We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

RPI Ground rent review every 7 years - which Mortgage lenders lend?

Comments

-

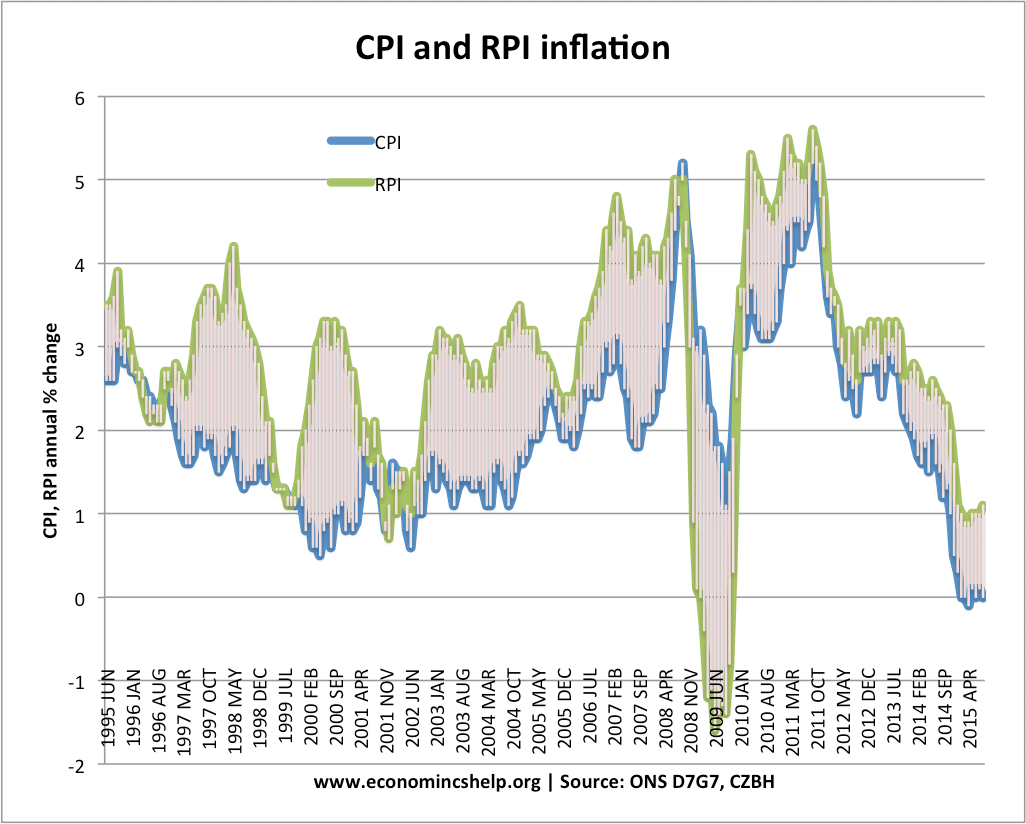

littlerock wrote: »One of the issues with RPI increases, is that there are upward only increases, the ground rent does not fall if inflation goes down.

Not really an issue as it is extremely unlikely for RPI to be negative over a whole review cycle.0 -

True, though you'd need to go back to the 1930s to find a period of 7 years over which there was aggregate deflation, so I doubt this is a significant risk.littlerock wrote: »One of the issues with RPI increases, is that there are upward only increases, the ground rent does not fall if inflation goes down.0 -

...and to agree with Anselld and Davidmcn by illustration...

Since the end of that graph, it's been back above 0% constantly.0 -

From "Lawyer Monthly"

https://www.lawyer-monthly.com/2018/03/rip-for-rpi-ground-rent-clauses/

Ground rents which automatically double every 10 years may now have fallen out of favour but there remains another weapon in the developer’s armoury which has not: ground rents which increase by the percentage increase in the retail price index (RPI) over the preceding 10-year period. These clauses are invariably worded so that any decrease in RPI, no matter how unlikely, means that the rent will stay the same, and so the review is “upwards only”. The problem for prospective purchasers of leases is that most banks and commercial lenders insist on further investigation where a lease clause links increases in ground rent to RPI, and some of the smaller banks will refuse to lend against such a lease at all. Take Accord Mortgages, for example, part of the Yorkshire Building Society, which states that ground rent “must not be capable of being increased during the first 21 years of the lease” – a major problem when a lease provides for an RPI-linked rent review every 10 years.

The index hit a bottom of -1.6 per cent in June 2009 but has risen since then to 4 per cent today; and, with the end of central bankers’ unprecedented experiment in quantitative easing on the horizon, inflation is expected to rise even further – fears which strongly influenced the sudden downturn in global equity markets in early February this year. On 31st January, Mark Carney, the Bank of England governor, told the House of Lords economic affairs committee that he wants “a deliberate and carefully timed” withdrawal of RPI from its use in government contracts because “most would acknowledge [that it] has no merit” and contains “known errors.”0 -

Barclays current policy on Ground rents when lending for mortgages:

https://www.ftadviser.com/mortgages/2018/09/12/barclays-sheds-light-on-ground-rent-policy/0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards