We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Is he a BAD mortgage broker?

Comments

-

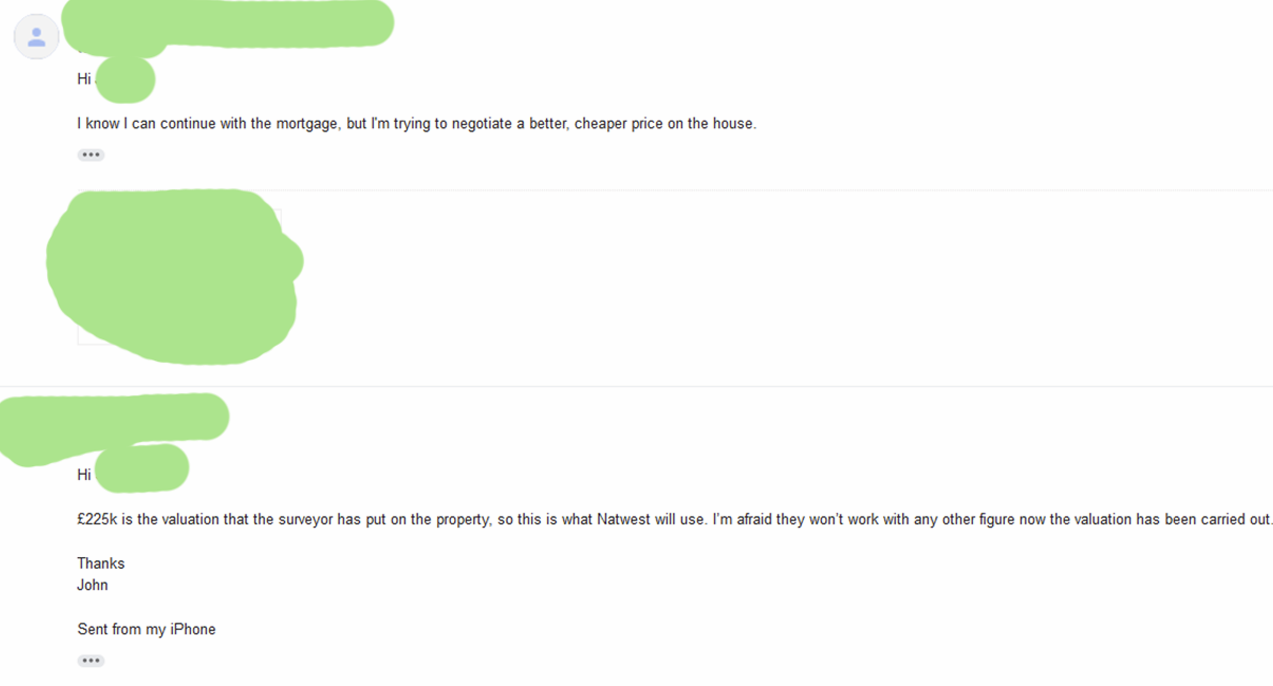

His reply to my email made it seem as if i couldnt get a different price on the house. That's why i created this thread because it sounded shady. But if it is just mis-communication then I understand. I have emailed him a while ago to call me.

As you can understand, his response makes it seem I'm not allowed to get a cheaper purcahse price.0 -

You've misunderstood quite spectacularly.

He is saying that Natwest value the house at £225k. That's all.

Regardless of you negotiating the house to £230k £240k £666k or 17 farthings.

Depending on where you end up (you, not him) on price will result in your LTV.0 -

Well, tbf, if the OP negotiates lower than £225k, then that's what they'll base the LtV on...You've misunderstood quite spectacularly.

He is saying that Natwest value the house at £225k. That's all.

Regardless of you negotiating the house to £230k £240k £666k or 17 farthings.

Depending on where you end up (you, not him) on price will result in your LTV.0 -

I knew what he was talking about when he said the valuation will stay the same. Its the fact I told him i wanted to get a lower house price on 2 occasions and he just gave me the same answers, instead of acknowledging my intentions.You've misunderstood quite spectacularly.

He is saying that Natwest value the house at £225k. That's all.

Regardless of you negotiating the house to £230k £240k £666k or 17 farthings.

Depending on where you end up (you, not him) on price will result in your LTV.0 -

To be fair to the OP I can see why they think what they think. It is not exactly clear from the email.

But you can renegotiate. Even if you can not get £225k, you may get something in between and it may enable you to get an 85% product which means only a minor increase in the rate.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

I don't see how its a big ask to find out what purcahse price your customer is trying to achieve & get the best rates for them. After all what is the point of a broker if they are not helping you? You can attack me, but I believe this is poor customer service.0

-

Thank you.To be fair to the OP I can see why they think what they think. It is not exactly clear from the email.

But you can renegotiate. Even if you can not get £225k, you may get something in between and it may enable you to get an 85% product which means only a minor increase in the rate.0 -

As far as he's concerned, the price is £240k. That's the number on the memorandum of sale, and the number that everybody's agreed.I don't see how its a big ask to find out what purcahse price your customer is trying to achieve

You want to change that? Speak to the EA - not your mortgage broker.

It. Is. Not. His. Job.

Getting you a loan based on some other price won't help, because...

1. The lender aren't ever going to base LtV on more than £225k

2. The only price that's currently in play is £240k.

What he's actually telling you is "the downvaluation is not necessarily a showstopper - you can still make £240k work, and this is how."

He is helping you. He's helping you get the best deal he can for the price that's been agreed.After all what is the point of a broker if they are not helping you?

Nobody's attacking you. They're merely trying to explain reality to you. You don't want to know, because you've already made your mind up based on only half understanding what you've actually hired him to do.You can attack me0 -

Indeed, me too.Bad broker or bad customer?

I think I know.

But, further,

Brilliant! Bad dog!BAD mortgage broker. No biscuit.

Seems you found a perfectly straightforward broker: Think yourself lucky.

But, if you don;t like him or don't trust him go elsewhere: Just as you would if you didn't like the property. But surely you knew that answer?

Bad broker? I had one, asked me which bank account the mortgage payments would come from, copies of statements, my address etc etc: Account was my "second", largely incoming smaller amounts. He transposed the post code, the lender concluded I wasn't living where I said I was as I was up to fraud: Plus the bank account didn;t show the various (five..) pensions I said I had - and do have: Took 3 months to unwind that lot. Stuck with him, got a good deal!

A little give 'n take always helps. Hope the people buying one of my houses take a sensible view to brokers!

Best wishes to all, including those who don;t agree with me.0 -

From his emails it seems he doesnt want me to negotiate a lower price on the house. I have put foward how strongly I want to reduce the purchase price of the house and he is replying as if thats not an option.

I was buying a house this year July (fell through) and it was undervalued by £10,000 with Natwest direct from website and they accepted the mortgage. So im surprised when I have decided to go with broker, there's no wiggle room.

Sometimes you find similar views on here. Most likely the seller will keep coming up against "undervaluations" so you negotiating their price down is certainly an option.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards