We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Investing in biotech stocks - My experience so far

Comments

-

BananaRepublic said:BrockStoker said:Michael121 said:

Seems outrageous to think such a high performer will do the same again in the next 5-10year. If it was that easy everyone would be on it.bowlhead99 said:

Most US-based fund managers have no real interest in sorting out regulatory stuff for EU and UK retail investors if they have already raised an $8bn fund from domestic US investors and institutions and would struggle to deploy $50bn into the same strategy.BrockStoker said:That's a shame. I have a feeling it's available on my off shore platform (but can't log in to check as it went inactive and I can't log in right now - trying to get that sorted), but as bowlhead says, it's probably not a good idea.Hopefully at some point it will be made available if they sort out the regulatory stuff.

The fund will be on a lot of people's radar due to the high performance, but if you look at its history since inception, it doubled its money over the first five years to early 2020 (just like the wider S&P), then dropped with the wider S&P as covid hit, and then suddely quadrupled in a space of less than a year. So the '$10k became $55k over 6 years' is a cool story but not necessarily representative of what might happen next The stocks it's invested in are highly disruptive. Gene therapy and gene sequencing are the future of medicine, without doubt. It's not unlike buying into oil stocks at the start of the last century. So yes, it could potentially keep doing what it has been doing in terms of performance, although I think it is currently in a bubble, with many of it's stocks overbought on pure speculation:Personally I'd only consider investing (given the opportunity) after a significant correction.You may well be right, I really do not know, but this does sound like the dot com boom with talk of disruptive technologies. The Dow Jones Pharceuticals Index does not look to be in boom and bust territory. Carry on like this and you'll persuade me to invest ... Anyway, I have some research to do.There are a lot of people getting exited about the new generation of disruptive tech, and with investors just starting to get wind of it/realizing the possibilities, things get hyped up and overbought, so some bubbles are inevitable. The problem is that in the scramble some companies are getting bought, that might be ticking time bombs (if/when they tank because they were not all that they were cracked up to be), but I think there are plenty of companies who can/will deliver, and we are already starting to see the the first evidence for that, hence the excitement.I think there are going to be more fundamentals driving the price increases in these companies than there were in the case of 2001, at least in many cases if not the majority of cases, so I think although there could be small burst bubbles along the way, big bubbles should be avoided, and the sector trend should be up.It's probably easier to list the reasons NOT to be in this sector than it is to list the reverse, it's getting that ridiculous, but I'll give it a try:-Massive tailwinds/incentive from governments having to care for ageing populations who already cost a fortune to look after, putting many healthcare systems under strain. Basically it's cheaper for the government to pay for a single course of a super expensive one-off break through therapy than it is to care for many patients with complex needs over decades.-High beta sector, but defensive at the same time, and not very well correlated with the wider equity market.-Multi-trillion (I'd guess?!) healthcare sector, with a significant part of it ripe for disruption.-Unlike previously where Big Pharma made 100's of billions by gradually selling small molecule drugs and building up steadily with relatively small payments over time, disruptive therapies that work have the potential to bring in very large sums in a very short space of time, generating explosive growth.-Managing and even curing illnesses that have previously been impossible to even put a dent in. Not just a revolution, but a "golden age" of medicine is what we are on the cusp of. Biotech is where the FANGs were 5-10 years ago, and the foundations have been laid for a similar thing to happen in medicine. I think the implications are even more profound than things like Netflix Apple products/services, not to mention, questions like "what price would people pay for biotech to bail them out of a situation like covid?", so disruptive leaders are lightly to remain highly valued IMHO.It's getting hard to ignore how well things are setting up for the sector, and I really can't see what's not to like unless you are someone who can't stomach a little volatility. As I've said before, the key here is understanding what you own. Good DD should pay off handsomely.I think I may have posted it at the time, but taking the best example I know again, Arrowhead, Dr Christie Balantyne, Baylor College of Medicine referring to Arrowhead's ARO-APOC3 (cardiovascular therapy) trial data said: "game changing, disruptive technology."A bit about Dr Christie Balantyne:There are many people out there with cardiovascular issues, and ARWR has a game changer (it appears), so the TAM is huge and there for the taking.The real beauty of ARWR's RNAi platform though, is that it can reel off another "ARO-APOC3" every 6-12 months, and that will get quicker I have little doubt. If one treatment works, there's a (very) high chance the others will. Cancer, hepatitis B, covid, cystic fibrosis are all being trialed right now, and there should be important updates from at least 3 or 4 before the year is half way through, which should pretty much seal the deal if the data continues to be good. If the flawless data/execution continues, the share price should gap up more as Wall Street realizes how consistently good safety and efficacy are with ARWR's RNAi platform, and how quickly multi-billion $ indications can be churned out.Watch this space closely as I think we will see first hand how the first in a new generation of companies disrupts it's way to the top.. I think the science means the odds are stacked in it's favor, but the next few weeks should make certain in many people's eyes if that is the case. That's the thesis right now anyway!

The stocks it's invested in are highly disruptive. Gene therapy and gene sequencing are the future of medicine, without doubt. It's not unlike buying into oil stocks at the start of the last century. So yes, it could potentially keep doing what it has been doing in terms of performance, although I think it is currently in a bubble, with many of it's stocks overbought on pure speculation:Personally I'd only consider investing (given the opportunity) after a significant correction.You may well be right, I really do not know, but this does sound like the dot com boom with talk of disruptive technologies. The Dow Jones Pharceuticals Index does not look to be in boom and bust territory. Carry on like this and you'll persuade me to invest ... Anyway, I have some research to do.There are a lot of people getting exited about the new generation of disruptive tech, and with investors just starting to get wind of it/realizing the possibilities, things get hyped up and overbought, so some bubbles are inevitable. The problem is that in the scramble some companies are getting bought, that might be ticking time bombs (if/when they tank because they were not all that they were cracked up to be), but I think there are plenty of companies who can/will deliver, and we are already starting to see the the first evidence for that, hence the excitement.I think there are going to be more fundamentals driving the price increases in these companies than there were in the case of 2001, at least in many cases if not the majority of cases, so I think although there could be small burst bubbles along the way, big bubbles should be avoided, and the sector trend should be up.It's probably easier to list the reasons NOT to be in this sector than it is to list the reverse, it's getting that ridiculous, but I'll give it a try:-Massive tailwinds/incentive from governments having to care for ageing populations who already cost a fortune to look after, putting many healthcare systems under strain. Basically it's cheaper for the government to pay for a single course of a super expensive one-off break through therapy than it is to care for many patients with complex needs over decades.-High beta sector, but defensive at the same time, and not very well correlated with the wider equity market.-Multi-trillion (I'd guess?!) healthcare sector, with a significant part of it ripe for disruption.-Unlike previously where Big Pharma made 100's of billions by gradually selling small molecule drugs and building up steadily with relatively small payments over time, disruptive therapies that work have the potential to bring in very large sums in a very short space of time, generating explosive growth.-Managing and even curing illnesses that have previously been impossible to even put a dent in. Not just a revolution, but a "golden age" of medicine is what we are on the cusp of. Biotech is where the FANGs were 5-10 years ago, and the foundations have been laid for a similar thing to happen in medicine. I think the implications are even more profound than things like Netflix Apple products/services, not to mention, questions like "what price would people pay for biotech to bail them out of a situation like covid?", so disruptive leaders are lightly to remain highly valued IMHO.It's getting hard to ignore how well things are setting up for the sector, and I really can't see what's not to like unless you are someone who can't stomach a little volatility. As I've said before, the key here is understanding what you own. Good DD should pay off handsomely.I think I may have posted it at the time, but taking the best example I know again, Arrowhead, Dr Christie Balantyne, Baylor College of Medicine referring to Arrowhead's ARO-APOC3 (cardiovascular therapy) trial data said: "game changing, disruptive technology."A bit about Dr Christie Balantyne:There are many people out there with cardiovascular issues, and ARWR has a game changer (it appears), so the TAM is huge and there for the taking.The real beauty of ARWR's RNAi platform though, is that it can reel off another "ARO-APOC3" every 6-12 months, and that will get quicker I have little doubt. If one treatment works, there's a (very) high chance the others will. Cancer, hepatitis B, covid, cystic fibrosis are all being trialed right now, and there should be important updates from at least 3 or 4 before the year is half way through, which should pretty much seal the deal if the data continues to be good. If the flawless data/execution continues, the share price should gap up more as Wall Street realizes how consistently good safety and efficacy are with ARWR's RNAi platform, and how quickly multi-billion $ indications can be churned out.Watch this space closely as I think we will see first hand how the first in a new generation of companies disrupts it's way to the top.. I think the science means the odds are stacked in it's favor, but the next few weeks should make certain in many people's eyes if that is the case. That's the thesis right now anyway!

1 -

It is possible to get ark ETFs if you use trading 212 you can copy pies such as this https://www.trading212.com/pies/l71F4dJAcqHItmVp4J5uRsHIM5mi in order to simulate the funds.When using the housing forum please use the sticky threads for valuable information.1

-

tom9980 said:It is possible to get ark ETFs if you use trading 212 you can copy pies such as this https://www.trading212.com/pies/l71F4dJAcqHItmVp4J5uRsHIM5mi in order to simulate the funds.Yep and I have seen people are doing that. What I am not quite sure (have not tried it myself) is thatIf you have your own stock pick , is it possible to mix "the pie" with your own stock picks without messing up the weighting.Also Is it possible to have several pies (thus seperate ETF with its own weighting) to creates multiple ETFs in one account.How to overcome the time consuming needed to adjust the weighting which keep changing.0

-

Biotech, revolutionises the cure of disease which was impossible to do in the past, so when there is a promising way of curing diseases, then it is a no brainer to make money.

Keep in mind everyone cares about their health. Very rich people will pay whatever it takes if it could cure their diseases.

0 -

A lot of healthcare cost comes from long term care, managing a condition. If you can cure someone, even though that cure might cost £10,000 say, the result might be an overall cost saving. And yes of course you’re right, the rich will pay whatever it takes.adindas said:Biotech, revolutionises the cure of disease which was impossible to do in the past, so when there is a promising way of curing diseases, then it is a no brainer to make money.

Keep in mind everyone cares about their health. Very rich people will pay whatever it takes if it could cure their diseases.

0 -

Yes you can create multiple pies so one for each ark fund if you want. You can edit and rebalance the pie in a few clicks.adindas said:tom9980 said:It is possible to get ark ETFs if you use trading 212 you can copy pies such as this https://www.trading212.com/pies/l71F4dJAcqHItmVp4J5uRsHIM5mi in order to simulate the funds.Yep and I have seen people are doing that. What I am not quite sure (have not tried it myself) is thatIf you have your own stock pick , is it possible to mix "the pie" with your own stock picks without messing up the weighting.Also Is it possible to have several pies (thus seperate ETF with its own weighting) to creates multiple ETFs in one account.How to overcome the time consuming needed to adjust the weighting which keep changing.

You can change weighting yourself or wait for someone to update it, you then export from your existing pie and import it into the updated pie. It is fiddly at the moment but they are planning to make this easier.When using the housing forum please use the sticky threads for valuable information.1 -

adindas said:

Keep in mind everyone cares about their health. Very rich people will pay whatever it takes if it could cure their diseases.

Not only that, but biotech is not just about medical necessities.For example, engineering crops to be more productive while having better resistance to pests/diseases. But they are also working on things like extending the age of people, and they are already able to make mice live significantly longer lives, so it will likely not be long till the same can be said for people.Then there are companies like Amyris, who make valuable molecules, which would otherwise be expensive to produce/extract, but Amyris can make them at scale without the expense.So many opportunities for biotech to disrupt, and for investors to make significant profits. In many cases those profits will be made at the expense of established companies, (but not always eg. life extending tech) and I think investors will need to be cautious that they are not on the wrong side of disruptive tech. That is one of the big reasons I whittled down my portfolio of stocks from around 19 to just 5.Once again taking Arrowhead as an example, when they released data from their cystic fibrosis trial late last year, Vertex which has a CF monopoly, immediately lost $11B of market cap in response. It's recovered some of this since, and currently stands at just under $62B MC, but should ARWR continue to produce results as good as the have in CF, then Vertex is dead in the water unless they strike a deal with ARWR on ARWR's terms, which is a possibility, but either way it's win/win for ARWR and not very good (at best) for VRTX. ARWR currently has a MC of $8.4 (so just one successful indication more than justifies current MC). If it's CF treatment makes it to market, there's no reason it shouldn't steal around $50B of VRTX's MC. What ARWR is doing to VRTX could so easily be repeated with other stocks in indications such as hep B., etc, and what is in ARWR's pipeline now, is really just the start since RNAi has the potential to treat literally hundreds of conditions/illnesses in time. So it's easy to see how something as overlooked as ARWR could literally send shock-waves through the whole biopharma sector over the next FEW years, and it's already underway. Once ARWR ramps up, the pace of change will be shocking.Many still do not see it coming, but with every new data readout, the chances that ARWR bulls are right is increased. It's the phase 2 and 3 trial data that really counts, and ARWR has 3x phase 2 trials underway, and two of those are already having massive resources being pored into them by ARWR's partners JnJ and Amgen. There is an update of a trial being expanded on average every week, and this has been going on for months, suggesting big pharma is already extremely bullish on the prospects, so they are literally pulling out all the stops. This works well for ARWR because while it's partners concentrate on proving the tech, ARWR can concentrate on working on the rest of it's pipeline and adding new indications at an ever increasing pace. Many companies get bought out on the strength of good phase 2 data, and while I don't think that will happen to ARWR, the phase 2 data will effectively be POC (proof of concept) for ARWR's RNAi platform.So given this example, it's easy to see how a disruptive company like ARWR could justify growing it's valuation from under 10B now to 100B or more in just a few years.

1 -

Thanks Great info. Will have a try ...tom9980 said:

Yes you can create multiple pies so one for each ark fund if you want. You can edit and rebalance the pie in a few clicks.adindas said:tom9980 said:It is possible to get ark ETFs if you use trading 212 you can copy pies such as this https://www.trading212.com/pies/l71F4dJAcqHItmVp4J5uRsHIM5mi in order to simulate the funds.Yep and I have seen people are doing that. What I am not quite sure (have not tried it myself) is thatIf you have your own stock pick , is it possible to mix "the pie" with your own stock picks without messing up the weighting.Also Is it possible to have several pies (thus seperate ETF with its own weighting) to creates multiple ETFs in one account.How to overcome the time consuming needed to adjust the weighting which keep changing.

You can change weighting yourself or wait for someone to update it, you then export from your existing pie and import it into the updated pie. It is fiddly at the moment but they are planning to make this easier.

0 -

The problem with CISPR Therapeutics.. and why I decided to sell + how it compares with ARWRIn a nut shell, it's not as precise as the hype would have you believe. The process damages the existing human genome in order for an extra artificial code to be inserted, and the long term consequences of this are unknown. Also, once edited, there's no way to be "un-CRISPRed". Here's what Wikipedia says:"Knock-out mutations caused by CRISPR-Cas9 result in the repair of the double-stranded break by means of non-homologous end joining (NHEJ). NHEJ can often result in random deletions or insertions at the repair site, which may disrupt or alter gene functionality. Therefore, genomic engineering by CRISPR-Cas9 gives researchers the ability to generate targeted random gene disruption. Because of this, the precision of genome editing is a great concern. Genomic editing leads to irreversible changes to the genome."So there could be a problem further down the line, and I would not want to be invested in CRSP if that is the case. I sold out of it just before ARK got in, missing out on the large gains it's made since (purely/mostly due to ARK hype), although I did OK from it (around 50% gain IIRC), but I think ARK has pushed it up into bubble territory, and with serious questions over the tech.. it's the "ticking time bomb" stock I was eluding to a few posts back.(So perhaps it might be better to re-construct ARK Genomics Revolution, missing out CRSP!)In contrast, RNAi technology targets a single (although more is possible) gene in a non-destructive way, basically signaling it to reduce/turn down the production of a single protein - it does not seek to alter the human genome in any way unlike CRSPR. CRSPR on the other hand could inadvertently affect 1 or more existing genes.There is a whole host of illnesses caused or aggravated by unwanted or over-production of a particular protein, all of which can in theory be targeted by RNAi therapies. The real trick is getting the medicine to the particular type of tissue where the medicine is needed without causing off target side effects (reducing the production where it is not intended can cause harm), and as I've said before, I believe that this is one of those areas where ARWR excels. The competition as far as I know are still stuck in the liver, but ARWR has already started to get good clinical results in lung tissue (CF), and is working on/trialing other tissues (tumor, and skeletal tissue). Each new tissue type opens the door to multiple indications, dozens or perhaps hundreds in some cases, I'm not exactly sure, but it's enough to keep ARWR busy for a long time to come even with just one tissue type. Cracking other tissue types though, will give ARWR the chance to pick off the juiciest indications first, before anyone is even close!So while RANi therapy is not permanent, it is quite long lasting it appears. One of ARWR's partners, Amgen just recently announced it was expanding a phase 2 trial where participants would be dosed once every 6 months. "Once in 6 months" dosing regime is almost unheard of, especially to treat major conditions/illnesses like hep B, cancer, etc, and it makes it so much easier for everyone, as well as making such medicines that much more valuable.I know I'm probably starting to sound like an advert again, but what is more, ARWR management has said that it believes the design/participation of the currently running phase 2/2b trials is so good that it may not even need to go through phase 3 trials in order to get FDA approval on ARO-APOC3. I think that is partly because the bar is set so low combined with stellar data so far, and because current drugs don't really work, so there is a desperate need for something which does. Only it appears that not only have ARWR come up with something that just "works", it's a "game changer".Keep in mind that ARWR only chooses previously validated targets (ie where research has previously shown that knocking down a specific protein where it is not wanted or being over produced results in improvement of condition), usually in mice or rats, but there is a consistent trend so far that the human data betters the animal model data significantly.There are many reasons why I think RNAi (and in particular ARWR) is one of the best bets in biotech right now, but hopefully others reading this can also see why ARWR is in such a sweet spot right now, and should be able to stay there for a while yet...and also see that I'm not totally delusional - there really is a fair chance that ARWR can grow into a monster in just a few short years. Of course that is purely my opinion, and I might be wrong about something, but, things have never looked so promising than they do now, and I really can't help being super excited by it all! Also the wait/anticipation for the next data drop is killing me right now! There could literally be news at any time in the next few days, or in less than 2 weeks during earnings call, and we know that they will already have had time to analyze data from at least one important trial which we have not yet had any data from (cancer) and likely have updates on others. The high options volumes for Feb $110 calls suggests at least some think something good is about to happen. Another deal is a possibility (Vertex perhaps) too, and I would expect it to be the last, giving ARWR more than enough payments/milestones for it to expand it's non-partnered indications, but for the moment using other companies expertise in certain markets (eg. Vertex/CF)/with certain ailments, and their existing supply chains is a clever way to bolster the coffers while it gets everything in place that is needed to launch it's wholly owned products.0

-

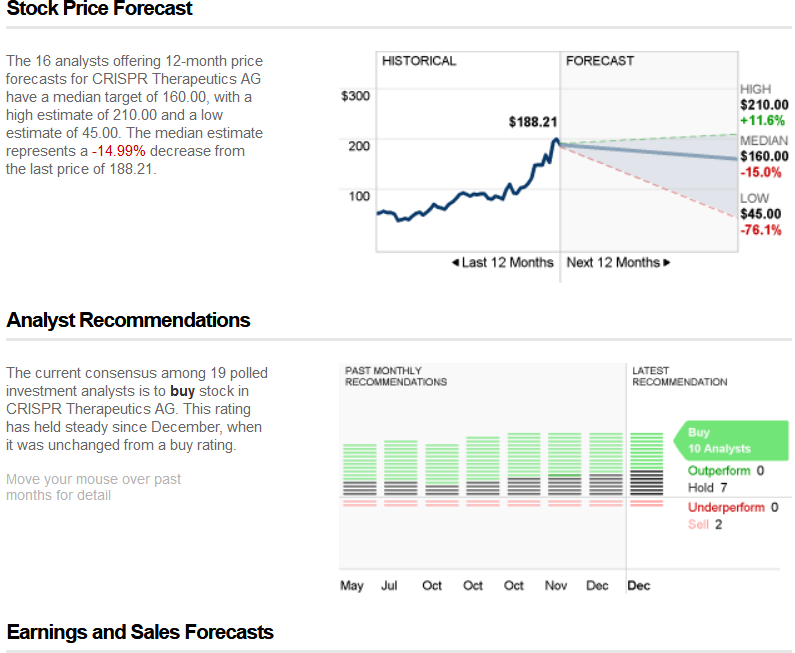

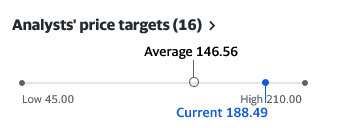

WIth the current share price, CRISPR Therapeutics AG (CRSP) is not good for investors because more downside rather than the upside based on opinion of wall street analysts. It might be ok but it is the thing you will need to consider first before taking decision or to look further into your own DDs.

Another one from Yahoo finance

Another one from Yahoo finance

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards