We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

@Chris_the_bee I know about that increase - I realise now I did not phrase that very well. I mean the top paying RS at Darlington BS is 3.5% (their special occasion, green, and regular saver) but they should've also increased the rate to 3.5% on their Darly Young Saver, Teen Goal Saver, High Days & Holidays Saver, and Junior High Days & Holidays Saver at the same time. They didn't, like how Chorley didn't also. But after Chorley received customer dissatisfaction (and some of us wrote to Darlington), they changed it. I suppose I'm hoping Darlington will listen to our dissatisfaction and increase the rate on all of them to match their special occasion, green, and regular savers.chris_the_bee said:

WEF 30th Nov, Darlington did increase Special Occasion, Green and Regular Savers to 3.5%.ForumUser7 said:

Hopefully Darlington Building Society takes note and increases all their RSs to 3.5% to match their top paying one too - high days and holidays, capital super saver, children’s regular savers etc.where_are_we said:I have been informed by Chorley BS, that following customer dissatisfaction (it wasn`t just me?) with the interest rate of their new Seasonal Saver Issue3 30/11/23 @2.3% compared to their new RS 30/11/23 @3.5%, they have decided to upgrade the interest rate on the new SS3 to 3.5% to match the new RS.This will happen on the 15th December (I think that is the date mentioned, I didn`t write it down because I was in the garden brushing the soil off my dahlia tubers prior to parking them in a box in the garage)SS3 is only available as a maturity product. RS 30/11/23 is still a superior product because you can discontinue monthly payments if the variable interest rate becomes uncompetitive. SS3 30/11/23 is less flexible because it`s T&C`s state - "if you fail to make the minimum payment (minimum monthly deposit £25) in any calendar month your account will revert to our Easy Access Chorlean Account. No withdrawals or closure make both accounts borderline to be worth opening. You can only have one account - either the SS3 or the RS.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

Lost patience with High Days. Closed it and put some in a fixed rate, with the rest to be fed into Bucks RS Locals and ESBS, as well as Darlo's open RS1

-

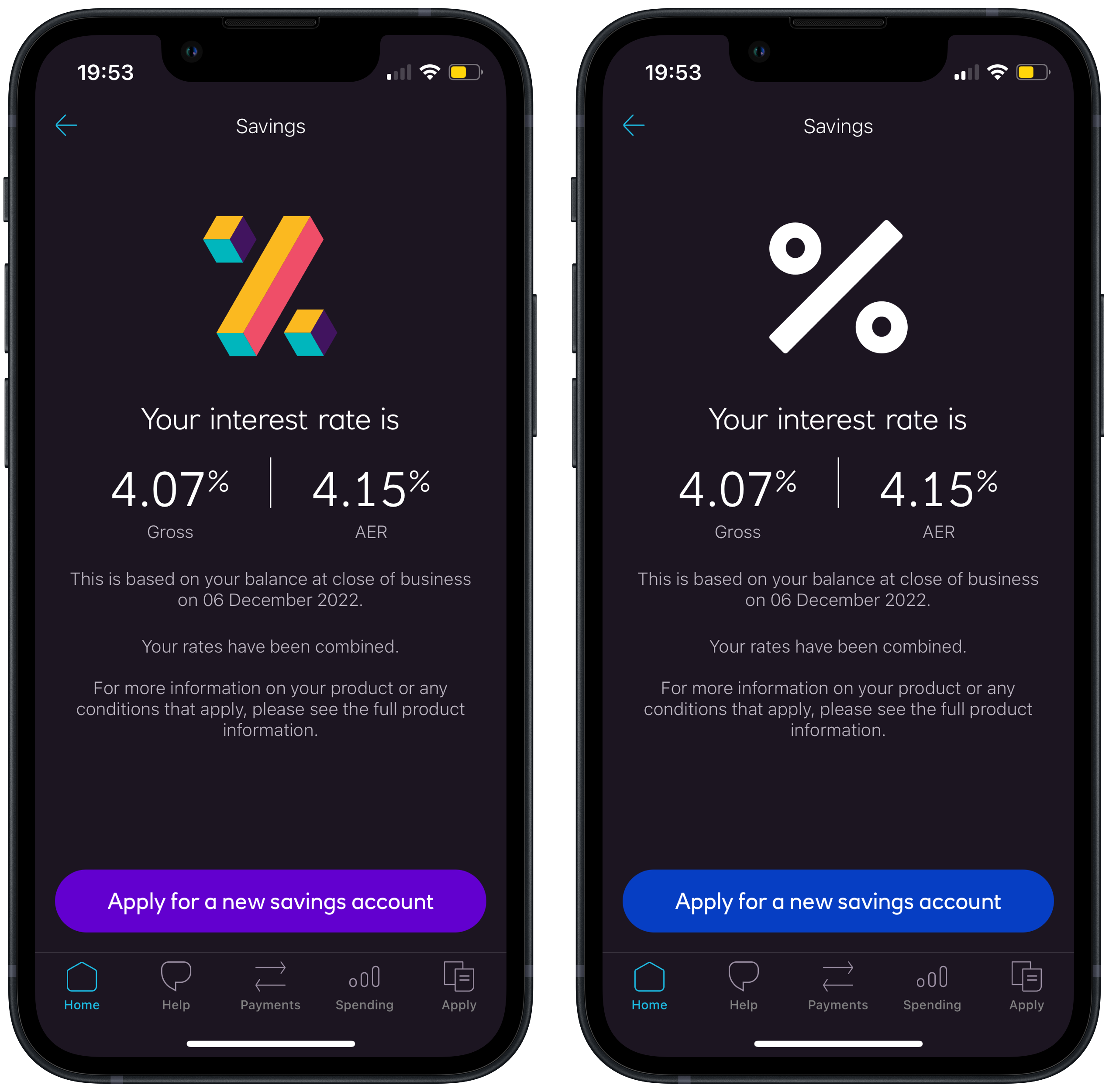

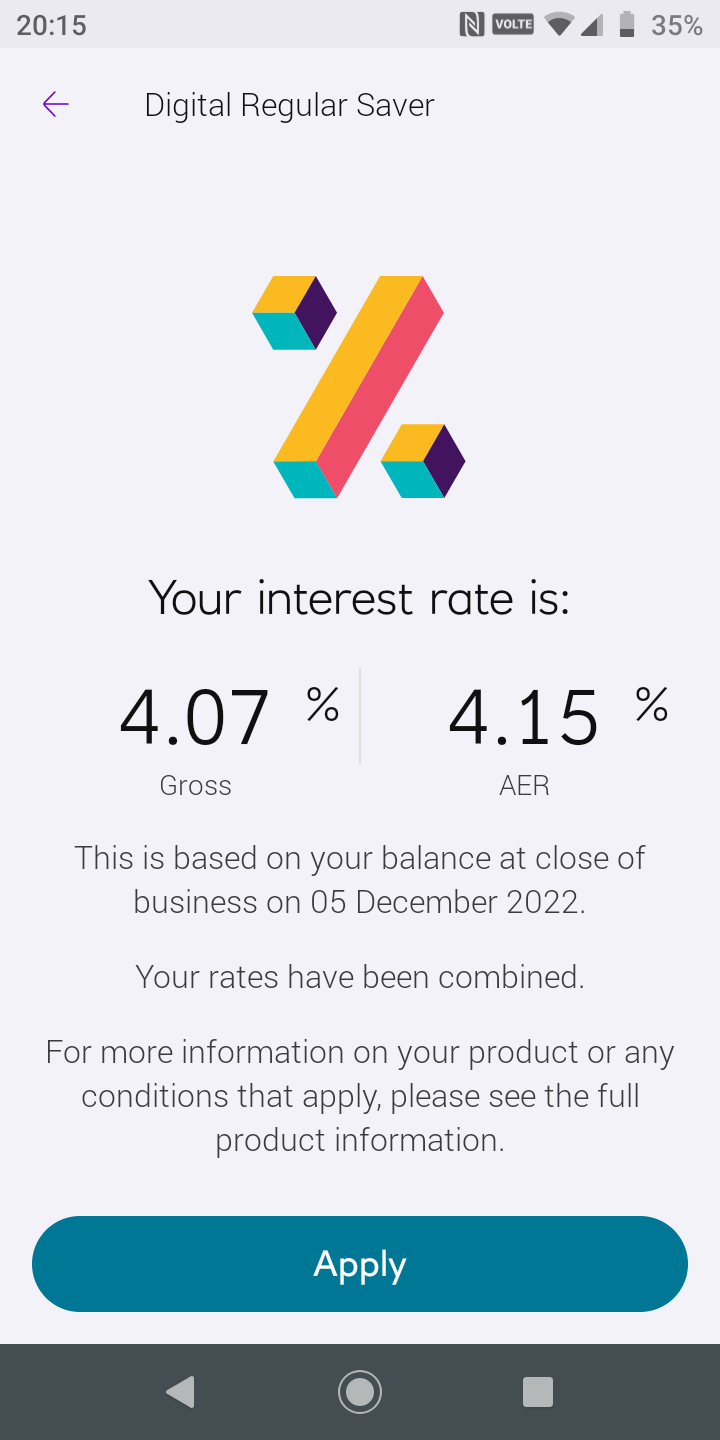

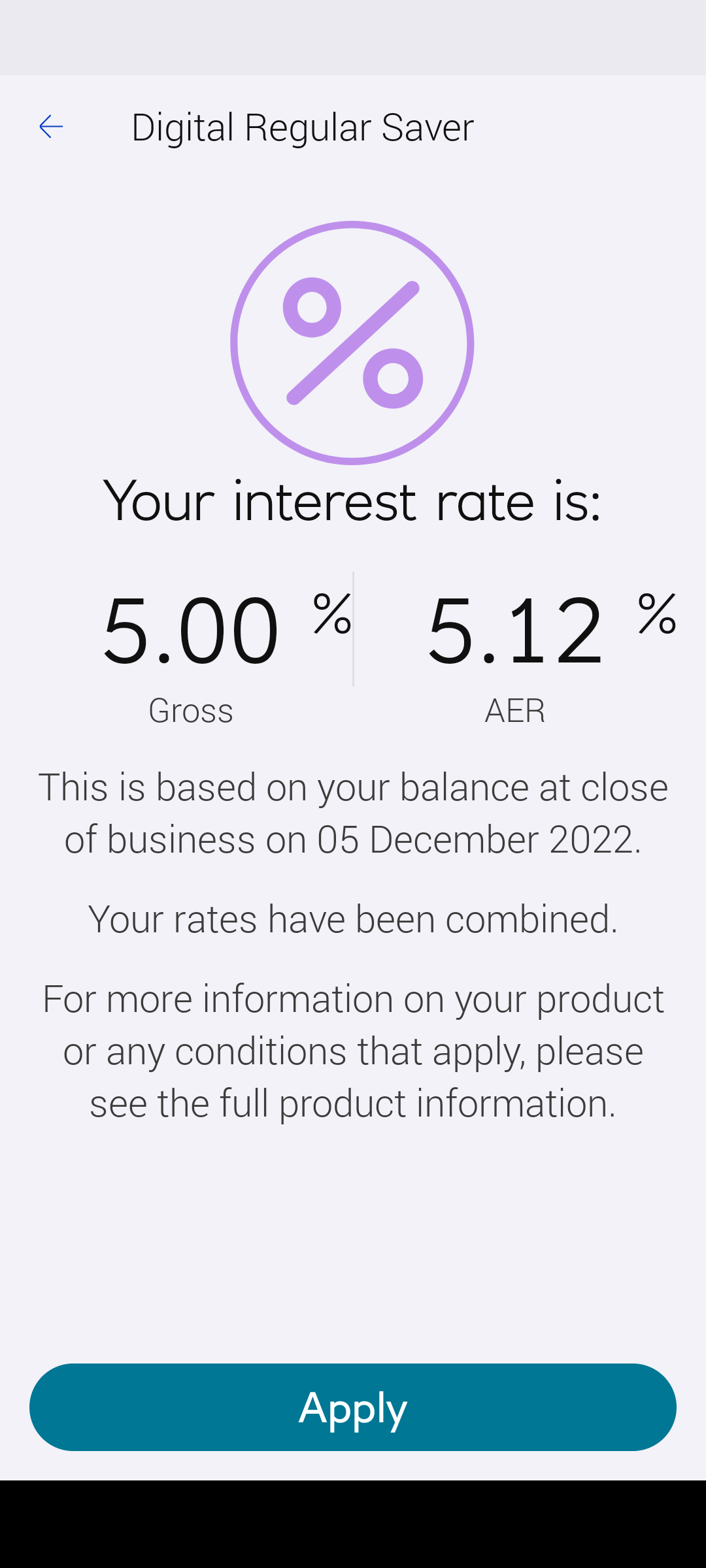

Has anyone's RBS/NatWest Digital Regular Saver balance specific rates updated yet please? I assumed that'd be today given the rate changed today, but perhaps it is tomorrow? My balance is approx £1,300 so I think it's right for that, but definitely not right for the new rates.

Thanks

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

Re NatWest Digital Regular saver

@ForumUser7

I am on Android and mine shows the same rate as yours, but it says it is based on the balance at close of business on 05 December 2022.

1 -

Mine has also not been updated to 5% above £1k. It showed earlier as of close of business on December 5, but has now been updated to COB December 6. I expect they will change the rate overnight.1

-

Mines showing today...

0 -

is your balance higher than £1,000?2

-

My rates have also yet to update to the latest changes, although the rates showing on my app are 4.47% gross / 4.56% AER, which reflects yesterday's close of business balance, despite the app saying it's based on today's CoB balance.ForumUser7 said:Has anyone's RBS/NatWest Digital Regular Saver balance specific rates updated yet please? I assumed that'd be today given the rate changed today, but perhaps it is tomorrow? My balance is approx £1,300 so I think it's right for that, but definitely not right for the new rates.

Thanks1 -

Mine is definitely using today's actual balance. The interest rate went down, too, compared with earlier today as I made a deposit today.AmityNeon said:

My rates have also yet to update to the latest changes, although the rates showing on my app are 4.47% gross / 4.56% AER, which reflects yesterday's close of business balance, despite the app saying it's based on today's CoB balance.ForumUser7 said:Has anyone's RBS/NatWest Digital Regular Saver balance specific rates updated yet please? I assumed that'd be today given the rate changed today, but perhaps it is tomorrow? My balance is approx £1,300 so I think it's right for that, but definitely not right for the new rates.

Thanks1 -

Re NatWest/RBS Digital Regular Savers.

I am sure the rate for over £1,000 will show as 5.00% tomorrow.

It appears that there are far more geeks on this site than NW/RBS have in their IT departments. 2

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards