We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

It's time to start digging up those Squirrelled Nuts!!!!

Comments

-

michaels said:

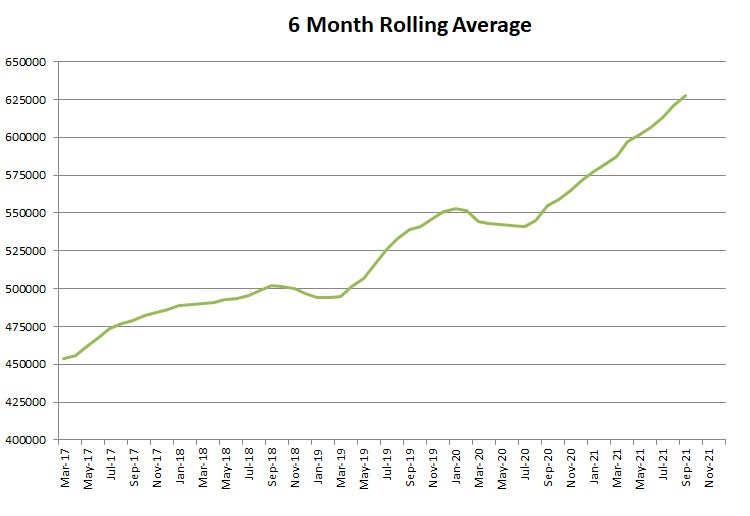

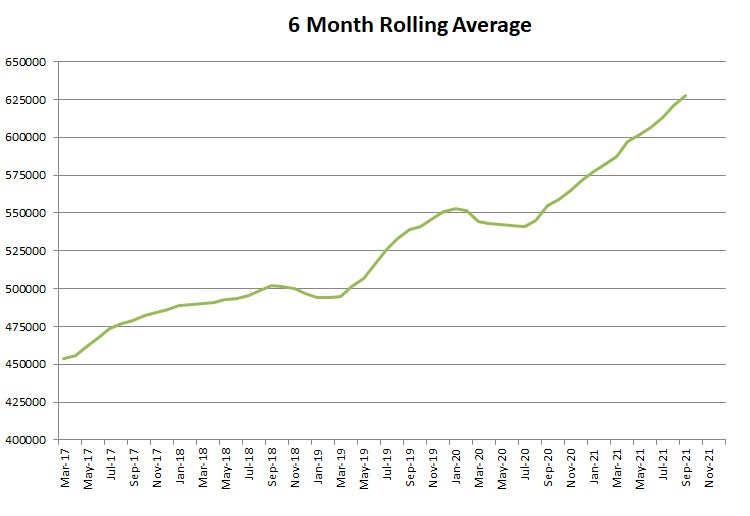

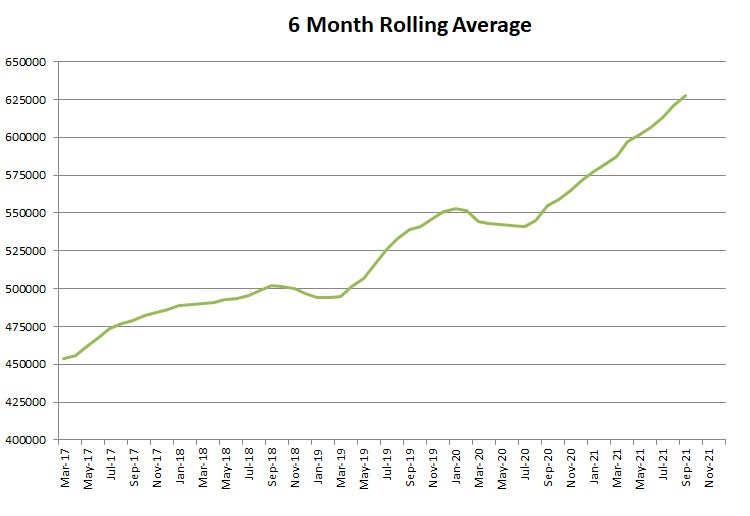

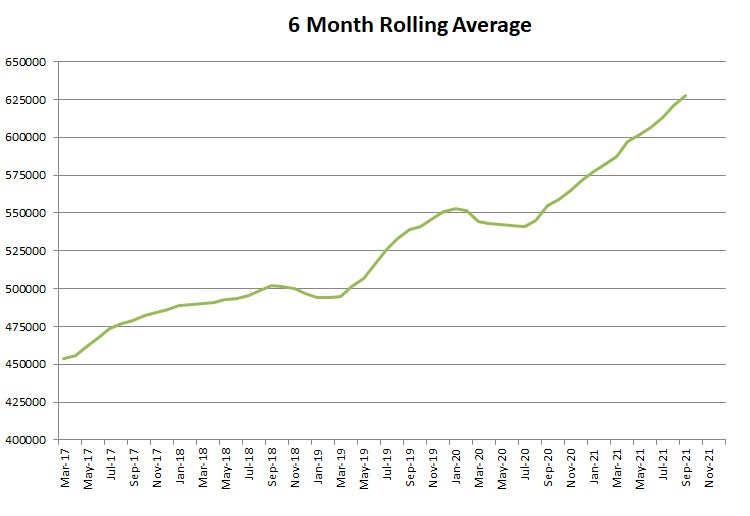

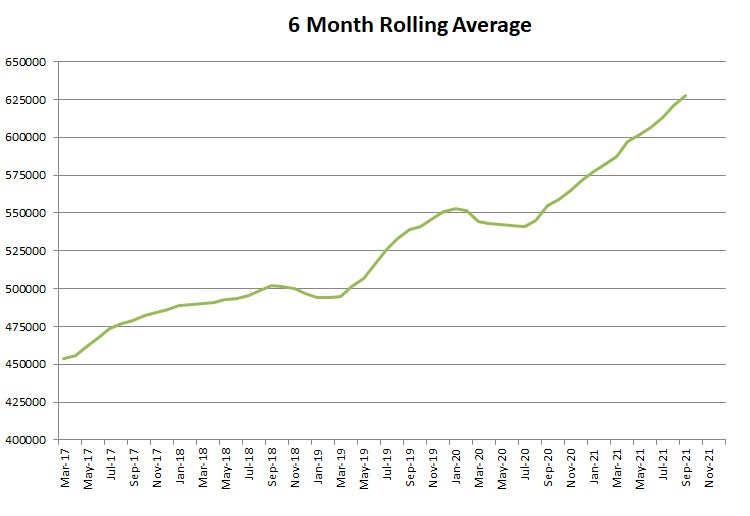

Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.Sea_Shell said:For anyone interested, this is the graph on our various spreadsheets that we shall be keeping the keenest eye on.

It is basically a rolling 6 month average of our total retirement pot value, over time. So if it starts to flatline, that's no bad thing (as spends would be equalling growth), and even if it starts to drop, that's still not too bad, as long as it doesn't start to fall too low!!

There has been no "new" money to add to the pot since July 2019. This line will drop, just a matter of when!

A 20% drop would take us back to our original starting point of c.£500,000

We have inflationary adjusted projections on another spreadsheet!! 🤣

"Right direction" for us can even be a gentle downslope, and only HAS to last 10 years (at full spends).

I realise that no one can predict the future, and the past is all we have to go on, which is partly the reason for this thread. A "real life" seat of your pants journey through early retirement.

My OP did mention "crashing and burning"!!!!

Keep tuning in to find out what happens next....How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)2 -

So an 75% drop tomorrow with no recovery would see you on £156k, enough to take £15k6 for ten years? And you're only hoping to spend £15k pa anyway? Sounds like you'll be fineSea_Shell said:Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.

We have inflationary adjusted projections on another spreadsheet!! 🤣

"Right direction" for us can even be a gentle downslope, and only HAS to last 10 years (at full spends).

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.6 -

QrizB said:

So an 75% drop tomorrow with no recovery would see you on £156k, enough to take £15k6 for ten years? And you're only hoping to spend £15k pa anyway? Sounds like you'll be fineSea_Shell said:Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.

We have inflationary adjusted projections on another spreadsheet!! 🤣

"Right direction" for us can even be a gentle downslope, and only HAS to last 10 years (at full spends).

IF the market did do that...we wouldn't keep blindly spending £15pa either, "rule" or no rule!!

Belts would be tightened right up!!How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)3 -

In this case I'm pretty sure the outcome will be a success. If Sea Shell's withdrawal strategy isn't safe, there is no hope for any of usmichaels said:

Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.Sea_Shell said:For anyone interested, this is the graph on our various spreadsheets that we shall be keeping the keenest eye on.

It is basically a rolling 6 month average of our total retirement pot value, over time. So if it starts to flatline, that's no bad thing (as spends would be equalling growth), and even if it starts to drop, that's still not too bad, as long as it doesn't start to fall too low!!

There has been no "new" money to add to the pot since July 2019. This line will drop, just a matter of when!

A 20% drop would take us back to our original starting point of c.£500,000 9

9 -

Not so fast, inflation at what, 10 or 12 percent for a few years on top of the 75% would wipe you out. You're doomed ! You'll have to go back to work or spend even less.QrizB said:

So an 75% drop tomorrow with no recovery would see you on £156k, enough to take £15k6 for ten years? And you're only hoping to spend £15k pa anyway? Sounds like you'll be fineSea_Shell said:Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.

We have inflationary adjusted projections on another spreadsheet!! 🤣

"Right direction" for us can even be a gentle downslope, and only HAS to last 10 years (at full spends). 3

3 -

Away from pure conjecture, M’Lud (“I suspect”), where is your evidence to back this concern up?michaels said:

Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.Sea_Shell said:For anyone interested, this is the graph on our various spreadsheets that we shall be keeping the keenest eye on.

It is basically a rolling 6 month average of our total retirement pot value, over time. So if it starts to flatline, that's no bad thing (as spends would be equalling growth), and even if it starts to drop, that's still not too bad, as long as it doesn't start to fall too low!!

There has been no "new" money to add to the pot since July 2019. This line will drop, just a matter of when!

A 20% drop would take us back to our original starting point of c.£500,000

I recall reading that if the first 10 years are survived well, then sequencing risk is massively reduced.

Naturally I cannot rapidly find the specific article (might have been a MMM one), but I assume you have something to disagree with that assessment?

Plan for tomorrow, enjoy today!0 -

Is something like https://www.kitces.com/blog/understanding-sequence-of-return-risk-safe-withdrawal-rates-bear-market-crashes-and-bad-decades/ what you were thinking off?cfw1994 said:

Away from pure conjecture, M’Lud (“I suspect”), where is your evidence to back this concern up?michaels said:

Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.Sea_Shell said:For anyone interested, this is the graph on our various spreadsheets that we shall be keeping the keenest eye on.

It is basically a rolling 6 month average of our total retirement pot value, over time. So if it starts to flatline, that's no bad thing (as spends would be equalling growth), and even if it starts to drop, that's still not too bad, as long as it doesn't start to fall too low!!

There has been no "new" money to add to the pot since July 2019. This line will drop, just a matter of when!

A 20% drop would take us back to our original starting point of c.£500,000

I recall reading that if the first 10 years are survived well, then sequencing risk is massively reduced.

Naturally I cannot rapidly find the specific article (might have been a MMM one), but I assume you have something to disagree with that assessment?

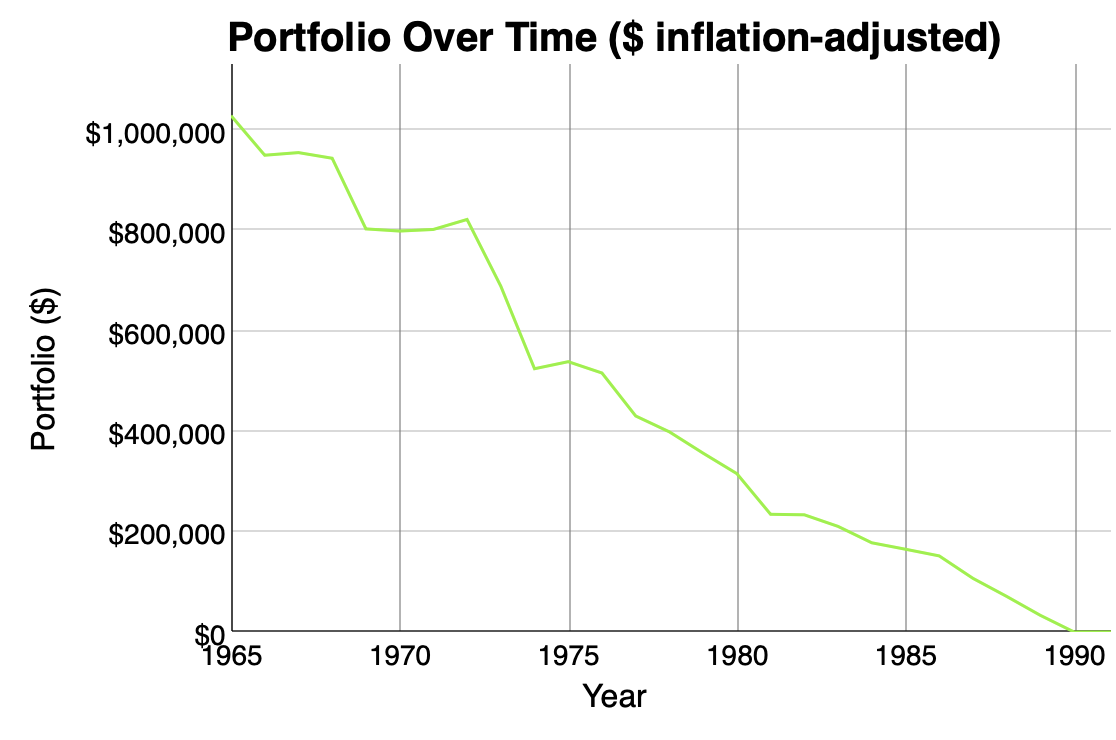

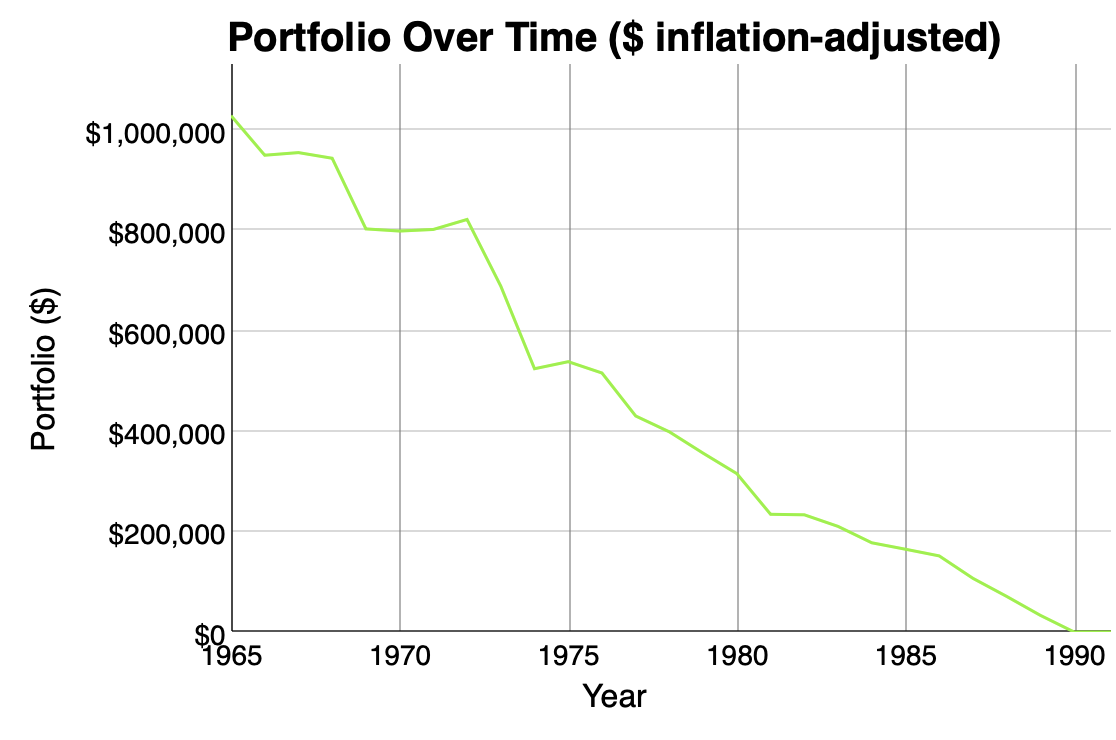

For 30 year US retirements with 60/40 portfolios and 4% withdrawals, the failed cases all look something like this (this is from cfiresim)...

A review after 5 years probably wouldn't be too disappointing, but a review after 10 years would be worrisome (and a reduction in withdrawals warranted).

2 -

shinytop said:

Not so fast, inflation at what, 10 or 12 percent for a few years on top of the 75% would wipe you out. You're doomed ! You'll have to go back to work or spend even less.QrizB said:

So an 75% drop tomorrow with no recovery would see you on £156k, enough to take £15k6 for ten years? And you're only hoping to spend £15k pa anyway? Sounds like you'll be fineSea_Shell said:Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.

We have inflationary adjusted projections on another spreadsheet!! 🤣

"Right direction" for us can even be a gentle downslope, and only HAS to last 10 years (at full spends).

I think you're joking...Hopefully!!

Well, we'll cross that bridge if we come to it. We'll still be in a better position than most, if things got that bad!!

There are plenty of things I would go without, if it meant not having to go back to work...but would there be any jobs to go back to if things got that bad, as no one would have any spare money for anything, as it'd all be going on Fuel and Baked Beans, so the wider economy would collapse.

I think 12% inflation on top of a 75% crash would wipe almost everyone out...not to mention people losing the homes if interest rates shot up to try and counter inflation.

So, "end of civilisation as we know it" aside....I'll take my chances!! How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)2

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)2 -

Well you can never be too careful, can youSea_Shell said:shinytop said:

Not so fast, inflation at what, 10 or 12 percent for a few years on top of the 75% would wipe you out. You're doomed ! You'll have to go back to work or spend even less.QrizB said:

So an 75% drop tomorrow with no recovery would see you on £156k, enough to take £15k6 for ten years? And you're only hoping to spend £15k pa anyway? Sounds like you'll be fineSea_Shell said:Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.

We have inflationary adjusted projections on another spreadsheet!! 🤣

"Right direction" for us can even be a gentle downslope, and only HAS to last 10 years (at full spends).

I think you're joking...Hopefully!!

Well, we'll cross that bridge if we come to it. We'll still be in a better position than most, if things got that bad!!

There are plenty of things I would go without, if it meant not having to go back to work...but would there be any jobs to go back to if things got that bad, as no one would have any spare money for anything, as it'd all be going on Fuel and Baked Beans, so the wider economy would collapse.

I think 12% inflation on top of a 75% crash would wipe almost everyone out...not to mention people losing the homes if interest rates shot up to try and counter inflation.

So, "end of civilisation as we know it" aside....I'll take my chances!!

At least you'll have the triple lock. Oh, wait a minute ...

0 -

That could be it! For those not reading the link (& it is a bit technical), a couple of lines that stand out to me:OldScientist said:

Is something like https://www.kitces.com/blog/understanding-sequence-of-return-risk-safe-withdrawal-rates-bear-market-crashes-and-bad-decades/ what you were thinking off?cfw1994 said:

Away from pure conjecture, M’Lud (“I suspect”), where is your evidence to back this concern up?michaels said:

Sadly while it looks great I suspect many 'failing' withdrawal portfolios looked great for the first few years. You also need to present it it real inflation adjusted) terms for it to be meaningful. I'm not saying any info is worse than no info but just that seeing a line go in the right direction for 5 (or even 10+) years doesn't actually mean that the overall outcome will be a success.Sea_Shell said:For anyone interested, this is the graph on our various spreadsheets that we shall be keeping the keenest eye on.

It is basically a rolling 6 month average of our total retirement pot value, over time. So if it starts to flatline, that's no bad thing (as spends would be equalling growth), and even if it starts to drop, that's still not too bad, as long as it doesn't start to fall too low!!

There has been no "new" money to add to the pot since July 2019. This line will drop, just a matter of when!

A 20% drop would take us back to our original starting point of c.£500,000

I recall reading that if the first 10 years are survived well, then sequencing risk is massively reduced.

Naturally I cannot rapidly find the specific article (might have been a MMM one), but I assume you have something to disagree with that assessment?

For 30 year US retirements with 60/40 portfolios and 4% withdrawals, the failed cases all look something like this (this is from cfiresim)...

A review after 5 years probably wouldn't be too disappointing, but a review after 10 years would be worrisome (and a reduction in withdrawals warranted).there is a strong and consistent relationship between safe withdrawal rates for a 60/40 portfolio and the real returns of equities during the first decade of retirement. ……

…… In other words, just as a bad first decade can be so severe with ongoing withdrawals that a subsequent market rebound just isn't enough to recover, but a good first decade can be so positive than even a subsequent bear market can’t ruin the outcome!Does that article reassure you, michaels?I still reckon many of us here would fail long before Seashell has any issues 🤣👍

Plan for tomorrow, enjoy today!2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards