pay into compared to the best Instant Access I hold.

If the RS rate is lower I:

Reduce to minimum / stop payment (where possible)

Withdraw balance (again where rules of account allow).

In these dynamic rate times it's a little more effort than the previous few years but still worthwhile I feel.2 -

@patrington re loughborough BS, when I asked, they said you can skip monthly payments whenever you wish, so you could probably stop your monthly contribution if you wanted toPatrington said:Re Loughborough (but is relevant to any RS)

My monthly contribution is currently just set at the minimum - due to poor rates.

At the end of each month (my contributions to my many RS go out at the beginning of the month) I check the rates of the various RS I pay into compared to the best Instant Access I hold.

If the RS rate is lower I:

Reduce to minimum / stop payment (where possible)

Withdraw balance (again where rules of account allow).

In these dynamic rate times it's a little more effort than the previous few years but still worthwhile I feel.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

Thanks - I had £10.- £1000 as my contribution min and max on my records for my Flex Monthly Saver.ForumUser7 said:

@patrington re loughborough BS, when I asked, they said you can skip monthly payments whenever you wish, so you could probably stop your monthly contribution if you wanted toPatrington said:Re Loughborough (but is relevant to any RS)

My monthly contribution is currently just set at the minimum - due to poor rates.

At the end of each month (my contributions to my many RS go out at the beginning of the month) I check the rates of the various RS I pay into compared to the best Instant Access I hold.

If the RS rate is lower I:

Reduce to minimum / stop payment (where possible)

Withdraw balance (again where rules of account allow).

In these dynamic rate times it's a little more effort than the previous few years but still worthwhile I feel.0 -

I was talking about the RSI 1Patrington said:

Thanks - I had £10.- £1000 as my contribution min and max on my records for my Flex Monthly Saver.ForumUser7 said:

@patrington re loughborough BS, when I asked, they said you can skip monthly payments whenever you wish, so you could probably stop your monthly contribution if you wanted toPatrington said:Re Loughborough (but is relevant to any RS)

My monthly contribution is currently just set at the minimum - due to poor rates.

At the end of each month (my contributions to my many RS go out at the beginning of the month) I check the rates of the various RS I pay into compared to the best Instant Access I hold.

If the RS rate is lower I:

Reduce to minimum / stop payment (where possible)

Withdraw balance (again where rules of account allow).

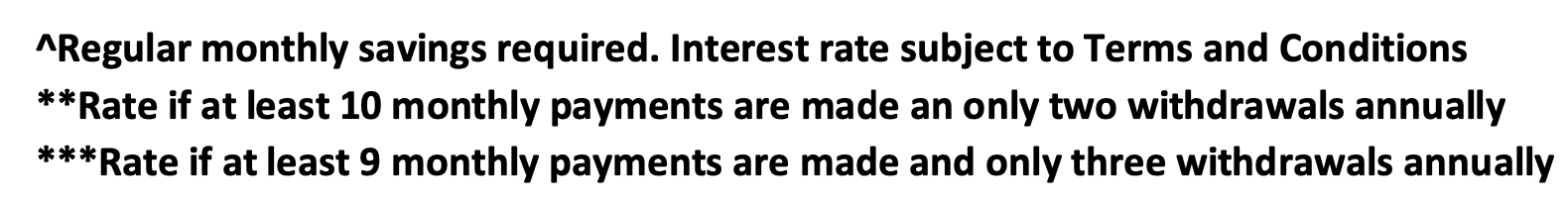

In these dynamic rate times it's a little more effort than the previous few years but still worthwhile I feel.For yours, the 2.50% Flexible Monthly Saver, it says 2.50% ***Rate if at least 9 monthly payments are made and only three withdrawals annually and ^Regular monthly savings required. Interest rate subject to Terms and Conditions

Additionally that product still says Flexible Monthly Saver £10-£500^***, not £10-£1000

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards