We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Alternative Green Energy Thread

Comments

-

So the conclusion must be that the system is working in providing the best possible value for money for the consumer? But obviously at a price that investors are (or were at the time of their decision) willing to accept. In these times of escalating energy prices, a solid foundation for consumers with a relatively safe and stable return for investors sounds like the best balance has been achieved?JKenH said:World's largest offshore wind farm 'unprofitable' for Equinor, say government-funded researchers

We see considerable enthusiasm for renewable energy and the hope that it will solve our energy problems. However not everything in the garden is rosey as a recent report for the Norwegian government found.“In our estimate, Dogger Bank is unprofitable,” said University of Stavanger professor Petter Osmundsen. "The project has to compete with alternative investment opportunities."

Equinor has not disputed the study's conclusions, but emphasised that it had benefited from selling stakes in the project.

Costs have indeed come down for the bottom-fixed Dogger Bank and other offshore wind projects, but not at the same pace as strike prices have fallen in UK offshore wind auctions, according to the study.

The researchers calculated the Dogger Bank project's expected net present value (NPV) at minus £970 million (minus $1.3 billion). A negative NPV indicates that the value of the investment is below the rate of return which the company should require from its investments.

Equinor's bigger wind turbines, low prices for raw materials and limited competition helped the company generate solid profit from its larger early offshore wind projects.

That climate has since changed, as the world's largest player in the segment, Orsted of Denmark, has warned about supply-chain blockages and higher raw material prices. Increased competition for new licences also has significantly reduced strike prices in auctions.

Install 28th Nov 15, 3.3kW, (11x300LG), SolarEdge, SW. W Yorks.

Install 2: Sept 19, 600W SSE

Solax 6.3kWh battery1 -

A safe real return somewhere between 3.6% and 4.4% sounds pretty good to me, I would buy some of that in my pension for sure. What the piece did not say was what the CFD strike price was as this should give some indication of where bids might be in the current round.Exiled_Tyke said:

So the conclusion must be that the system is working in providing the best possible value for money for the consumer? But obviously at a price that investors are (or were at the time of their decision) willing to accept. In these times of escalating energy prices, a solid foundation for consumers with a relatively safe and stable return for investors sounds like the best balance has been achieved?JKenH said:World's largest offshore wind farm 'unprofitable' for Equinor, say government-funded researchers

We see considerable enthusiasm for renewable energy and the hope that it will solve our energy problems. However not everything in the garden is rosey as a recent report for the Norwegian government found.“In our estimate, Dogger Bank is unprofitable,” said University of Stavanger professor Petter Osmundsen. "The project has to compete with alternative investment opportunities."

Equinor has not disputed the study's conclusions, but emphasised that it had benefited from selling stakes in the project.

Costs have indeed come down for the bottom-fixed Dogger Bank and other offshore wind projects, but not at the same pace as strike prices have fallen in UK offshore wind auctions, according to the study.

The researchers calculated the Dogger Bank project's expected net present value (NPV) at minus £970 million (minus $1.3 billion). A negative NPV indicates that the value of the investment is below the rate of return which the company should require from its investments.

Equinor's bigger wind turbines, low prices for raw materials and limited competition helped the company generate solid profit from its larger early offshore wind projects.

That climate has since changed, as the world's largest player in the segment, Orsted of Denmark, has warned about supply-chain blockages and higher raw material prices. Increased competition for new licences also has significantly reduced strike prices in auctions.

I think....1 -

The strike price, I think, is £39.65michaels said:

A safe real return somewhere between 3.6% and 4.4% sounds pretty good to me, I would buy some of that in my pension for sure. What the piece did not say was what the CFD strike price was as this should give some indication of where bids might be in the current round.Exiled_Tyke said:

So the conclusion must be that the system is working in providing the best possible value for money for the consumer? But obviously at a price that investors are (or were at the time of their decision) willing to accept. In these times of escalating energy prices, a solid foundation for consumers with a relatively safe and stable return for investors sounds like the best balance has been achieved?JKenH said:World's largest offshore wind farm 'unprofitable' for Equinor, say government-funded researchers

We see considerable enthusiasm for renewable energy and the hope that it will solve our energy problems. However not everything in the garden is rosey as a recent report for the Norwegian government found.“In our estimate, Dogger Bank is unprofitable,” said University of Stavanger professor Petter Osmundsen. "The project has to compete with alternative investment opportunities."

Equinor has not disputed the study's conclusions, but emphasised that it had benefited from selling stakes in the project.

Costs have indeed come down for the bottom-fixed Dogger Bank and other offshore wind projects, but not at the same pace as strike prices have fallen in UK offshore wind auctions, according to the study.

The researchers calculated the Dogger Bank project's expected net present value (NPV) at minus £970 million (minus $1.3 billion). A negative NPV indicates that the value of the investment is below the rate of return which the company should require from its investments.

Equinor's bigger wind turbines, low prices for raw materials and limited competition helped the company generate solid profit from its larger early offshore wind projects.

That climate has since changed, as the world's largest player in the segment, Orsted of Denmark, has warned about supply-chain blockages and higher raw material prices. Increased competition for new licences also has significantly reduced strike prices in auctions.

I have Greencoat Wind shares in my pension portfolio for exactly this reason. (Although they are predominately onshore, they do have a stake in Walney). They are currently returning around 5% on my investment with an additional small increase in the capital value. I'm sure I read somewhere that some of their recent investments will be selling at the wholesale market rate, so no strike price. Of course I can't recommend this, but it suits me and probably more for the nature of the investment which I like, rather than the expected returns.Install 28th Nov 15, 3.3kW, (11x300LG), SolarEdge, SW. W Yorks.

Install 2: Sept 19, 600W SSE

Solax 6.3kWh battery1 -

Exiled_Tyke said:

So the conclusion must be that the system is working in providing the best possible value for money for the consumer? But obviously at a price that investors are (or were at the time of their decision) willing to accept. In these times of escalating energy prices, a solid foundation for consumers with a relatively safe and stable return for investors sounds like the best balance has been achieved?JKenH said:World's largest offshore wind farm 'unprofitable' for Equinor, say government-funded researchers

We see considerable enthusiasm for renewable energy and the hope that it will solve our energy problems. However not everything in the garden is rosey as a recent report for the Norwegian government found.“In our estimate, Dogger Bank is unprofitable,” said University of Stavanger professor Petter Osmundsen. "The project has to compete with alternative investment opportunities."

Equinor has not disputed the study's conclusions, but emphasised that it had benefited from selling stakes in the project.

Costs have indeed come down for the bottom-fixed Dogger Bank and other offshore wind projects, but not at the same pace as strike prices have fallen in UK offshore wind auctions, according to the study.

The researchers calculated the Dogger Bank project's expected net present value (NPV) at minus £970 million (minus $1.3 billion). A negative NPV indicates that the value of the investment is below the rate of return which the company should require from its investments.

Equinor's bigger wind turbines, low prices for raw materials and limited competition helped the company generate solid profit from its larger early offshore wind projects.

That climate has since changed, as the world's largest player in the segment, Orsted of Denmark, has warned about supply-chain blockages and higher raw material prices. Increased competition for new licences also has significantly reduced strike prices in auctions.

michaels said:

A safe real return somewhere between 3.6% and 4.4% sounds pretty good to me, I would buy some of that in my pension for sure. What the piece did not say was what the CFD strike price was as this should give some indication of where bids might be in the current round.Exiled_Tyke said:

So the conclusion must be that the system is working in providing the best possible value for money for the consumer? But obviously at a price that investors are (or were at the time of their decision) willing to accept. In these times of escalating energy prices, a solid foundation for consumers with a relatively safe and stable return for investors sounds like the best balance has been achieved?JKenH said:World's largest offshore wind farm 'unprofitable' for Equinor, say government-funded researchers

We see considerable enthusiasm for renewable energy and the hope that it will solve our energy problems. However not everything in the garden is rosey as a recent report for the Norwegian government found.“In our estimate, Dogger Bank is unprofitable,” said University of Stavanger professor Petter Osmundsen. "The project has to compete with alternative investment opportunities."

Equinor has not disputed the study's conclusions, but emphasised that it had benefited from selling stakes in the project.

Costs have indeed come down for the bottom-fixed Dogger Bank and other offshore wind projects, but not at the same pace as strike prices have fallen in UK offshore wind auctions, according to the study.

The researchers calculated the Dogger Bank project's expected net present value (NPV) at minus £970 million (minus $1.3 billion). A negative NPV indicates that the value of the investment is below the rate of return which the company should require from its investments.

Equinor's bigger wind turbines, low prices for raw materials and limited competition helped the company generate solid profit from its larger early offshore wind projects.

That climate has since changed, as the world's largest player in the segment, Orsted of Denmark, has warned about supply-chain blockages and higher raw material prices. Increased competition for new licences also has significantly reduced strike prices in auctions.

It is actually working very well for the consumer with the current level of wind penetration, or rather it was prior to last year’s stilling. If wind speeds don’t pick up it will be disastrous for consumers and the industry alike as the current returns of 3-4% will disappear altogether and with less generation alternative sources will be required. The rise in gas prices to some extent concealed the underlying problem that more wind generation, while cheaper in itself leads to higher average prices. Doubling wind generation will only reduce the back up capacity we need by around 5- 10%. Back up plant is paid enormous sums of money to sit there doing nothing much of the year. When the wind stalls as we saw last autumn and in January this year prices go through the roof. Thes peaks are a feature of the market and will increase with the higher penetration of wind.

Anyway that’s another discussion (albeit an important one) and the article I posted was looking at the investment argument for wind (renewables) rather than consumer pricing (or indeed the CO2 benefits which we all accept.)

So going back to the returns of 3-4%, that might be attractive in a low interest market but interest rates are rising and putting pressure on margins. Also the costs of operating/maintaining the turbines are increasing. The present wind turbines will no doubt keep their heads above the water financially if wind speeds hold up but if wind speeds fall they could quickly be in trouble.

Wind power increases with the cube of the wind speed so a doubling of generation gives 8 times the power. Imagine what might happen if wind speeds fell a further 5%, that would produce around a 15% fall in generation. As wind farm operators on CfDs get a fixed rate per MWh generated that is going to translate directly into a 15% fall in revenue. Costs are essentially fixed (although there might be a small saving in maintenance).

This isn’t just me being alarmist - see Europe’s electricity generation from wind blown off course | Financial Times

It wouldn’t take much for the that 3-4% profit margin to turn into a 10% loss. If you hold an asset that generates a 10% loss for the remainder of its fixed price contract with no prospect of renegotiating the selling price then that business is in serious trouble and its shares would be virtually worthless.

Shares in wind energy companies have already started to fall.

Vestas and Orsted warn of tough times for renewable energy | Financial Times

Just have a look at Orsted’s share price over the last year. Orsted AS Share Price DKK10

Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.1 -

Yes, Greencoat wind are doing well. As you say it may be due to them being mainly onshore and presumably therefore earlier wind farms, perhaps with FiT deals.Exiled_Tyke said:

The strike price, I think, is £39.65michaels said:

A safe real return somewhere between 3.6% and 4.4% sounds pretty good to me, I would buy some of that in my pension for sure. What the piece did not say was what the CFD strike price was as this should give some indication of where bids might be in the current round.Exiled_Tyke said:

So the conclusion must be that the system is working in providing the best possible value for money for the consumer? But obviously at a price that investors are (or were at the time of their decision) willing to accept. In these times of escalating energy prices, a solid foundation for consumers with a relatively safe and stable return for investors sounds like the best balance has been achieved?JKenH said:World's largest offshore wind farm 'unprofitable' for Equinor, say government-funded researchers

We see considerable enthusiasm for renewable energy and the hope that it will solve our energy problems. However not everything in the garden is rosey as a recent report for the Norwegian government found.“In our estimate, Dogger Bank is unprofitable,” said University of Stavanger professor Petter Osmundsen. "The project has to compete with alternative investment opportunities."

Equinor has not disputed the study's conclusions, but emphasised that it had benefited from selling stakes in the project.

Costs have indeed come down for the bottom-fixed Dogger Bank and other offshore wind projects, but not at the same pace as strike prices have fallen in UK offshore wind auctions, according to the study.

The researchers calculated the Dogger Bank project's expected net present value (NPV) at minus £970 million (minus $1.3 billion). A negative NPV indicates that the value of the investment is below the rate of return which the company should require from its investments.

Equinor's bigger wind turbines, low prices for raw materials and limited competition helped the company generate solid profit from its larger early offshore wind projects.

That climate has since changed, as the world's largest player in the segment, Orsted of Denmark, has warned about supply-chain blockages and higher raw material prices. Increased competition for new licences also has significantly reduced strike prices in auctions.

I have Greencoat Wind shares in my pension portfolio for exactly this reason. (Although they are predominately onshore, they do have a stake in Walney). They are currently returning around 5% on my investment with an additional small increase in the capital value. I'm sure I read somewhere that some of their recent investments will be selling at the wholesale market rate, so no strike price. Of course I can't recommend this, but it suits me and probably more for the nature of the investment which I like, rather than the expected returns.Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.1 -

Australia breaks renewable records but steep fossil fuel costs cause higher wholesale electricity prices

I came across the article above which is another example of the recurring theme of high renewable output and increasing wholesale costs. Now I know we have high gas prices at the moment but there seems to be more to this than just that.

A bit more research on the net came up with a couple of articles, one recent and the other from 2017 which suggest that the structure of the electricity market breaks down with high penetration of renewables. In fact it was predicted back in 2013 that this would happen.

If Solar And Wind Are So Cheap, Why Are They Making Electricity So Expensive?

The main reason appears to have been predicted by a young German economist in 2013.

In a paper for Energy Policy, Leon Hirth estimated that the economic value of wind and solar would decline significantly as they become a larger part of electricity supply.

The reason? Their fundamentally unreliable nature. Both solar and wind produce too much energy when societies don’t need it, and not enough when they do.

Solar and wind thus require that natural gas plants, hydro-electric dams, batteries or some other form of reliable power be ready at a moment’s notice to start churning out electricity when the wind stops blowing and the sun stops shining.

Renewables are cheaper than ever – so why are household energy bills only going up?

The design of electricity systems has failed to catch up with the revolution in renewable energy. Competitive electricity markets, established in many countries to try and minimise costs, are actually suffering the greatest price rises. This is not because governments elsewhere use taxes to subsidise electricity (though some do), but because in wholesale electricity markets, the most expensive generator sets the price.

Renewables are cheaper than ever – so why are household energy bills only going up?

Apologies to Mart, I accidentally posted this on the G&E news thread as I happened to be looking at that thread at the time. Genuine mistake. Now deleted.

Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.0 -

Surprise , surprise. World energy prices are linked to fossil fuels. A refinery blows up on Saudi Arabia and all energy prices immediately go up. One thing is constant, the price of renewables keeps going down. The only thing that hasn't been tackled, despite decades of notice, is the provision of storage, for varying time intervals, to make best use of the variability of most RE. Also, the most potentially reliable RE, tidal, has not been exploited sufficiently.

1 -

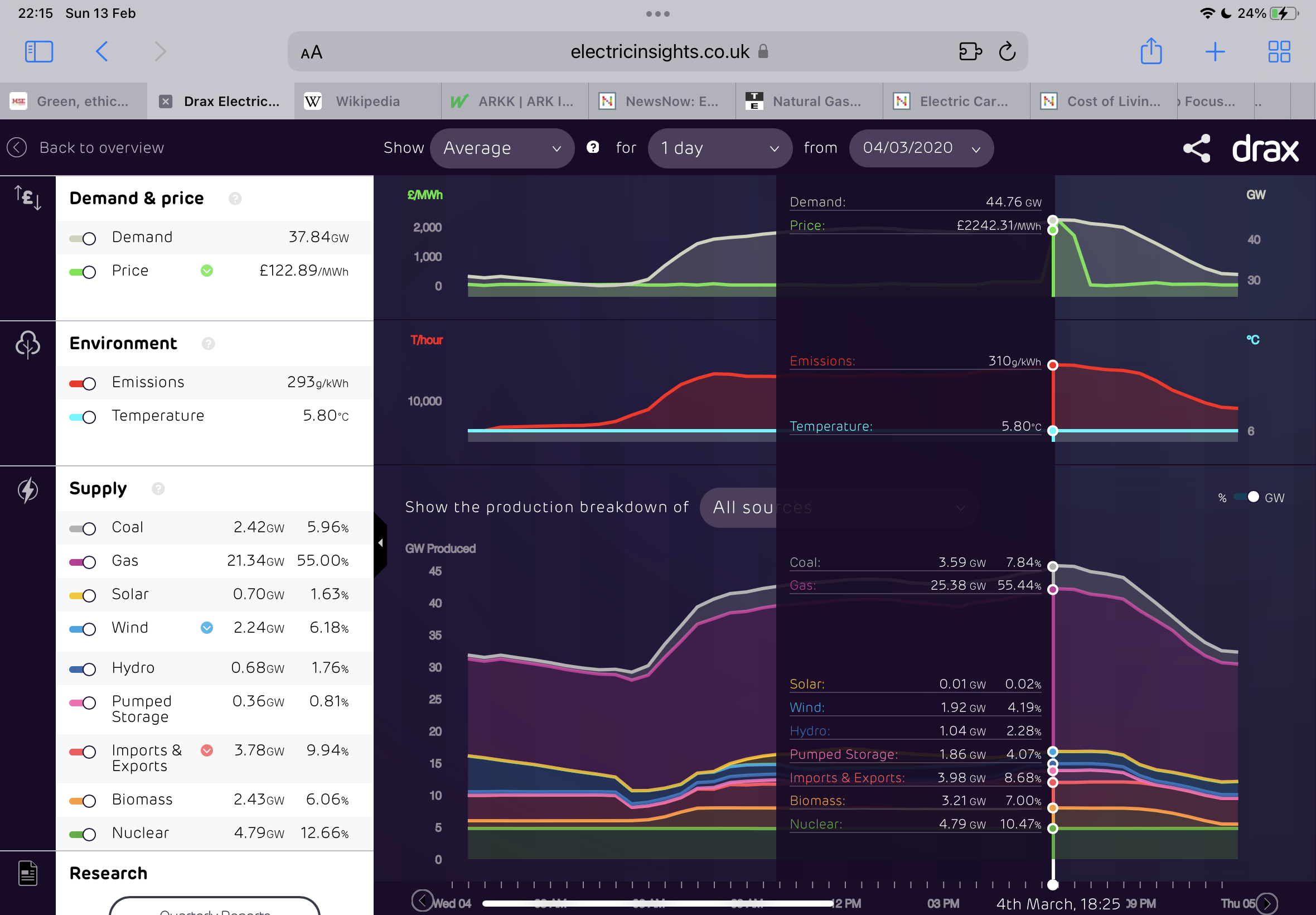

Yes, renewable prices are falling and as fossil fuel prices rise, world energy prices rise but in March 2020 when fossil fuel prices were at record lows we still saw electricity prices of over £2000/MWh. The high natural gas prices are driving up baseload generation costs but the peak prices are being driven by low wind speeds when the electricity market finds it hard to respond.

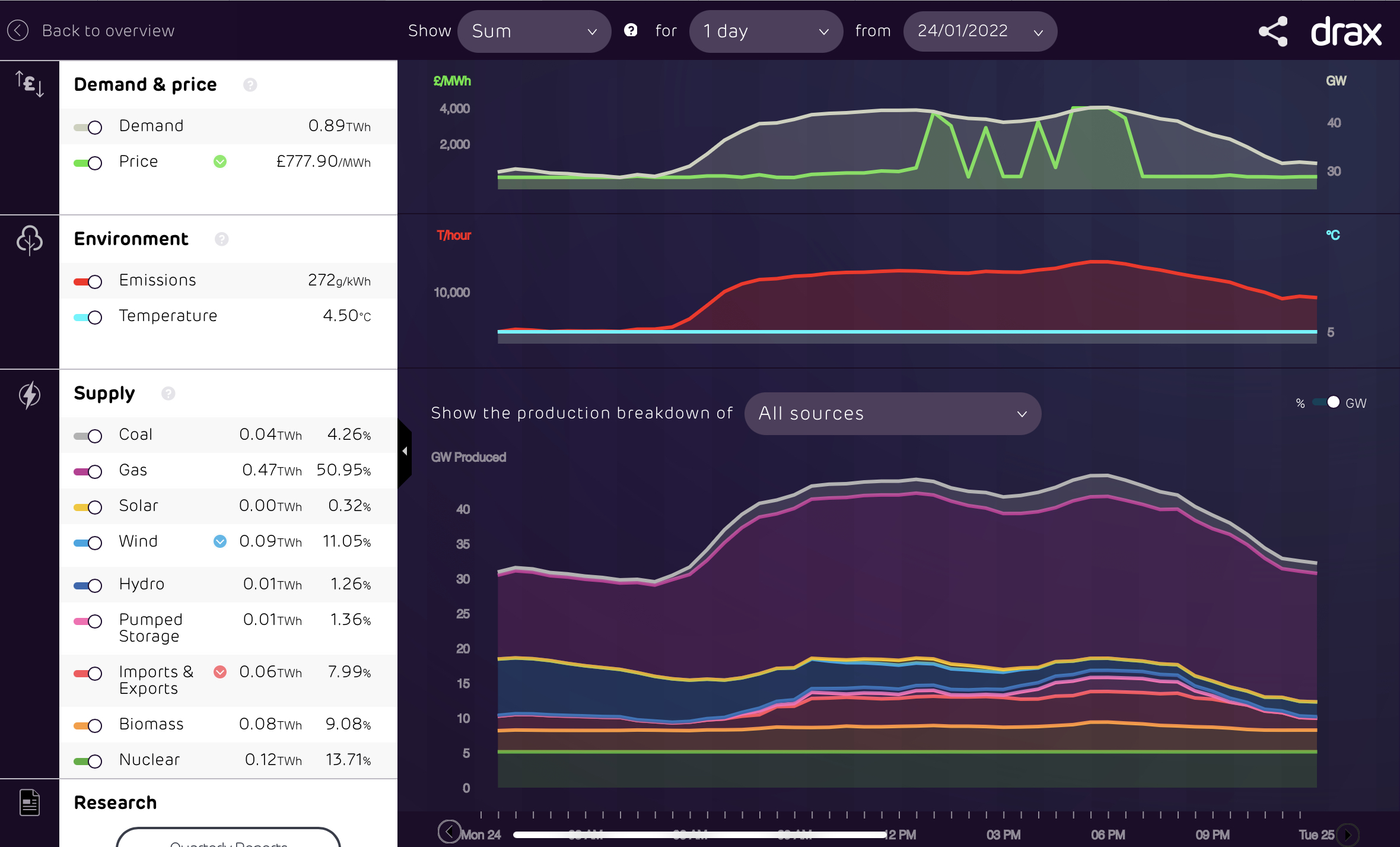

Usually this is just for an hour or two as in March 2020 but in January 2022 we had very high prices for several hours and a consequently very high average price for the whole day.

Usually this is just for an hour or two as in March 2020 but in January 2022 we had very high prices for several hours and a consequently very high average price for the whole day. These distortions are likely to get worse as more wind is rolled out. High natural gas prices will subside but the problem of balancing the grid will still be there.

These distortions are likely to get worse as more wind is rolled out. High natural gas prices will subside but the problem of balancing the grid will still be there.

The current high price of gas is proving a (convenient for the renewables lobby?) distraction for the media from the underlying problem of operating a heavily renewables focussed grid.You are quite right that we need much more storage but what I have been arguing for some time is that the roll out of renewables and storage needs to be coordinated. At the moment we have new wind farm being commissioned without anything like the storage we require to balance them. We celebrate on here every new wind farm that is announced but without storage it is only making the electricity supply problem worse.

Sometimes it is necessary to put aside the dogma and think these things through fully, something the media seem incapable of doing. It is far more appealing for them to whip up hysteria about profiteering and campaign for a windfall tax than address the fundamental problem of balancing the grid.

NG ESO are aware of the problem, that is why they are putting so much effort into managing demand, such as the Octopus trial and pressing for the roll out of more smart devices. It may be demand management on a severe scale is the only solution but there needs to be some honesty about why that is the case.Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.0 -

JKenH said:Yes, renewable prices are falling and as fossil fuel prices rise, world energy prices rise but in March 2020 when fossil fuel prices were at record lows we still saw electricity prices of over £2000/MWh.Thst's the spot price in the balancing mechanism. Hardly any electricity will have traded at that price (about 81MWh, if I'm reading this table correctly). For comparison, demand in that 30-minute period was 44.76GW so more than 22GWh were supplied; 0.4% of it changed hands at £2000/MWh.The day-ahead price for the same 30-minute slot was £161.48.

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.1 -

Fair point but that £161.48 compared to an average day ahead price for the first 3 months of 2020 of £30.98 MWh and took the average day ahead price for 4 March to £53.82 - 74% higher than the 3 month average.QrizB said:JKenH said:Yes, renewable prices are falling and as fossil fuel prices rise, world energy prices rise but in March 2020 when fossil fuel prices were at record lows we still saw electricity prices of over £2000/MWh.Thst's the spot price in the balancing mechanism. Hardly any electricity will have traded at that price (about 81MWh, if I'm reading this table correctly). For comparison, demand in that 30-minute period was 44.76GW so more than 22GWh were supplied; 0.4% of it changed hands at £2000/MWh.The day-ahead price for the same 30-minute slot was £161.48.On 9th September 2021 low winds took the day ahead average price to £666.90/ MWh compared to a average of £163.51 (307% increase) for the following month (from 10 September) by which time base load gas prices had started to riseLow winds over a 7 day period from 6th September produced an average of £241.37 compared to an average day ahead price of £101.41 for the preceding month (from 6 August), an increase of 138%.

The average day ahead price on 25th January 2022 was £327.61 compared to £179.66 for the following 7 days, an 82% increase.Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards