We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Investing in biotech stocks - My experience so far

Comments

-

Thanks, so far so good. Tissue Regenix went up almost 15% from two days ago when I bought. Might be a blip, but nice to see nevertheless.BrockStoker said:You might not need to hold them for 10+ years, but it's good to be mentally prepared to do so if required. Good luck!0 -

A dip on good news seems counter-intuitive: is this a typo, or the phenomenon you mentioned earlier of investors hoping for a take-over and selling when good news make this less likely?BrockStoker said:Knowing ARWR there will be a dip following great news.I think there is a good chance of analyst upgrades in the coming days, and possibly the share price might reflect this, but I would not be surprised to see a dip in the mean time (maybe!). Either way I'm hoping the share price will hang around till the HIF2a data which is due within 2 months - just enough time for the new ISA money, but as always with these things, and I've already had two in a row of near perfectly timed new money infusions, what are the chances this one will also hit the mark? It does seem like a realistic possibility at this point though!

And ISA money? My ISA only allows me to hold funds in sterling and buy securities listed in the UK, and suggested that these were rules that applied to all ISA providers. Did I simply pick the wrong ISA provider (II), or is there something more subtle going on here?

0 -

Financial headlines are not great!BrockStoker said:Knowing ARWR there will be a dip following great news.So we just had the earnings conference call, and I would say the news is verging on "great". Accordingly the share price is down in AH trading.

QUOTE

Quarterly ResultsEarnings per share were down 566.67% over the past year to ($0.20), which missed the estimate of $0.17.

Revenue of $21,303,000 declined by 27.68% from the same period last year, which missed the estimate of $86,690,000.

0 -

BrockStoker said:Knowing ARWR there will be a dip following great news.So we just had the earnings conference call, and I would say the news is verging on "great". Accordingly the share price is down in AH trading.Here are some CC highlights:-- Expecting to have Proof Of Concept in muscle tissue by end of summer. This is a big one - no one has achieved this before.-- Expecting to get first phase 3 trial underway before end of Q2.-- Plans for lung and solid tumor franchises. Hinting at deals in the works I guess?-- Open label trials of APOC3 and ANG3 to begin 2nd half 2021.-- Cash burn 200-250 million every year. $700 million in cash and investments.Saving the best news for last..HIF2a data due in the next couple of months. That's the first cancer biopsy data which everyone can't wait to see. Keep in mind these are patients with a very poor prognosis, who have tried everything else, and under normal circumstances, at least some would not have been expected to live this long into the trial (4 months now I think?). So the fact we have not heard of any deaths is great news for sure.I think there is a good chance of analyst upgrades in the coming days, and possibly the share price might reflect this, but I would not be surprised to see a dip in the mean time (maybe!). Either way I'm hoping the share price will hang around till the HIF2a data which is due within 2 months - just enough time for the new ISA money, but as always with these things, and I've already had two in a row of near perfectly timed new money infusions, what are the chances this one will also hit the mark? It does seem like a realistic possibility at this point though!

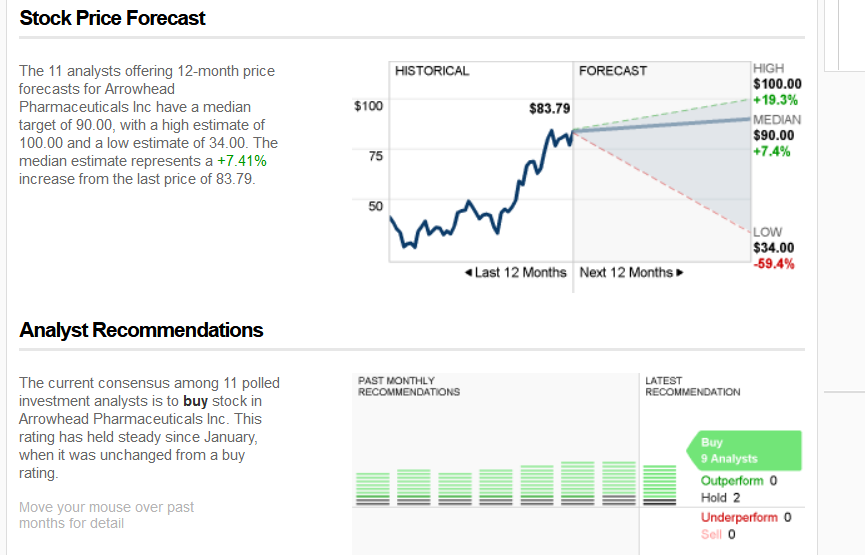

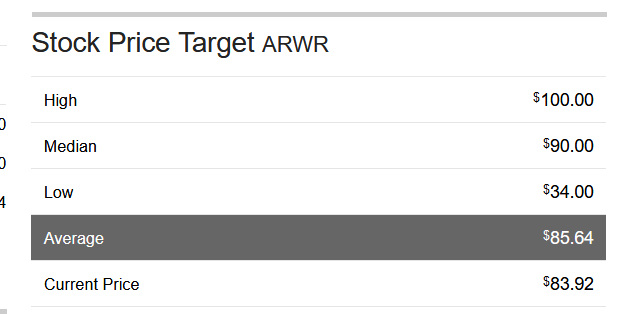

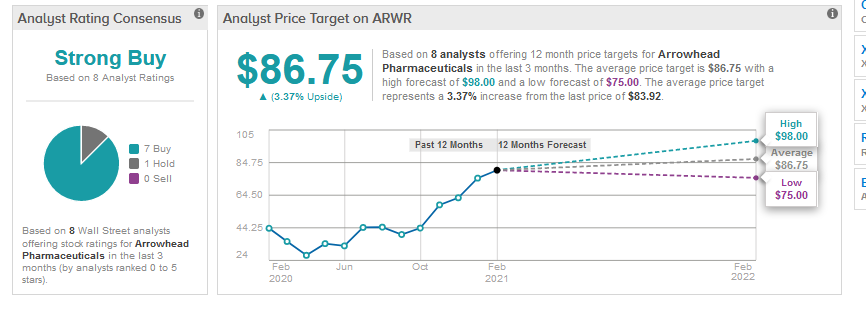

Most of Wall Analysts provide a price target of around $80 for this stock.

I just checked it is yet to make a significant dip. If I have money, I will wait until they fall much below 50 Simple Moving average (50 SMA). From the chart below if you observe it, every time they touch 50 SMA, they will bounce back and this has been tested multipple times. So 50 SMA will work as a good support level for this stock.

If you could get it around $70 it will be a very good entry. If you miss the bottom by a significant, you could always use a Dollar Cost Avareging (DCA) tool to mend it. Also partial in and out when they are in consolidation phase, moving sideways.

I have been swinging this stocks multiple times. Sofar my success rate is 100% as I buy low and sell high and I hardly ever sell stocks when they are in red. I will sell it back when they are in all-time high or when I need the money back and already making some profit. I treat Swing Trading a stock like this along with Microsoft, FAANG, and other high profile blue chip stocks that have always gone up after making a dip as my high interest saving account. :

But again, I never put too much money when swinging the stock like this. If my memory serves well, the maximum I have for this stock is 5 stocks so far.

If you want to swing trade this stock please do it wiht your own risk.

1

1 -

Apodemus said:

While the SRNE COVI-MSC approach (and potentially some of the other ASC treatments currently under trial) looks highly promising, I am struggling to see what is actually patentable in this, or even commercially exploitable. Extracting ASC, multiplying them in-vitro and infusing them into a patient is all relatively straightforward and potentially achievable at the level of the local specialist hospital - that is surely one of the huge benefits of the approach? So, once the benefits of treatment are confirmed, where does the commercial gain come in for the companies who have invested in the work?Voyager2002 said:Social media are saying that this morning SRNE received a US patent for a fluid delivery apparatus. The only article about this is behind a pay-wall: any idea what it is?

And the share price has pulled back somewhat: is that likely to be profit-taking after yesterday, or has something happened?

While it could be repeated by another company, patents should stop that, and SRNE has first mover advantage. It might be relatively straight forward, but it has to be manufactured in an FDA approved facility. Every company would need approval for their version of the therapy, and I'm sure there will be certain steps that make SRNE's therapy unique to it (and likely more effective than the competition's competing therapies), which other companies would not be able to follow without falling foul of patents.

1 -

Yes, I saw. Not a bad start. Such a small stock it could be very volatile, and easily give back those gains, but hopefully not.ultrasilvam said:

Thanks, so far so good. Tissue Regenix went up almost 15% from two days ago when I bought. Might be a blip, but nice to see nevertheless.BrockStoker said:You might not need to hold them for 10+ years, but it's good to be mentally prepared to do so if required. Good luck!

0 -

Keep in mind this is still a clinical stage biotech. EPS is going to go up and down a bit, although I wouldn't be surprised if it was very close to turning positive. What matters more is that the balance sheet is positive, and at current rates of cash burn (which is actually very conservative when compared with it's peers), ARWR can fund it's operations for a good few years to come, even without any additional deals. However, I would expect further deals and milestone payments, so the picture is very rosy IMHO.I'd definitely avoid Benzinga as those figures paint a rather misleading picture.Indeed, there are now FIVE new price target upgrades from analysts:ARWR $99 target from Piper, up from $90

ARWR price target raised to $95 from $90 at H.C. Wainwright

RBC raises target to 90 from 80

Jefferies raises target price to $102 from $100

Chardan Capital's Keay Nakae raises PT from $81 to $97The upgrades are on the cautious side at the moment, but if ARWR follows through on what has been promised (and you all know how positive I am on ARWR's potential), I'm sure the big upgrades will follow over the coming months.0 -

ARWR just hit a new 52 week high of $87.88 (previously $86.99) - currently up 4.71% to $87.87.Unrelated, but Orchard tearing it up today after $150m financing announcement:(set above link to sort by percentage gain)

0 -

Make that 25%+ in 2 days... For whatever weird reason it was the 3rd most traded volume on FTSE AIM today (volume). There was no news this week about the company, no idea what caused it.BrockStoker said:

Yes, I saw. Not a bad start. Such a small stock it could be very volatile, and easily give back those gains, but hopefully not.ultrasilvam said:

Thanks, so far so good. Tissue Regenix went up almost 15% from two days ago when I bought. Might be a blip, but nice to see nevertheless.BrockStoker said:You might not need to hold them for 10+ years, but it's good to be mentally prepared to do so if required. Good luck!

0 -

I'm just not understanding why it needs to be a company at all. A well equipped hospital lab could biopsy my adipose tissue, the hospital lab could grow up my ASCs and give me them back as an i/v infusion. At worst, it's only marginally more difficult than a bone marrow transplant and it might actually be simpler! Even if it needs to be allogeneic, it doesn't need to be from a commercial source. Stem-cell therapy is going to make a huge difference to our lives, but I see it largely being a local thing, more akin to blood transfusion than, say, IL therapy which is likely to be commercially manufactured.BrockStoker said:Apodemus said:

While the SRNE COVI-MSC approach (and potentially some of the other ASC treatments currently under trial) looks highly promising, I am struggling to see what is actually patentable in this, or even commercially exploitable. Extracting ASC, multiplying them in-vitro and infusing them into a patient is all relatively straightforward and potentially achievable at the level of the local specialist hospital - that is surely one of the huge benefits of the approach? So, once the benefits of treatment are confirmed, where does the commercial gain come in for the companies who have invested in the work?Voyager2002 said:Social media are saying that this morning SRNE received a US patent for a fluid delivery apparatus. The only article about this is behind a pay-wall: any idea what it is?

And the share price has pulled back somewhat: is that likely to be profit-taking after yesterday, or has something happened?

While it could be repeated by another company, patents should stop that, and SRNE has first mover advantage. It might be relatively straight forward, but it has to be manufactured in an FDA approved facility. Every company would need approval for their version of the therapy, and I'm sure there will be certain steps that make SRNE's therapy unique to it (and likely more effective than the competition's competing therapies), which other companies would not be able to follow without falling foul of patents.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards